Corporate Office Properties (NYSE:OFC) is a MidCap real estate investment trust (“REIT”) that owns and operates office and data center properties. While the office exposure may immediately instill concern in some, OFC is different.

The majority of their portfolio is in locations that support the United States Government (“USG”) and their contractors in mission-critical priorities, such as national security, defense, and information technology (“IT”) related activities. Their properties and tenant base, as such, are reflective of these priorities.

Since a prior update on the stock, shares are down over 12%. This compares unfavorably to the nearly 7% gain in the broader S&P (SPY) over the same period. The weakness stems in part on the general association to the broader negative sentiment inflicting the real estate sector.

Seeking Alpha – Basic Trading Data Of OFC

But the weakness could also be attributable to the uncertainties in the debt ceiling negotiations. This is due to the implications for defense spending, which is a critical variable in the operations of OFC’s tenant base. With resolution near the finish line, this should be a bullish indicator for OFC, especially considering the current deal includes a topline increase to defense spending. But shares are up just under 1.5% following the weekend news. This is despite largely positive first quarter results that included healthy leasing activity and positive revisions to guidance. Given these considerations, I remain bullish on OFC and see upside potential of nearly 30% in the shares.

Strong Leased And Occupied Rates

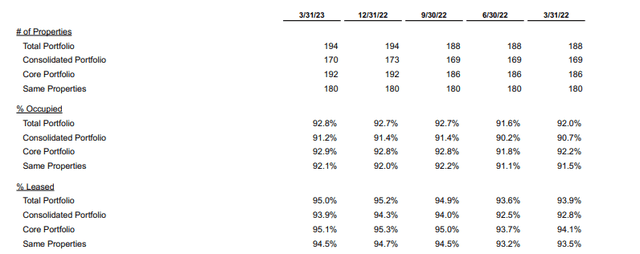

At the end of Q1FY23, OFC’s reported FFO/share came in $0.02/share above the midpoint of the guidance. And the leased rate in OFC’s core portfolio stood at 95.1%. This represents a 100 basis point (“bps”) YOY improvement.

Leased and occupied rates held steady within their same-property pool, but the composition of it did change following the addition of nine new development properties, which are 92% occupied, and the removal of three fully leased joint venture data shells.

Q1FY23 Investor Supplement – Summary Of Occupancy/Leased Rates By Quarter

Leased rates in their Defense/IT segment were slightly better than the portfolio average at 96.7%. Moreover, this was reported to be the highest leased rate since disclosure on the segment began in 2015.

It’s also worth noting the aggregate leased rate is 98.4% in their three largest Defense/IT locations, which account for approximately 45% of their core annualized rental revenues. In addition, 50% of their core annualized rental revenues in their data center shell portfolio comes from assets that are 99.1% leased.

Positive Trends In Retention Rates

While the overall retention rate was 64%, it was 78% in their Defense/IT locations. Furthermore, retention in the quarter was negatively impacted by known non-renewals in their regional office portfolio.

But looking ahead, management increased the midpoint of their full year retention guidance by 250bps to 80% to 85% due to a combination of recent activity and optimism surrounding ongoing discussions with their customers. And for 2.3 MSF of leases expiring through year-end of 2024, retention is seen at above 95% or 100% of the 1.1 MSF expiring in 2023.

The favorable outlook for retention follows a quarter with total leasing volume of 788K SF, 194K SF of which was attributable to renewals. There was also 99K of vacancy leasing during the quarter, which is in-line with their full-year target of 400K SF.

Development Activity On Track

And with regards to development leasing, the 495K SF of leasing completed during the quarter represented 70% of their full year goal.

At present, OFC has 1.5 MSF of active developments consisting of nine projects with a total estimated cost of +$478M. Collectively, these projects are collectively 92% leased. From a funding standpoint, management expects an annual funding commitment of +$250M to +$275M.

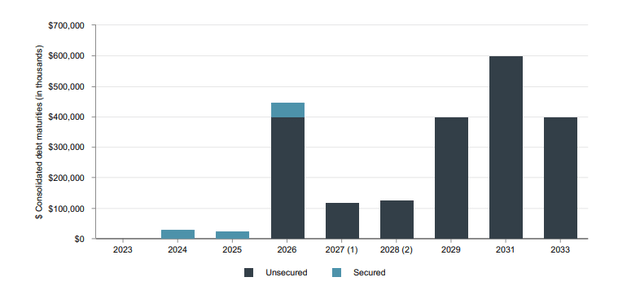

Balanced Debt Profile With Limited Near-Term Maturities

In my view, I don’t see these commitments creating any strains on liquidity levels, considering they currently maintain a balanced debt profile with extended maturities on their debt load, with no significant obligations due until 2026 at the earliest. Additionally, they maintain a high proportion of unsecured debt and hold very little variable rate exposure.

Q1FY23 Investor Supplement – Debt Maturity Schedule

Investment-grade ratings from the three major reporting agencies also provide OFC with a backstop to refinancing-related risks.

Why OFC Is A Buy

I continue to view OFC in a positive light due to their relative discount in relation to their current operational performance and portfolio metrics.

In the most recent quarter, for example, leased rates in their pivotal Defense/IT segments reached the highest level since disclosure on the segment began in 2015. In addition, strong first quarter results in the overall portfolio translated into positive revisions throughout full-year guidance.

For one, retention is expected to improve by 250bps to the 80% range, which would be in-line with their 10-year record high last reached in 2017. And though growth in their same-property pool is expected to moderate in the periods ahead, the midpoint of their cash NOI guidance was still increased due to the 8.3% YOY cash increase reported in Q1.

A more conservative posture on FFO did leave guidance here unchanged. But the current midpoint still represents modest YOY growth. And looking ahead the metric is still expected to grow at a compound rate of 4% between 2023 and 2026.

All considered, I view management’s expectations for the current year and beyond as attainable due to the favorable demand environment for national defense priorities, particularly in cyber-related programs, which is a key aspect of their overall portfolio.

Up until now, gridlock surrounding the debt ceiling was one potential headwind that could have been partly attributable to the weakness in the stock since my last update. But resolution appears to be all but certain in the days ahead.

As it relates to OFC, the current agreement sees defense spending up 3% in fiscal 2024 and up to nearly +$900B in fiscal 2025. Arguably, this isn’t nearly enough to keep up with today’s global threats, especially when considering that growth fails to keep up with inflation. But the growth does indicate bipartisan recognition that continued spending on defense is necessary.

Consistent with my prior analysis, I continue to view a 12x forward multiple as a reasonable take on OFC. This would bring the value of its shares up to what Easterly (DEA) currently commands and would imply an estimated fair price in the $28/share range. This would represent upside potential of about 27%. Combined with the 5% yielding dividend, OFC could provide above-average returns over the long term. As such, I am maintaining my bullish view on the stock.

Read the full article here