The Neos Enhanced Income Cash Alternative ETF (NYSEARCA:CSHI) is a novel fund incepted in August 2022 that combines a portfolio of short-term treasury bills with a systematic strategy to sell put spreads on the S&P 500 Index.

Fund Overview

The Neos Enhanced Income Cash Alternative ETF is an actively managed ETF that seeks to distribute monthly income from a portfolio of short-term treasury bills and a data-driven put writing option strategy.

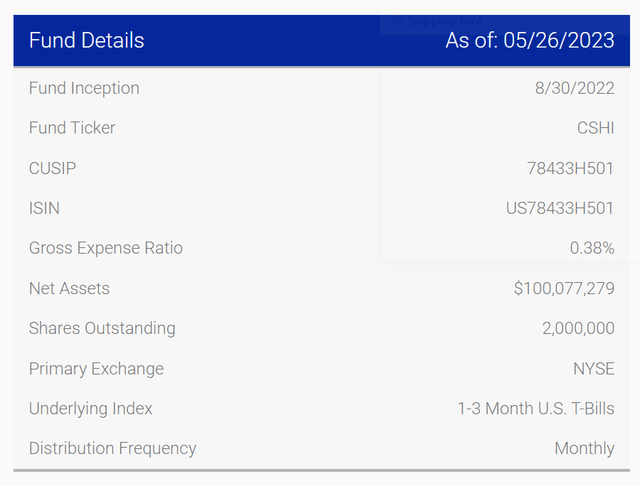

The CSHI ETF has $100 million in assets and charges a 0.38% gross expense ratio (Figure 1).

Figure 1 – CSHI fund details (neosfunds.com)

CSHI Strategy In Detail

The CSHI ETF’s strategy involves holding short-term treasury bills, typically less than 90 days in duration, and selling S&P 500 Index put option spreads to generate additional income.

The S&P 500 Index put spread strategy is intended to generate high monthly income in a tax efficient manner by using option contracts that qualify as “Section 1256 contracts”. Under IRS Section 1256, option contracts held by an investor at year end is treated as if it were sold at fair market value on the last business day of the tax year. If the contracts produce capital gain or losses, gains or losses are treated as 60% long term and 40% short term, regardless of how long the contracts were held.

The CSHI ETF focuses primarily on European-style (options can only be exercised at expiration date) put options that settle in cash on the S&P 500 Index, avoiding the need to take delivery of securities.

Portfolio Holdings

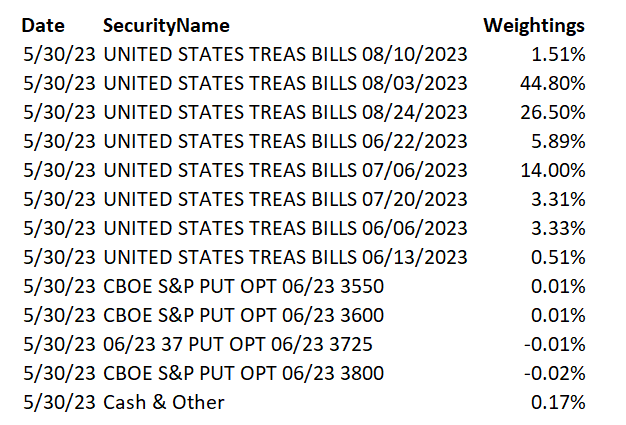

Figure 2 shows the CSHI ETF’s portfolio as of May 30, 2023. The portfolio consists of treasury bills maturing between June to August and deep out of the money (“OTM”) puts on the S&P 500 Index that expires in June.

Figure 2 – CSHI ETF holdings (Author created from fund holdings report)

Returns

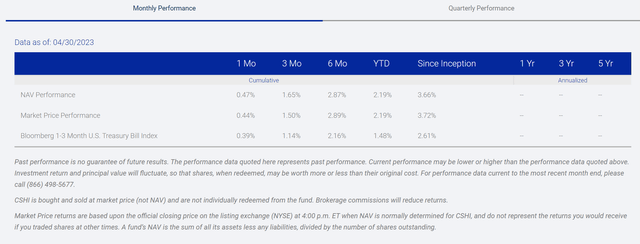

The CSHI ETF was only incepted in August 2022, so it does not have a long returns history to analyze. So far, the fund has delivered modest performance commensurate with short-term treasury yields plus the option premium obtained from selling SPX Index put spreads (Figure 3).

Figure 3 – CSHI returns history (neosfunds.com)

Distribution & Yield

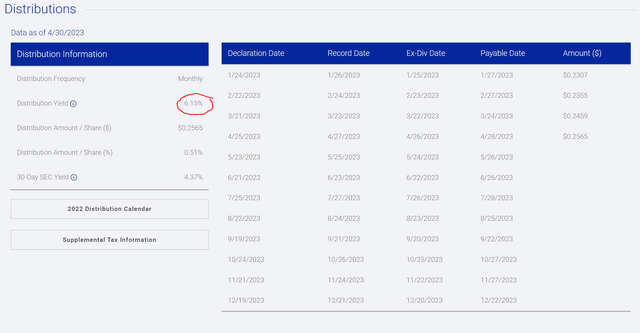

The CSHI ETF pays a monthly distribution with the most recent distribution of $0.2565 / share annualizing to a 6.2% distribution yield (Figure 4).

Figure 4 – CSHI pays a 6.2% annualized yield (neosfunds.com)

As a comparison, the US Treasury 3 Month Bill ETF (TBIL) that I have written several articles about invest in 3-month treasury bills while paying a latest annualized distribution yield of 4.8%, so the CSHI ETF has a yield premium of ~1.4% compared to the TBIL ETF.

