AI and ChatGPT have been the most salient investing theme of 2023.

Brian Dress, CFA — Director of Research, Investment Advisor.

Your humble correspondent hasn’t been replaced by AI (yet)!

But with all the fuss and hubbub about artificial intelligence in the investing world over the past month, it certainly wouldn’t be an unreasonable question!

The NASDAQ Composite Index (COMP.IND) is on a 2-month strong uptrend, driven mainly by outperformance by some of the world’s largest companies. The catalyst for this market progression has been the explosion in the artificial intelligence (AI) narrative, specifically in the past few weeks. In this month’s newsletter, we will concentrate on the primacy of AI as an investing theme in 2023, along with our expectations of how this may cause things to play out in the medium term.

We have plenty of other topics to discuss in what has been an extremely eventful month of earnings and other news. We have the macroeconomic worries as we usually do: the persistent percussive drumbeat of pundits predicting an imminent recession and, of course, the saga of the debt ceiling playing out in the halls of Congress. Through it all, we have taken great heart in the fact that markets have been hanging in and moving forward throughout the month of May. We don’t think we should let the chaos in Congress head fake investors. Could the dark clouds be lifting over the financial markets after two years of nothing but negativity? Only time will tell.

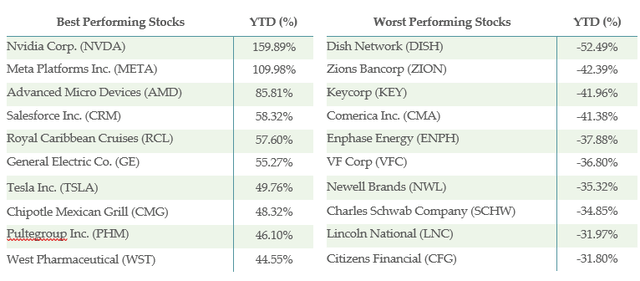

As we wrote this month’s newsletter, we thought it would be a useful exercise to go back and take a look at which stocks were outperforming year-to-date, along with those that are underperforming. From the S&P 500 Index (SP500) in the first five months of the year, we see the following stocks have been the best and worst performers in the index (data source – Slick Charts):

Slick Charts

We wanted to start the letter off with this data because it gives us a clear roadmap of how to describe what we are seeing occur in markets over the first five months of the year. Let’s start with the best performers. Clearly large and mega-cap tech stocks dominate this list, including Nvidia Corporation (NVDA), Meta Platforms, Inc. (META), Advanced Micro Devices, Inc. (AMD), Salesforce, Inc. (CRM), and Tesla, Inc. (TSLA). While, yes, we do think there continues to be upside in some of these stocks, the moves in stocks like these have already been quite profound this year. We also note the strength in travel – Royal Caribbean Cruises Ltd. (RCL) – and homebuilders – PulteGroup, Inc. (PHM). Chipotle Mexican Grill, Inc. (CMG) has been one of the most frustrating stocks to try and handicap over the years, but it is certainly in a growth phase now.

One of our main topics this week will be the explosion of artificial intelligence as an investment theme so far in 2023. Though we knew there was great progress being made in this industry, it does seem as though things have gone exponential over just the last quarter. We will look at this in greater depth below.

We certainly like to see stocks with great momentum, but sometimes stocks that have experienced downside also show interesting opportunities. We see that very much in the list of the worst performing stocks of 2023 (to date). As we look through the list of the 10 worst performing stocks, we see that six of them are regional or super regional banks. The mini-banking crisis that we have seen over the first five months of 2023 accounts for the large downside moves in those names, but we do think there is opportunity developing here.

With that all being said, let’s get into it! Investing themes are getting clearer, in our view, so we want to share our thoughts with you!

An Extremely Top-Heavy Market

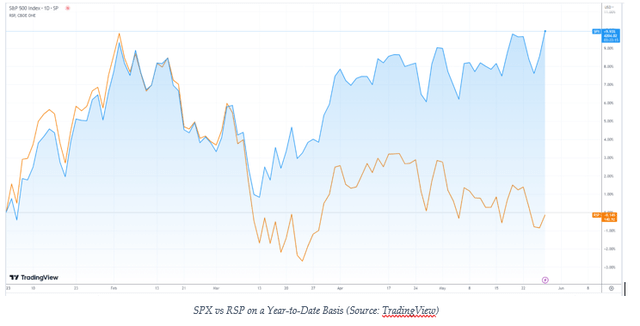

We have mentioned in this newsletter that the market’s strength has been quite narrow. This has continued to play out over the last month. We wanted to give you a visual representation of this point by overlaying the chart of the S&P 500 index (blue line) with a year-to-date chart of the Invesco S&P 500 Equal Weight ETF (RSP – orange line). The S&P 500 itself is a market-cap weighted index, which, by definition, means that the largest stocks have a huge impact on the direction of the index’s price. By taking a look at the RSP, we can get a much less distorted picture of how the “average” stock in the index is faring:

