Investment thesis

Cloudflare’s (NYSE:NET) stock was among the hottest during the 2020-2021 stock market frenzy. It was fair, given the company’s stellar financial performance and secular tailwinds related to increased digitalization and general cloud technology adoption. My analysis suggests the company is well-positioned to continue benefiting from favorable secular shifts, but the valuation looks too high. Therefore, I assign the stock a neutral rating.

Company information

Cloudflare is a global cloud services provider that delivers web infrastructure and cybersecurity solutions. NET’s website and application security offerings include Web Application Firewall, Bot Management, Distributed Denial of Service [DDoS], API Gateway, and Secure Origin Connection. The company’s Cloudflare One suite combines how employees connect, on-ramps for branch offices, secure connectivity for applications, and control access to SaaS applications in a single pane of glass. Apart from cybersecurity solutions, NET offers other developer-based solutions. According to the company’s latest 10-K report, NET had over 162 thousand customers across more than 180 countries as of the last annual reporting date.

The company’s fiscal year ends on December 31 with a sole operating segment. In FY 2022, 47% of sales were generated outside the U.S.

Financials

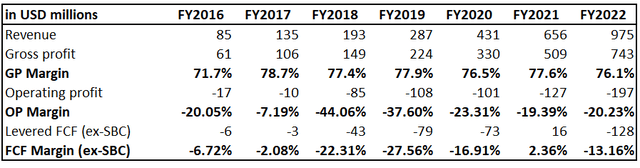

The company has the highest possible “A+” Growth grade from Seeking Alpha Quant, and I cannot disagree here. NET’s revenue increased more than tenfold between FY 2016 and FY 2022, meaning a 50% CAGR. The gross margin expanded as the business scaled up, from 72% to 76%. Compared to the tenfold increase in revenue, the gross margin expansion does not look stellar. To me, it also indicates little room for upside from the future scaling up. Despite the massive increase in sales, the operating margin did not improve. The free cash flow [FCF] margin is still not stable yet.

Author’s calculations

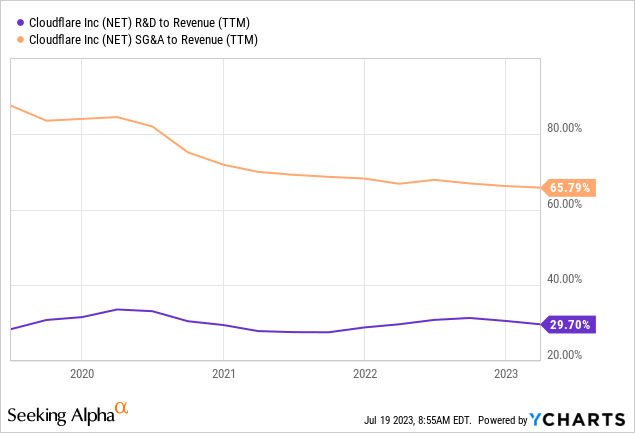

I like the management’s commitment to innovation which I see from the high R&D to revenue ratio. For a growth company investing in innovation is crucial to ensure the longevity of its technological advantages over competitors. On the other hand, the SG&A to revenue is also massive and is decreasing slowly compared to the massive revenue growth. To me, that means the risk of revenue deceleration if the company starts optimizing selling expenses. Still, such a high SG&A to revenue proportion suggests a massive potential for the operating and FCF margins expansion over the long-term.

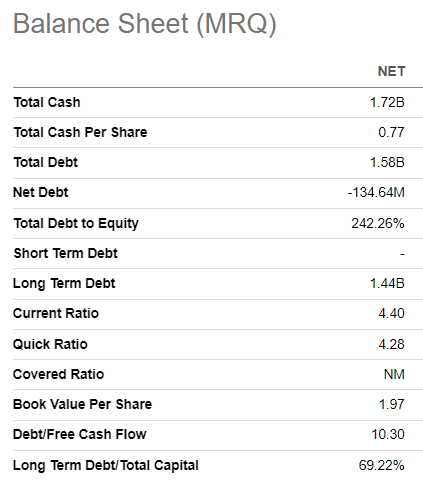

The balance sheet is solid, with total debt lower than the cash outstanding balance as of the latest reporting date. Liquidity metrics look healthy as well.

