Confluent’s (NASDAQ:CFLT) stock has done well in recent months on the back of improving sentiment towards growth stocks and relatively strong first quarter results. While growth is still reasonably robust, it is falling and customer additions are soft. Confluent has also not made that much progress towards operating profitability, which in large part is due to high SBC expenses.

Demand Drivers

While the macro environment remains difficult, Confluent continues to be optimistic about its prospects due the TCO advantage of its cloud offering. Confluent believes that this advantage is sustainable due to the deep technical moat that the company has developed over time.

Much of the cost of running Kafka is related to cloud infrastructure, including compute, storage, networking and the tools needed to ensure smooth operations. The personnel responsible for configuring, deploying and managing Kafka is the other major cost component. Kafka is a sought after skill and as a result, knowledgeable personnel are generally well compensated.

Rather than just offering open-source Kafka as a service, Confluent has made a number of innovations which reduce the cost of operating its cloud service. Unlike many open-source cloud offerings, Confluent’s service is capable of multi-tenant operations which allows it to pool customers on shared infrastructure, driving higher utilization. Confluent also provides intelligent tiering of data between memory, local storage and object storage to help reduce storage costs. Confluent also utilizes real-time performance data from customers to optimize the routing of traffic, thereby improving performance and reducing costs. This is a scale-based advantage that is likely to increase over time as Confluent Cloud grows larger.

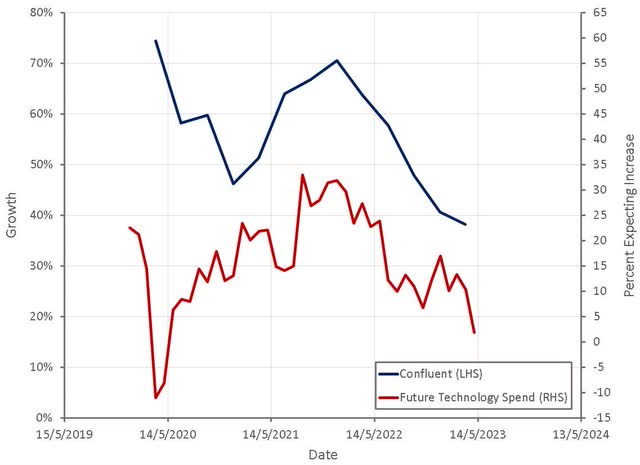

Confluent is not immune from the macro environment though, which appears to be deteriorating. Planned technology expenditures continue to decline, which is suggestive of a further moderation in growth for Confluent. While investors may be expecting AI to reverse this trend, the impact of generative AI in the near-term is likely to be more narrow than many expect. There is also significant danger extrapolating the recent surge in interest caused by LLMs. While LLMs and tools like Copilot are likely to be important long-term, they are probably overhyped at the moment. Confluent is also unlikely to be a significant direct beneficiary from AI, despite forming a critical part of modern data stacks. Confluent’s management team has suggested that they could benefit by providing LLMs with access to fresh data, but the incremental demand from this may be small relative to their existing business.

Figure 1: Confluent Revenue Growth and Future Technology Spending (source: Created by author using data from Confluent and The Federal Reserve)

Financial Analysis

Confluent Cloud continues to drive Confluent’s growth, increasing by 89% YoY in the first quarter. Confluent’s international business was also an area of strength, with revenue outside of the US increasing by 49% YoY. Europe’s recovery from the initial impact of the war in Ukraine and Asia fully emerging from the pandemic are possible tailwinds at the moment. Growth in RPO was impacted by a decline in average contract duration during the first quarter, along with longer deal cycles and a tough comparable period in 2022.

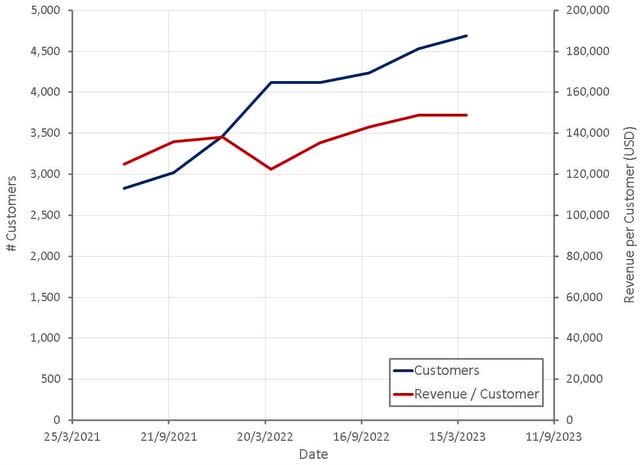

Table 1: Confluent Growth (source: Created by author using data from Confluent)

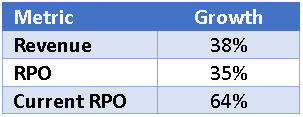

Revenue growth in the second quarter and for the full year is expected to be 30-31% YoY. Confluent’s revenue growth continues to decelerate, but this has not been as severe as many peers, which may have contributed to share price strength in recent months.

