Enbridge (NYSE:ENB) has had a rough year. Especially compared to some of the other pipeline stocks out there. While some of it is thanks to collapsing oil & gas prices, the rest is up for debate. There are a lot of questions about the recent acquisition and whether it was a good move or a bad move. While it may not be what shareholders were looking for in the short term, Enbridge always thinks long-term in my opinion. That said, the dividend is the real draw here. At just under 8%, it’s very hard to pass up. I believe any weakness in Enbridge like we have been seeing is a great buying opportunity. I also believe that you can tuck Enbridge away in a long-term portfolio and sleep well while the dividends pile up.

How Safe Is The Dividend?

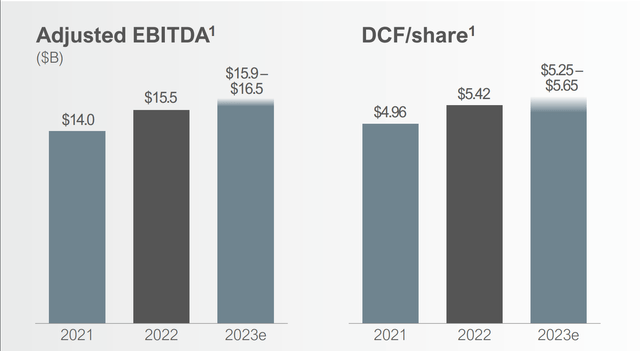

To be short, extremely safe in my view. Now let’s dig into just why that is. You may look at the payout ratio of 235% and see the yield increasing to 7.7% and think to yourself that a cut is imminent! However, the pipeline world doesn’t base dividend safety or ability on the standard payout ratio. Something to always keep in mind when looking at pipeline stocks is that net income is somewhat irrelevant due to the depreciation of assets. This drags on net income overall and makes things look worse than they are. So what’s the go-to indicator? Say hello to distributable cash flow, or DCF. Simply put, DCF is the value of available funds not required to meet current or anticipated obligations of the company. Looking below, we can see that Enbridge is expecting between $5.25 – $5.65 DCF/share for 2023. Enbridge targets a 60-70% payout ratio with respect to DCF. We expect the dividend to total $3.56, taking the middle of the expectation ($5.45) and we get 65%. Dead center of where the company wants to be. Even if we see a weak Q4 and the company ends up at $5.25, that’s still only 68% which leaves even more room to slide.

Enbridge

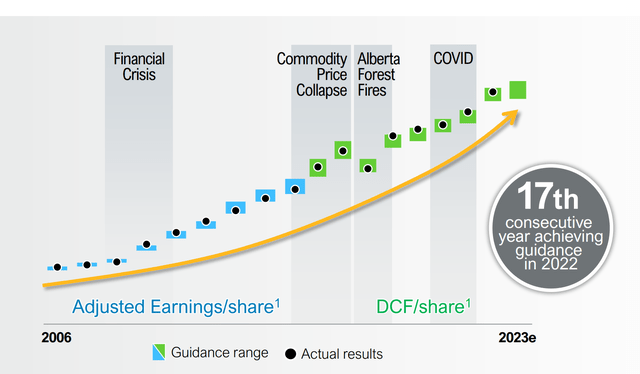

Looking at the share price and the decline over the last year, you may question just how reliable the DCF forecast is. It is a wide range, but as you can see below, regardless of what’s been going on in the world, Enbridge hits its guidance range. Being predictable regardless of the environment is extremely important as it allows investors to trust your word. That’s even more important for a dividend giant like Enbridge. Many rely on Enbridge for income that supports their lifestyle or their retirement. Should they start to miss guidance, it could be a red flag for what’s to come.

Enbridge

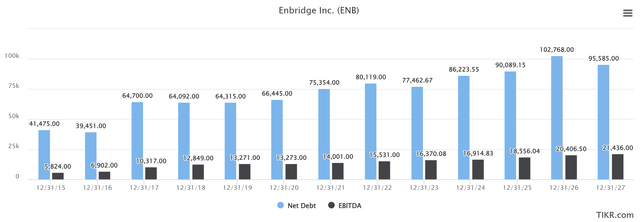

Not only is the dividend safe, but I fully expect the increases to continue. Many may point to the debt as a reason to be concerned. Again, while it is what many industries would consider “at risk”, the assets aren’t cheap to build or acquire. Enbridge has a range of 4.5-5x concerning Debt to EBITDA and they are forecasted to finish right in the middle of that range this year. Part of the reason I think that Enbridge has come under fire is the large debt in a “high-interest” environment. However, only 10% of the debt portfolio is exposed to floating interest rates. Every 25 basis points equate to roughly $2 million in interest expense. That goes both for and against depending on the change.

