Introduction

I want to take a little detour from covering dividend opportunities.

In this article, we’ll discuss a very important topic: material supply chains. Especially in a period of accelerating investments in the ongoing energy transition, access to rare earths is key. These materials are dominated by China, which means the country has a lot of leverage – at least in certain supply chains.

MP Materials Corp. (NYSE:MP) is America’s hope to somewhat ease these risks. The company is ramping up production of rare earths and is in a terrific spot to benefit from government support.

In this article, we’ll discuss all of this and assess the risk/reward of buying/owning MP shares at current prices.

So, let’s dive into mining and geopolitics!

Make America Independent Again

I believe that former President Trump’s Make America Great Again is being recycled by the current Biden administration. While the current President is using different wording, he is spending billions of dollars to push for higher investments in the United States. Especially at a time when companies are working to become less dependent on China, it’s a great opportunity for the U.S. to become more powerful in a wide number of supply chains. This includes electric cars, semiconductors, renewable energy, and so much more.

Additionally, Europe is struggling with de-industrialization, which causes a lot of European companies to invest in the U.S.

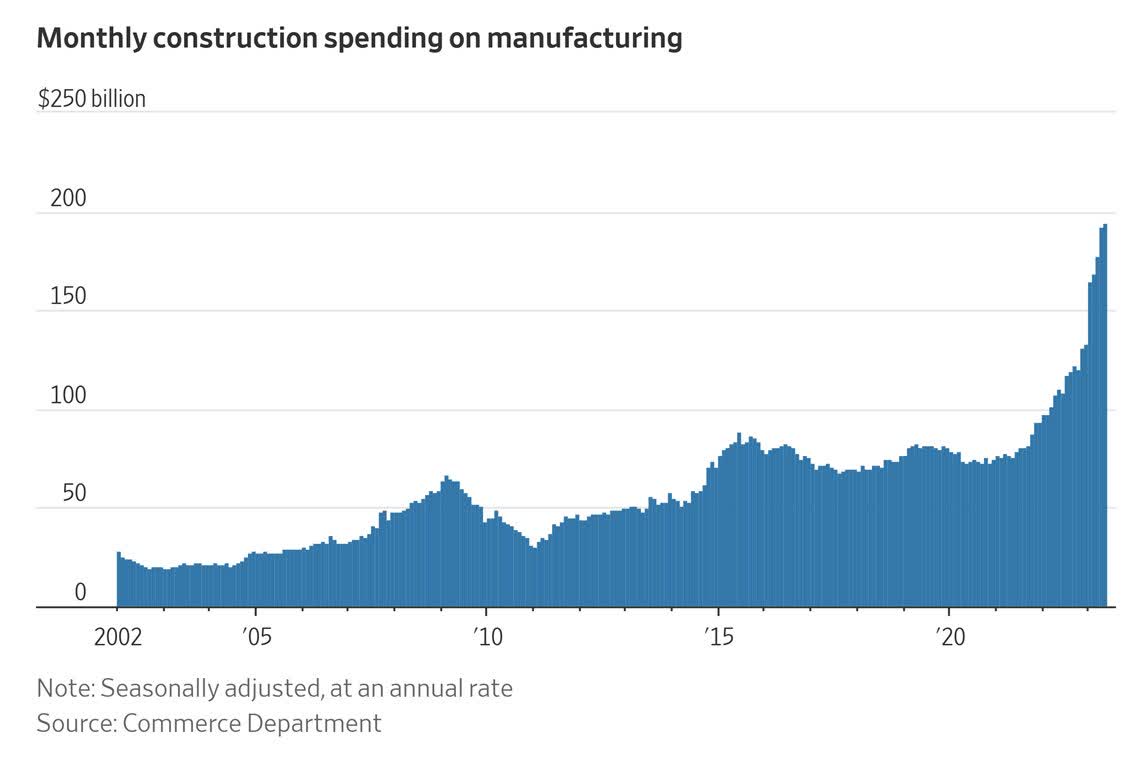

The chart below supports my case, as it shows that construction spending on manufacturing in the U.S. has exploded.

Wall Street Journal

The problem is dependence on rare earth materials, which is an issue I have often discussed on Seeking Alpha, social media, and in a lot of podcasts and interviews.