Figure 2: Confluent Revenue Growth (source: Created by author using data from company reports)

Confluent’s gross retention rate remains above 90%, which should in theory lead to decent profit margins in time. Confluent’s position as a connector between applications also means lock-in could increase over time as the number of applications relying on the service increases.

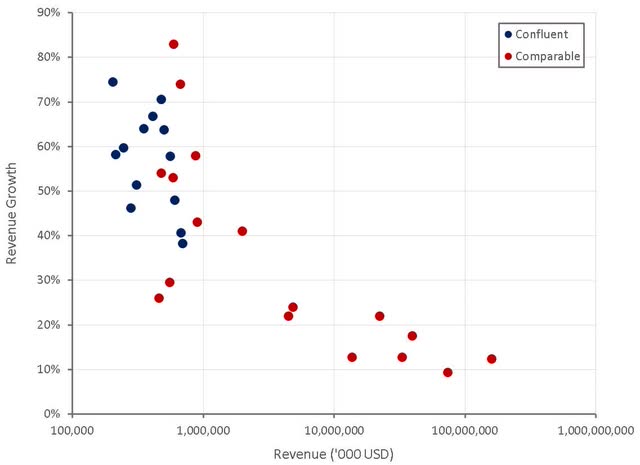

Net retention continued to be strong in the first quarter, although net new customers moderated somewhat. The number of large customers (>100,000 USD ARR) increased by 34% YoY, indicating strength amongst larger organizations. Large customers were responsible for 85% of Confluent’s revenue in the first quarter. The number of customers with more than 1 million USD ARR increased by 53% YoY.

Confluent’s growth is in large part driven by increasing consumption, and providing the underlying activity of customer applications remains strong, growth should not deteriorate too much.

Figure 3: Confluent Customers (source: Created by author using data from Confluent)

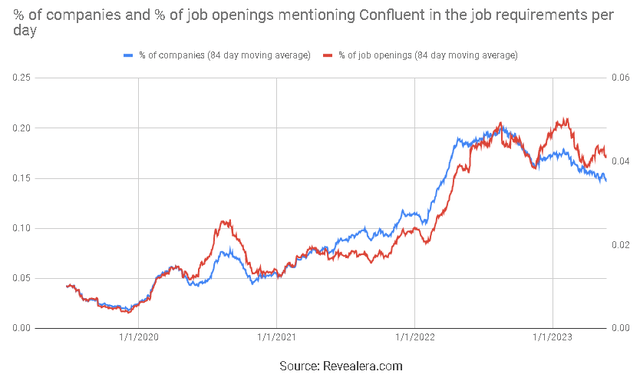

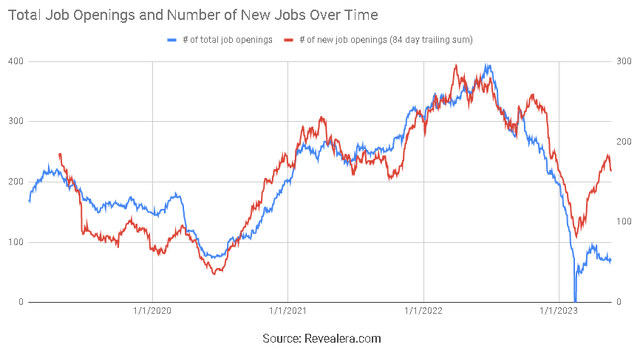

The number of job openings mentioning Confluent in the job requirements has trended downward over the past 12 months, which broadly reflects the slowdown in customer additions.

Figure 4: Job Openings Mentioning Confluent in the Job Requirements (source: Revealera.com)

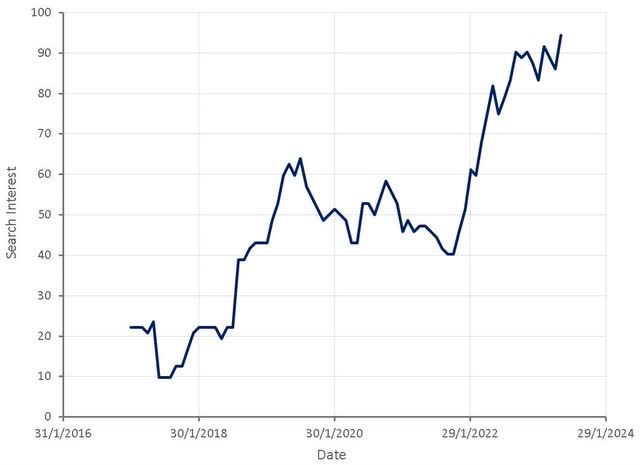

Growth in search interest for “Confluent Pricing” has also begun to moderate in recent months. This seems to align with other indicators of a softer demand environment.

