Introduction

In this article, I want to talk about a fairly new BDC that I think investors looking for income should consider adding to their portfolios. I’m always researching dividend stocks to add to my portfolios and came across this BDC in 2022. My followers can probably tell by now that I’m a big fan of BDCs and REITs. Both are similar as they are required by law to pay out a high portion of their earnings to shareholders. When I tell my family and friends, most of them have never even heard of a BDC or a REIT. These are, in my opinion, sectors that investors often overlook. This year, it seems a majority of people have been looking for the next big A.I. stock to make them rich. And with the high interest rates, inflation, the failure of Silicon Valley Bank, and economic uncertainty, both REITs and BDCs have sold off tremendously; creating a great opportunity for income investors like myself. Let’s get into why I think income investors should consider adding Blackstone Secured Lending (NYSE:BXSL) to their portfolio.

#1 They’re Newer

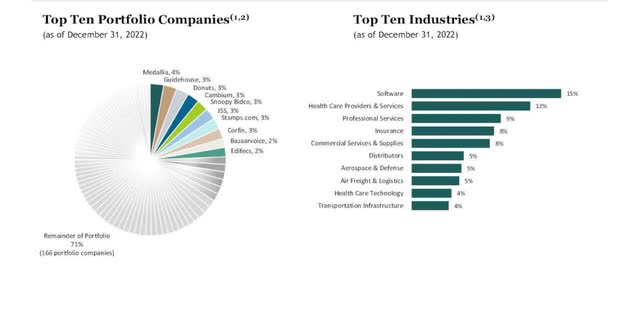

BXSL is a business development company that primarily invests in the first lien senior secured debt of private U.S. companies. The BDC is managed by the very popular asset manager Blackstone (BX), the largest alternative asset manager in the world. One thing I like about this BDC is that it is still fairly new having only launched in 2018. In my opinion, this BDC still has plenty of room to grow in value having launched only 5 short years ago. Being managed by Blackstone also gives the BDC a competitive advantage as their platform provides scale, deep relationships, access to insights and expertise, and value-added operational support for borrowers. The company is recognized by Private Debt Investor and won multiple awards including: BDC manager of the Year, Global Fund manager of the Year, Debt of the Year, Global Responsible Investor of the Year, and Lender of the Year. Below are the top ten portfolio companies and industries as of December 31st, 2022:

Blackstone Investor presentation

As you can see, Software and Health Care Providers & Services are its top two industries followed by Professional Services and Insurance. I don’t think this is by mistake. Since the pandemic, the software industry has seen major growth. Stay-at-home measures have only reinforced the importance of technical infrastructure, and as we move into the future, it’s likely businesses will only depend on these tools more. According to statista.com software revenue is expected to show an annual growth rate of 5.42%, resulting in a market volume of almost $900 billion by 2028.