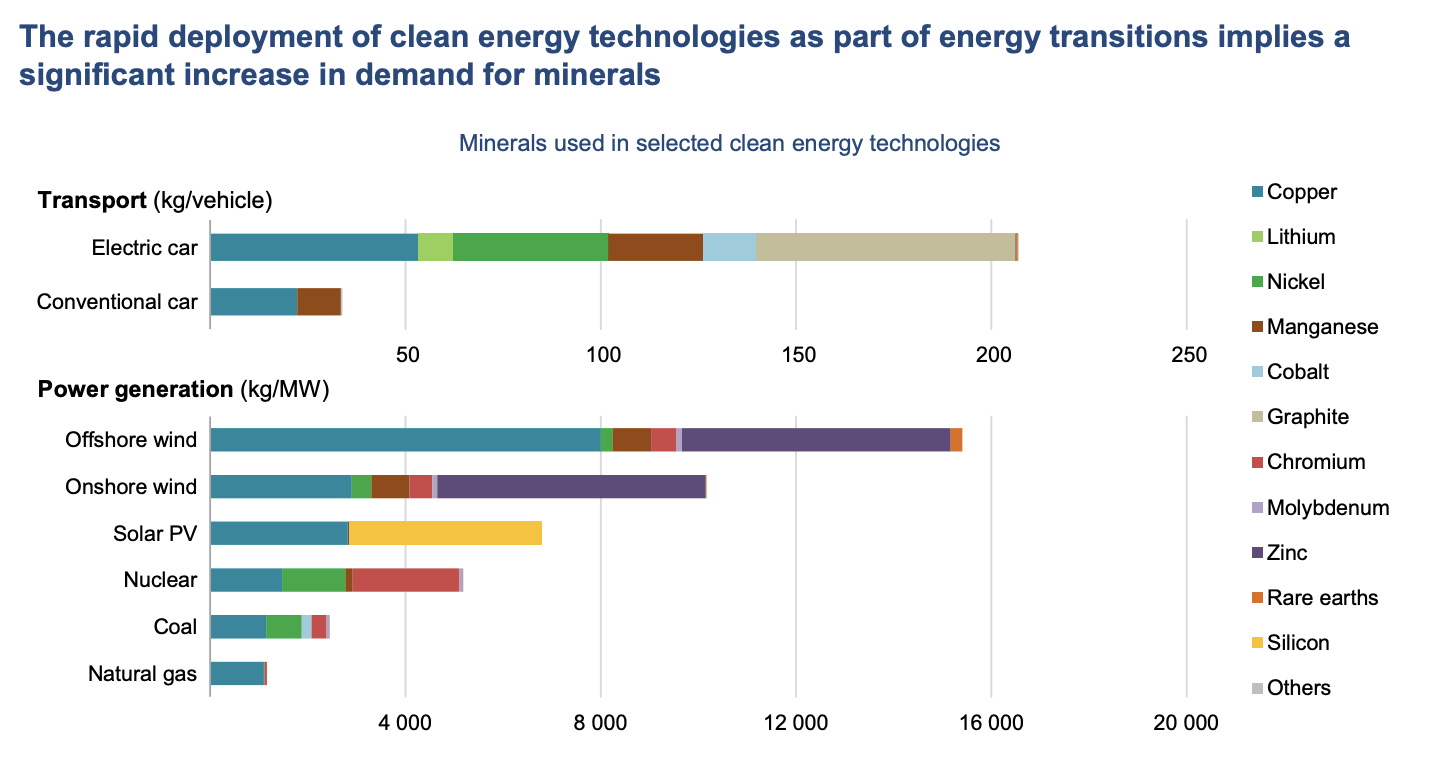

For example, earlier this year, I wrote an article on mining giant Rio Tinto Group (RIO). I used a chart that showed the massive amount of materials used in energy transition technologies like electric cars and solar/wind energy sources.

International Energy Agency

Now, the U.S. government has woken up. In an April article, the Wall Street Journal highlighted the importance of becoming less dependent on China and the willingness of lawmakers to spend money to achieve these goals.

Wall Street Journal

In that article, it was highlighted that China currently dominates the rare earth industry, controlling 91% of refining activity, 87% of oxide separation, and 94% of magnet production.

This concentration creates concerns about supply chain security and the potential impact of geopolitical tensions on production and exports.

With approximately 60% of all mined rare earth minerals sourced from China, the dependence on the country becomes even more pronounced further down the supply chain.

Hence, efforts are underway to challenge China’s dominance and develop alternative rare earth production projects.

The problem is, this is a tough task. Establishing full-scale rare earth facilities comes with technical and financial challenges. Building the entire supply chain requires expertise that currently exists primarily in China.

