One thing that always amazes me about the markets is just how irrational they can be from time to time. Even when you have a company that is continuing to grow at a nice clip, on both its top and bottom lines, and that same business is trading on the cheap, shares can still underperform the broader market for a time.

Such has been the case when it comes to Belden Inc. (NYSE:BDC), an enterprise that specializes in providing its customers with networking and connectivity solutions. Examples of its work include enterprise solutions like network infrastructure, cabling, and more. And it also is involved in the industrial space by providing customers with things like on machine connectivity systems, physical network components, and more. Recently, financial performance achieved by the company has been quite impressive. Across the board, the firm has shown growth compared to what it achieved last year. And while shares of Belden Inc. may not be the cheapest, they do look attractively priced at this time.

A disconnect

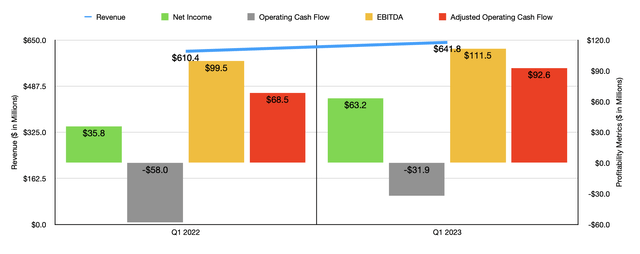

In this modern era, an era that’s defined by all things data, you would think that the market would be all over a business like Belden. To see what I mean, we need only look at recent financial performance achieved by the company. During the first quarter of its 2023 fiscal year, for instance, Belden generated revenue of $641.8 million. That’s 5.1% above the $610.4 million the company generated one year earlier. The vast majority of this increase was driven by higher sales volume and favorable pricing that helped the company to the tune of $40.9 million. Acquisitions contributed another $7.9 million to this top line growth.

The Belden picture would have been better had it not been for two key contributors. First, foreign currency fluctuations negatively impacted revenue by $8.8 million. And the second, management had to absorb some of the increase in costs associated with copper prices rising. That hit sales by $8.6 million.

Author – SEC EDGAR Data

Despite these problems, bottom line results for the company have also improved. Net income, for instance, shot up from $35.8 million to $63.2 million. This came about even though research and development expenses jumped by 25.3% and as selling, general, and administrative costs grew by 18%. In addition to benefiting from the rise in revenue, the company also benefited on its bottom line as a result of a 43.1% reduction in interest expense and, more importantly, a 410 basis point improvement in its gross profit margin. Honestly, I would have liked to know more about this margin improvement. But management has been very quiet on the matter.

Naturally, other profitability metrics for Belden Inc. also improved as a result of this. Operating cash flow, for instance, nearly halved from negative $58 million to negative $31.9 million. If we adjust for changes in working capital, we would have seen this metric grow from $68.5 million to $92.6 million. And finally, EBITDA for the firm expanded from $99.5 million to $111.5 million. No matter how you stack it, these bottom line improvements are quite impressive.

But even with these numbers coming in strong, shares of the company generated a return for investors since I last wrote about the business in February of this year by only 0.4%. While that’s better than a negative, the increase was far lower than the 4.7% rise seen by the S&P 500 (SP500) over the same window of time.

If this was the only data that we had at our disposal, I would say that the market is just pricing in future weakness. However, management does not think this to be very likely. Consider their recent revenue forecast. They believe that sales for 2023 will come in at between $2.71 billion and $2.76 billion. This compares nicely to the $2.67 billion to $2.72 billion range management previously forecasted. At the midpoint, this is an upward revision of $40 million.

This is not to say that everything has been great for Belden. Earnings per share, for instance, should come in between $5.71 and $6.01. This is actually lower than the $5.73 to $6.13 that management previously forecasted.

At the midpoint, the earnings per share guidance provided by management would imply in that income of $255.9 million. That’s a modest improvement over the $254.7 million the company generated in 2022. The other profitability metrics should be more impressive if we annualize results experienced so far for the year. Operating cash flow, on an adjusted basis, should be around $453 million for 2023. That compares to the $335.1 million generated last year. Applying the same thought process to EBITDA would give us an estimate for this year of $497.1 million. By comparison, the metric in 2022 came in at $443.6 million.

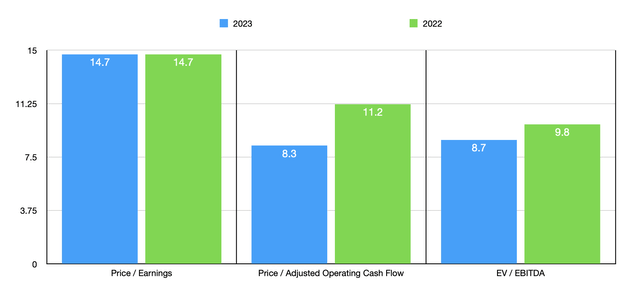

Author – SEC EDGAR Data

Assuming the chips fall in place in the way that I have outlined, shares of the company look reasonably attractive from a pricing perspective. Consider, for instance, the chart above. In it, you can see that the price to earnings multiple for the company of 14.7 matches the 14.7 reading would get using data from 2022. The price to adjusted operating cash flow multiple, on the other hand, should drop from 11.2 last year to 8.3 this year. And over that same window of time, the EV to EBITDA should drop from 9.8 to 8.7. As I do with any other company that I analyze, I also like to compare the firm in question to similar companies.

On a price to earnings basis, as you can see in the table below, three of the five companies ended up being cheaper than Belden. Using the price to operating cash flow approach, only one of the companies ended up being cheaper, while using the EV to EBITDA approach would result in two of the five being cheaper.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Belden | 14.7 | 8.3 | 8.2 |

| Vishay Intertechnology (VSH) | 8.5 | 6.4 | 4.1 |

| Knowles Corporation (KN) | 10.6 | 14.3 | 8.8 |

| Bel Fuse (BELFA) | 10.1 | 9.6 | 7.3 |

| Littelfuse (LFUS) | 18.7 | 15.3 | 12.4 |

| Amphenol Corporation (APH) | 24.8 | 20.2 | 16.5 |

Takeaway

When I last wrote about Belden Inc. in an article in early February of this year, I acknowledged that the company had done exceptionally well leading up to that point. I believe that statement still holds true today. Unfortunately, after seeing a span of several months in which the company’s stock price outperformed the broader market, we have seen a slowdown.

But investors should view this as a short-term thing. After all, shares of Belden Inc. look quite cheap on an absolute basis and look reasonably attractive relative to similar firms. Add on top of this the aforementioned improvements and management’s relatively bullish guidance, and I still firmly believe that Belden Inc. stock makes for a decent “buy” candidate right now.

Read the full article here