Commercial Vehicle Group, Inc. (NASDAQ:CVGI) has been a supplier to heavy equipment and truck manufacturers for decades, but new growth in demand for electric vehicle [EV] wiring could spike sales/profits and the share price into 2024. My research conclusion: if EV-related sales trends continue rising as projected by management, today’s below-normal valuation should be corrected by Wall Street with an oversized stock price gain in coming months. Why?

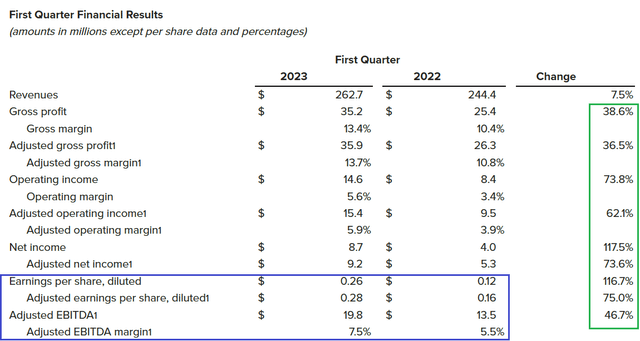

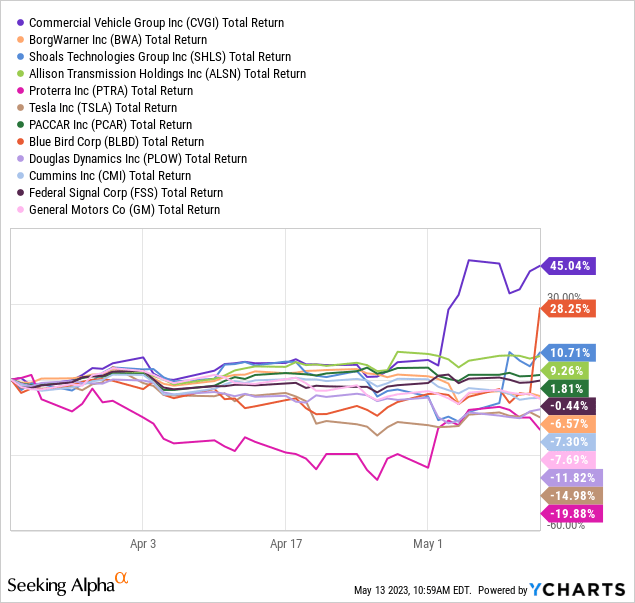

A stellar and mostly record Q1 2023 performance span, announced in early May, has pushed the share price into overdrive. I have drawn below the superb increase in operating profitability between January and March vs. last year’s period, boxing in green and blue spiking results. This report has translated into a leading 8-week advance for investors vs. peer transportation parts suppliers and vehicle builders.

Commercial Vehicle Group Website – Q1 2023 Earnings Statement

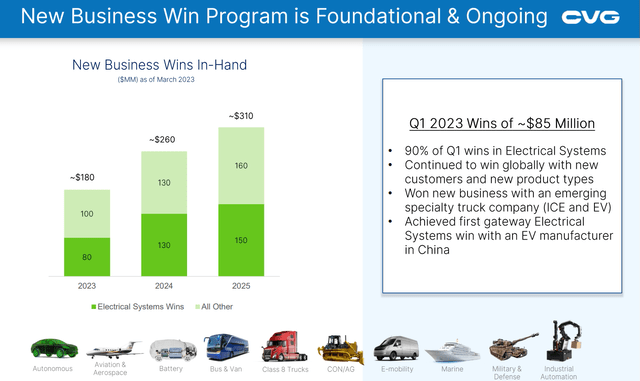

New EV design wins are projected to double the company’s revenue presence in this space between the end of 2022 and early 2025. In addition, a focus on cost cutting in other divisions has the company projecting net profit margin expansion of at least 2% on over $1 billion in annual sales. The overall picture for the business is quite bright (assuming a serious global recession is avoided in the second half of this year). From an equity market capitalization around $330 million today, EPS of around $1.00 this year could grow far above this rate in 12-18 months, making the sub-$10 stock quote an appealing choice for further research.

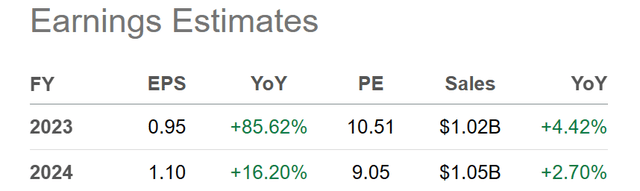

It is entirely possible the 2023-24 Wall Street analyst EPS and sales forecast below for Commercial Vehicle Group is understating an accelerating EV wiring demand backstop.

