Lost all your money buying one too many BMWs? Wife has a designer bag addiction? Well, I know something that will take the stress off… it’s called a cigarette. And the best way to take advantage of all the benefits smoking has to offer is buying stock in British American Tobacco (NYSE:BTI).

Company Description

British American Tobacco sells tobacco and nicotine products to consumers worldwide. About half of BTI’s sales come from the US, making it the company’s primary market. BTI has five product categories: (1) Vapor (2) Tobacco Heating Product (THP), (3) Modern Oral, (4) Traditional Oral, and (5) Combustibles. The company has over 50,000 employees and is headquartered in London, England.

Combustibles Down

In the past two years, BTI’s US cigarette volume declined over 20%. This was offset by price increases which have been seemingly well received by customers. More on price elasticity later. The company is shifting from combustibles (declining demand) to non-combustibles (increasing demand).

The reality is, in developed countries, cigarette use has been on decline for decades. Using this fact alone is not a legitimate case for a bear thesis against BTI unless the drop happened to be extreme (i.e., 50% of the smokers quite at the same time), which it is not. The reduction in cigarette volume is reflected in the current valuation.

Industry Resiliency

Along those lines, society will not collectively quit nicotine. There is a saying which goes, “the sum of all vices is equal.” In other words, people do not remove addictions, they simply replace them with other addictions.

In the case of smoking, the medium of inhalation is irrelevant – call it whatever you want: a cigarette, pen, dip, pouch, etc; they are all nicotine-based products. The percentage breakdown of how many people smoke each category does not matter. What matters is the number of people who are in this pool of nicotine users do not meaningful reduce.

For example, if less people smoke cigarettes, but instead choose to vape, then there is no net change in the number of nicotine users. The product categories would have different pricing and margins, but that is besides the point I am making. Therefore, the two biggest factors that could reduce earnings are: 1) government legislation forcing people to stop using BTI’s products 2) people avoiding BTI’s products as a whole on their own accord.

Legislative Risk

If we establish, in regards to the latter of the two, that people will always use nicotine products, then the million-dollar question becomes: will governments restrict enough of BTI’s product line from being marketed and/or sold that its profitability will never recover? Maybe, but I doubt it. Here is how I think of it:

It’s not as if government regulation is new. Tobacco companies have been dealing with punitive and preventative legislative acts for decades. As smokers shift from combustibles to non-combustibles, there will naturally be legislative pressure introduced because non-combustible products are new (relatively). When you buy shares of BTI, you are placing your trust that the management team will find alternative non-combustible products to sell legally in order to maintain their revenue and earnings.

We know that people will never stop consuming nicotine just like people will never stop consuming caffeine or sugar or any other addictive substance. The management team has to find a legal product to “give people their fix.” If you believe they can deliver, the stock is undervalued. If you believe they cannot, your premise becomes the stock is overvalued. If you are unsure, it would be best to wait and watch.

Never feel rushed in investing. There are people who become millionaires buying Wal-Mart, Microsoft, and McDonalds decades after they became household names.

ESG Investing

I could not care less about the concept of ESG investing as most of it is marketing hype. For example, BTI’s 2022 campaign is literally called “Build a Better Tomorrow.” This is a bit ironic, needless to say.

That being said, I do not buy tobacco stocks. It is a personal, moral decision I made when I started investing. I understand tobacco companies are not forcing people to smoke and these individuals are smoking by their own free will. But I also understand addiction is not so black and white – and that really breaks my heart. I provide this anecdote only as an explanation for readers who read this article and then ask, “why doesn’t the author own shares?”

Alright, now moving on!

Capital Preservation vs. Growth

I am not a dividend investor, but one thing I have noticed in the community is many investors seem to ignore capital losses and only count dividend gains. This needs to be addressed:

This methodology is misguided and will not lead to financial gains, only the illusion of it.

Even if an investor has no inclination of liquidating a position if the stock price falls, they have to understand the price fell for some reason. Stocks do not rise or fall in a vacuum. If the stock price fell, it means investors are concerned about a reduction in future earnings. If future earnings fall, the dividend is at risk. Therefore, owning potentially at risk dividend stocks, but simply ignoring the “at-risk” part paints an incomplete picture of your holding.

Investors need to pay value prices for their dividend paying stocks so that enough margin of safety is baked into the price that your cost basis will likely never be surrendered, barring unexpected circumstances. From that starting point, the dividend is “pure gravy.” This is the true “live off your dividends” scenario that dividend investors seek. You have to buy your dividend stocks dirt cheap, no exceptions.