TIKR.com

Pipelines are a great way to generate income in any portfolio. I feel as if they are often misunderstood and usually follow energy prices more than they should. As oil & gas is on sale, it’s a great time to add some extra income to your long-term accounts in my view.

Why Is Enbridge Down?

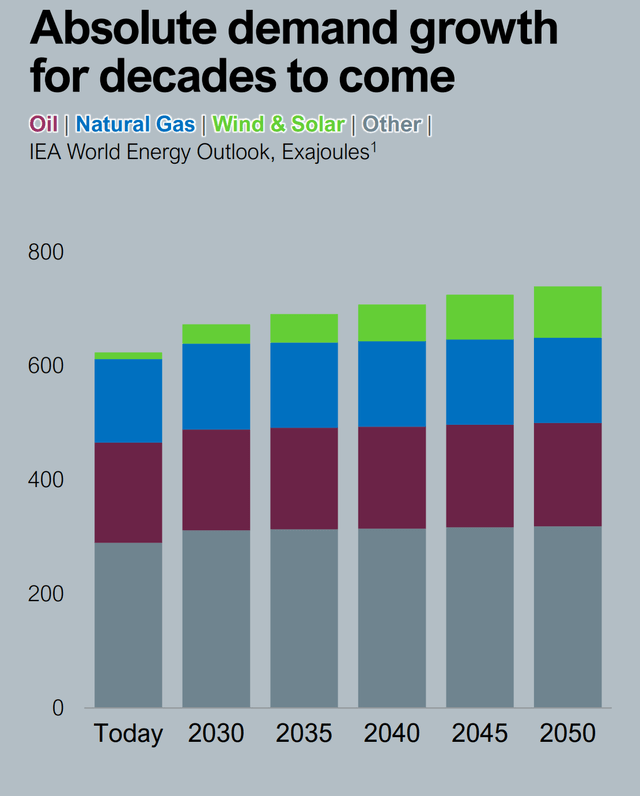

There is some debate about which energy source will be the go-to source over the next 20+ years, but there is little debate that energy demand in general will be higher. There’s a good chance that renewables will account for the largest in terms of growth, but the legacy sources (oil & gas) aren’t going anywhere anytime soon.

Enbridge

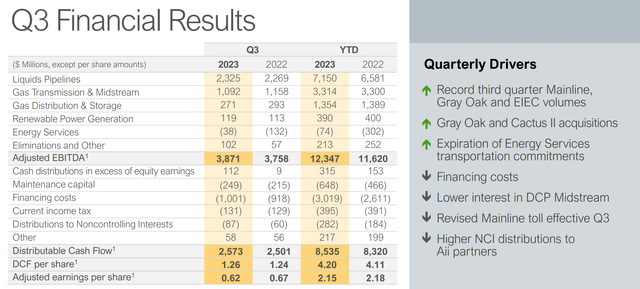

The good news is that Enbridge has its hand in renewables. While it’s not a massive part of the business at this point, it’s there and I have no doubt it will continue to grow. I don’t want to spend a lot of time on the Q3 results, but looking below you can see that they are generally fairly positive. The main reason I want to show these results is so we can start the conversation with respect to why the stock might be down over the last year.

Enbridge

I really think that the reason we have seen Enbridge get a hard time is mostly tied to the commodity prices. That said, more recently I believe it is tied to the acquisitions the company made in early September. There were three deals with Dominion Energy (NYSE:D) to buy multiple natural gas utilities for a combined $14 billion. This deal was done with $9.4 billion in cash and $4.6 billion of assumed debt. This deal will create the largest natural gas utility in North America. The stock crashed 7% on the news and saw downgrades come in. The reason behind these downgrades was mostly centered on the idea that this was a long-term play by Enbridge. Current energy investors are chasing free cash flow and capital return, this deal works against both of those metrics. While I do agree with the general idea that there are short-term implications here, when you buy an infrastructure company like Enbridge, you have to have a longer-term view.

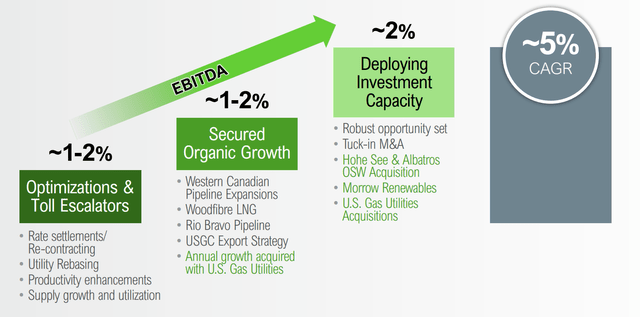

Enbridge

So, taking a longer-term view here, we can see that it is generally positive. Over the next 2 years, they are looking for EBITDA growth of 4-6%. DCF growth of 3%. Looking beyond 2025, they expect EBITDA to grow by ~5% and DCF by ~5%. As DCF increases, we will continue to see dividend increases so long as the payout ratio sticks between 60-70%.

