Ahead of earnings, I took a bullish view on Devon Energy (NYSE:DVN). While the stock posted solid results, the initial investor reaction was to sell the stock. Let’s take a closer look at the quarter.

Q1 Earnings

For Q1, DVN saw revenue inch up 0.3% to $3.8 billion, in line with analyst estimates. It recorded adjusted earnings of $952 million, or $1.46 per share. That topped the consensus estimate by 7 cents.

Total production climbed 11% to 641,000 boe/d from 575 boe/d, helped in part by its Validus Energy acquisition in the Eagle Ford, which likely added between 35,000-40,000 Boe/d based on its production forecast at the time the deal was completed in late September. Oil production rose to 320,000 barrel a day and wad 2,000 barrels a day above its forecast.

The company saw its production in the Delaware rise 5% to 415,000 boe/d. Anadarko production also rose 5% to 81,000 boe/d, while Williston production jumped 10% to 53,000 boe/d and Powder River Basin production climbed 7% to 19,000 boe/d. Eagle Ford production soared 90% to 68,000 boe/d, driven by the aforementioned Validus acquisition.

Production costs averaged $12.02 per boe, a -2% sequential decline. Field level cash margins were $34.42 per boe.

The company generated operating cash flow of $1.7 billion in the quarter. Free cash flow was $665 million in the quarter. It spent $988 million in capex.

DVN ended the quarter with $6.4 billion in debt and $887 million in cash. Its debt-to-EBITDAX ratio was 0.6x.

Overall, DVN put up a solid quarter that saw its oil production exceed expectations, despite the issues at its Stateline 8 compressor station. Production was solid across its assets, and it saw a slight decline in production costs, which is a good sign.

Capital Allocation

DVN was active in the quarter returning cash back to shareholders both in the form of dividends and buybacks.

It declared a fixed-plus-variable dividend of 72 cents per share. Its fixed divided is 20 cents, while 41 cents is from excess free cash flow, and 11 cents from a divestiture contingency payment. The dividend will be payable on June 30th to shareholders of record at the close of business on June 15th.

The company also noted that it has bought back 12.9 million shares year to date, spending $692 million in the process. DVN also announced it was increasing its share repurchase authorization by 50% to $3 billion, which is equal to about 9% of DVN’s market cap. Since late 2021, the company has spent $2 billion buying back 38.5 million shares.

DVN has been one the most shareholder friendly companies around, and this quarter proved no different. The announced variable dividend is a nice bonus, and the company continues to be an aggressive buyer of its shares, which I continue to view as undervalued.

Outlook

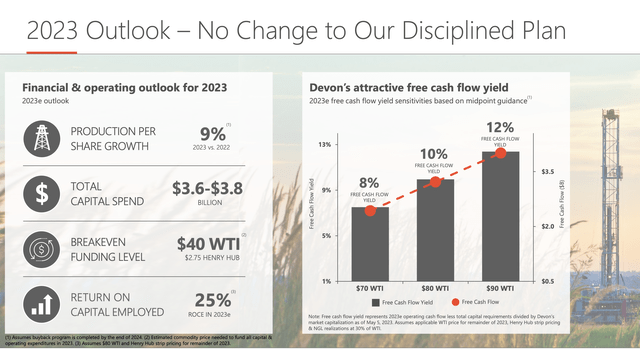

Looking forward, DVN maintained its guidance for production of between 643,000 to 663,000 boe/d. That would be production per share growth of 9%. Oil production is projected to be 320,000-326,000 Bbls/d.

The company also continued to project that it will spend between $3.6-3.8 billion on capex this year. It said it needs just $40 WTI and $2.75 natural gas prices to fund its capex program.

For Q2, DVN is projecting production of 643,000-664,000 boe/d. Oil production is expected to be 316,000-324,000 Bbls/d. The Q2 oil outlook was a bit below analyst expectation, due to timing.

Discussing the outlook for the rest of 2023 on its Q1 call, CEO Richard Muncrief said:

“Looking to the remainder of 2023, there is no change to our disciplined operating plan we laid out for you earlier this year. Now that our Delaware infrastructure is fully operational and actively ramping to place more wells online, we expect our production to grow over the remainder of the year. This momentum places us right on track to average just over 650,000 BOE per day this year, which translates into a healthy production per share growth of approximately 9% on a year-over-year basis.

“With capital, we’ve not made any revisions to our outlook of $3.6 billion to $3.8 billion for the year. As a reminder, this capital for cash assumes a low single-digit inflation rate compared to our 2022 exit rate. However, in the first quarter, we did experience service price stability for the first time in many quarters, and we began to see signs of increased availability of goods and services due to an overall slowdown in industry activity. If these trends continue, we see potential for downward pressure on service costs later this year and into 2024. With much of our contract book shifting towards shorter duration agreements, we’re now well positioned to work with our service partners for better terms as more frequent contract refreshment occurs over the next several quarters.”

Notably, the Stateline 8 compressor station which was down earlier came back online in Q1. This impacted volume growth out of the Delaware some in the quarter, but is not expected to have any issues going forward. DVN also brought on its new Stateline 10 compressor station as well. The E&P expects to bring online 200 wells in the Delaware this year, which includes the 42 that came online in Q1. It is currently operating 16 rigs and 4 frac crews in the basin.

Company Presentation

While investors may have had some issues with the Q2 oil production guidance, timing issues are pretty common in the energy patch, and it was able to maintain its full-year production guidance. There was also some talk of disappointment in spending guidance, but this too was maintained, and the company said it is seeing downward pressure that could help it later this year or in 2024.

Conclusion

I think any disappointment in DVN’s outlook is nitpicky at best. At the end of the day, minor timing differences on production or the company not slightly taking down CapEx numbers due to moderating costs isn’t really going to impact the intrinsic value of the company.

With DVN, investors are still getting one of the best positioned E&P companies in the Delaware Permian, the best oil basin in the U.S. The Permian is likely going to account for the bulk of U.S. oil production growth over the next decade, which makes DVN one of the most well positioned E&Ps out there. Its other assets are also geared towards oil and are showing solid growth.

Where oil prices head will obviously play a role in DVN’s results and where it trades. There is some concern that a global recession will bring down crude demand and thus prices, and OPEC+ was already proactive in making a surprise production cut in April. However, there are still a lot of positives going on for oil, including a re-opening China and a depleted U.S. strategic reserve.

Given this, along with DVN’s very shareholder friendly policies, I think the stock remains a “Buy.”

Read the full article here