Is BTI that Opportunity?

At face value, the stock is underpriced at its forward P/E is only 6-7x earnings, but should investors buy now or sacrifice some gains by waiting for a clear signal legislative risks have declined? I think investors can afford to wait, but it is not necessary. I believe enough pessimism is baked into the price. With that in mind, let’s talk valuation…

Valuation

It is important to note, no two investors will get the same valuation. There are a million assumptions one can make in regards to a DCF. The goal is to calculate a valuation that is based on known data, bakes in a margin of safety, and factors in guidance.

Assumptions

In this DCF, I am going to utilize more conservative estimates.

Specifically:

- Revenue growth is set to 3% per year

- Operating margin is set to 38%

- Tax Rate is set to the British corporate tax rate of 25%

- Net current assets set to sales is set to (5)%, which reflects historical averages

- CAPX set to previous level and CAPX growth reflects moderate investments

- WACC was hand calculated to be roughly* 6%

- Terminal value set to 2%

*BTI did not provide a debt schedule. They provided ranges so I had to use unweighted averages within those ranges to get a rough estimate of the company’s WACC. Also, I used a higher beta to be even more conservative. Therefore, 6% might overstated by about 50 basis points.

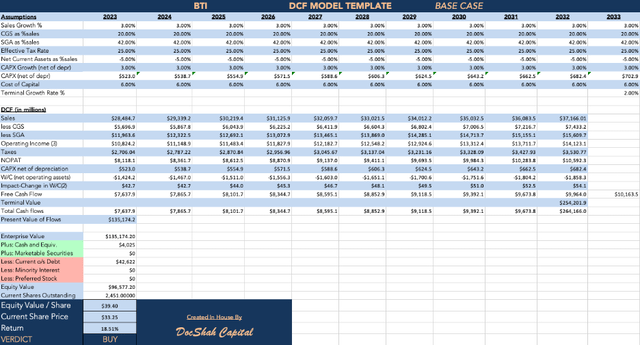

DocShah’s BTI DCF (Base Case)

BTI Base Case DCF (FastGraphs)

Based on these estimates, the stock’s fair value is about $40 per share, which represents 20% upside from current levels.

Zooming out, the company’s revenue in ten years is about 30% higher than today. This is certainly achievable under normal circumstances, but the stock price does not reflect that. It seems like the market has priced in some degree of legislative risk and volume decline. Whether it’s priced in enough or not is had to say because I cannot predict what the FDA and courts will rule in regards to BTI’s current or future products.

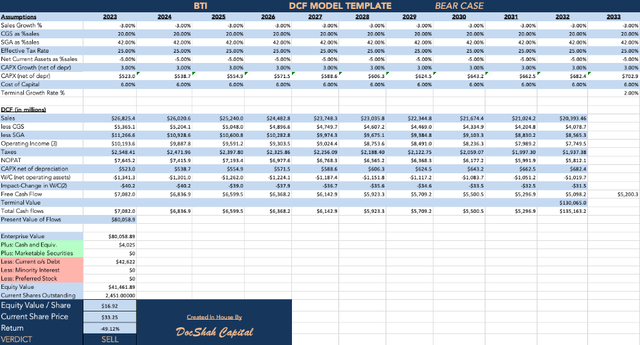

DocShah’s BTI DCF (Bear Case)

BTI Bear Case DCF (Author, DocShah Capital)

If the company’s revenue slowly deteriorates over time, it is worth about half the value of what it is trading at today. The stock’s fair value would be around $17 per share.

Zooming out, revenue in ten years is $20.3 billion, which would make BTI 25% smaller than today. While this is possible, the primary cause would likely be legislation reducing earnings, not a reduction in nicotine users.

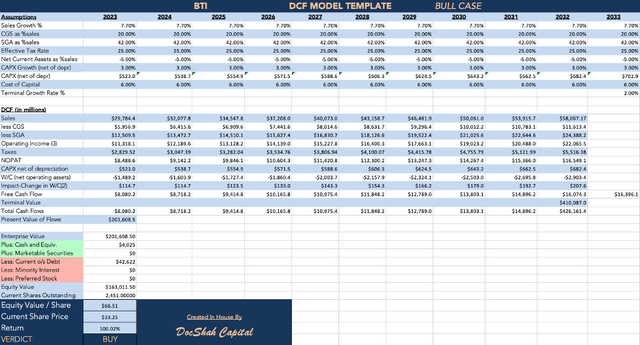

DocShah’s BTI DCF (Bull Case)

BTI Bull Case DCF (Author, DocShah Capital)

If we apply management’s forward guidance from their latest earnings call, then the stock’s fair value would be $66.51 per share, which represents 100% upside from the current level.