Alternatively, investors can invest directly in treasury securities to earn yields above 5% without having to pay management fees via treasurydirect.gov.

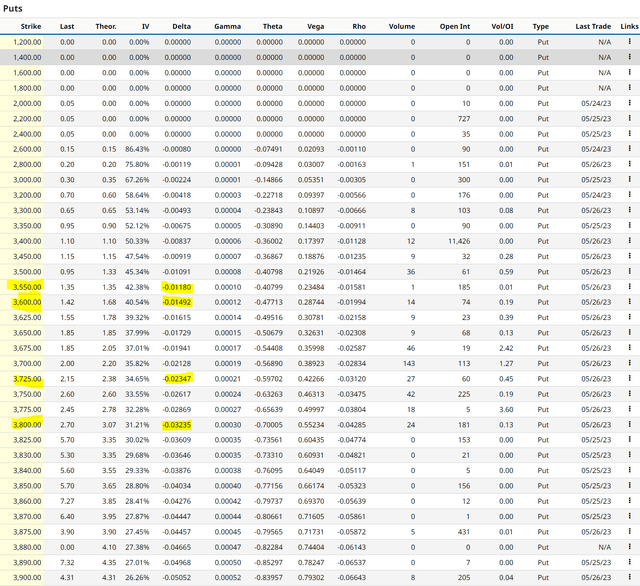

Picking Up Nickels In Front Of A Steamroller

Judging by the put options the CSHI ETF currently holds in its portfolio, the fund manager is literally selling put spreads for nickels on the dollar, as the fund currently hold short positions on SPX Index puts expiring on June 8, 2023 with strikes of 3,800 (90% money relative to SPX close of 4205 on May 26th, 2023) and 3,725 (88.6% money) while it holds long positions on puts with strikes 3,600 (85.6% money) and 3,550 (84.4% money) (Figure 5).

Figure 5 – SPX option valuations (barchart.com)

With less than 2 weeks until expiry, these put spreads are unlikely to pay out and hence trade with 1 to 2% delta, respectively. Assuming the put spreads are not triggered and expire worthless, the CSHI ETF will earn the difference in premiums per contract, or ~$0.70 to $1.30 / option. The max loss on CSHI’s put spreads would be 125 to 250 pts (measured using 3,800/3,550 and 3,725/3,600) per option, depending on the strike used to calculate the pay-out.

While these low delta options do not pay out most of the time, as the S&P very rarely declines by more than 10% within 2 weeks, we also know that black swan events can happen.

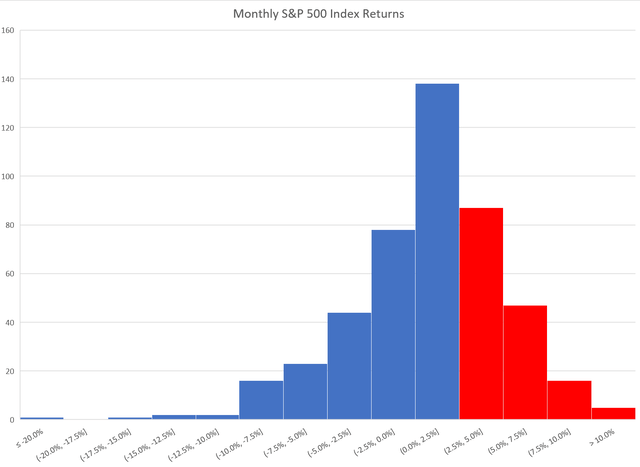

For example, Figure 6 shows the historical monthly returns distribution of the S&P 500 Index. We can see that although the vast majority of monthly returns have been better than -10%, there are outlier periods, for example October 1987, August 1998, September 2002, October 2008, and March 2020, when the S&P 500’s monthly loss exceeded 10% and presumably the put spread sold by CSHI may be triggered.

Figure 6 – Monthly S&P 500 Index returns (Author created with data from Yahoo Finance)

Assuming the strategy typically earns ~$1 / contract 26 times a year, the max loss of $125 to $250 / contract can wipe out 5 to 10 years’ worth of premium income.

So the real question investors need to assess is the frequency and severity of these ‘outlier’ events. If they occur infrequently, say once every 20 years, and do not trigger max losses, then the yield enhancement strategy pursued by CSHI may add value. Otherwise, the manager is simply picking up nickels in front of a steamroller that may wipe out years of premium income and more.

Another key consideration investors should be asking themselves is whether this strategy is suitable for them at all. Presumably, investors looking for a steady income from owning ultra-low risk treasury bills are very risk-averse. Why should risk-averse investors stretch for yield in exchange for the potential of large losses?

Conclusion

The Neos Enhanced Income Cash Alternative ETF is a new fund concept that combines the safety of short-term treasury bills with yield enhancement from selling deep OTM put spreads on the S&P 500 Index. So far, CSHI’s strategy adds approximately 1.4% to the yield derived from owning treasury bills.

However, the key risk is that outlier events occasionally do occur. In the event of an outlier, the losses incurred from the put spread may wipe out years of premium income. Furthermore, for risk-averse investors attracted to ultra-low risk treasury bills in the first place, does it make sense to add extreme left-tail risk to an asset class that is supposed to be risk free and provide capital preservation?

For me, the answer is no. I am happy with the ~5% distribution yield from treasury bills within my cash allocation and prefer to gain market exposures elsewhere in my portfolio.

Read the full article here