TradingView

As you can see from the chart, the overall S&P 500 index is up roughly 10% for the year, but that does not tell the entire story of the broader market. The equal-weight index has actually lost ground for the year. The divergence really became evident in early-mid March, when we saw a very sharp rally in the largest stocks in the index, the types of which are on the best-performing chart you see above.

We don’t have any profound takeaways from this fact, but we did want to make you aware of the narrow nature of the current rally. We do like many of the stocks at the top of the market, but we think investors, especially those who index through S&P 500 or NASDAQ funds, should know that they hold extremely high concentrations of the 5-10 largest stocks.

We think this divergence is creating opportunities for investors who are willing to look the other 490 stocks in the S&P 500 or even stocks not eligible to be in the major indices. The major shift to passive investing through indexing has created some distortions that favor the world’s largest stocks. While we cannot predict when this may change or what will be the catalyst, as noted investor Benjamin Graham said, “In the short run, the market is a voting machine but in the long run, it is a weighing machine.” What this means to us is that the fundamentals of smaller outstanding businesses that are currently being ignored will eventually win out.

Sources of these opportunities could come from some of the most neglected sectors of 2023: health care, financials, and retail. Yes, we really do like the large-cap tech companies and the incredible business opportunities they have at their fingertips, but we also advocate for a balanced portfolio. If/when the rally stalls out on the mega-caps, you will be glad you pursued diversification!

AI – The Explosion of an Investing Theme

Throughout 2023, we have written about the rise of AI as an investing theme. Even before the last week, when we have observed breathtaking moves higher in AI-related stocks, this story had been playing out palpably. We think that the rise of AI has a lot to do with the stock price divergence we discussed above.

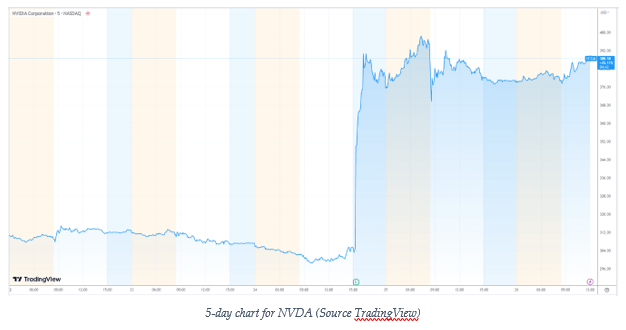

The AI narrative received a turbo boost in the form of the Nvidia Q1 earnings report, which was released on Wednesday night of this week. After some extremely positive news, the stock made a stunning move after-hours:

TradingView

The nearly 25% move represented roughly a $175 billion increase in market capitalization in one day, a record in the history of Wall Street. Not only that, but we also saw huge moves in other semiconductor stocks in sympathy, including Advanced Micro Devices, Inc., SuperMicro Computer (SMCI), Arista Networks (ANET), Broadcom (AVGO), and many more. Clearly, the market is reading through what it heard from Nvidia and extrapolating that the rise in AI could be a game-changing event in the future for these types of stocks. We tend to agree, though we do think investors will need to be more discerning in determining the winners here, over time.

We say it all the time, but our favorite time of the year is earnings season. This is not because we love the volatility of huge stock price moves. No, we love earnings season because we get to hear from the mouths of management what is going on in a given company, along with the themes that the team sees developing throughout an industry.

No CEO is a more exciting listen than NVDA CEO, Jensen Huang. In some ways I feel like your annoying friend that discovered a great band before they were mainstream, but Huang has been my favorite CEO for five years, when I heard his retelling of saving Nvidia from imminent doom in the company’s early days (skip to 23:30 to hear how he rescued Nvidia from the brink).

Nvidia is at the epicenter of the rise in Generative AI, which is made possible by the sheer computing power of Nvidia’s GPU chips. Often times, huge stock price moves are driven by hype and sizzle, and very little substance. After we read NVDA’s earnings call, this could not be further from the truth, in this case.