Zooming out, the company would be earning $58 billion in revenue, which is twice as much as today. For perspective, the company’s 2022 revenue was double its revenue ten years ago, so this rise is not unprecedented. However, it is hard to say if management’s guidance for 2023 growth is a one hit wonder or has the legs to last a decade.

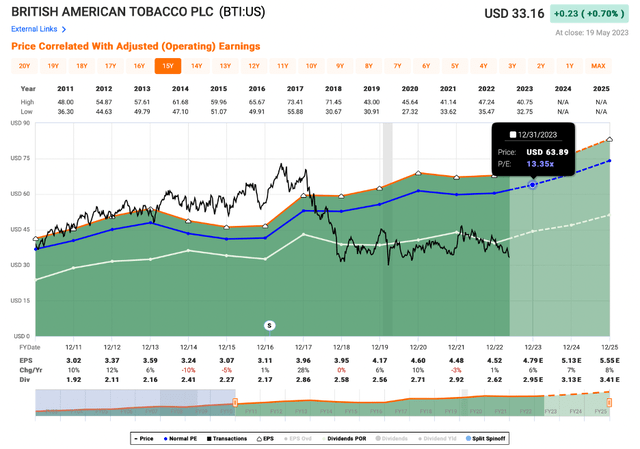

FastGraphs

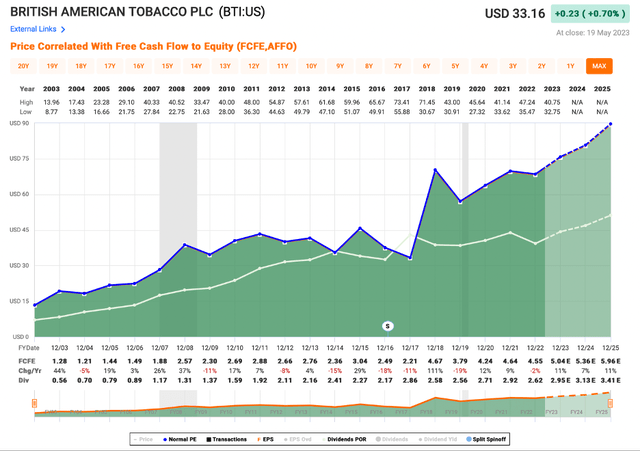

BTI Earnings Plot (FastGraph)

Based on analysts future expectations, the stock’s fair value is about $64 per share (applying its normal P/E ratio). The stock was overvalued for a period of years before flipping to being undervalued. Stocks almost always intersect with their fair value if given enough time, so if analysts are correct, I would expect BTI’s stock to rise to its normal P/E.

Note: I shortened the time frame to remove some of the bigger growth years.

BTI Free Cash Flow (FastGraphs)

The company’s dividend payout ratio is 58% (white line) and is therefore, adequately covered by free cash flow (green area). Barring any unforeseen circumstances, the dividend should remain robust, yet safe.

With that being said, please notice the dividend payments in dollars on the bottom row. BTI does not place emphasis on increasing its dividend each year the way Altria (MO) does, for example. Investors should be prepared for the company’s dividend to be reduced whenever management sees fit. In the last nine years, the company has issued a dividend cut in five of them.

Demand (In)Elasticity for Smoking

There is another interesting way to think about revenue growth, which I have not seen discussed anywhere else:

There was a study which concluded that the price elasticity of demand for smoking was -0.71, which means a 10% increase in price results in a 7.1% decrease in demand for smoking. This is an example of inelastic demand (the consumption of cigarettes is not significantly sensitive to an increase in price).

The real-world application is that as/if demand for smoking falls, BTI can absorb this reduction in overall smokers by increasing the price on current smokers by a few percentage points, which would allow revenue to be unaffected. This is happening in real time, by the way.

Example: If BTI has 100 customers paying $10 per pack of cigarettes, it makes $1,000. However, due to inelasticity, BTI can increase prices by 10% on existing customers, thus charging $11 per pack; and since we established that a 10% increase in prices reduces smoking by 7.1%, BTI would be left with 93 customers. If each of them pays $11 per pack, the company’s revenue would keep pace at $1,023.

Note: There is a limit to effectively raising prices as 10% of $11 is more than 10% of $10. In other words, every additional 10% price hike winds up being more dollars in absolute terms. Therefore, at a certain point, a 10% increase would start resulting in a price elasticity of greater than -1.

