What is DocuSign?

DocuSign, Inc. (NASDAQ:DOCU) is an eSignature platform that allows businesses and individuals to sign documents electronically in a matter of minutes. Beyond electronic signatures, the company also offers document generation, contract lifecycle management, clickwrap agreements, guided forms, and more. That said, DocuSign, Inc.’s electronic signature technology is its selling point.

The world used to require physical signatures for all legal and business documents. DocuSign created the technology required to treat digital signatures as legally binding. Instead of overnighting stacks of papers for signatures then mailing them back to the original party, 82% of DocuSign agreements are completed in one day.

Where Has DOCU Stock Been?

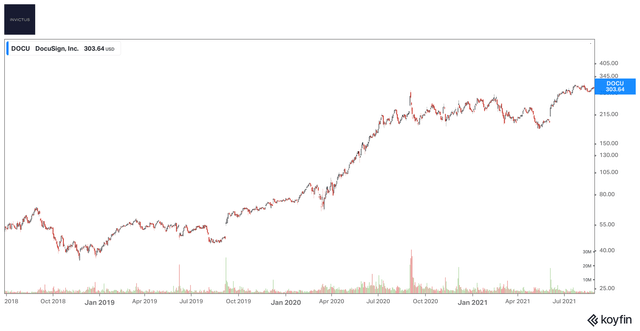

This service became immensely valuable during the COVID-19 pandemic and was grouped in with Zoom Video Communications, Inc. (ZM) as the future of workplace solutions. This was reflected in the share price:

Koyfin

Shares jumped from the mid-$50s to over $300 per share by August 2021. This rapid share price growth, however, was not justified by DocuSign, Inc. fundamentals. Revenue in August 2019 was ~$900 million and doubled to ~$1.8 billion in the next 2 years. Yes, this is rapid growth, but the 6x increase in stock price primarily came from an expansion in its multiples:

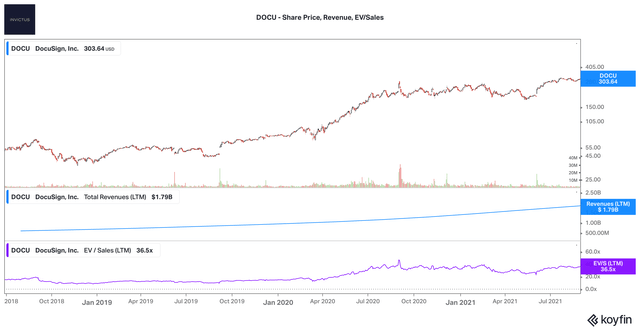

Koyfin

DocuSign’s EV/Sales increase from 10.2x to 36.5x over this period, pricing in some serious growth expectations. Those expectations have not come to fruition. In the nearly ~2 years since then, revenue has grown to $2.5 billion. In absolute terms, revenue:

- Increased by ~$900 million from Aug. 2019 to Aug. 2021

- Increased by ~$700 million from Aug. 2021 to June 2023.

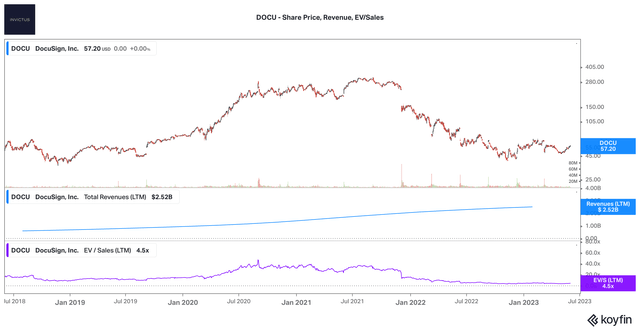

For me, this is where considering DocuSign as an investment ends. And I’m not the only one disenchanted with the company’s results. Since breaking above $300 per share in 2021, shares are once again near $55, and the EV/Sales has fallen to 4.5x:

Koyfin

The pandemic provided a perfect tailwind for DocuSign’s services and brought about mass adoption of electronic signatures (I sign things electronically multiple times per week, something I would have never said pre-COVID). In fact, the number of global electronic signature transactions have risen from 89 million to 754 million over the last 5 years.

And yet, the company has not generated any kind of revenue leverage (let alone opex leverage). Despite the once-in-a-lifetime tailwind and a “growing customer base” (more on why I’m putting that in quotes below), DocuSign is not growing revenue at a faster clip than it was in 2019.

Why I’m Not Touching DocuSign

1. Lack of Moat & Competition

DocuSign was the pioneer in electronic signatures. It was the first-mover and built an attractive, easy-to-use platform that changed how people sign documents. The number of electronic signature transactions is up ~8x in the last 5 years, yet DocuSign’s revenue is increasing at a decreasing rate – a sure sign it has yet to uncover revenue leverage.