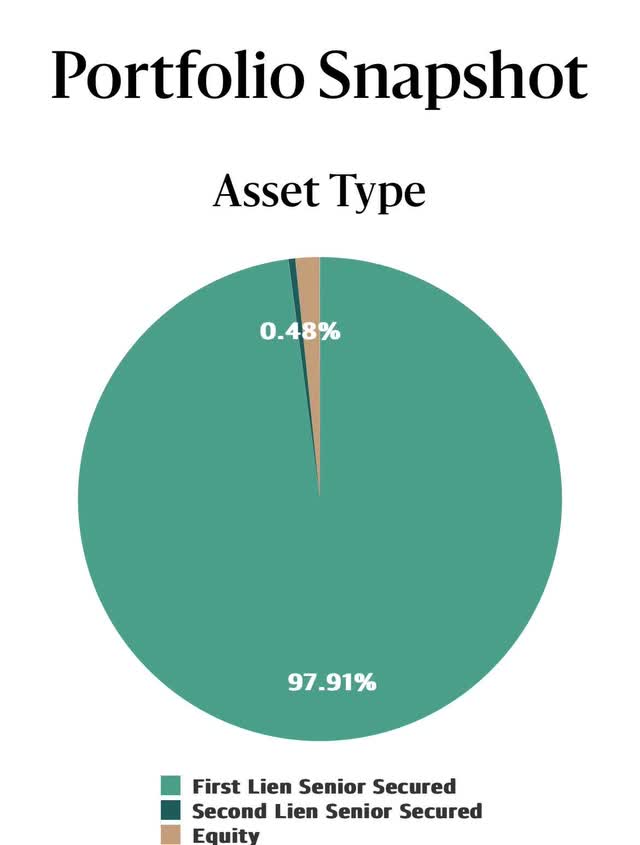

#2 First Lien Concentration

Besides being managed by the largest asset manager in the world, another thing I like about them is their concentration in first lien senior secured loans at almost 98% to Ares Capital (ARCC)’s 68%. And while 98% of ARCC’s loans are floating rate, BXSL’s is slightly higher at 99.9%. BXSL is also diversified outside of the U.S. with 5.05% of its investments in Canada and 2.19% in Europe.

BXSL.com

Management Matters

Both ARCC and BXSL are managed by what are to be considered two of the best and largest alternative asset managers in the world. Blackstone is the largest with over $1 trillion in Assets Under Management (AUM). The company also has 12,600 real estate assets and more than 230 portfolio companies. Ares on the other hand has $360 billion in AUM and $49 billion in real estate assets from 24 partners. The company is well-positioned for defense and continued growth with $1.2 billion of liquidity in cash and their undrawn lending lines. ARCC’s portfolio is also valued at $21.1 billion and is diversified across 466 companies and 25 different industries. ARCC’s management team is considered seasoned and experienced with an 9-year average tenure. BXSL’s management team is fairly new with an average tenure of less than a year. This is understandable as the BDC has only been around since 2018 and IPO’d in 2021.

#3 Rapid Growth

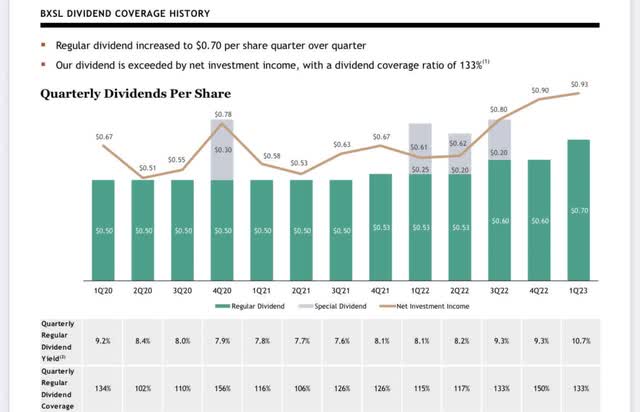

Since inception, BXSL has returned 10.3% annual total net return. During Q1 earnings the BDC reported NII of $149 million, or $0.93 a share in the quarter, up 3% from $0.90 in the prior quarter, and 52% over the last year! They also raised the dividend by 10% to $0.77 from its prior of $0.70. I believe this speaks volumes to the quality of the BDC especially in the current macro-environment. Since paying a dividend in 2021, the company has raised it by more than 45% from $0.53 to its current of $0.77 less than 2 years later. Investors who invested in this BDC also saw almost 20% in price appreciation. This was higher than two other favorite BDCs of mine, Capital Southwest (CSWC) and ARCC. You can check that out here.