Seeking Alpha Table – Commercial Vehicle Group, Analyst Projections for 2023-24, Made on May 14th, 2023

Business Background

The company is based in Ohio, with 7,600 employees, running numerous plants/offices and selling to hundreds of wholesale partners and OEMs located all over the planet.

Commercial Vehicle Group – Website Homepage, May 14th, 2023

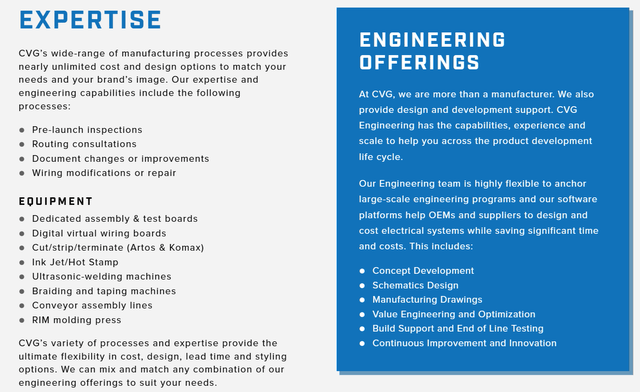

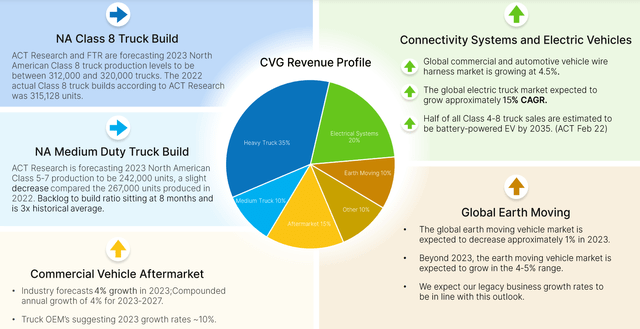

I have taken some slides from the Q1 Earnings Presentation below to outline a basic review of the company’s sales makeup and management forecasts for EV-related growth. While EV wiring demand for trucks and buses sits at less than an estimated 5% of total revenue currently, a double and triple in this number into 2025-26 is possible, supporting real growth for the whole enterprise.

Commercial Vehicle Group – 2023 Q1 Earnings Presentation Commercial Vehicle Group – 2023 Q1 Earnings Presentation Commercial Vehicle Group – 2023 Q1 Earnings Presentation

Material Undervaluation

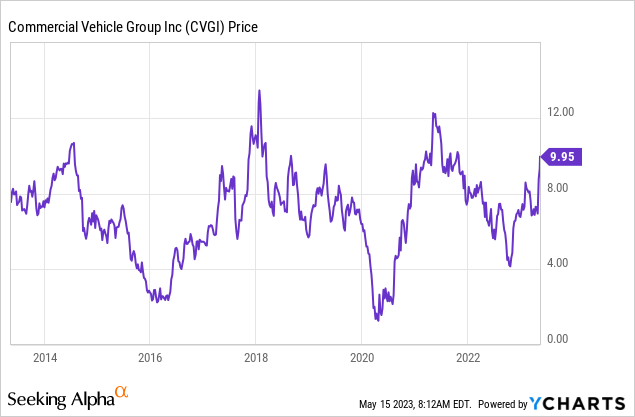

Will investors reward much improved profitability and expanding growth with a higher price and valuation? My answer is a sharply advancing share quote is clearly justifiable. From a $9 price and market cap just 1/3rd of trailing revenues, plenty of upside potential is building. Below is a chart review of the roughly flat stock price from 10 years ago.