Seeking Alpha

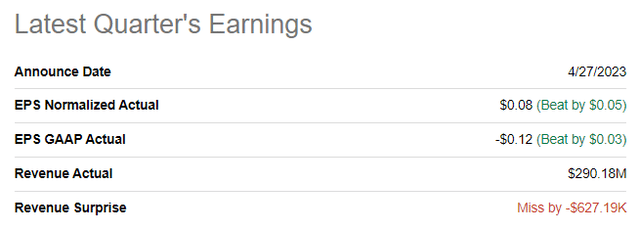

The latest quarterly earnings were released on April 27; the company slightly missed revenue consensus estimates but delivered higher-than-expected EPS. Revenue demonstrated strong momentum with a 37% YoY growth, and the adjusted EPS expanded notably from $0.01 to $0.08. On the other hand, as comps become more challenging to beat, the YoY revenue growth decelerated from 54% to 37%. The gross margin shrank from 78% to 76%, while the operating margin improved slightly. During the quarter, the company invested in R&D 28% of the quarterly sales.

Seeking Alpha

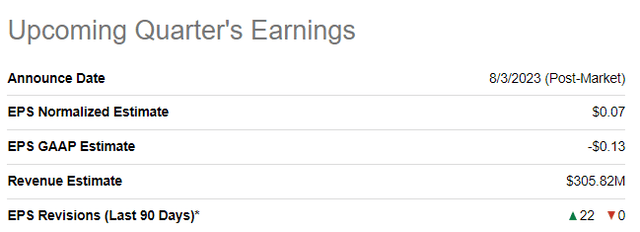

The upcoming earnings release is close, scheduled on August 3. Consensus estimates look optimistic, with 22 upward EPS revisions in the last 90 days. Quarterly revenue is expected at $306 million, about 30% higher than last year’s quarter. The adjusted EPS is expected to expand from zero to $0.07.

Seeking Alpha

I think that during the upcoming earnings call, the management will emphasize the company’s new features and opportunities related to the generative AI tools. The company has a wide gross margin, meaning that substantial resources are available to invest in product enhancement and in AI features mainly. Two weeks ago, the company announced new AI features, including two new plug-ins for ChatGPT. A little bit earlier, in May, Cloudflare introduced new AI-powered scanning tools to protect intellectual property and customer data. The company looks well-positioned to benefit from the opportunities that AI unlocks for IT companies.

Valuation

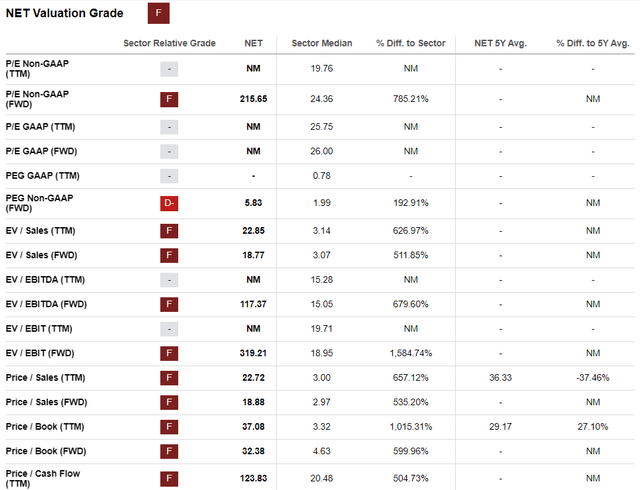

The stock delivered a massive 70% rally year-to-date, significantly outperforming the broad market. Seeking Alpha Quant assigns the stock the lowest possible “F” valuation grade due to substantially higher multiples than the sector median.

