Note:

I have covered Castor Maritime (NASDAQ:CTRM) previously, so investors should view this as an update to my earlier articles on the company.

Earlier this week, Cyprus-based shipping company Castor Maritime announced its first quarterly report following the recent spin-off of the company’s tanker operations into a new, Nasdaq-listed entity named Toro Corp. (TORO) or “Toro”.

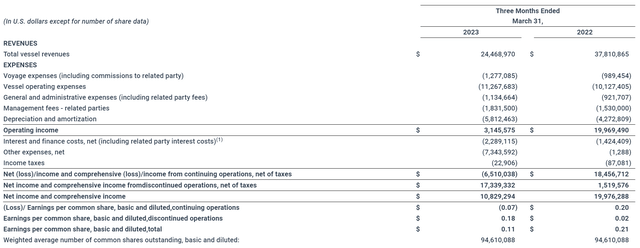

That said, the company’s Q1/2023 results still included more than two months of contributions from Toro as the spin-off wasn’t completed before March 7:

Company Press Release

While Castor Maritime reported positive earnings of $0.11 per common share, this was solely due to the Toro contribution while the company’s continuing operations actually recorded a loss.

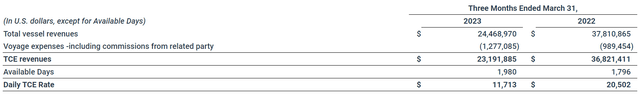

Following elevated seasonal weakness in the Baltic Dry Bulk Index (“BDI”) during the first quarter, the company’s daily time charter equivalent (“TCE”) rate was down more than 40% on a year-over-year basis:

Company Press Release

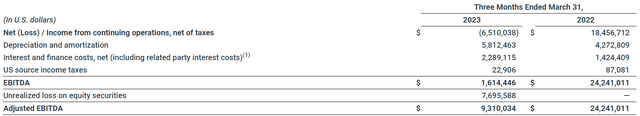

As a result, Adjusted EBITDA took a substantial hit:

Company Press Release

Moreover, I was surprised to see the company showing a $7.7 million unrealized loss on equity securities at quarter end without providing further details in the earnings release. The cash flow statement shows $31.5 million in net purchases of equity securities in Q1 which apparently have been recorded under “Other current assets” on the balance sheet.

Furthermore, an “Investment in Related Party” of $117.3 million has been recorded under “Non-Current Assets” which appears to be the assumed market value of the preferred stock issued by Toro to the company at the time of the spin-off.

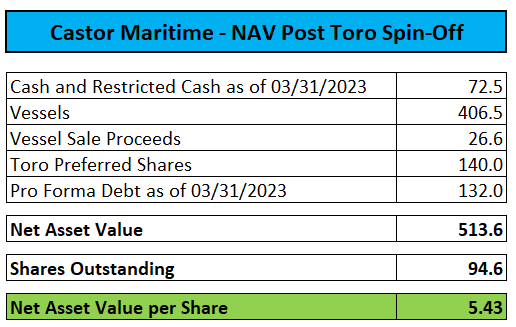

Cash and restricted cash of $72.5 million was almost cut in half from the end of 2022, largely as a result of the recent Toro spin-off and the above-discussed unspecified purchases of equity securities during the quarter.

Solely from a net asset value (“NAV”) perspective, Castor Maritime appears to be one of the greatest bargains in the shipping industry:

Company Press Releases, MarineTraffic.com

Please note that I valued the preferred stock issued by Toro to the company at its $140 million liquidation preference but even when using the lower value recorded on Castor Maritime’s balance sheet, NAV per common share would still calculate to approximately $5.20.

Clearly, investors are discounting the fact that the company has aggressively pursued growth at the expense of common equity holders in recent years thus resulting in shares being down 98% since listing on Nasdaq four years ago.

But even with the company’s common shares now trading at a 90%+ discount to NAV, Castor Maritime recently entered into a new $30 million equity distribution agreement with Maxim Group LLC (“Maxim”) with the very real potential to dilute existing equity holders substantially.

Not surprisingly, market participants have been heading for the exits in recent sessions thus causing shares to mark new all-time lows.

Please note also that the company is not in compliance with Nasdaq’s $1 minimum bid price requirement but has been provided a 180 day grace period until October 17.

Bottom Line

With the tanker bonanza having been spun off into Toro, Castor Maritime’s near-term earnings and cash flows will be impacted quite meaningfully, particularly as dry bulk charter rates have been nothing to write home about as of late.

While last week’s sell-off has caused the discount to estimated net asset value to increase to above 90%, the company’s recent involvement in unspecified equity purchases and the new $30 million equity distribution agreement with Maxim provides additional cause for concern.

In addition, investors will likely have to prepare for another reverse stock split later this year.

Given these issues, I am downgrading Castor Maritime’s common shares from “Hold” to “Sell“.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here