The crypto markets broadly celebrated the Ripple (XRP-USD) ruling last Thursday. Coinbase Global, Inc. (NASDAQ:COIN) saw a 25% rally after the announcement. COIN has tripled since the start of the year and nearly doubled in the last month.

The ruling stated that the XRP token was considered a security when sold directly to institutions but not when offered to the public on exchanges. This implies a possible constraint on the SEC’s power to intensify its crackdown on crypto. The court’s decision is seen as a challenge for the SEC’s other lawsuits, especially the one filed in June against Coinbase for allegedly offering unregistered securities. With legal outcomes seemingly stacked against the SEC, Coinbase appears to be experiencing ample tailwinds from improving-sentiment.

The recent rally in COIN is likely a combination of short covering and positive adjustments to financial models. As these forces run out of steam, the reality of Coinbase’s fundamentals will begin to play a larger role in COIN’s price. And the reality is rather bearish.

The Business Model

Coinbase has four main sources of revenue: transaction fees, interest, staking, and custodial fees. The first two are pretty much the same business model as a normal brokerage – commissions paid for trading and interest paid by cash sitting in accounts. Staking is a crypto specialty, where yield is generated by staking crypto on proof-of-stake blockchains to help secure the chain. Coinbase calls this “blockchain rewards.” Custodial fees are paid by firms who trust Coinbase to securely store their crypto in cold wallets. BlackRock’s high-profile Bitcoin ETF application lists Coinbase as the custodian. Coinbase states a few more revenue streams in their filings, but these are largely negligible.

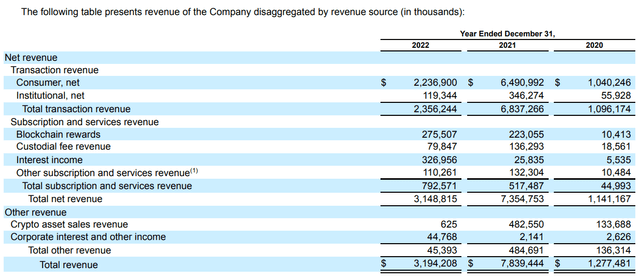

Revenues (10K) Revenues (10Q)

In 2022, more than 2/3 of revenue came from transaction fees. In Q1 2023, about half came from transaction fees. Interest income seems to be expanding, but this is because interest rates have increased so much since 2021. If rates stay where they are, then we could expect interest income to hold. If rates fall, interest income will take a hit, but transaction fees might increase because falling rates could lead to more crypto trading volume.

Operating in a Cutthroat Industry

For a company to generate value to shareholders, it needs to have some kind of moat. Basic economics tells us that perfect competition causes economic profits to tend towards zero. The only way corporations today generate profits is with their moats – their ability to provide something others cannot easily provide. Currently, the only solid moat Coinbase has is its brand reputation. Superior versions of every single one of its services already exist and will continue to propagate.

Given this reality, it’s not hard to see that Coinbase’s top line faces various existential threats.

Coinbase’s business model is increasingly vulnerable because crypto is close to perfectively competitive thanks to its decentralization. The lack of regulation (and often, the inability of regulators to even enforce regulations) lowers the hurdle to build products. Smart contracts with anonymous development teams can handle millions of dollars daily. One prominent example of this is GMX, a decentralized exchange on the Arbitrum and Avalanche chains with a completely anonymous team. The ubiquitous nature of the Internet makes it much easier for users to learn about and switch over to other platforms.

Transaction Fees Should Decrease

Coinbase’s trading fees should be lower. It isn’t particularly hard to build crypto exchanges with much lower fees, and cheaper decentralized exchanges are already starting to take market share from centralized exchanges. Regardless of what happens to crypto’s regulatory acceptance in the U.S., U.S. based investors can easily find cheaper alternatives to Coinbase.

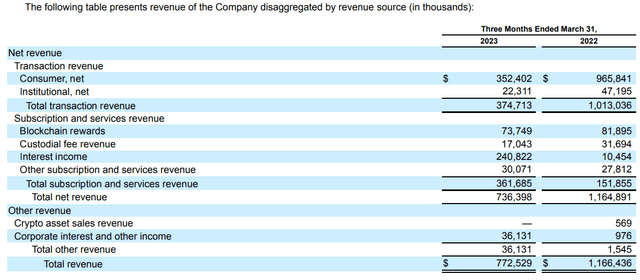

Fees (Coinbase)

As the industry matures, these transaction fees should trend towards zero because of competition. Other centralized exchanges can offer a similar mechanism of custodied crypto and then have a backend which tracks who “owns” tokens during live trading and then displays the updates to the frontend. No on-chain transactions need ever be recorded, and if the user wishes to withdraw, the exchange can simply send some of the custodied crypto to a target address. The cost of these updates is almost zero, which means the fees cannot be much higher than zero. For reference, Binance’s spot trading fees are 20 bps and its derivatives fees are in the low single digits. If Coinbase were to make such a change, its transaction fee revenue would take a big cut.