Seeking Alpha

#4 Non-Accruals

While ARCC reported a modest rise in non-accrual loans to 2.3% from 1.7% during last quarter, BXSL reported a very low 0.14% of non-accrual debt investments during its Q1 earnings report. Based on the fair market value of the portfolio, this would be even lower at 0.07%. The company also managed to grow its NAV from $25.93 to $26.10 from December 22′ to March 23′. It is to be noted that the company does have some debt maturities due in the month of July. And while the FED is expected to raise rates again this week, I believe the company is well-prepared as its next debt maturity date (after this month) is not until May of 2025 at a very low interest rate of 2.525%. With the constant threat of a recession, non-accruals are a very important metric to look at when investing in BDCs as this number could continue to rise as companies see declines in sales and profits, as well as cash flow issues, leading to potential bankruptcies. Then there’s also the FED’s promise for interest rates to remain elevated to battle inflation. But while inflation has seemed to cool quite a bit, it is still above the target of 2%. With this, we may see a change of heart from the FED soon.

#5 Higher Dividend

ARCC currently pays a quarterly dividend of $0.48 to BXSL’s $0.70. Although they recently raised it to $0.77, this is not payable until October 26. They also reported 133% dividend coverage during first quarter. As seen below, BXSL has maintained triple digit dividend coverage since Q1 2020.

BXSL.com

As an income investor, I’m constantly searching for dividend stocks to supplement my income in retirement. And while some investors prefer other well-known companies such as Walmart (WMT) or McDonald’s (MCD), I prefer BDCs and REITs. But one thing I’ve learned to be careful of is yield chasing. This can be dangerous as chasing high yields can lead to cuts in the dividend as seen with many mortgage REITs like Cherry Hill Mortgage (CHMI). The REIT cut the dividend twice in the last few years, once in 2020 by 32.5% from $0.40 to $0.27, and recently in June of 2023 from $0.27 to $0.15, a 44.4% decrease. Before those cuts, the stock was highly touted among several popular SA analysts here on Seeking Alpha. Net Investment Income and FFO coverage are two very important metrics I teach my friends about when investing in stocks. “Quality over quantity” is something I constantly think about with everything that I do and I hope to instill that in my readers and followers as well.

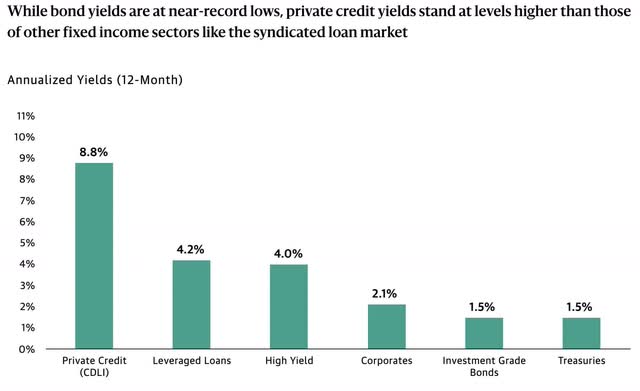

Investment Comparison

I know in the past many investors have made comments about putting their money into bonds or high-yield savings accounts, or even in Certificates of Deposits (CDs). While these are also great investments, the current yields being offered by several banks are temporary due to the current high-interest rate environment. Below is the comparison of private credit lenders like BXSL compared to bonds and treasuries. At 8.8%, this doubles the current leveraged loans and high-yield savings offered by most banks. According to investopedia.com, Betterment has the highest APY at 5.25%, over 40% less than private credit.

BXSL.com

Investor Takeaway

To be clear, I hold both ARCC and BXSL. I am not saying one is necessarily better than the other but I just wanted to do a small comparison to show the quality of BXSL to ARCC as they are a fairly new BDC and ARCC is one of the more popular BDCs. Even though they don’t have a long track record like ARCC, the BDC held up well during COVID and if it continues its streak of dividend raises and smart investments, BXSL will be talked about for many years to come. They trade at a very slight premium to NAV but I rate the BDC a buy. Investors looking to add a position should consider adding small amounts and dollar cost averaging into BXSL at opportune times. The BDC held up well during COVID and managed to grow its NAV and dividend during recent economic downturns. With its concentration in first-lien senior secured loans and low non-accrual rate, I believe BXSL is a well-managed BDC that is a long-term hold for income investors.

Read the full article here