Investment Overview

Coherus Stock Collapses On Drug Approval Delay – Management Moves To Acquire Surface Oncology

Back in January I covered Coherus Biosciences (NASDAQ:CHRS) in a note for Seeking Alpha, giving the Redwood City, California based biotech a tentative “BUY” recommendation.

The recommendation was based on several factors, the main one being the potential approval of its drug candidate Toripalimab, a PD-1 inhibiting drug with a similar mechanism of action to e.g. Merck’s all-conquering Keytruda, and Bristol Myers Squibb’s (BMY) Opdivo – respective global sales of >$20bn, and >$8bn.

Coherus has re-filed a Biologics License Application (“BLA”) with the FDA for approval of Toripalimab in metastatic or recurrent locally advanced nasopharyngeal carcinoma (“NPC”).

The initial application was rejected with a Complete Response Letter by the FDA citing manufacturing difficulties, but a new Prescription Drug User Fee Act (“PDUFA”) date had been set for December, only to be postponed as the FDA could not complete an onsite inspection of Coherus’ partner Junshi Biosciences’ manufacturing facility.

Toripalimab is already approved in China, where Junshi and its manufacturing plant are based. Owing to COVID protocols in China the FDA had been unable to complete its inspection, but at the end of May Coherus stated in a regulatory filing that the FDA had “successfully completed” its inspection, and made three separate observations about plant deficiencies. Although Coherus says these observations are “readily addressable” its stock tanked on the news, sinking to a low of $4 on June 1st.

Coherus seems undeterred by the setback, however, recently announcing the news that it will acquire Surface Oncology (SURF), a struggling Cambridge Massachusetts based biotech whose share price is down >90% over the past 5 years. According to a press release, the stock for stock transaction has been valued at up to $65m – a “threefold premium to over Surface’s anticipated net cash of $20 – $25m at closing”. Coherus says that:

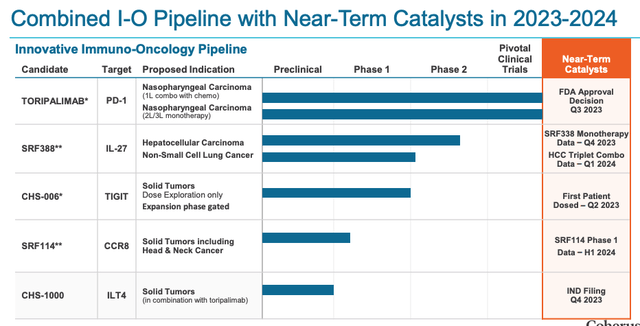

The Surface acquisition adds two differentiated clinical stage assets to Coherus’ novel I-O pipeline: SRF388, a novel IL-27-targeted antibody currently being evaluated in Phase 2 clinical trials in lung cancer and liver cancer, and SFR114, a CCR8-targeted antibody currently in a Phase 1/2 study as a monotherapy in patients with advanced solid tumors.

Coherus adds that the transaction will “transform Coherus into an Immuno-Oncology (“I-O”) company with multiple next-generation immunotherapies in clinical development funded by growing revenues.

Biosimilar Sales Underwhelm But New Products Hold Promise

At the same time as building out its I-O franchise, Coherus markets and sells three FDA approved biosimilar drug products. As I wrote in my previous note:

Biosimilars are versions of already existing drugs that have lost patent protection, that are not identical in chemical composition to the existing drug, but similar enough to achieve the same therapeutic and clinical result.

Unlike generic drugs, which are chemically identical to the original drug, but can only work as substitutes for synthetic drugs i.e. those made using chemical processes, biosimilars can reproduce the effect of so-called “biologics” drugs, made from living organisms like yeast, bacteria, or animal or plant cells.

Biologics drugs are newer to the market – and significantly more expensive – than synthetic / chemical drugs, but first generation biosimilars are now beginning to lose their patent protection, opening up the biosimilars market.

