Introduction

Shares of Conn’s, Inc. (NASDAQ:CONN) have fallen 41% YTD. Since my previous article, where I followed a Sell recommendation, the company’s stock has declined 48%, while the S&P 500 Index (SP500) has risen 22%. Despite the fact that the company’s shares have seriously underperformed the index and are not expensive compared to previous periods, I believe that it is still not the time to change our view of the company.

Investment thesis

In my personal opinion, based on market trends and comments from company management, pressure on Conn’s business growth will continue in the coming quarters due to the impact of macro headwinds on consumer spending in the discretionary segment. A decrease in business volume may lead to continued pressure on operating margins due to the deleverage effect, since the company’s distribution costs are fixed. In addition, I fear a deterioration in the quality of the loan portfolio, which could lead to an increase in provisions and adversely affect the contribution of the loan segment to consolidated operating income.

Company overview

Conn’s is a specialty retailer of home goods (furniture and mattress, home appliance, consumer electronics etc.). The company operates in 2 main segments, the retail segment and the credit segment. The main market is the USA. According to the results of the fiscal 1st quarter of 2024 (ended April 30, 2023), the company has more than 170 stores in 15 states. The main sales channel is offline and online formats.

FQ1 2024 Earnings Review

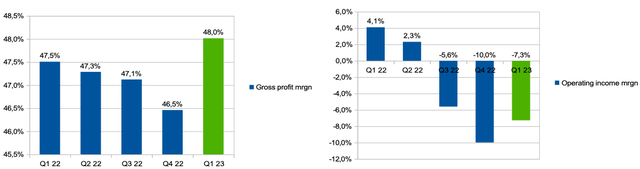

The company’s report for the fiscal 1st quarter turned out to be worse than investors expected. The company’s revenue decreased by 16.3% YoY and reached $284.6 million. The largest contribution to the decline in revenue was made by the retail sales segment, where revenue decreased by 18.3% YoY, while in the finance charges segment, revenue decreased by 8.2% YoY. Despite the fact that the consolidated gross margin increased from 47.5% in 1Q 2023 to 48.0% in 1Q 2024, we saw a decrease in operating income from 4.1% in 1Q 2023 to – 7.3% due to an increase in the share of spending on SGA (% of revenue) from 39.1% in Q1 2023 to 45.4%. This was due to the opening of new stores where efficiency is lower. In addition, the credit segment made a negative contribution to operating income.

Margin trends (Company’s information)

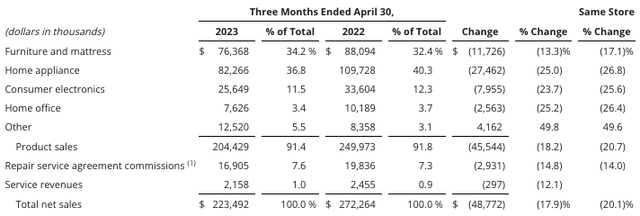

The decrease in revenue in the retail segment was due to continued pressure on comparable sales, which decreased by 20.1% in the first quarter due to lower consumer spending in the discretionary segment amid unfavorable macro headwinds. In addition, in the retail segment, we continue to see pressure on margins. Thus, the gross margin decreased from 34.5% in Q1 2023 to 33.5% in Q1 2024 due to a decrease in business volumes with a high share of fixed costs (rent, distribution), which led to the deleverage effect. You can see the change in the product mix in the segment on the chart below.

Product mix (Company’s information)

In the credit segment, the decrease in revenue was due to a decrease in the portfolio and a decrease in insurance premiums. I would like to draw attention to the fact that the operating loss in the credit segment in 1Q 2024 was about $0.8 million, while in 1Q 2023 the company showed income of $16 million. The main reason is the increase in reserves for doubtful debts. In my view, if the company continues to stimulate revenue growth by liberalizing credit requirements, then this could lead to an increase in delinquencies and require additional reserves, which could put pressure on operating income going forward.

