Here at the Lab, in early Jan, we commented on BHP (NYSE:BHP) (OTCPK:BHPLF) with an analysis called ‘it’s fairly valued‘. In detail, we scrutinized the company’s latest acquisition, and according to our calculation on an NPV basis, we estimated that BHP overpaid for OZ Minerals’ mines. Mare Evidence Lab’s net asset value calculation was 1.4x and combined with BHP accounts, there is a positive contribution of only 1.5% at the EBITDA level. This was based on BHP’s best and final offer at A$28.25 compared to the previous one at A$25 per share. Before OZ Minerals’ board of directors’ green light, in our M&A optionality follow-up, we explicitly said that:

BHP’s offer was already expensive on NPV calculation and the company is targeting a business that has always traded at a superior valuation. As we already mentioned, BHP might feel some pressure to move on with M&A targets after having reduced its coal division and on the way to exiting its oil segment.

On May 2, the 100% OZ Minerals acquisition was completed. In our calculation, BHP already entered a $5.0 billion new loan facility to support the OZ acquisition (as a reminder, with the second proposal, the total value consideration reached A$9.6 billion). On the disposal side, BHP also started the Blackwater and Daunia facility sale, as these mines struggle to have a good return on BHP capital framework standards. This is not coming as a surprise; however, it might be more difficult than anticipated given the recent royalty hike.

OZ Minerals acquisition

Source: BHP press release

From HY to Q3 results comment

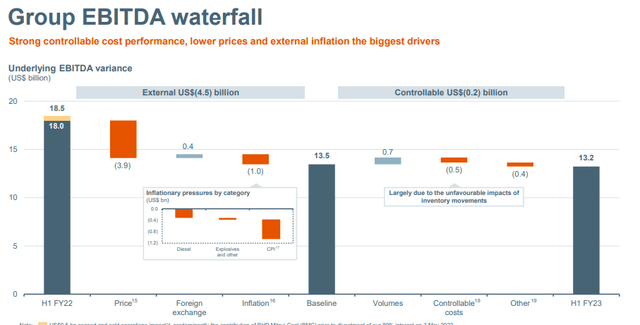

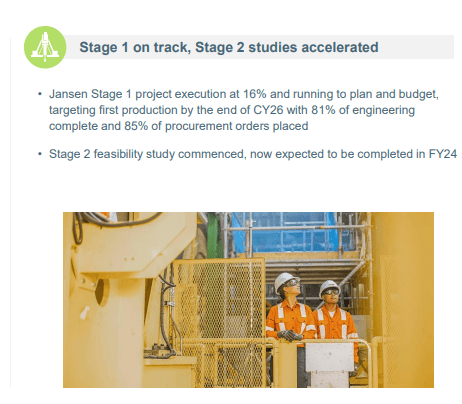

In the half-year performance, BHP’s profits from core operations stood at $10.8 billion and were down 27% on a yearly basis comparison. This was driven by a $4.8 billion reduction in sales which was largely due to lower prices mainly related to the two commodities iron ore and copper. However, what is key to note is the fact that unit costs (across the board) were much higher than expected. Looking at the detail, we see that BHP lagged on inflation and inventory. Cross-checking BHP’s previous estimates, iron ore at Pilbara was 4% above in cost, while at Escondida mines, BHP reached the top-end estimate guidance which was at $1.25-1.45/lb (signing a 4% miss). At comparable FX assumptions, met and thermal coals were also above estimates by 4% and 27% respectively. For this reason, underlying EBITDA reached $13.2 billion (from $18 billion) with a margin of 54%.

BHP EBITDA evolution

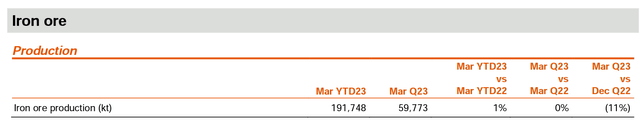

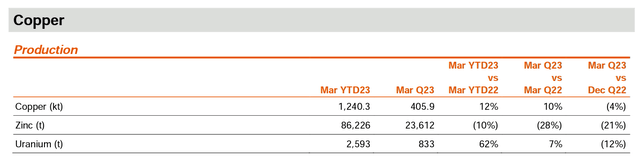

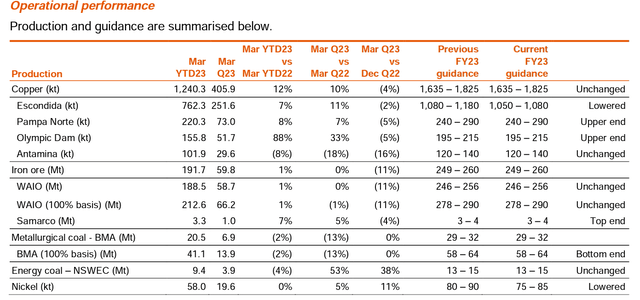

Looking at the Q3 production report analysis, the mining company’s performances were rather mixed and very much in line with our estimates. There was a negative sign on higher cost guidance; however, copper and iron ore results were ok. In detail:

