Are we at or near peak yields for risk assets? The possibility is looking more likely these days.

The future is still uncertain, of course, and so all forecasts should be viewed cautiously. For perspective, let’s start with the one thing we know is true: We’re closer to the peak than we were in the previous update (May 5) for this periodic profile of trailing 1-year yields of the major asset classes. The mystery, as always, is the exact date of the upcoming peak.

It’s notable that there’s rising confidence among economists for predicting that the Federal Reserve will lift rates one last time at the July 26 FOMC meeting. The central bank “will raise its benchmark overnight interest rate by 25 basis points to the 5.25%-5.50% range on July 26, according to all 106 economists polled,” Reuters reports. A majority expect that the expected hike will be the last for the current tightening cycle.

A one-and-done outlook for interest rate hikes is also the expected path ahead, according to Fed funds futures, based on data published by CMEgroup.com.

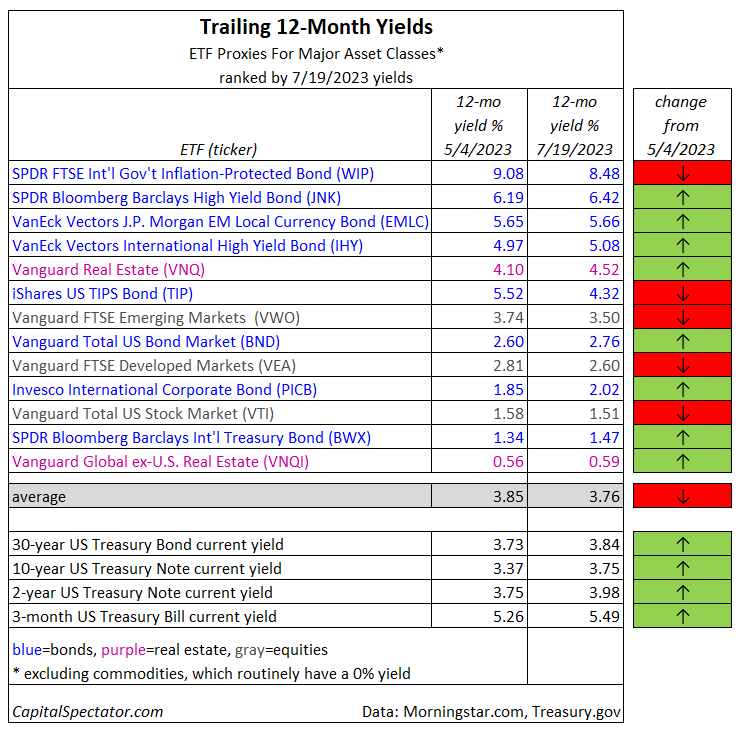

Consider, too, that the average yield for the global risk assets dipped again, based on a set of ETFs. Today’s update indicates that the trailing 12-month yield for the major asset classes slipped to 3.76% — the third straight decline for these updates.

The highest-yielding slice for global markets is still inflation-indexed government bonds ex-US (WIP), currently at 8.48%, according to Morningstar.com. Although that’s down 60 basis points from the May update, it remains a rich payout rate – more than double the average for the ETFs listed above.

Note, too, that the 3.76% average trailing yield for the risk assets above nearly matches the current yield on a 10-year Treasury Note (3.75%), based on Treasury.gov data.

The bottom line: Markets are still offering a fair amount of opportunities for yield-hungry investors. The standard caveat, however, is always lurking, namely: the trailing payout yields for stocks and other risk assets listed above aren’t guaranteed (in contrast with current yields from government bonds).

Also keep in mind the possibility that whatever you earn in payout rates in a stock, bond or real estate fund could be wiped out, and more, with lower share prices.

Meanwhile, CapitalSpectator.com is forecasting that we’ve seen the peak for the average yield in global risk assets. The main risk for that outlook: easing inflation of late proves to be stickier than expected, or perhaps rebounds in the months ahead. That’s a low probability risk at this stage, but it’s not zero.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here