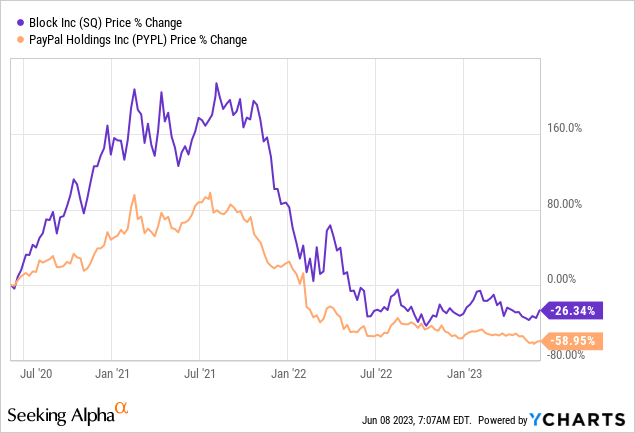

Shares of Fintech companies such as Block (NYSE:SQ) or PayPal (PYPL) have seen sharp downside moves in the last two years as post-pandemic growth slowed and investors became more critical of high valuations in the sector. However, Block is still growing its top line at double-digit rates and the company’s core product, the Cash App, continues to have a lot of momentum which is reflected in impressive Y/Y gross profit growth rates. While shares of Block are not cheap, there is real momentum in the roll-out of the Cash App ecosystem. Additionally, Block has an opportunity to grow its revenues internationally and a larger percentage of its top line is likely going to come from markets outside of the U.S. going forward. As a result, I believe Block’s shares have upside revaluation potential!

Block continues to see strong momentum in its core product, the Cash App

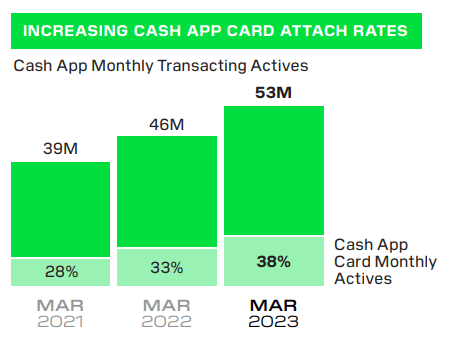

As I indicated in my last work on Block, the best reason to buy into the Fintech at this time, in my opinion, is that it has a lot of momentum with its Cash App… which I previously described as the company’s crown jewel. The Cash App is a mobile payment service available to users in the U.S. and the U.K. and facilitates instant money transfers within the app and allows Cash App Card users to access in-network ATMs for free. The Cash App has seen growing popularity with users and it had 53M active accounts at the end of the first-quarter, meaning Block added a massive 14M new users in the last two years. The roll-out of the Cash App Card is an especially promising driver of growth for Block: The Fintech had about 20M users of its Cash App Card (38% of Cash App users) in March 2023 compared to just 11M two years ago (28% of Cash App users).

Source: Block

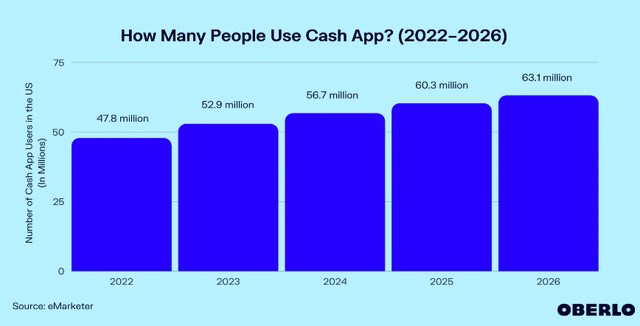

According to eMarketer, the Cash App’s popularity is expected to continue to result in significant customer attraction in the next few years. Block is expected to add approximately 3-4M new Cash App users to its ecosystem annually over the next three years, a number that I believe could be conservative given the recent momentum in Cash App user sign-ups. I believe the Cash App could have 72-75M users by the end of FY 2026… if the company’s most recent momentum in sign-ups can be sustained.

Source: Oberlo

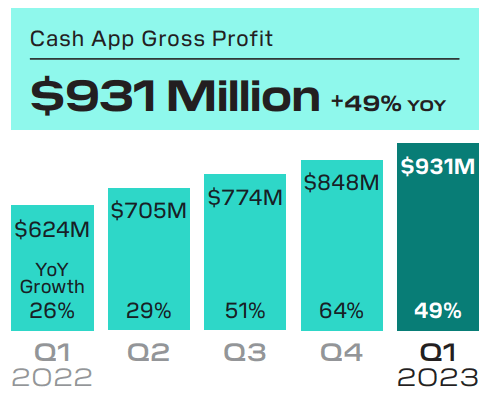

In Q1’23, the Cash App generated $3.3B in revenues, resulting in $931M in gross profit. Block’s Cash App gross profit growth was 49% year over year in the first-quarter and is driving the company’s consolidated gross profit growth. Strong growth in Cash App gross profit is due to the fact that the Cash App is benefiting from accelerating customer adoption, new money inflows to the Cash App ecosystem and increasing customer uptake of the Cash App Card.