- WAIO output was in line with Wall Street estimates. Cyclone Isla and a few fatalities caused a two-day outage; however, production was solid and we believe that the company will meet the yearly guidance (Fig 1);

- As already mentioned in the half-year output, copper continued to underperform expectations in the Escondida mine (Fig 2); however, the company had solid growth at Olympic Dam and Pampa Norte. In detail, BHP lowered Escondida’s outlook to 1.05-1.08mt. On the positive news, the company flags a new copper discovery in Arizona; however, we are not still pricing in any positive flow given the fact that it would likely take a few years before a material resource will be announced;

- Metallurgical and Energy coal signed a positive recovery on a quarterly basis with improvements in productivity and production guidance was left unchanged (Fig 3).

BHP – Iron ore

Source: BHP Q3 production analysis – Fig 1

BHP – Copper

Fig 2

Metallurgical and Energy coal cost basis unchanged

Fig 3

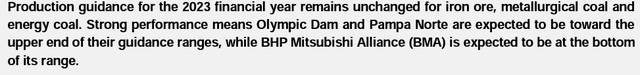

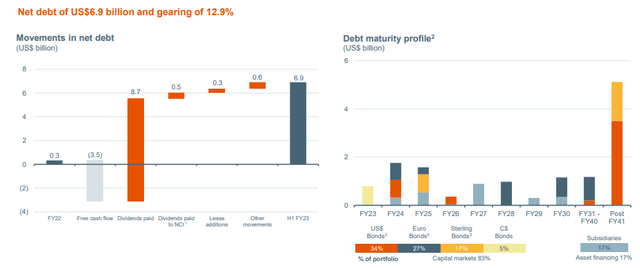

Dividend and net debt

Regarding BHP’s shareholder remuneration policy, the board proposed an interim dividend of 90 US cents per share which is equivalent to a 69% payout ratio for a total consideration of $4.6 billion payment. The dividend per share was weaker than expected, given the lower FCF and the higher tax payment (this was also partially offset by a lower CAPEX). In detail, net debt reached $6.9 billion versus consensus expectations of $5.4 billion, while here at the Lab, we are not surprised (Fig 1). In our last analysis, we indicated that BHP’s debt will increase by almost $10 billion, and we also estimated that the OZ deal was funded by a new loan facility and cash reserve. As a memo, we were already including higher CAPEX requirements over the next two years estimated at another A$2.5 billion. Still related to BHP’s project updates, it is important to report that Jansen Stage 1 is accelerating with the first production expected to be in 2026 from 2027. A feasibility study for Jansen 2 has also been started and is expected to be finished by 2024 (Fig 2).

BHP debt evolution

Fig 1

Jansen update

Fig 2

Conclusion and Valuation

Copper output was broadly in line; however, Escondida facility production was weak due to road blockades and higher diesel costs. This was also reported at WAIO mines as a result of higher inflation and labor availability. Despite that, BHP’s full-year guidance WAIO was left unchanged, and it is even more surprising that NSWEC 2023 outlook was stable, given the fact that Q3 just ended, BHP produced only 64% of their production target. New South Wales Energy Coal (NSWEC), WAIO, and Escondida are based on the following rate exchange at USD/CLP 830 and AUD/USD 0.72 (this might be another risk). In our estimates, we are revising upward NSWEC and BMA costs of $87 and $100 per ton respectively. Given the strong output from other assets, the fiscal year 2023 cost guidance was essentially unchanged.

Higher costs

In our assumption, we are forecasting a working capital outflow of $1.2 billion and an effective tax rate at a mid-point between 30% and 35%. Considering also our CAPEX and debt calculation (already included in BHP is a fairly valued publication), we decided to reiterate our neutral valuation, confirming a price of A$40 per share (and $54 in ADR). As already mentioned, our internal team continues to see a balanced risk profile for BHP and believes that the company is fairly priced. This is based on an EV/EBITDA multiple of 4x (in line with comps valuation), and given the same commodity mix profile, we still prefer Rio Tinto. An additional risk in BHP includes a lack of growth options after the oil demerger, a full coal exit may be also warranted, rendering the company even less diversified (and potentially we might have other value-destructive M&A operations).

BHP production guidance update

Previous BHP production analysis:

- BHP Group: Q1 Production Report Analysis

- BHP Group: Q4 Production Report Analysis

Main comps covered by Mare Evidence Lab:

- Anglo-American: Balanced Approach To Earnings Diversification

- Rio Tinto: Q4 Production Report Analysis

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here