YCharts – Commercial Vehicle Group, 10 Years of Price Change

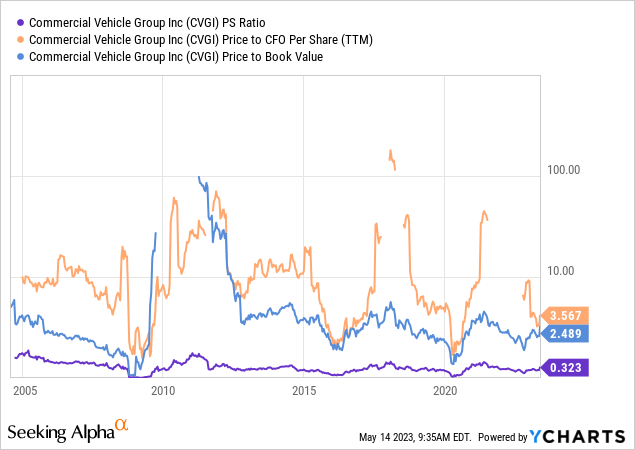

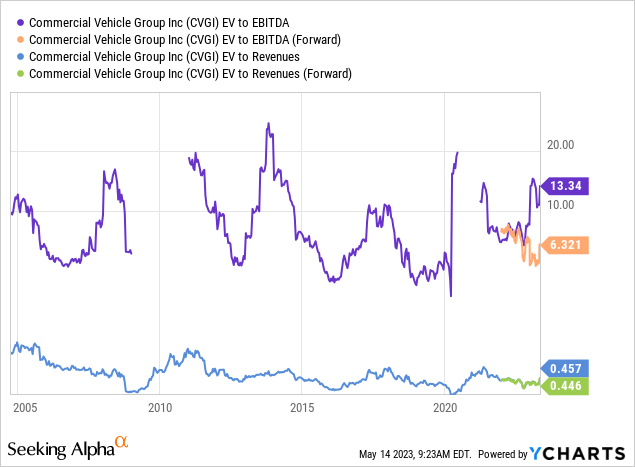

When we look at the fundamental setup of the stock, even before EV growth takes off, we find Commercial Vehicle Group is trading near its lowest “trailing” valuation since the COVID pandemic bottom in early 2020. Overall, based on ratio analysis of price to sales, cash flow, and book value, CVGI has only traded lower in basic valuation about 10% of the time since 2004.