At this point in DocuSign, Inc.’s lifecycle and given the state of the industry, I would like to see the company have a positive ROIC and revenue increasing at an increasing rate. We see the opposite, clear indication the company either:

- Doesn’t know how to grow

- Is a commodity / can’t demonstrably beat its competition.

I’m leaning toward #2.

Adobe Inc. (ADBE), Dropbox, Inc. (DBX), HelloSign, signNow, PandaDoc, Zoho Sign, and a host of others are all offering the same product. DocuSign’s income statement shows a failure to create revenue leverage or operating expense leverage, its ROIC is negative, and its management team is disjointed. All signs point to its product/services being a commodity.

Plus, DocuSign achieved its current market position with a well-paid sales team which it is now restructuring. Although its Sales & Marketing expenses are quite high (~62% of revenue in FY23), this seems like the only channel that is bringing in new revenue. The company is only reducing headcount by 10%, and I doubt it’s going to fire its top salespeople, but it still shows a lack of commitment to what has historically been its best revenue-generator, and has no other channel to replace it.

2. Legal Spats & Management Issues

In 2022, CEO Dan Springer suddenly stepped down and was temporarily replaced by interim CEO Maggie Wilderotter. In October 2022, the company announced Allan Thygesen would be the next CEO and replace Mr. Springer, who was resigning from the Board of Directors.

Mr. Springer then filed a lawsuit against DocuSign claiming that he had not resigned and that the phony announcement was an effort to remove him from the Board. The company then confirmed Mr. Springer had not resigned and he would retain his position on the Board, without litigation.

This is not unimportant. This is the team leading the company and making strategic decisions. As a potential investor, this is the team you’re considering partnering with to manage your company. Personally, this is almost reason enough for me not to invest in DocuSign, Inc.

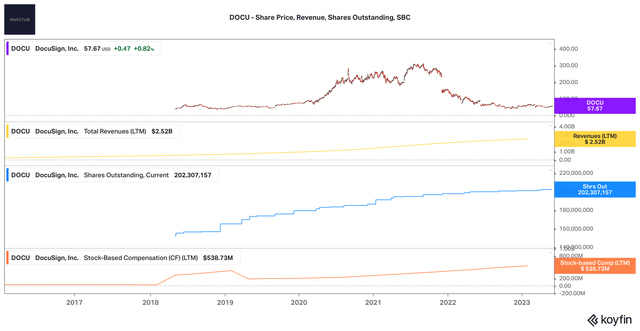

3. Share Dilution & SBC

Speaking of management decisions, it has diluted the number of shares outstanding by ~33% since becoming a public company in 2018. Additionally, stock-based compensation reached ~$539 million in FY23, ~21% of total revenue:

Koyfin

Once again, this is evidence DocuSign, Inc. is run by a management team that is not focused on rewarding shareholders. This is not a team I want to partner with.

Valuation

Despite my criticism, the DocuSign, Inc. business itself is doing alright, largely due to its first-mover advantage and the industry tailwinds. Since 2017, revenue has grown at an extremely impressive ~39% CAGR. Despite that growth, the company has failed to create top- or bottom-line leverage, and its negative ROIC is worrisome when trying to price in future growth.

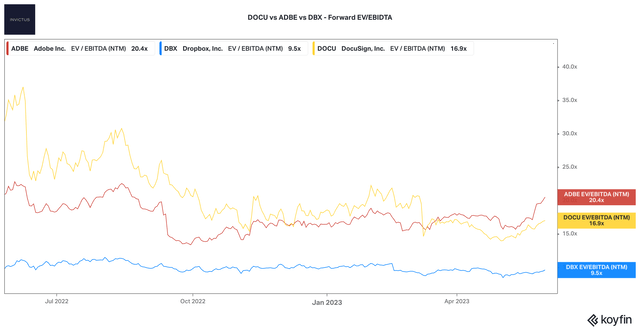

Its product and/or sales strategy is not noticeably better than its host of single-product competitors (HelloSign, signNow, Panda Doc, Zoho Sign, etc.), and its larger competitors (Adobe and Dropbox) can continue to leverage their existing user bases. In my opinion, it does not warrant a premium valuation based on its growth prospects, although Mr. Market does not completely agree:

Koyfin

Given the risks I highlighted above, DocuSign would need to be trading at a significant discount to Adobe for me to get interested, closer to DBX’s forward EV/EBITDA of 9.5x. This would put DOCU in the mid-$30s. As it stands today, there are much higher quality businesses to own at better prices (like Adobe) than DocuSign, even as a flier.

Conclusion

There is nothing wrong with DocuSign, Inc. product, but its failure to create meaningful revenue leverage is worrisome as an investor. The product itself is good, but there is a lot more to building a great business than having a good product, and I’m not confident the management team can build this into a very large business over the next 5 years. If DocuSign, Inc. stock falls into the low to mid-$30s it may be worth taking another look at, but until then I’ll be allocating my resources elsewhere.

Read the full article here