Coherus’ main bread-winner is a version of pegfilgrastim – better known as Neulasta and marketed and sold by Californian Pharma giant Amgen (AMGN), to help prevent infection in due to low white blood cell count in cancer patients undergoing chemotherapy, and generating revenues >$1bn in FY22.

Revenues of Coherus’ biosimilar to pegfilgrastim, UDENYCA, have been falling – from $475m in 2020, to $203.8m in FY22, to just $26.2m in Q123 – on account of increased competition and lower pricing – but the company won approval for a single-dose, prefilled autoinjector (“AI”) presentation of UDENYCA in March, which management hopes will allow it to reclaim market share.

Meanwhile, CIMERLI is a biosimilar for Roche’s (OTCQX:OTCQX:RHHBY) Lucentis (ranibizumab) indicated for the treatment of various ocular diseases: neovascular (“wet”) age-related macular degeneration (“AMD”), macular edema following retinal vein occlusion, diabetic macular edema, diabetic retinopathy, and myopic choroidal neovascularization.

With its “interchangability” tag (meaning it can be directly substituted for Lucentis at pharmacies without requiring the consent of the health care provider), and a new product specific insurance code making it easier to bill for and secure product reimbursement, management says it is confident CIMERLI will generate >$100m of revenues in FY23 – despite Q123 revenues being $6.2m – less than the $6.95m generated in Q422.

Mark Cuban’s Online Pharmacy Agree To Sell Coherus’ Humira Biosimilar

Coherus’ third biosimilar, YUSIMRY, is a version of Humira – AbbVie’s all-time bestselling drug indicated for a range of dermatological and autoimmune conditions, which earned >$20bn of revenue for the Big Pharma last year.

Humira’s US patents have finally expired and there are no fewer than 8 biosimilar versions of the drug set to hit the market this year. Coherus’ Chief Commercial Officer (“CCO”) told analysts on the Q123 earnings call that:

Market feedback confirms that price, robust supply and product presentation are the key criteria used to making formulary decisions and YUSIMRY is well-positioned to compete on each of these criteria. YUSIMRY will have a state-of-the-art auto-injector presentation. It includes our proprietary non-stinging citrate-free formulation and a 29-gauge needle for maximal patient comfort. We will have substantial supply volumes at launch with hundreds of thousands of YUSIMRY units ready for distribution in July.

YUSIMRY is set to launch in August, and at the beginning of June, Coherus announced that it will team up with entrepreneur Mark Cuban to offer Mark Cuban Cost Plus Drug Company customers YUSIMRY at an 85% discount to the price of Humira itself – apparently $569.27 for a carton of two autoinjectors.

Cuban’s venture is designed to offer generic and brand prescription drug products to the public with a standard, across the board 15% markup, as opposed to the much higher prices typically charged by larger drug companies, which has long been subject to criticism.

AbbVie responded to the news almost immediately, accusing Coherus of breaching its licence agreement and taking the matter to the courts, which could delay the launch of YUSIMRY – Coherus said in a filing that:

The parties engaged in discussions to attempt to resolve the dispute and on June 14, 2023 entered into a stipulation resolving the Company’s motion for temporary restraining order, whereby AbbVie agreed that it will not seek to terminate the AbbVie Agreement based on its June 6, 2023 notice, and that it will not terminate the Agreement unless it first serves a new notice of breach and affords the Company an opportunity to cure any alleged breach.

Coherus is optimistic about the revenue it can generate from YUSIMRY, despite there being numerous competitors, such as Amgen’s already launched Amjevita – $51m of sales in Q123 – and a version from Boehringer Ingelheim which is the only one to have been awarded an “interchangability” tag. Can YUSIMRY hang tough in this market?

Coherus’ CEO Danny Lanfear told analysts on the Q123 earnings call, in response to an analyst question about the company’s apparently targeting a 10% market share with YUSIMRY:

We deliberately spent about $45 million to move into very large-scale manufacturing. That’s an approval that Dr. Lavallee and team got last quarter. So, I think we are well prepared in terms of scale for competing at 10%-plus as we go forward.