While I understand the downgrades, I think they have presented a buying opportunity. Enbridge has valuable assets and will continue to churn out DCF which will be returned to shareholders. That’s not to say there aren’t risks, but I do think the good outweighs the bad for Enbridge.

What Are The Risks?

Commodity prices are the reason the stock is where it is. With both oil and gas prices coming off highs over the last year, Enbridge has suffered. I would argue that it has oversold, but nonetheless, that’s where we find ourselves at this current time. The largest long-term risk is government policy. As pipelines seem to create a lot of controversy, it forces the government to pick a side. Often, the large projects are the ones heavily impacted. The good news here is that there is tons of pipe already in the ground carrying energy in various forms across the world to the people who need it when they need it and that isn’t about to change. Companies like Enbridge who are forward-thinking will be built to last as pipelines can adapt and carry alternative products (like hydrogen) in certain blends. There will always be money to be made in the movement of energy, regardless of what form it is in.

What Does The Price Say?

While many are just in it for the yield, when it comes time to cash out, you would also hope to see some appreciation. If you are in it for the long run, this could be the stock for you.

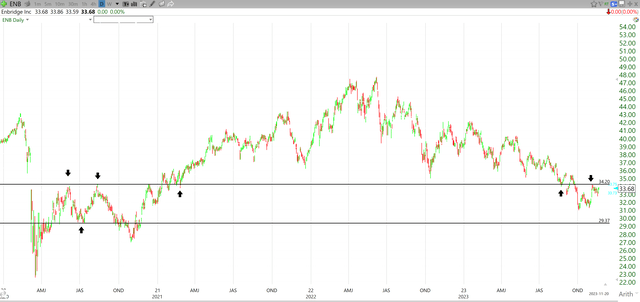

Looking below, we can see the stock is caught at a point of pretty solid resistance. The first chart is a daily view showing 2020 to the present, and the second chart is a weekly view going back to 2010. The reason I want to show the long history is that I’m sure many of you are wondering when the bleeding will stop. While I cannot predict that, I can set stops and look at price history to find previous spots of resistance & support.

TC2000.com

(Daily above, Weekly below)

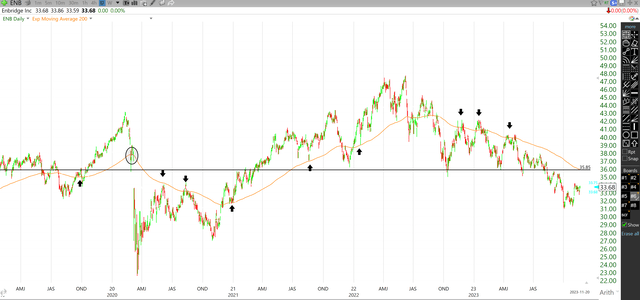

TC2000.com

The top line is $34.20. A breakthrough here would be very bullish and will serve as new support. Should we see another rejection, we could test the second line which is set at $29.37. That’s about 12% from current levels. If the stock drops to those levels, I would need to re-evaluate my position as we are likely headed for COVID-19 lows.

The next thing we need to see is the 200-day moving average get on the right side of things. By that, I mean below the current price. In my last article on Enbridge, I spoke on the 200-day moving average and you can see here that it still rings true today. On all three of the most recent touches of the moving average, we saw a breakthrough, but we did not see a bounce off the moving average to create that new support. Hopefully, the fourth test is the one that breaks through. Currently, the moving average sits at $35.85, about 8% from here.

TC2000.com

While the recent trend in the stock is positive, we are still in an ugly downtrend dating back to April 2022. I want to see this trend reverse before giving the official all-clear, but because of the yield and the multi-year support that isn’t far off, I am comfortable trying to time the market here and pick up some Enbridge at the lows for a longer-term hold.

TC2000.com

Wrap-Up

As you can see, there is a lot to like about what Enbridge has to offer shareholders in the long run. If you are looking to make a quick buck, this isn’t the stock for you. I would recommend buying any dip and tucking it away in a long-term portfolio. Keep an eye on the debt levels, as that is where many sellers will be making their decisions. I trust that Enbridge will continue to manage the debt efficiently. As we see rates stabilize, some of the pressure should come off of Enbridge and the share price should appreciate. I recommend picking up some Enbridge under $35.00.

Read the full article here