Custodian Fees Should Decrease, Even Though ETFs Could Be a Short-Term Boost

The ability to custody crypto is another area where Coinbase faces headwinds. It is not difficult to custody cryptocurrencies. The proliferation of wallets and storage solutions, coupled with an increasingly tech-savvy customer base, will likely lead to decreased custodian fees in the long run.

A cold wallet (one that is disconnected from the Internet) is also very easy to create and maintain. Technically, one can flip a coin over 250 times, record this sequence as the private key, and then use the private key to generate a public address to serve as the wallet. The private key doesn’t even have to be on a computer, let alone be disconnected from the Internet. It is very easy to secure crypto.

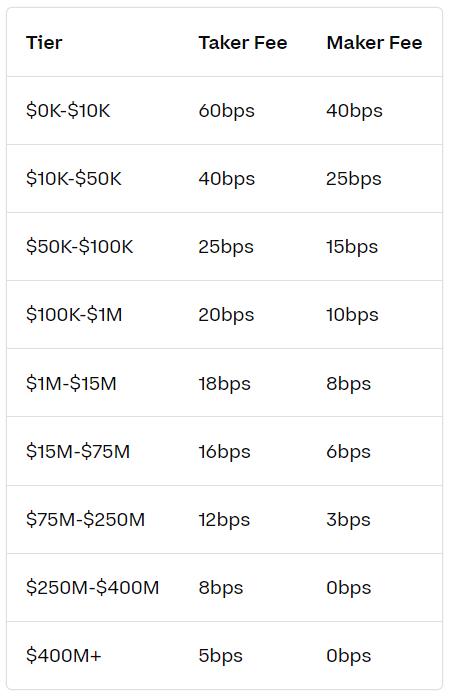

Though BlackRock has listed Coinbase as the custodian for its Bitcoin ETF, BlackRock absolutely can do the whole thing in-house and keep the custodian fees for themselves. Coinbase’s customers can terminate at any time and incur no penalty when doing so.

Custodial fees (10K)

In the short term, Coinbase might see more revenues from custodial fees if crypto spot ETFs become mainstream. However, the very design of crypto ensures coins are extremely simple to secure, creating significant headwinds for custodial fees in the long term. This is not IAU or GLD with their large vaults of physical gold.

Staking Income Will Probably Fall Too

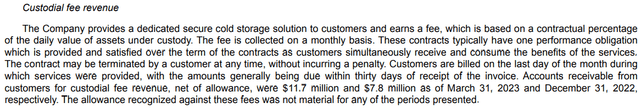

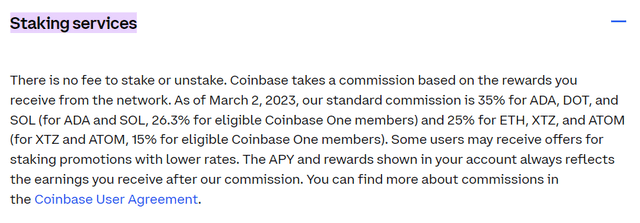

The commissions for staking are too high to be sustainable. It is trivial to stake ETH with just a 10% fee, let alone 20-30% of one’s staking yield.

Staking service (Coinbase)

Many big DeFi protocols also offer something called Liquid Staking Derivatives (LSD). Because staking crypto involves locking it up, one cannot then use the staked coins for trading or collateral. An LSD is basically an on-chain IOU for the coins that have been locked up. The IOUs can then be deposited into other DeFi protocols to earn more yield. Think of this process as allowing users to gain more capital efficiency. If used correctly, greater capital efficiency is obviously better for generating higher returns.

Coinbase does not offer anything like this. Once coins are staked on Coinbase, they must be unstaked (which takes some time) to be used for trading. There is no secondary protocol that the IOUs can be deposited in. The capital becomes “stagnant.”

Once again, Coinbase’s moat in this area is not a superior service, but simply its trusted brand name. Like custodial fees, staking services could see more revenue in the short term if crypto adoption in the U.S. increases significantly. However, the advantages of numerous alternatives will not be a secret to anyone who does any research at all.

Legal Issues are a Can of Worms, Even with a Victory

Coinbase has committed itself to a legal crusade in the name of obtaining fair U.S. crypto regulation. The company has stepped up to a legal battle against the SEC, a move that places considerable uncertainty on its future. Despite the Ripple win, it’s obvious the story isn’t over because the SEC can still appeal and the ruling itself doesn’t impact Coinbase’s situation as much as the headlines make it seem.