Figure 5: “Confluent Pricing” Search Interest (source: Created by author using data from Google Trends)

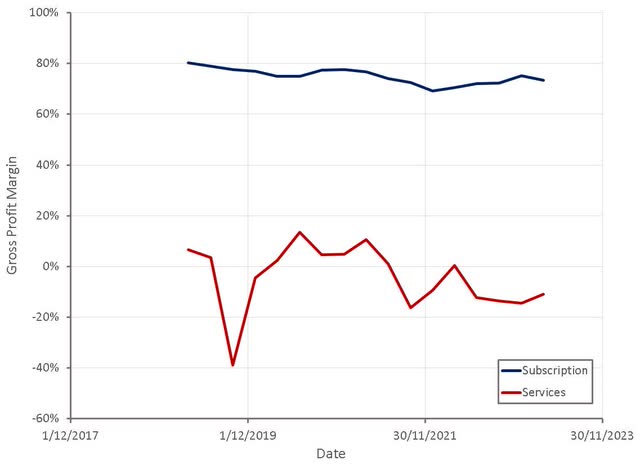

Confluent’s subscription gross margins continue to deteriorate as the cloud business grows in importance. Management has stated that unit economics of the cloud offering continue to improve though. It is unclear whether gross profit margins have already bottomed, but they are now broadly in line with management’s long-term target.

Figure 6: Confluent Gross Profit Margins (source: Created by author using data from Confluent)

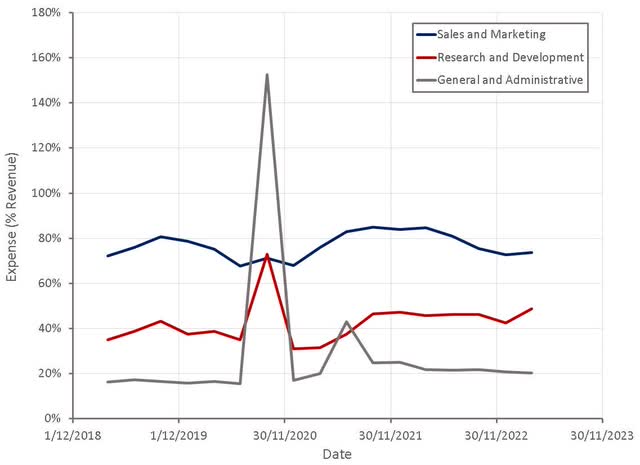

Confluent continues to focus on improving non-GAAP operating margins, but the company’s GAAP margins continue to be extremely poor. Sales and marketing expenses are high, and are yet to moderate, even with a substantial fall in growth. Investors should look for Confluent’s restructuring and more modest hiring to begin yielding benefits in the second half of the year.

Figure 7: Confluent Operating Expenses (source: Created by author using data from Confluent)

Job openings at Confluent have rebounded significantly in recent months, but now appear to have stabilized. This could suggest that the macro environment has deteriorated somewhat post SVB.

Figure 8: Confluent Job Openings (Revealera.com)

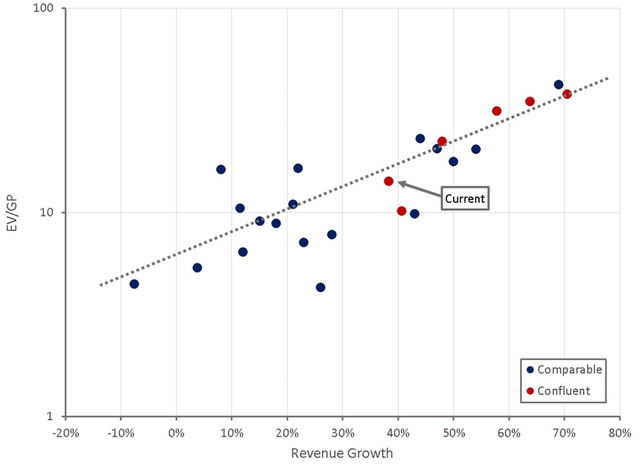

Valuation

The market continues to place a high weight on profitability relative to growth, which has been an important driver of Confluent’s stock price over the past 12 months. After the recent increase in price, the stock appears to be valued broadly in line with peers given the company’s growth rate, but the stock could fall again if growth continues to deteriorate.

Figure 9: Confluent Relative Valuation (source: Created by author using data from Seeking Alpha)

Read the full article here