Source: Block

Growth potential outside of the U.S.

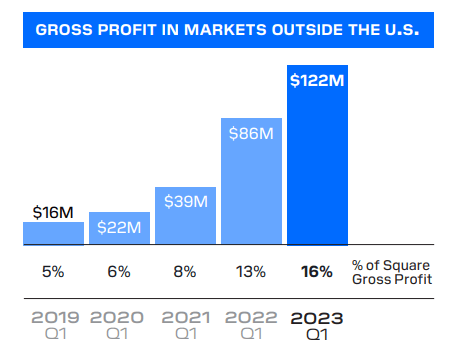

One aspect that I really like about an investment in Block is that the company is still fairly focused on the U.S. market for revenue and earnings generation, but the Fintech has aggressively pushed into the international marketplace in the last two years. In the first-quarter of 2023, 16% of Block’s gross profit ($122M) was achieved in markets outside the U.S. compared to just 6% ($22M) three years ago. Markets outside of the U.S. represents an enormous growth opportunity for Block and I estimate that, based on current growth rates, that non-U.S. markets could grow to a gross profit share of 25% by FY 2026.

Source: Block

Block’s valuation compared to PayPal

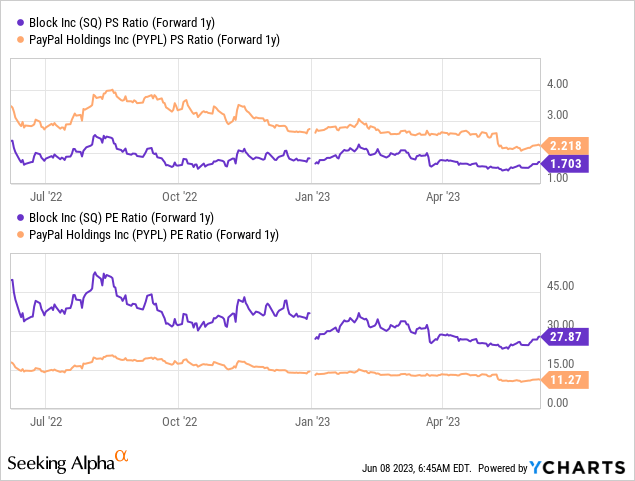

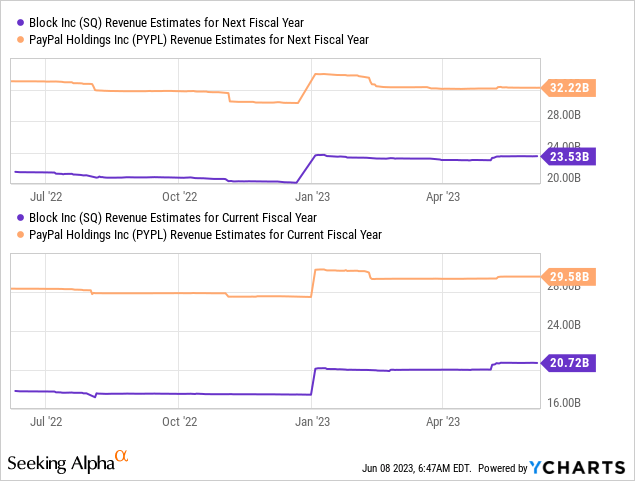

Block is highly valued due to its revenue and gross profit momentum that originates chiefly from the Cash App. Block is valued at a price-to-revenue ratio of 1.7X and a price-to-earnings ratio of 28X. PayPal has a much lower earnings multiplier factor of 11X, but PayPal is also growing its earnings at a much lower rate than Block. In other words, Block’s premium P/E is due to the fact that the company is expected to grow much faster than PayPal, largely due to its reliance on the Cash App ecosystem.

Block is expected to see top line growth of 18% in FY 2023 and 14% in FY 2024 which compares to revenue growth rates of 8% and 9% for PayPal. While PayPal is not growing as quickly as Block, I still like PayPal because the company is solidly profitable and generating a ton of free cash flow each quarter.

Risks with Block and other Fintech companies

Fintech companies have seen a moderation of their revenue pictures after the pandemic and the sector is no longer growing as fast as it did in FY 2020 and FY 2021. However, Block is still expected to grow at robust double-digit rates annually for the foreseeable future (Source). What would change my mind is if Block lost its momentum with its Cash App business which is the firm’s current growth driver.

Final thoughts

Block submitted a strong earnings sheet for the first-quarter that showed that the company’s core product, the Cash App, continues to benefit from growing reach and engagement. Cash App momentum is therefore, in my opinion, the best reason for investors to buy shares of Block, even if this growth comes at a premium price. While Block’s earnings potential isn’t cheap, the momentum seen in the Cash App ecosystem, I believe, is worth a premium multiplier. Block keeps executing well and since the company continues to see customer acquisition momentum and growing Cash App Card uptake, I believe the risk/reward trade-off is still very favorable for investors!

Read the full article here