Introduction

Burford Capital (NYSE:BUR) operates in the litigation finance industry, providing upfront cash to cover legal fees in exchange for a portion of the proceeds if the case is successful while incurring a loss if the case is unsuccessful.

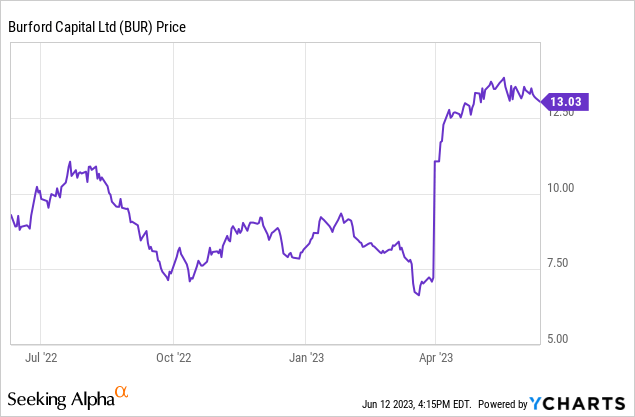

One of Burford’s most significant cases is the YPF case, involving the expropriation of energy company YPF’s shares by Argentina without a tender offer. Recently, Burford emerged victorious in this case, turning its initial $50 million investment into a value of up to $5 billion. This outstanding outcome caused a remarkable 70% surge in the company’s share price.

Despite the substantial increase in share price, we believe that BUR stock is undervalued compared to their true worth, presenting a compelling opportunity for capital growth. Allow me to explain why I am optimistic about Burford Capital’s prospects.

Company Overview

Burford Capital is a leading global provider of litigation finance and risk management solutions. Founded in 2009 and headquartered in Guernsey, the company operates intending to help businesses and law firms mitigate the financial risks associated with legal disputes. The company’s primary services are litigation funding, where it invests capital in exchange for a share of the potential recovery, and asset recovery and management, which involves monetizing legal claims or judgments already won. Burford has a global presence and has teams of legal and financial professionals applying rigorous due diligence and risk assessments to evaluate potential cases, ensuring that investments are only made in viable and promising opportunities.

The YPF Case

The Petersen/YPF case is the crucial factor to consider when evaluating an investment in Burford Capital. The YPF expropriation unfolded with Argentina leaking its intention to expropriate the company on January 27, 2012, in the Argentine newspaper Página 12. YPF’s stock price dropped by 11% the next day and continued to decline in subsequent trading sessions. On April 16, 2012, the then-President of Argentina, Cristina Fernández de Kirchner, officially announced the nationalization plan, which involved expropriating 51% of YPF from Repsol and taking control of the company. Argentina immediately replaced senior management to exercise control over YPF on the same day, leading to an additional 26% drop in the stock price over the next three weeks.

During YPF’s IPO on the NYSE in 1993, Argentina explicitly guaranteed that if YPF were expropriated, a tender offer would have to be made to all shareholders at a specified price calculated from a formula. This guarantee was outlined in YPF’s bylaws, stating that no entity could acquire more than 15% of YPF’s shares without making an offer for all outstanding shares. Furthermore, any tender offer would need to comply with laws and regulations imposed by the State of New York, the United States, and the NYSE. Section 28 of the bylaws specifically mandates a tender offer to minority shareholders if the government attempts to control over 49% of the shares.

On April 17, 2012, an Argentine minister publicly declared that Argentina would not comply with the bylaws’ requirement to launch the mandatory tender offer for the remaining YPF shares. This breach had severe consequences for Petersen and other YPF shareholders. Petersen faced bankruptcy as its dividend payments from the YPF stake, which it relied upon to cover interest expense obligations, were curtailed. Eric Mindich’s Eton Park eventually shut down in part due to losses related to YPF.

