Description

I reiterate to buy Doximity (NYSE:DOCS). The healthcare industry, pharmaceutical companies, and healthcare systems can all benefit from DOCS. Healthcare providers can coordinate patient care and communicate with one another in a secure, HIPAA-compliant environment, which also simplifies and digitizes many processes. It also allows healthcare systems to run targeted campaigns and coordinate patient care across different systems, which is especially useful for pharmaceutical companies looking to maximize the ROI of their digital marketing efforts.

Stock has been under pressure despite strong performance thus far, in my opinion because of management’s cautious guidance and comments about a challenging upsell year. Compared to the previous year, when upsell accounted for 10–12% of subscription revenue, management now anticipates only 5–7%. In my opinion, this adjustment simply reflects the reality that macro conditions have changed and the reason why the stock price was rangebound was simply because consensus had high expectations. In that case, the revision on expectation is now in favour of DOCS as there is a possibility of beating guidance if macro turns for the better. This degree of conservatism, in my opinion, establishes a target that can be met in FY24, allowing management to get back to their usual rhythm of beating and raising guidance.

Tough CY23

Everyone knows that CY23 is a challenging year, and it looks like that’s going to be the case for the rest of 2H23 as well. Companies are going to stay tight on their budget spending and delay implementations for as long as they can to preserve cash. DOCS is not immune to this, especially given their historical reliance on upselling to fuel growth. The big drug launches (mentioned by management) this year should serve as a catalyst to drive demand in FY24, so I don’t think this hold up can continue. With lower CY23 forecasts in place, DOCS stands to benefit from any improvement in the external operating environment if it is able to outperform expectations.

Workflow solution boosts value proposition

I expect DOCS value proposition to increase as its double downs on its Workflow solution – which is tracked via the metric quarterly active workflow providers [QAWP], which represents the net number of providers using email, fax, e-signature, telehealth and/ or scheduling. This seems like a logical next step for the DOCS solution to further integrate itself into the users’ ecosystem. Key solutions such as Newsfeed, Workflow, and Dialer are gaining popularity as more and more doctors start using the platform to streamline their practices. To put that in perspective, DOCS now serves roughly 40% of physicians with workflow tools, and the company boasts over 500K QAWP. The Dialer tool is my favorite because it makes calling patients to set up appointments the least painful of the three. With the Dialer, users can quickly contact patients and let them confirm appointments through text message links. Overall, I believe management is doing a good job of pinpointing these entry points, and if DOCS is able to capture the “workflow” part of its users, its retention rate would significantly increase due to the difficulty of ripping and replacing a company’s workflow process. This would also further open up more opportunities to upsell as I’m sure there are plenty of areas within the workflow process that can be targeted.

Long-term target is possible

DOCS has stated its long-term goals to be generating $1 billion in revenue by FY28 and maintaining an adjusted EBITDA margin of 45%. It was also confirmed that a large chunk of revenue, between 60% and 65%, is already secured through contracts, as such, I have high confidence for DOCS to hit FY24 guidance. An additional 30%-35% is anticipated to come from customer renewals and upsells, with the remaining 5% coming from new customer acquisitions. In my opinion, the most important factor in DOCS’s rapid growth to hit FY28 target is the industry’s transition from traditional to digital marketing. Upselling will also remain a growth driver even as the macroeconomic environment improves. I would also note that this is a game of confidence. If DOCS meets FY24 target, and continue to hit guidance for FY25/26, the market will increasingly price in the FY28 possibility.

Valuation

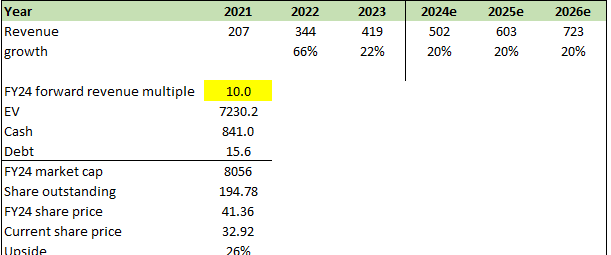

I believe DOCS is worth USD41.36 in FY25, a 26% increase from the time of writing. This graph is based on my model and the following assumptions:

- Revenue will meet expectations in FY24 since over half of the revenue is contracted (high visibility) and will continue to grow as DOCS captures share from shift in marketing investments to digital channels and the new workflow solutions. I believe DOCS’s growth momentum will continue because it is the market leader and there are numerous opportunities for it to upsell.

- DOCS is currently valued at 10x forward revenue, and I assume no change in multiples given my growth expectations remains the same at 20%.

Own estimates

Risks

During the COVID-19 pandemic, many healthcare facilities were compelled to quickly implement telemedicine. Doximity is among many telehealth companies that provide unique features and compatibility with other platforms. Some of the most fundamental telehealth platforms, however, are beginning to feel uniform. To the extent that suppliers are willing to pay less for a basic platform, Doximity may have trouble fully realizing the financial benefits of its platform.

Summary

I reiterate buy rating for DOCS due to its potential benefits for the healthcare industry, pharmaceutical companies, and healthcare systems. The platform enables secure communication and coordination among healthcare providers while streamlining processes. It also allows targeted campaigns and coordinated patient care across different systems, aiding pharmaceutical companies’ digital marketing efforts. Although the stock has faced pressure, which I believed is primarily due to management’s cautious guidance and a challenging upsell year, the adjustment reflects changing macro conditions. Despite the tough year ahead, DOCS can benefit from improvements in the external operating environment and its focus on the Workflow solution, which enhances its value proposition. With a long-term revenue goal of $1 billion by FY28, secured contracts, and growth opportunities, DOCS has the potential to achieve its targets and gain market confidence. Considering my valuation model, I estimate DOCS to be worth USD41.36 by FY25, indicating a 26% increase.

Read the full article here