Investment Thesis

Coty Inc. (NYSE:COTY) manufactures, markets, distributes, and sells beauty products globally, such as skin and body care products, fragrances, and color cosmetics. Through its prestige and consumer beauty segments, it provides products under well-known, solid brands. The company distributes its products in approximately 120 countries.

The company’s share price has appreciated over the last twelve months, and a number of factors can explain this. First, the lipstick effect has increased demand for beauty products, especially premium fragrances. Due to this demand, it appears retailers have been encouraged to restock Coty’s products on their shelves, leading to more sales. The company is also presented with growth opportunities, especially in the retail travel business, where it continues to increase its market share, and in China, with its significant potential for the beauty market to grow, especially after the relaxation of pandemic restrictions.

COTY is highly leveraged, but with its EBIT growth and conversion to free cash flow, I believe the company can handle its debt. Nevertheless, investors should still monitor its use of debt.

The Lipstick Effect

The lipstick effect originates from the notion that people indulge in small luxuries during an economic downturn to boost their mood or preserve the feeling of normalcy. These small luxuries are usually less expensive, and consumers can spend while staying within budget. An example of a small luxury is cosmetics, which are usually less pricey even during economic slumps. This phenomenon is reflected in Coty’s strong demand for its premium fragrances.

In the beauty industry, the fragrance category is thriving, especially in the US, where it is 60% higher than pre-pandemic levels and also revealed a 15% growth. This boom is also witnessed globally, such as in Europe, where the UK revealed a 10% growth, and in China, especially among Gen Zs. Key catalysts for this trend in fragrance are the increasing influx of consumers, frequent use of fragrances, and high demand for fragrances that last longer; thus, consumers are choosing more premium fragrances.

Following this boom, the company is benefiting from the fragrances’ growing demand as it offers affordable and high-end fragrances. The prestige segment grew 16% in Q3 fiscal year 2023, driven by the fragrance business. Some of its fragrances that benefited from the trending choice of premium fragrances that are private collections include Boss Bottle Parfum, Burberry’s Hero and Her, and Coty’s new addition to the collection, Gucci’s Alchemist Garden.

Additionally, as a result of the rapid surge in demand, retailers have restocked Coty’s products after maintaining strict control over their inventories. Following this restock, the company can meet its customers’ demand, leading to higher sales volume.

Growth Opportunities:

In Travel Retail

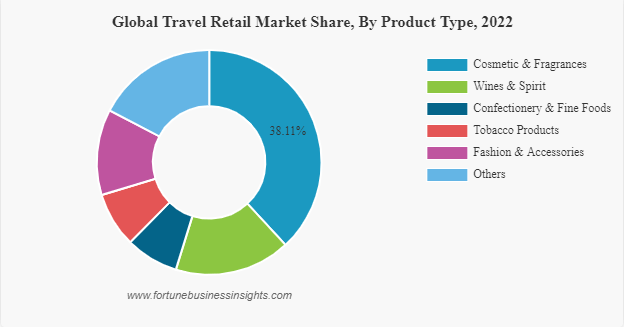

In 2022, the global retail market was valued at $55.74 billion and is expected to grow from $60.72 billion this year to $117.18 billion by 2030, resulting in a 9.85% CAGR. The surging number of both domestic and international travelers should drive market growth during this forecasted period due to increasing product demand. As of 2022, cosmetics and fragrances hold the largest share in the global travel retail market, attributable to the duty-free pricing of fragrances and increasing demand from females.

Fortune Business Insights

Today, companies in the beauty industry, including COTY, are utilizing duty-free shops at airports or main shopping districts to sell their products to boost sales.

The Asia Pacific is a fast-growing region in global travel retail. It is also dominating the duty-free retail industry, with a significant number of travelers keen on duty-free products. India and Thailand international travelers in the following twelve months are keen on shopping duty-free (54% for both), Indonesia 47%, Singapore 45%, and Malaysia 44%. Located at the center of this region is Hainan, China, with a favorable business environment that is continuously improved and refined. Hainan’s robust market, preferential policies, tourism resources, and free trade port present COTY with growth opportunities for its retail travel business. It has taken advantage of these opportunities by opening 29 doors in the shopping district. The company’s beauty brands that enjoy a significant and influential presence in Hainan include Lancaster, Gucci, Miu Miu, Chloe, Tiffany & Co., and Burberry.

The company has continued to increase its market share in the retail travel channel in the Americas and EMEA. Moreover, one of the trends in travel retail is that retailers are adopting a customer-centered approach to making sales online to increase their revenues. With its collaboration with Ant Group, COTY utilizes its platforms, which offer digital payment and marketing solutions. This digitalization has allowed the company to achieve a more targeted customer reach, anticipate their needs, and enhance their customer experience through virtual reality and online diagnostics.