In 2014, Repsol settled with Argentina for $5 billion after initially suing for over $10 billion in damages. This settlement amounted to approximately $25 per YPF share. Subsequently, in early 2015, Petersen’s Spanish liquidators appointed Burford to fund the litigation expenses in exchange for a portion of any winnings. Petersen and Burford filed a lawsuit against the Argentine Republic and YPF in April 2015, alleging breaches of contract and seeking compensatory damages.

On the 31st of March 2023, Judge Preska ruled in favor of Burford in their claim against Argentina. Argentina has been determined to be liable for its breach of contract in failing to tender for YPF shares as required by the bylaws. Burford may pursue damages once a notice date of expropriation is determined, and hence a damage amount is calculated using the formula in the bylaws.

How much is this claim worth to Burford?

To value how much this claim is worth to Burford, we must first determine a notice date of when the tender offer should have been made. This notice date, as determined by the bylaws, must be 40 trading days before the acquisition of shares. We will use the official announcement date of April 16th, 2012 which, gives a notice date of February 13th. It could be argued that the notice date was earlier than this which would lead to a higher valuation.

Using formula D in the bylaws we can determine the tender offer price. Formula D states that the tender offer price is net income per share in the previous four quarters multiplied by the highest price-to-income ratio in the last 2 years. With February 13th as our notice date, this gives a tender offer price of $3.25 * 27 = $87.75 per share.

With 112 million shares in the claim, this gives a total claim value of $9.8 billion. We take away $1.5 billion as the value of the claimant’s shares on the first trading day after expropriation, reducing the value of the claim to $8.3 billion. Additionally, a prejudgment interest rate of 6-8% is applied based on the ruling by Judge Preska. We use a simple interest (non-compounding interest) rate of 6% for 11 years as we are going for a conservative valuation, which brings the total claim value to $13.8 billion.

After payments to 3rd parties, Petersen’s owners and others, Burford’s share is $5.3 billion or $24.20 per share. US interest rates will apply to the total claim until payment is received. Burford will likely sell down some of its stake at a discount and there is also the risk that Argentina does not pay so enforcement action is required. As such we apply a discount of 50% giving a value per share of $12.10.

Valuation

After taking into consideration the Petersen case judgment and the other parts of the operating business we can calculate a value per share:

|

Asset |

Value per share |

Notes |

|

Petersen/YPF Case |

$12.10 |

With a 50% discount applied |

|

Other Operating Business |

$9.80 |

$0.70 (average yearly earnings 2016 – 2022) on 14x multiple |

|

Total Value |

$21.90 |

Sum of above |

This gives a total value of $21.90 per share compared to Burford’s current price of $13.06 per share, suggesting a 68% upside.

Risks To Consider

I have identified three main risks regarding my investment thesis for Burford:

Firstly, while Burford may have won the YPF case there is still considerable uncertainty regarding the amount attributable to Burford, and whether they negotiate a settlement for less with Argentina. Additionally, concerns remain over whether Argentina attempts to evade payment which could result in a prolonged and expensive enforcement operation.

Secondly, the ongoing pandemic-related court delays remain a concern. These prolonged litigation processes result in capital being tied up for extended periods, resulting in escalated costs and introducing uncertainties that may impact Burford’s financial performance resulting in lower rates of returns.

Furthermore, the future rate of returns constitutes a risk. Although Burford has demonstrated solid rates of returns in the past, this is no indication of future performance. The ultimate rate of return depends on several factors, including the outcome of legal proceedings, settlement negotiations, and competition from other providers in the litigation finance industry. Increased competition from other firms may limit Burford’s access to the most attractive cases and apply downward pricing pressure, thereby impacting Burford’s profitability.

Conclusion: Burford Capital’s Undervalued Potential

Burford Capital’s Petersen case win resulted in a 70% surge in the company’s share price. Even after this surge in price, I believe the company remains undervalued, with the potential of a 68% upside to fair value. The fair value itself was calculated on rather conservative assumptions, therefore there remains the possibility of an even greater upside. I continue to hold the shares and give this share a strong buy rating.

Read the full article here