Seeking Alpha

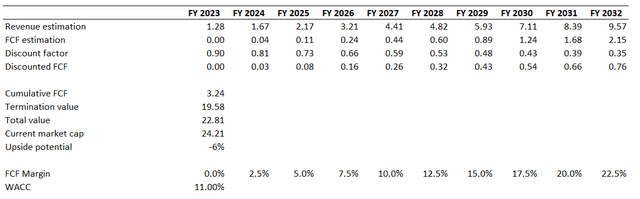

Valuation multiples are indeed very high. To understand Cloudflare’s valuation better, I want to run the discounted cash flow [DCF] simulation. Valueinvesting.io suggests that the company’s WACC is close to 11%, and I agree with this estimation. I have earnings consensus estimates projecting a very ambitious revenue CAGR of 25% over the next decade. That said, the revenue is poised to increase tenfold compared to FY2022-quite an ambitious plan. The company still does not generate sustainable FCFs. Therefore, I expect zero FCF margin in FY2023. But I expect yearly FCF margin expansion by 250 basis points each year. I evaluate these assumptions as optimistic, my first scenario for the DCF simulation.

Author’s calculations

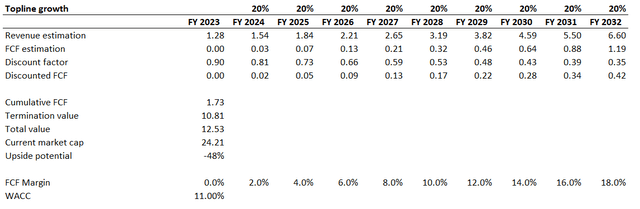

The stock is about fairly valued under these optimistic assumptions with a little downside potential. Now let me simulate a bit more conservative scenario with 20% revenue CAGR and 200 basis points FCF margin expansion.

Author’s calculations

As you can see, the revenue growth and FCF margin assumptions matter a lot. A revenue compounding at 20% over the decade is still a very challenging task. So is the 200 basis points yearly FCF margin expansion. Under these more pessimistic assumptions, my DCF model suggests that the stock is about 48% overvalued. That said, the stock is overvalued, even if I add back the net cash position of $134 million.

On June 5, UBS initiated a “Sell” rating on Cloudflare’s stock with a price target $55, which is about 25% lower than the current share price. UBS recognized NET’s vast opportunities related to AI, but the bank saw that a lot of optimism was already priced in.

Risks to consider

As we saw in the “Valuation” section, very aggressive revenue growth estimations are priced in. Sustaining a 25% revenue CAGR is challenging, especially considering the ten-year forecast horizon. Any signs of the revenue growth deceleration below consensus estimates levels will lead to a massive disappointment from investors who are highly likely to start a massive sell-off. Moreover, aggressively growing companies like NET are also vulnerable to sell-offs during the general panic in the market. For example, the stock price plunged about three-fold during the 2022 broad market’s sell-off. The stock currently trades far below its early 2022 levels. That said, potential investors should be ready to tolerate massive drawdowns and have sufficient funds to dollar-average.

Overall, the stock market looks overbought after a massive year-to-date rally, especially in the Technology sector. According to CNN’s Fear and Greed Index, extreme greed is currently driving the market. To me, the current rally reminds the greater fool theory. Therefore, even if you disagree with me regarding the overvaluation, be cautious and do not become “the greatest fool” at the end of the day.

Lastly, according to the company’s latest DDos Threat report, there was a worrying surge in cyberattacks in Q2 2023. According to the report, DDoS attack volumes increased 65% YoY, which is significant. While increased cyber threat risks create potentially more demand for Cloudflare’s offerings, it also increases threats for the company. As a cybersecurity company, NET’s reputation heavily depends on the reliability of its products when facing cyber-attacks. Therefore, increasing the level of cyber threats will be a test for Cloudflare’s products, and they have to demonstrate real value in terms of cyber safety to customers consistently. Failing to do so will make NET’s offerings inferior to competitors.

Bottom line

Cloudflare is an exciting company, but I have some questions. The first question relates to the volatile FCF margin making it hard to predict the break-even timing and further expansion. Second, very optimistic revenue growth expectations are priced in, and even with these aggressive growth assumptions, the stock looks overvalued. That said, I assign the stock a “Hold” rating.

Read the full article here