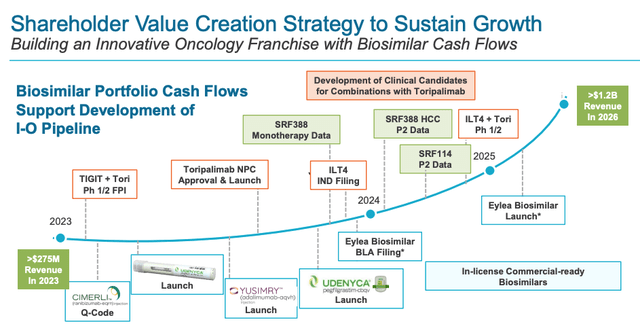

In a recent investor presentation, Coherus suggest that the Humira biosimilars opportunity is worth $17bn, implying a 10% share could be worth as much as $1.7bn, but I would also suggest that is an unrealistic target given Coherus’s stated target is to reach $1.2bn of total sales by 2026, as shown below.

Coherus value creation strategy (investor presentation)

As far as I am aware management hasn’t broken down its target revenue figure by product contribution, but let’s try to examine how things might play out, and how it might affect Coherus’ valuation and share price.

Coherus – How Have Latest Developments Affected Forward Valuation?

I discussed the Toripalimab opportunity in some detail in my January note, and it certainly seems to be front and centre in investors’ mind given the sharp sell-off after the news about the FDA factory inspection setback.

The NPC opportunity is rated by Coherus as one that offers “at least $200m in annual revenue potential”, which gets us only 17% of the way to the target $1.2bn revenue figure. The data seems to suggest the drug is safe and effective enough to support FDA approval – in combo with chemotherapy, Toripalimab reduced the risk of death by 37% versus chemotherapy alone with a median progression free survival (“mPFS”) of 21.4m versus 8.2m.

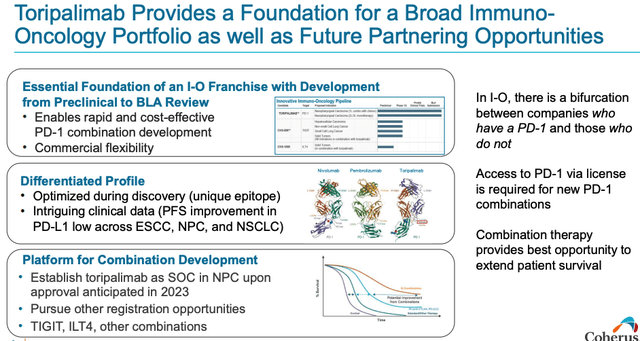

The great thing about the immune checkpoint inhibitor (“ICI”) – e.g. PD-1 and PD-L1 targeting – drug class is that these drugs have proven to be very versatile and work well alongside other drugs – Keytruda is approved in more than 10 different solid tumor indications – and that is the reason Coherus has moved for Surface Oncology.

Because Coherus has its own PD-1 inhibitor it can trial it in combo with Surface’s drugs, whereas Surface itself would have had to initiate trials with BMY’s Opdivo, or Merck’s Keytruda, which would mean obtaining a license to do so and paying for product.

Coherus discusses advantages of having an I-O drug (presentation)

Of course, Toripalimab is highly unlikely to prove as effective and versatile as Keytruda, but it could become the only ICI approved for NPC, which would be a notable achievement.

Nevertheless, can Coherus genuinely hope to revive the fortunes of Surface Oncology’s candidates, which did not seem to be interesting to the likes of Merck or BMY as potential combinations, given Surface’s sinking share price? Surface’s IL-27 (an immunoregulatory cytokine that acts as a “master-switch of checkpoint protein expression, Coherus says)-targeting SRF388 candidates achieved a coupe of Partial Responses (“PR”) in a trial as a monotherapy in patients with Non-Small Cell Lung Cancer, but it is hard to imagine Coherus taking on Keytruda in its most dominant market.