Essentially, investors had underestimated the level of opportunity present in the AI field and CEO Huang gave us a clear breakdown of what is happening in this industry. First of all, the company generated more than $7 billion in revenue over the past quarter, which is a 19% increase over just the previous quarter. This was impressive enough in its own right, but the company is forecasting more than a 50% increase in revenue for next quarter to more than $11 billion, as the company is seeing a huge surge in demand for artificial intelligence in the wake of the release of ChatGPT and other AI-linked products.

On the call, Huang called this an “iPhone moment” for AI, as the large language models that were in development are now transitioning to a product and service based on Chatbot technology. This technology requires huge amounts of computing power, which Nvidia is uniquely suited to deliver through its superior GPU chips. Huang also notes that AI is a “full stack problem” that requires software, algorithms, and computer hardware optimized to power the needs of these robust models. Nvidia has 4000 prebuilt software packages ready to deploy to build AI models. Beyond that, Nvidia has built 5 data centers of their own, so they are uniquely situated to help customers build their own infrastructure cheaply and efficiently, while delivering great quality and power.

Data centers with stout computing power enable AI models around the world. Huang notes that the problem limiting the broader deployment of AI is the antiquated nature of the world’s data centers. There is more than $1 trillion of data center infrastructure worldwide built with old-style switches and last-generation CPU chips. Huang asserts that this infrastructure will have to be replaced over the next 10 years in order to sustain generative AI applications. In our view, it is not surprising that the market responded so explosively to Nvidia’s report. If he is correct, a $1 trillion market opportunity should not only boost Nvidia’s earnings power, but also the earnings power of other semiconductor companies.

This report was truly the tide that lifted all boats. As we noted above, other semiconductor stocks experienced huge moves higher after the report. Not only that, but we saw significantly higher stock prices for ServiceNow (NOW) and Adobe (ADBE) after NVDA earnings, presumably due to the fact that Huang noted new partnerships now in place with those two companies.

The overall takeaway: the future is bright for Nvidia and other companies in the AI space, now that we see the vast opportunity to drive earnings from this emerging technology.

The Sectors Left Behind

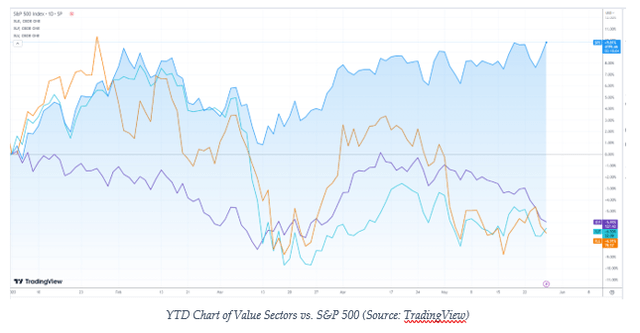

Our exploration of AI has left us minimal newsletter inches to discuss other topics, but we did want to address the acute underperformance we have seen in the value sectors in 2023, the best performing sectors of 2022. There are reasons why stocks in health care, finance, and energy are struggling, as you can see below:

TradingView

Here we see the Health Care Select Sector SPDR Fund (XLV – purple), Financial Select Sector SPDR Fund (XLF – teal), and Energy Select Sector SPDR Fund (XLE – orange), plotted against the S&P 500 (blue). These sectors are lagging badly for their own reasons. Financials have fallen, in part, due to the mini-banking crisis and the rapid increase in the Federal Reserve’s funds interest rate. Health care stocks have struggled amid some concerns about Medicare and Medicaid reimbursement rates, while energy stocks have lost momentum with recession fears driving down the price of oil and gas.

We will address this more fully in future newsletters and videos, but we think there are opportunities developing in this space for investors (1) looking for balance in their portfolios and (2) looking past 2023 for stocks that may perform well for the next 3-5 years. We have asked our investment analyst team specifically to do some work on regional banks, many of whose stocks are down in excess of 50% over the past 2 months, to determine whether we want to deploy capital to this segment of the market. We look forward to sharing our findings with clients, prospective clients, and readers here one month from now.

Takeaways

There is some uncertainty in the markets around the debt ceiling and banking, but we are as optimistic as we have been in some time. The AI-revolution has come rapidly to market and has caused some explosive moves in a number of stocks overnight. Time will tell who the winners will be, but we have conviction in Nvidia, a company that we have watched closely over the years.

Our concern is the narrow nature of the market performance over the past months, but we do not think that will last. While we look to participate in the tech updraft, we also continue to look for opportunities especially in downtrodden sectors like energy, health care, and financials.

Read the full article here