Different deposits have unique characteristics, requiring bespoke processing equipment that can be very expensive.

Moreover, junior mining projects often require investment from larger mining companies, but securing capital is difficult due to uncertainties around returns and lengthy project times. Mining managers aren’t always willing to take on that much risk. Additionally, the process of getting permits for large projects can take very long.

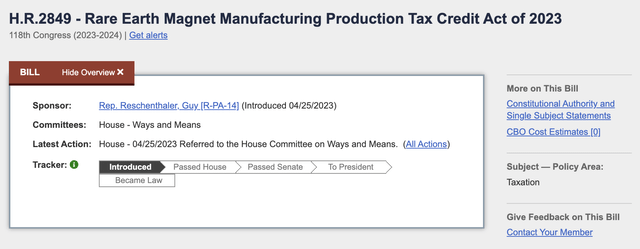

As a result, Washington is pushing for investments in that area. According to the aforementioned WSJ article, Congress aims to offer a tax credit to encourage the establishment of rare earth magnet production in the United States.

Rare earth magnets are an important component of the clean energy transition, particularly in electric vehicles, offshore wind turbines, and robotics.

Without these magnets, the energy transition will likely fail.

The bill called the Rare Earth Magnet Manufacturing Production Tax Credit Act of 2023 offers a $20-a-kilogram credit for U.S.-made magnets. Manufacturers who source 90% of their component parts from U.S. producers could be eligible for a $30-a-kilogram credit.

US Congress

Unfortunately, as we just discussed, supply is limited.

That’s where MP Materials comes in.

What Makes MP Materials So Special

MP Materials is only one of two companies outside of China and Myanmar that have facilities for rare earths.