The second asset SRF-114 depletes CCR8+Tregs which “results in significant activation of both innate and adaptive immune responses” Coherus says, and management will presumably want to move the candidate into combination studies with Toripalimab as soon as possible – the current development status of each drug is shown below, with data catalysts included.

I-O pipeline status (presentation)

Turning to the biosimilars franchise, Coherus appears to be on less shaky ground here. Management is very optimistic that its UDENYCA autoinjector can turn its market share losses around, and allow it to compete for an estimated 600k annual Neulasta OnPro units, management says, which is ~50% of the entire market, and implies UDENYCA could perhaps match or even exceed the revenues it generated in 2020, and drive >$500m annual sales.

If we add the opportunities up, we have $200m in Toripalimab revenues (I am not optimistic the drug will be approved in any other indications before 2026, and neither is Coherus), plus let’s assume $200m in CIMERLI revenues, and let’s be generous and say ~$400m in UDENYCA revenues – $800m total.

Could YUSIMRY drive another $400m in sales by 2026? First of all, I would be sceptical that this a $17bn market. Humira’s total sales – when AbbVie could charge whatever it wanted thanks to patent protection – never exceeded $21bn, and its average selling price will be devastated by the new generic competition.

Furthermore, AbbVie has developed other drugs – notably Skyrizi and Rinvoq – to compete for Humira’s market share. Who will be prescribing YUSIMRY? Nevertheless, if the market for biosimilars was just $5bn, and YUSIMRY did grab a 10% share, it would drive revenues of $500m per annum.

Another exciting prospect to look out for is the biosimilar for Regeneron’s all-conquering Eylea, Lucentis’ nemesis being indicated for the same Ocular disease, but earning close to $10bn of revenues per annum.

Concluding Thoughts – Am I Concerned By CHRS Stock Price Losses, And Can The Company Bounce Back?

I am little surprised that the factory inspection news rocked Coherus stock as much as it did as it seems to imply that this is Coherus’ most significant opportunity.

A cynic might suggest that Coherus’ bid for Surface Oncology was a piece of opportunism that will allow them to placate shareholders if Toripalimab is rejected again by the FDA in a few month’s time. “Never mind NPC”, management might say, “we have the next Keytruda on our hands and two great new drugs to test it in combination with!”

I doubt that is the case – but I am equally unsure what Coherus can achieve with Surface’s drugs what Surface itself failed to spot, therefore I would not value the (risk of failure adjusted) opportunity outside NPC very highly.

Could Coherus scrape their way to $1.2bn of revenues by 2026? If they can then clearly the company is presently massively undervalued at a market cap of $317m – in that scenario the company would deserve a multi-billion market cap, so there is an opportunity for risk-on investors in play.

Coherus has one final problem – in FY21 and FY22, the company made a net loss of $(292m), and $(287m). As of FY22, current assets were $316m, so there is a danger the funding runway will run out.

Despite the risks I have discussed throughout this article, I am going to stick my neck out and give Coherus another “BUY” recommendation. Based on my research I believe that Toripalimab will eventually secure approval in NPC and that ought to provide a major upside catalyst, perhaps allowing Coherus stock to recapture its January share price of ~$8.

Although my suspicion is that management is overrating some of the biosimilar opportunities, the new approval for the UDENYCA autoinjector could help the company rebuild market share, and although the news about YUSIMRY’s inclusion in the Mark Cuban Cost Plus Drug Company’s product list feels a little gimmicky, being one of the first 10 Humira biosimilars to the market does offer up a triple-digit-million market opportunity. Within eye disease, CIMERLI needs a strong quarter to convince me it is a >$100m revenue drug, whilst the Eylea opportunity is one to keep an eye on.

I am fond of the saying “a bird in the hand is worth 2 in a bush”, and promising $1.2bn of revenues by 2026 is very different than delivering it. I don’t think management can meet those lofty targets, but if it generates enough revenues to stem its losses and look profitable again, whilst continuing to fund studies of Toripalimab and its new Surface assets, Coherus’ valuation surely deserves to be much higher, and investors who bought in January may be able to start looking upward again.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here