Seeking Alpha Data

Here is some helpful supplementary data from Seeking Alpha.

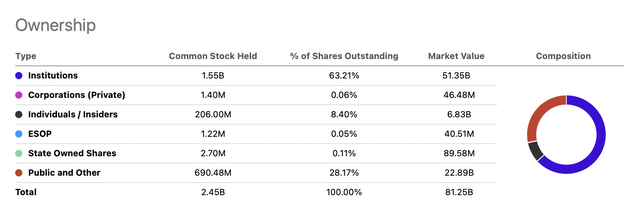

Inside Ownership (Seeking Alpha)

I was pleasantly surprised when I saw that insiders own over 8% of shares. Typically, large cap companies have fractional levels of inside ownership. This suggests the interest of management is aligned with the interest of shareholders.

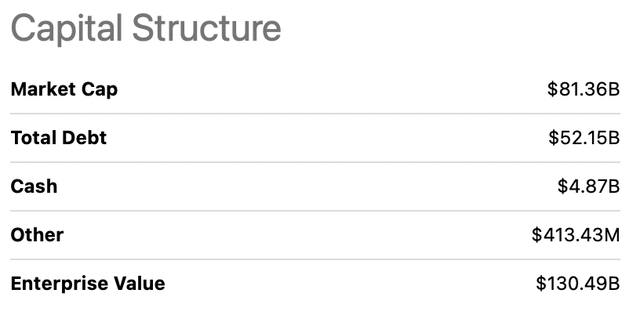

BTI Capital Structure (Seeking Alpha)

The company has a lot of debt, but produces more than sufficient free cash flow to cover its leverage. Also, no large debt payment is due within the next year. The company’s debt pacing is evenly spaced out.

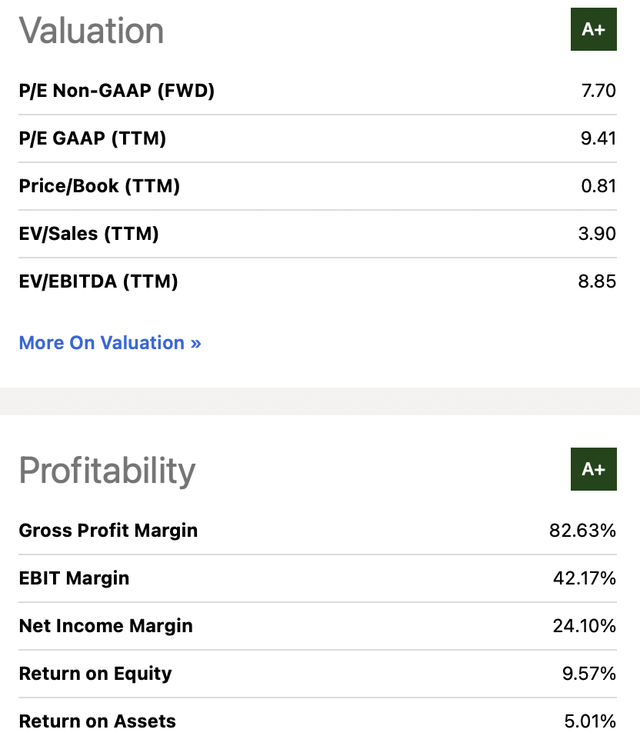

Valuation and Profitability Ratings (Seeking Alpha)

The company’s valuation, margins, and return are all graded A+ by Seeking Alpha’s calculations.

Note: Its growth received a C rating.

Risks

- The government bans BTI products, such as Vuse, reducing profits

- The rate of smoking continues to decline as a whole (with no shift towards replacements)

- Margins deteriorate, offsetting any efforts to increase in revenue growth

- ESG investing continues to gain traction

- Inflation and interest rate risk erodes profitability

- Analysts’ estimates are wrong and EPS materializes much lower

- Exchange rate risk

- For the company’s set of risks, please click here

Takeaway

British America Tobacco represents an interesting opportunity in the market. The current stock price reflects a substantial amount of legislative risk and volume decline, but potentially not all of it. If investors believe the management team will find a way to create revenue regardless of government bans and consumer reduction in nicotine use, then the current stock price is a bargain.

The industry is resilient, has faced a lot of regulation previously, and has the advantage of demand inelasticity. Therefore, the risk/reward is compelling and investors have an opportunity lock in a great cost basis for a high dividend paying stock. For the conservative investor, waiting and seeing would be a great approach. There is no rush. As Peter Lynch once said,

Don’t be out of breath when you call your broker.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here