YCharts – Commercial Vehicle Group, Price to Trailing Fundamentals, Since 2004

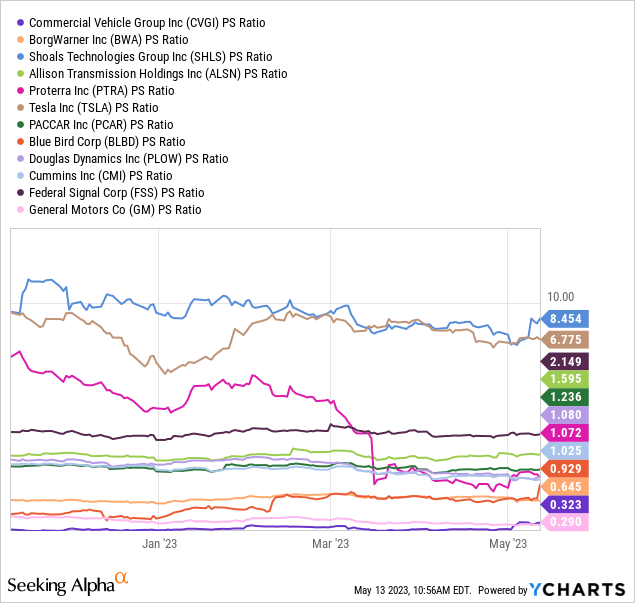

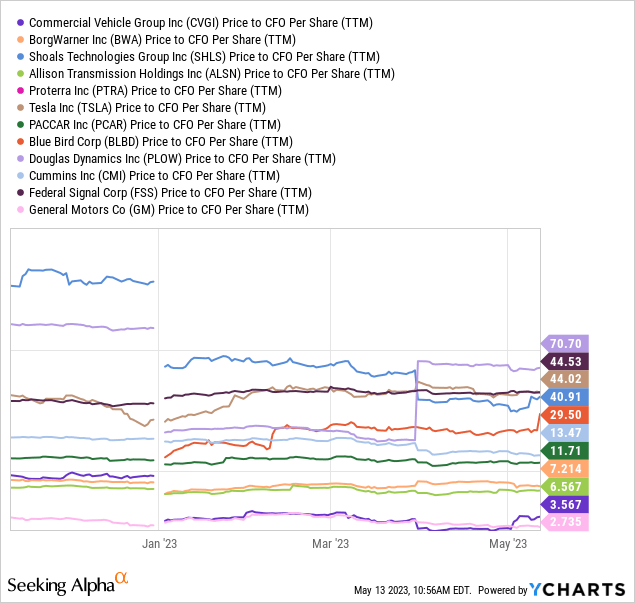

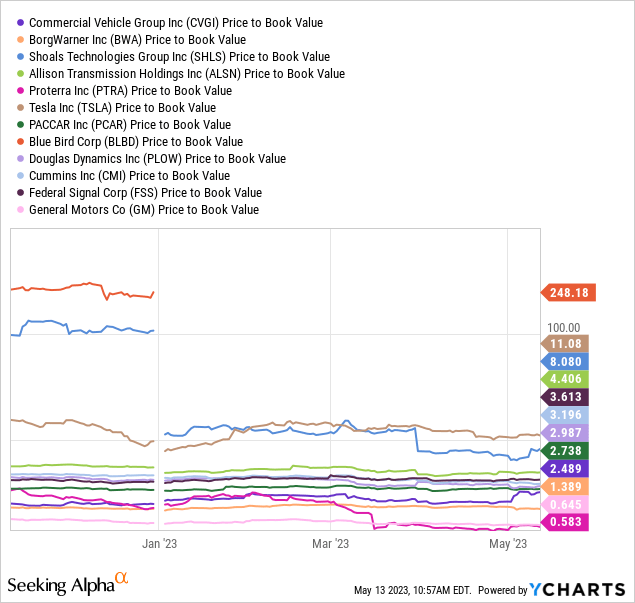

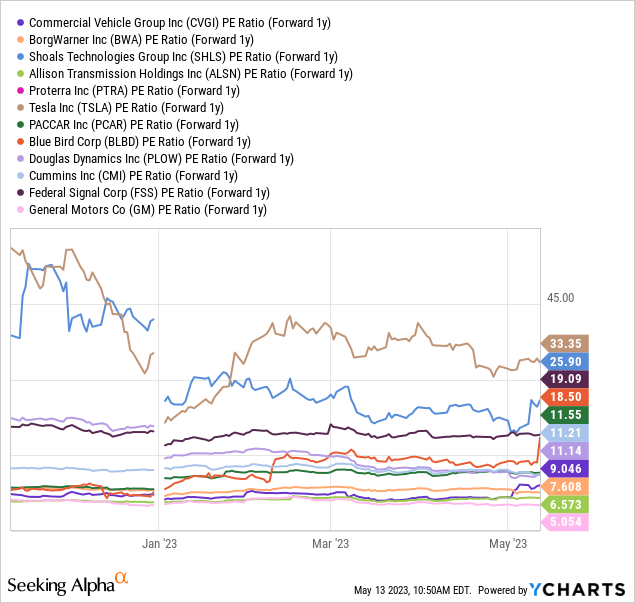

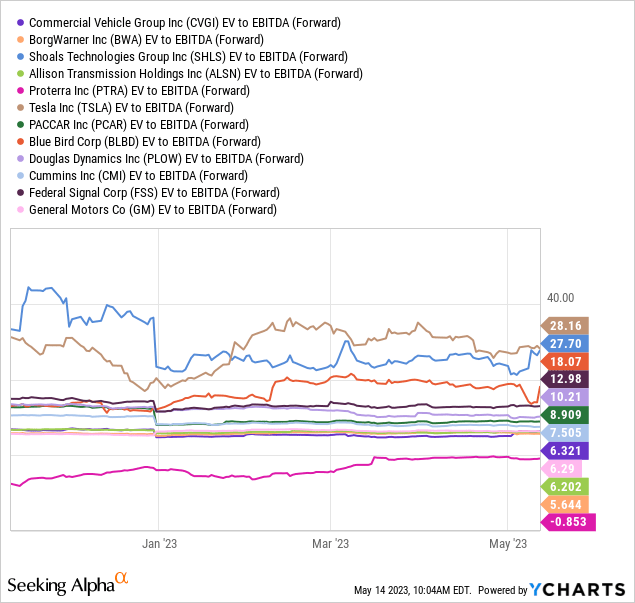

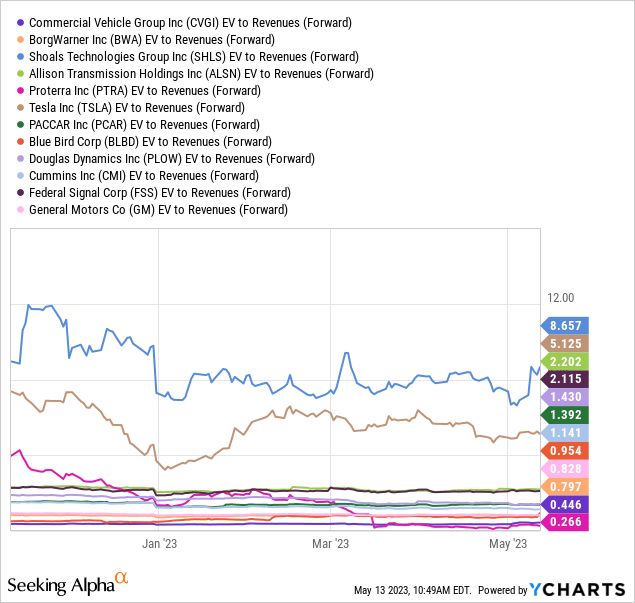

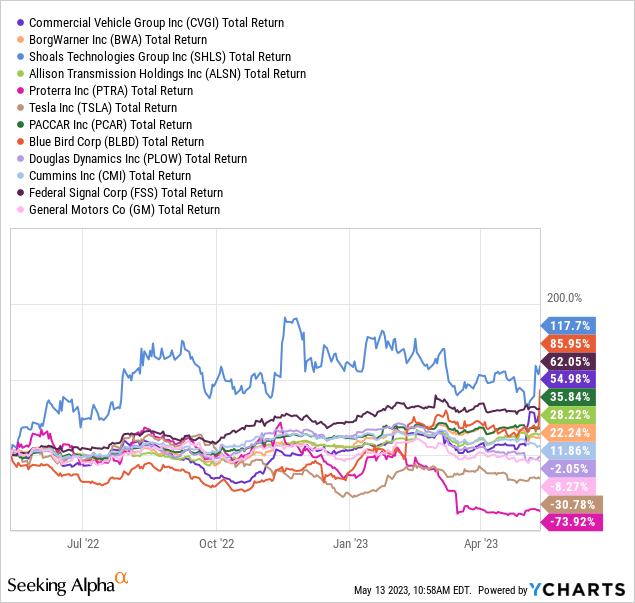

And, when we compare the current valuation against peers in the engineered wiring solutions, heavy equipment, truck, and EV sectors, the low valuation really stands out. My sort list includes another EV parts favorite in the auto parts sector – BorgWarner (BWA), plus wiring leader for utilities and green energy Shoals Technologies (SHLS). Others included are Allison Transmission (ALSN), parts supplier Proterra (PTRA), EV giant Tesla (TSLA), heavy-truck manufacturer PACCAR (PCAR), bus maker Blue Bird (BLBD), truck accessory Douglas Dynamics (PLOW), Cummins (CMI), parts supplier Federal Signal (FSS), and major car/truck producer General Motors (GM).

On price to sales, cash flow, and book value, Commercial Vehicle Group is near the cheapest in each category.

YCharts – Heavy Equipment & Truck Suppliers and Manufacturers, Price to Trailing Sales, 6 Months YCharts – Heavy Equipment & Truck Suppliers and Manufacturers, Price to Trailing Cash Flow, 6 Months YCharts – Heavy Equipment & Truck Suppliers and Manufacturers, Price to Trailing Book Value, 6 Months