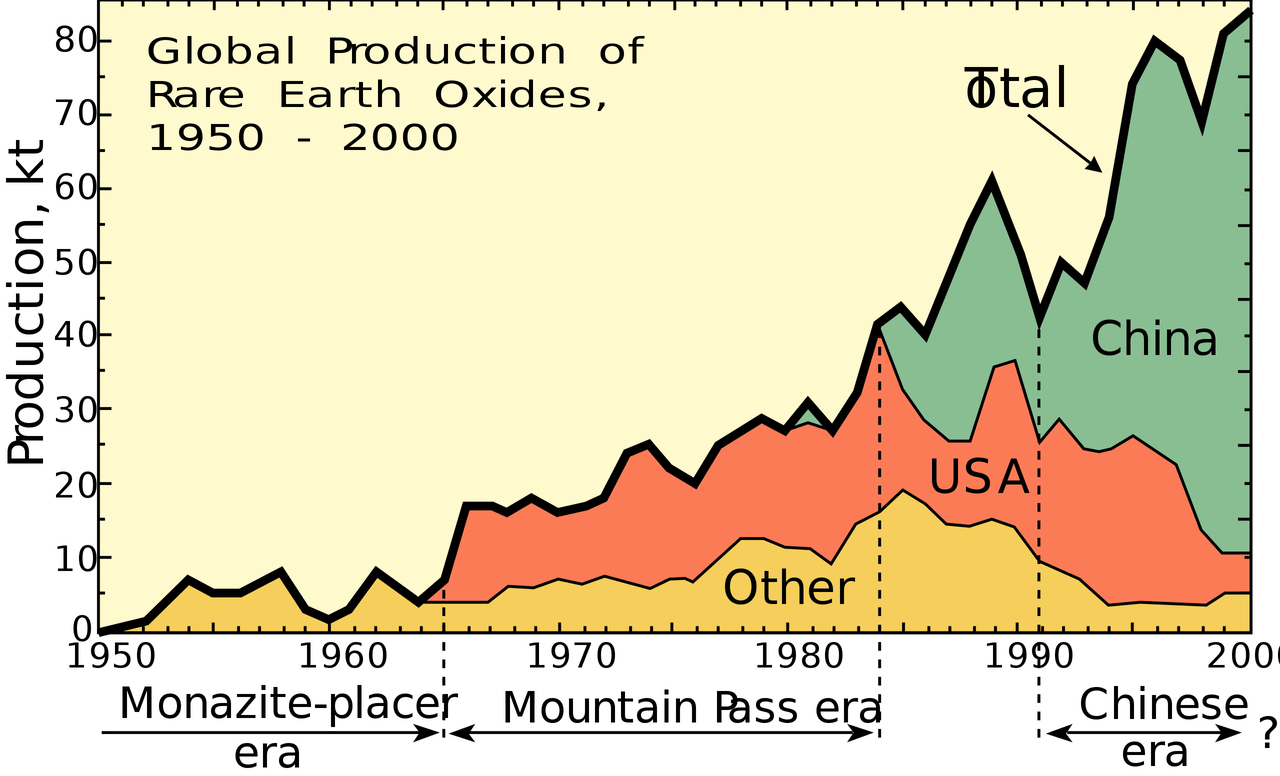

The company is reviving the Mountain Pass mine, located on the border between California and Nevada. Once the world’s primary source of rare earths, the mine suspended operations in 2002 but was restarted in 2017 by MP Materials. Looking at the chart below, we see that the mine allowed the U.S. to be a major producer of rare earth oxides until the early 2000s.

United States Geological Survey

The company plans to establish a refining facility on-site and invest $700 million in a magnet production site in Fort Worth, Texas.

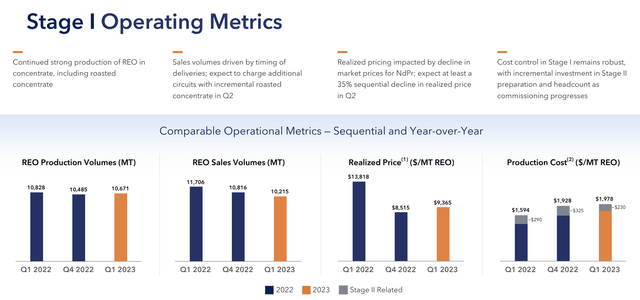

Hence, one of the best things about MP – besides its location – is the fact that it is already producing rare earths. In Stage I, the company currently produces 10,000 metric tons of rare earth concentrates per quarter – for eight straight quarters.

MP Materials Corp.

To be precise, in the first quarter, the company reported 10,671 metric tons of REO (rare earth oxide) in concentrate produced, similar to the comparable periods.

Needless to say, the company remains dependent on pricing.

The realized pricing for NdPr (neodymium and praseodymium) recovered in the first quarter with a 10% sequential increase. However, compared to the first quarter of the previous year, pricing was down 32%.

Even worse, the company expects a significant sequential decline in realized pricing in the second quarter, assuming current prices hold throughout the quarter due to recent softness in the market.

While this trend isn’t favorable for investors, the company remains in a good spot, as production costs of roughly $2,000 per MT of REO are still way below the realized price of REO.

MP Materials Corp.

Furthermore, not only does this company benefit from existing operations, but it also has a strong balance sheet.

During its first-quarter earnings call, the company emphasizes its strong balance sheet and low-cost and cash-generative upstream Stage I business.

MP Materials has nearly $1.2 billion of gross cash and short-term investments, and it has completed the major lift and cost risk of Stage II construction.

At the end of this year, the company is expected to have $320 million in net cash, meaning more cash than gross debt.

Cash flow from operations in the quarter was roughly $55 million, while the company’s capital expenditures were nearly $75 million. After excluding growth CapEx, the company’s cash flow conversion remained solid at $51 million after maintenance CapEx.

The company expects to spend roughly $300 million in CapEx for the year, including the tail end of Stage II spending and investments in heavy separations and Stage III projects.

Speaking of Stage II, during the first quarter call, the company provided an update on Stage II commissioning. They mentioned that they have already put over $200 million of assets into service and expect further ramp-up as the remaining Stage II assets come online.

They anticipate generating NdPr sales in the back half of the year, with sales being heavily backloaded due to the expected ramp-up in production.

However, they emphasized that initial sales may have a lower margin profile until they achieve full run-rate production and smooth out their operations.