While a win against the SEC could indeed lead to rallies in COIN’s price, it still doesn’t negate the issue of diminishing trading fees, which will continue to erode revenues. Moreover, this legal battle presents the ultimate free-rider problem: should Coinbase prevail, other U.S. exchanges can quickly enter the market and leverage the regulatory groundwork laid by Coinbase without incurring the associated costs or risks.

On the flip side, should Coinbase lose its legal battle, the stock is likely to suffer a significant price correction. While they could potentially pivot and move operations overseas, they would then have to face off against formidable global competitors such as Binance. Coinbase is in a precarious situation.

Other Headwinds

The very nature of crypto presents a unique challenge for Coinbase. The U.S. crypto market remains fairly niche, with a large proportion of potential customers who are highly motivated to bypass domestic regulatory obstacles. The use of VPNs to evade apps which geofence the U.S. is one such example. This implies a potential loss of domestic customer base too.

Again, the core ethos of cryptocurrencies – decentralization – implies a market environment characterized by perfect competition. Under such conditions, Coinbase’s competitive edge appears to be thinning. At present, it can perhaps rely on its strong brand name and trusted reputation for security. However, as the market becomes increasingly saturated and consumers become more knowledgeable and comfortable with the industry, the value of this “moat” should dwindle.

How Coinbase Might Turn Things Around

Throughout this article I have been saying that Coinbase’s brand name is its only moat right now. This is largely true, and it underscores the fact that Coinbase is an innovative company that has built what could be considered a good central aggregator to conveniently access many crypto ecosystems. Coinbase has been relentless in innovating, including announcing the development of Base, an Ethereum L2.

The first thing COIN needs is a clear path to actual profitability. Its forward EPS is -$2.74. Its free cash flow per share in the last twelve months is -$4.87. Current revenue streams all face substantial long-term issues. Coinbase must find a way to pivot its business model away from exchange, staking, and custodial services, which all face a race to zero as crypto knowledge becomes more widespread. They are not profitable even with the current moat. Things will get much worse when this moat begins to disappear as competitors catch up. I see Base as the beginning of a pivot to embrace on-chain economic activity in Web3 and DeFi. Coinbase did a similar pivot years ago when they switched from being a Bitcoin-only service provider to an exchange for hundreds of tokens. This helped them ride the waves of altcoin booms in the last few years.

The second thing COIN needs is some regulatory clarity. COIN is clearly trying to “do the right thing” by going through the U.S. legal process in good faith. Other service providers have been quick to simply abandon the U.S.A. market. The problem is this does not mean they are no longer Coinbase competitors! U.S. users can easily get on other exchanges with more favorable terms at very little cost to themselves. There’s no legal recourse for Americans who choose to use exchanges which are in obvious violation of U.S. laws. The sooner Coinbase gains regulatory clarity, the sooner it can stop spending money on legal battles and have a clear product suite, or maybe decide to move operations abroad. For now, they are trying to make everyone happy by dynamically changing their product suite. Of course, regulations aren’t really under Coinbase’s control.

A third way for COIN to turn things around is through strategic partnerships and investing, although this is quite a long shot. Since there are so many startups in the Web3 space, an early-stage investment in something that becomes big could pay big dividends. Coinbase’s public backing is also an asset for the startups. Currently, Coinbase Ventures is a program which does exactly this. It has a diverse portfolio of investments in DeFi and Web3. Most of these investments will be worthless just by the nature of early stage investing. Absolutely a long shot.

Valuation and Conclusion

There is no need for complicated models here. COIN is headed to zero if it cannot be profitable. This is an economic fact. Right now, the path to profitability seems unlikely. I am also not certain the U.S. will be friendly towards crypto either. The reality is a lot of tokens are probably securities. Proof-of-stake also has many properties that are equity-like. I discuss this in an article analyzing the SEC’s lawsuits in June. Much of COIN’s valuation hinges on what transpires in the next few months in court.

Furthermore, Coinbase is a speculative investment. If the Fed cuts rates or if the current risk-on trend we’ve seen this year persists, then the COIN rally could continue. In the long-term, lack of profitability will catch up.

I like Coinbase as a company and believe in their mission of increasing economic freedom around the world. It is a bold and worthwhile objective. I admire Coinbase for holding its ground in the U.S. even though so many others have decided to go overseas. That said, there are noble intentions and there are good business practices, and the two are often unrelated to each other.

I rate COIN a sell. However, I will continue to watch the company’s developments and publish updates to this investment thesis. Privately, I do hope for a turnaround in all their prospects.

Read the full article here