My expectations

According to management comments during the Q1 earnings call after the 1Q2024 results, there is a positive improvement in demand among high credit customers in April. However, we cannot know for sure how all categories of customers are behaving, especially those using credit products companies to finance purchases. In addition, I think that credit facilitation is targeted precisely at those clients who do not have the highest credit quality, which is a signal to me that demand from certain categories of clients is still under pressure.

Based on market data, industry trends, and comments from other companies, I believe that demand pressure in the discretionary segment will continue into at least Q2 2024 and possibly beyond. I believe that pressure on business growth will continue, which could lead to pressure on operating margins due to the deleverage effect. In addition, the simplification of the lending process, which management spoke about during the Earnings Call, could lead to an increase in provisions in the lending segment, especially if we see deterioration in macro conditions.

According to management comments, the company does not plan to open new stores within the next 2 years. On the one hand, this can be viewed positively, since the optimization of existing stores looks like the most optimal strategy in the current environment, but on the other hand, this may lead to additional pressure on business growth rates.

I believe that at the moment, the company is still in the process of streamlining processes and trying to find ways to increase operating margins. In my personal opinion, this process may take longer than one or two quarters.

Valuation

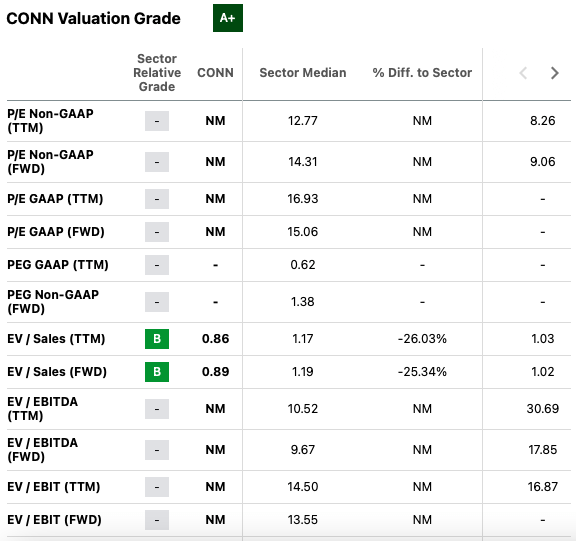

Despite the fact that the company’s shares are cheap relative to historical data, I don’t think it’s worth making a decision to buy shares based on a relatively cheap valuation alone. Thus, according to the EV/Sales multiple, the company is trading below the industry average, however, we cannot evaluate based on the P/E and EV/EBITDA multiples, as the company currently shows negative net income.

Valuation (SA)

Risks

Margin: according to management comments, the company has made the process of using loan products easier than before. In my personal opinion, I accept the risk that stimulating the growth of the core business by simplifying the lending process could lead to a deterioration in the payment quality of borrowers, which could lead to the creation of additional reserves and pressure on the operating income of the lending segment.

Competition: I still believe that competition is one of the main risks for the company, as there are quite a lot of large players in the sector that have greater purchasing power and competitiveness. Increasing competition in the sector, investment in prices and marketing could lead to both a decrease in the company’s market share and a decrease in operating margins.

Macro: decrease in consumer spending in the discretionary segment due to pressure on real income may continue to put pressure on business growth in the next periods.

Drivers

Margin: In line with management comments, the company has adjusted its marketing strategy in favor of the most effective customer acquisition channels, so if the new strategy is successful, it could boost profitability by increasing the effectiveness of marketing spend.

Revenue growth: the company has simplified the process of using credit segment products, which can help increase demand for the company’s products among existing and new customers. In addition, the company continues to improve its e-commerce strategy by optimizing delivery and improving content, which could have a positive impact on online revenue growth.

Conclusion

I’m sticking with a Sell recommendation on Conn’s, Inc.’s stock, as I currently see no improvement in trading trends or upside catalysts that could drive the company’s stock higher. In my personal opinion, we may see continued pressure on financials in the coming quarters due to weak demand and the contribution of the lending segment. I will gladly change my recommendation on Conn’s, Inc. stock if I see positive changes in the company’s reporting and market trends.

Read the full article here