On a forward 1-year look at 2023-24 earnings, price valuations are on the low end of the peer group with a projected multiple of 9x. Such stands at a 25% discount to the median average of peers, and a 50% discount to the S&P 500 index (not pictured).

YCharts – Heavy Equipment & Truck Suppliers and Manufacturers, Price to Projected Earnings, 6 Months

The enterprise valuation setup, including debt and cash holdings, provides essentially the same bargain picture on immediate-future projected results. Looking at net enterprise value to forward cash EBITDA and sales for 2023, a long runway for share price gains now exists.

YCharts – Commercial Vehicle Group, EV Stats on EBITDA & Revenues, Since 2004 YCharts – Heavy Equipment & Truck Suppliers and Manufacturers, EV to Forward Projected EBITDA, 6 Months YCharts – Heavy Equipment & Truck Suppliers and Manufacturers, EV to Forward Projected Sales, 6 Months

Building Momentum

The price breakout “idea” is one stock traders and investors hunt for 24 hours a day in their research efforts. In my estimation, that’s exactly what has been happening in May for Commercial Vehicle Group. Over the last eight weeks of trading, CVGI has outperformed peers with a +45% quote spike, and could eclipse multi-year highs around $12, even all-time highs above $13.50 this year. In addition, the 52-week total return of +55% has easily surpassed returns closer to no gain from the S&P 500 or other U.S. equity market averages, alongside the vast majority of peers.

