Blue Bird (NASDAQ:BLBD) recently reported much better-than-expected results, resulting in a stock surge of approximately 36%. The company’s Q2 revenue of $299.8 million was up 44.4% year-over-year (Y/Y) and exceeded consensus expectations by $50.27 million. Additionally, its earnings per share (EPS) of $0.27 surpassed consensus by 19 cents. This marked the company’s first profitable quarter after five consecutive quarters of losses.

Despite the lack of optimism among many investors and analysts regarding the company’s prospects prior to the earnings announcement, I had anticipated this outcome and gave the stock a buy rating in my previous article published in March.

The narrative was straightforward. As a school bus manufacturer, the company had suffered due to schools shifting to online education during the COVID-19 pandemic. Although the company started receiving new orders after the reopening, it faced challenges in fulfilling them due to supply chain constraints. Moreover, the company’s margins were negatively impacted by a spike in steel prices following the Russia-Ukraine war. As a result, the company reported several quarters of losses. However, none of these headwinds were permanent or insurmountable structural issues for the business. In recent quarters, the easing of supply chain constraints has allowed the company to convert its high backlog of orders. Furthermore, steel prices have corrected, and the company has begun entering into forward contracts to hedge against the volatility of steel prices. Additionally, the completion of the company’s legacy orders, which were booked at lower prices, was nearing.

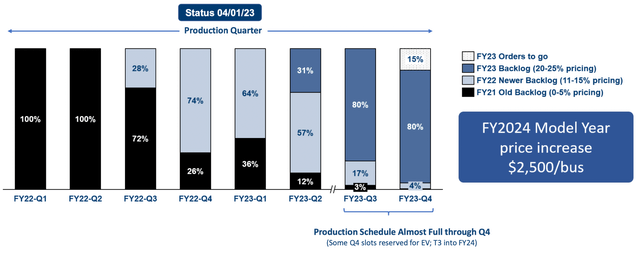

BLBD Backlog Mix (Company Presentation)

Therefore, the company’s performance was poised to reverse, forming the central argument of my previous article. As expected, the company experienced a favorable outcome. With the easing of supply chain constraints, the company sold 373 more units in Q2 FY23 compared to the second quarter of the previous fiscal year. Moreover, bus revenues per unit increased by approximately 22% Y/Y, rising from $97.6 thousand in Q2 FY22 to $118.7 thousand in Q2 FY23. Both of these factors contributed to a significant increase in revenues. BLBD’s margins also benefited from rising average selling prices (ASPs), improved supply chain conditions, volume leverage, and the correction in steel prices. The company reported an adjusted EBITDA margin of 6.6%, compared to a negative 5.1% adjusted EBITDA margin in the same quarter of the previous year.

Looking ahead, the company’s future prospects appear promising. Its backlog remains at a healthy level of 5,783 units, and the company’s future order outlook is favorable, thanks to the Clean School Bus Rebate Program, which allocates $5 billion to aid local school jurisdictions in purchasing zero and low-emission buses from 2022 to 2026. Management expects this funding to generate incremental revenue of $1 billion for the company in the coming years.

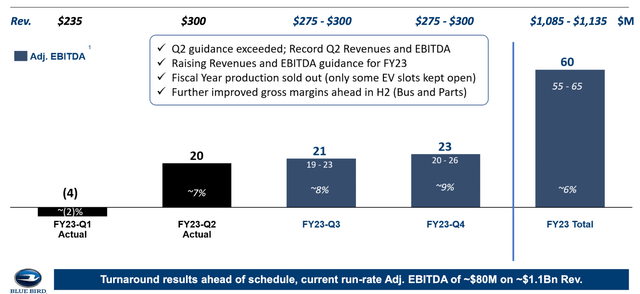

For the next two-quarters of FY23, management has provided revenue guidance ranging from $275 million to $300 million.

BLBD Management Guidance (Company Presentation)

I believe this guidance is conservative, and the company is likely to meet or exceed the upper end of this range for a couple of reasons. Firstly, management has stated that all production slots for the current fiscal year are already sold out, with only a few EV slots remaining. Additionally, the company has been increasing its production capacity. So, this means units produced in the coming quarters will likely be higher than the Q2 run rate. Moreover, as the low-price old order backlog has already been completed, the orders executed in Q3 and Q4 will have higher average selling prices (ASPs). The increase in units, along with higher ASPs suggests that Q3 and Q4 will likely generate higher revenue than Q2. Considering that Q2 revenue was already around $300 million, I expect more than $300 million in revenue for both Q3 and Q4, surpassing the upper end of management’s guidance. Furthermore, rising ASPs should continue to bolster margins as the year progresses.

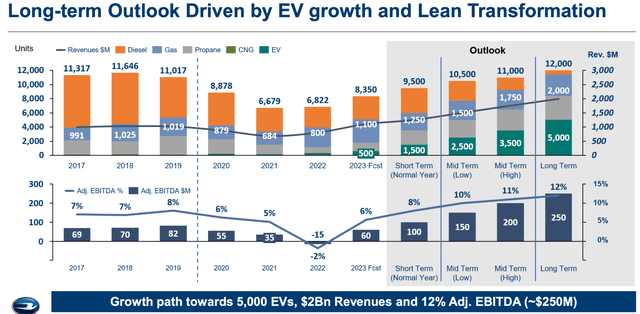

Regarding the long-term outlook, management has provided various scenarios for the company’s unit sales, revenues, and margins.

BLBD Long Term Scenarios (Company Presentation)

In my view, a reasonably conservative normalized scenario for the company would involve achieving around 11,000 unit sales. Prior to COVID-19, the company sold over 11,000 units each in 2017, 2018, and 2019. Therefore, I believe reaching a pace of 11,000 unit sales over the next couple of years should be easily attainable. With a higher proportion of high-margin electric vehicles (EVs) in the sales mix, increasing ASPs, and the company’s lean transformation, management expects adjusted EBITDA margins of approximately 11% and targets approximately $200 million in adjusted EBITDA in this scenario. While some investors may be skeptical about this margin target, I find it reasonable. Based on the current mix, management has guided for the company to achieve approximately 9% adjusted EBITDA margin by the fourth quarter of this year. A couple of hundred basis points improvement from there, driven by higher volume, higher ASPs, and a better mix, doesn’t seem difficult to achieve. I believe the company’s margin performance over the next two quarters should bolster investor confidence in management’s long-term margin targets.

Following the recent surge, the company has a market capitalization of approximately $850 million. It has long-term debt of around $120 million and cash and cash equivalents of approximately $18 million. Thus, considering the normalized scenario with an adjusted EBITDA of approximately $200 million, the company’s enterprise value-to-EBITDA multiple is still below 5x, which is attractive. I believe medium to long-term investors who can hold the stock for the next couple of years and wait for the company to return to annual sales of 11,000 units or more can expect a good upside potential. Hence, I maintain my buy rating on BLBD stock.

Read the full article here