COTY’s travel retail sales grew 30% in both its MRQ and year-to-date, which resulted in the channel’s sales contributing to 8% of its overall business. With no signs of diminishing global consumers’ desire for travel, the company should maintain its strong optimistic outlook regarding the growth opportunities the retail travel channel presents in our view.

In China

China’s beauty market has significant potential for growth, with its per capita beauty consumption less than half that of the US, Europe, Korea, and Japan’s mature markets. The China beauty and personal care market are expected to grow at an annual rate of 5.41% from 2023 to 2027, and approximately 28% of consumers in the country prefer to buy premium cosmetics, which is a higher percentage than its Australian and South Korean peers.

The country’s beauty industry is recovering quickly following a challenging year marred by economic fluctuations and COVID-19 restrictions and policies. Further, although skincare still dominates China’s beauty market, premium fragrance demand has increased by more than 60% compared to three years ago. Fragrances account for more than 10% of the market, and Chinese consumers persist in leaning more toward prestige fragrances than the West. This is a gap that COTY can fill with its portfolio of premium-brand fragrances.

In addition, as discussed earlier, with its optimized business environment, the Hainan shopping district in China provides an excellent opportunity for the company’s travel retail business. The easing of the pandemic restrictions has enabled the reopening of the Chinese market, presenting Coty with an opportunity to grow.

Financial Stability

COTY currently has a total debt of $4.61 billion, a reduction from $4.79 billion from the previous year. If the company decides to pay its debt with the $245 million in cash available, its net debt would be $4.36 billion. I looked at its operating expenses to see if the cash can cover anything. The company has operating expenses of $3 billion, which the cash available cannot pay off. Looking at its liabilities, Coty has total liabilities amounting to $8.5 billion. The combination of receivables ($464.2 million) and cash ($245 million) amount to $709.2 million. Its liabilities are, therefore, $7.85 billion more than the mentioned current assets. With its market cap at $9.41 billion, investors should monitor the company’s debt use since this could lead to dilution.

Since debts lead to interest expenses, assessing the interest coverage ratio is important. The company reported an EBIT of $403.3 million over the trailing twelve months, which has been increasing since 2020. Its debt has attracted interest expenses totaling $234.7 million, resulting in an interest coverage ratio of 1.7x. Although the EBIT covers the interests, it is very weak, an indication of the company’s high leverage. It is important to note that during the last two years, Coty had more free cash flows than its EBIT, indicating how efficiently it can convert EBIT to free cash flow. Free cash flows can be used to service the company’s debt, and therefore, its ability to convert EBIT to free cashflows should be encouraging to potential investors as it shows Coty’s ability to service its debt.

However, although it appears the company can handle its debt, it’s only beneficial if it is used appropriately, for example, to fund CapEx and other value-adding initiatives that increase shareholders’ returns. With this in mind, it’s important for investors to keep a close eye on how the company deploys its debt financing.

Valuation

Going by relative valuation metrics, Coty is trading at a PE GAAP TTM of 51.83x, which is quite higher than the industry medians of 21.87x. Further, it has a PS GAAP TTM of 1.73x higher than the industry medians. Looking at these ratios, the company appears to be trading at a premium, which is justified by its strong financial growth over its peers. To explain the point further, Coty has an overall grade A in growth as per Seeking Alpha. To narrow down a bit to specifics, its EBIT growth YoY was 23.15% compared to the industry median of 2.35%, and an EPS diluted growth YoY of 41.32% compared to 2.26%. In my view, this strong growth justifies what appears to be a premium price.

Additionally, the company has forward PE and PS ratios of 21.11x and 1.71x, respectively. I believe it shows the market is optimistic about the company’s future earnings and sales. This can be further justified by the forward revenue growth of 8.0%, higher than the industry median of 5.82%, and a forward EBIT growth rate of 25.79% compared to the industry median of 5.68%. To conclude, the company’s current price is justified by its solid financial growth, and the future is very promising, given the attractive forward multiples.

Risks

Although COTY’s performance in relation to its EBIT and free cash flows shows that it can handle its debt, investors should be cautious about the high debt levels, especially when the macroeconomic environment is turbulent. Shareholders could also face significant dilution should the company not have sufficient cash flows when the debt matures

Conclusion

COTY is surrounded by growth opportunities that it can exploit to advance its growth and ensure its success, starting with the strong demand amidst economic downturns, the growing travel retail market, and the geographical potential of China. Considering these factors, I believe the company is set for a more rewarding future and its investors as well.

Read the full article here