YCharts – Heavy Equipment & Truck Suppliers and Manufacturers, Total Returns, 8 Weeks YCharts – Heavy Equipment & Truck Suppliers and Manufacturers, Total Returns, 1 Year

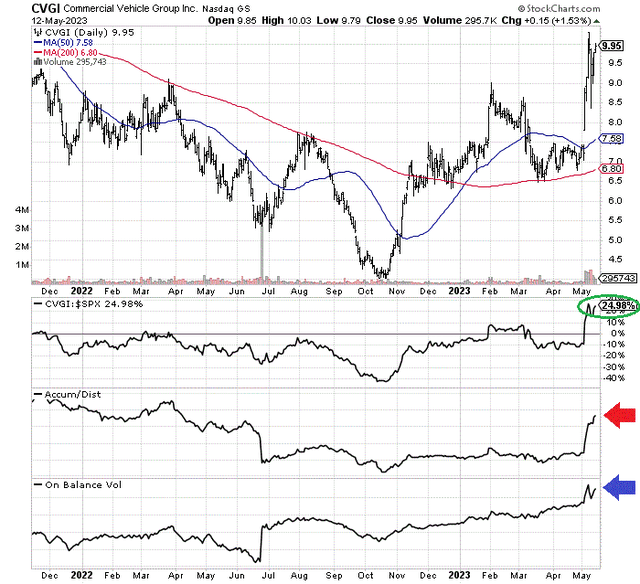

On the 18-month chart below of daily price and volume changes, the Wall Street realization of a stronger growth outlook since the May earnings release is quite visible. Price has skyrocketed past both the important 50-day and 200-day moving averages, turning them higher in trend.

Relative outperformance vs. the S&P 500 is suddenly +25% over the last year and a half (circled in green). The Accumulation/Distribution Line has jumped appreciably, showing substantial buying during the middle of each trading session (red arrow). And, On Balance Volume has continued its trend of zigzags higher from last June’s bottom (blue arrow).

StockCharts.com – CVGI, Author Reference Points, 18 Months of Daily Price & Volume Changes

Final Thoughts

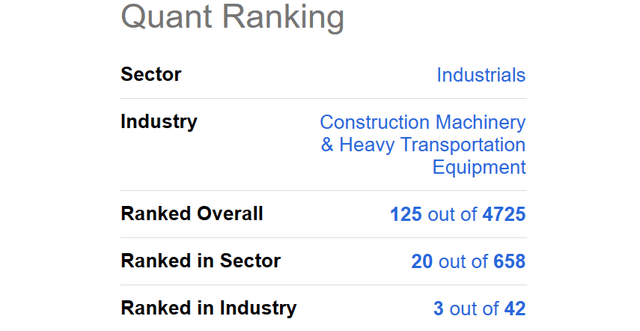

Seeking Alpha’s computer sorting of stock investments has Commercial Vehicle Group shooting up its list of sound buy ideas. The current Quant Ranking is sitting in a Top 3% position out of a universe of 4,725 equity names. So, the upside momentum story continues to build for CVGI.

Seeking Alpha Table – Commercial Vehicle Group, Quant Rank, May 14th, 2023

What is the main investment risk? I would say the biggest downside would come from a major and prolonged recession. Overall industry demand for trucks, heavy equipment and electric vehicles would surely weaken in such an environment. I am thinking total sales would fall and income growth might be restrained given macroeconomic contraction and challenges.

The good news is Commercial Vehicle Group is already selling for a depressed valuation that has somewhat discounted a slowing manufacturing economy in America. I doubt a steep -50% price decline below $5 would appear this year, even given a deep recession. The EV growth story is real and could multiply beyond current estimates on design wins. In the end, a price cut in half today would deliver a record-low valuation.

The upside is literally unlimited if EV-related sales ramp dramatically. If we put a 10-year average valuation on current results, the stock quote could rise +50% to +100% without any business growth. With only minor underlying business expansion into 2025, projecting a double to $20 a share seems appropriate. If sales and EPS start to beat expectations on a regular basis, targets of $25 to $30 are not unreasonable in 18-24 months.

I rate shares a Buy. I own a decent-sized position and may purchase additional shares on weakness in coming weeks.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Read the full article here