Valuation

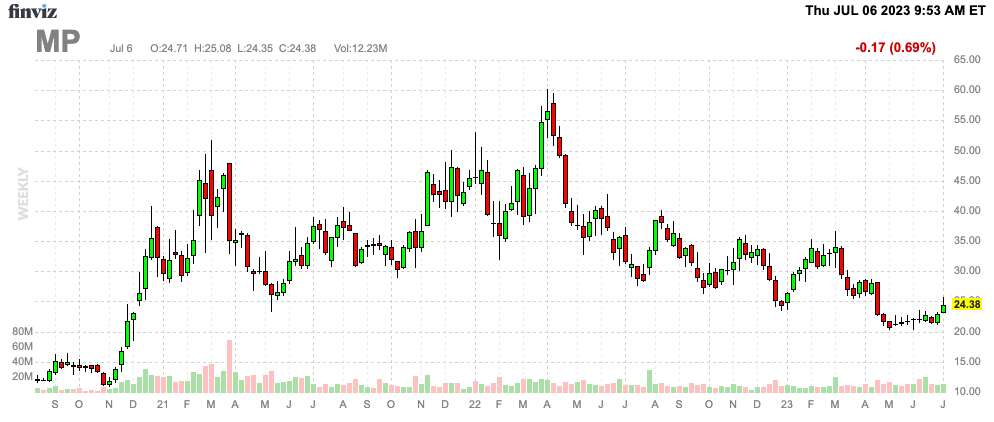

Despite all of the good news, MP shares are trading at $25, which is more than half of the price investors were paying in April of 2022.

FINVIZ

In this case, the decline is caused by slower global economic growth, which has hurt the prices of metals – both rare and abundant metals.

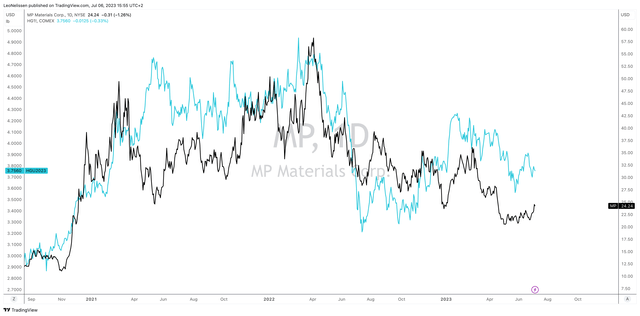

The chart below compares MP’s stock price to the price of COMEX copper (blue line). This isn’t scientifically correct because MP doesn’t mine copper, but given copper’s importance in the energy transition, it is no surprise that the correlation between the two lines is rather high.

TradingView (MP, COMEX Copper)

Furthermore, even without pricing in higher prices, the company is expected to boost its net sales from $340 million in 2023E to roughly $800 million in 2025E.

This surge is expected to result in an EBITDA surge from $150 million to $460 million.

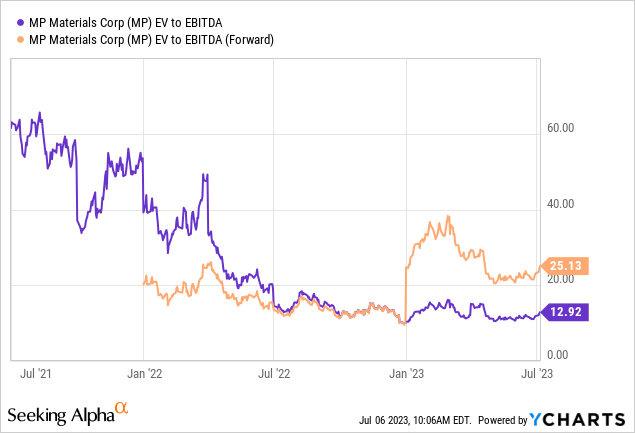

The only reason why the stock is trading at 25x NTM EBITDA and less than 13x LTM EBITDA is because of lower prices impacting profitability in 2023.

Hence, my long-term bullish rating is based on my expectations that we will likely see a steep surge in prices the moment economic growth bottoms. For now, cyclical weakness is more than offsetting secular tailwinds. I expect that to change the moment indicators, like the ISM Manufacturing Index, hint at a sustained uptrend in economic demand.

I expect MP shares to bottom in the $18 to $25 area. The current consensus price target is $37, which is 55% above the current price.

That’s a reasonable assumption. However, that target won’t be reached without support from economic demand. Once that support becomes a reality, I expect MP to blow through that target on its way to $60 and higher.

Nonetheless, I need to add that MP is a highly speculative investment. I usually buy conservative dividend stocks. Only buy MP if you are aware of the risk. If you’re not a trader, I advise you to ignore MP.

Takeaway

The race to reduce dependence on China for rare earth materials is heating up, and MP Materials is positioning itself as America’s hope in this critical supply chain.

With government support and its revival of the Mountain Pass mine, MP is already producing rare earths and has plans for refining and magnet production facilities.

While pricing challenges exist, the company’s low production costs, strong balance sheet, and anticipated sales growth make it an intriguing investment opportunity.

Despite the recent stock price decline, the long-term outlook is bullish, with the potential for significant gains once economic demand strengthens.

However, it’s important to note that MP Materials Corp. stock is a speculative investment and carries significant risk. Conservative investors should be careful.

Read the full article here