A new company has been born from the combination of DSM and Firmenich, creatively called DSM-Firmenich (OTC:DSMFF). While it might not have the most catchy corporate name, this is a giant of a company that gets surprisingly little coverage. It operates in highly attractive sectors, primarily specializing in ingredients.

This is an industry that tends to generate very healthy operating margins and returns on invested capital. There are several reasons for this, including the fact that these ingredients tend to represent a small percentage of the final price of the products that use them, but have a significant impact on their properties. For example, these ingredients can be sold to customers that manufacture food or perfumes, and they will not easily switch to buying from a competitor for the risk that the final customer might notice a difference in how the product tastes or smells. Therefore part of the competitive moat is due to high switching costs, although DSM-Firmenich also benefits from economies of scale and significant intellectual property.

The merger of the two predecessor companies was completed on May 8th, 2023. The new company has four main business lines as shown in the slide below. We believe the strongest moat is found in the Perfumery & beauty segment, which makes around 30% of revenue. Taste, Texture, and Health has also been delivering solid results. However there has been some weakness in the other two segments, both of which have been affected by weak performance in the overall vitamin market.

DSM-Firmenich Investor Presentation

Financials

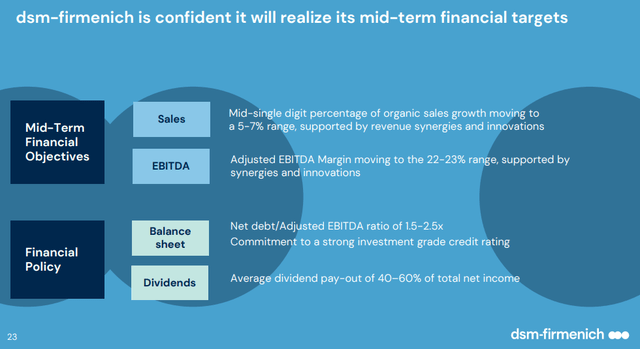

The company has some ambitious targets, but it will take some time for it to reach them, especially as they assume overcoming problems in the vitamin segment, and the realization of some merger synergies.

DSM-Firmenich believes it can attain sustainable organic sales growth of 5-7% per year, with a mid-term adj. EBITDA margin of around 22 to 23%. We view these targets as reachable, but far from guaranteed. It will take a lot of work and efficiency improvements to get there. One thing we particularly appreciate is that the company is very straightforward as to what its financial policy will be with respect to debt and the dividend. It is planning to distribute between 40% and 60% of the previous year’s net income to its investors, while maintaining very low leverage with a net debt to adj. EBITDA of 1.5x to 2.5x. This would help the company maintain a very strong investment grade credit rating.

DSM-Firmenich Investor Presentation

Q3 2023 Results

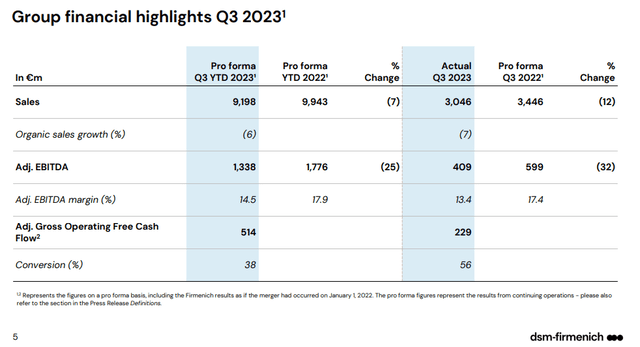

Results for the third quarter were not great, given the weakness in the Health Nutrition & Care and Animal Nutrition & Health segments. These two segments were impacted by low vitamin prices. The company saw a 7% organic sales decline in the quarter with a 1% reduction due to pricing and 6% reduction due to volumes.

The company is responding with a transformation of the vitamin business that is aiming to reduce costs by €200 million. According to the company the merger is going according to plan, and is still expecting significant synergies from the combination. One positive in the quarter is that the company was able to increase the percentage of adjusted EBITDA converted to free cash flow.

DSM-Firmenich Investor Presentation

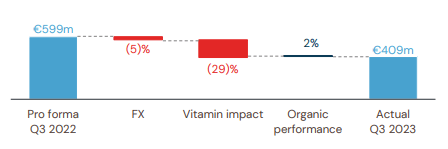

Still, the vitamin impact was significant, taking away almost a third of the company’s adjusted EBITDA for the quarter. This caused by far the biggest change when comparing to the previous year’s quarter. Foreign exchange had a slightly negative effect, while there was a small positive contribution from organic growth.

DSM-Firmenich Investor Presentation

Current Conditions

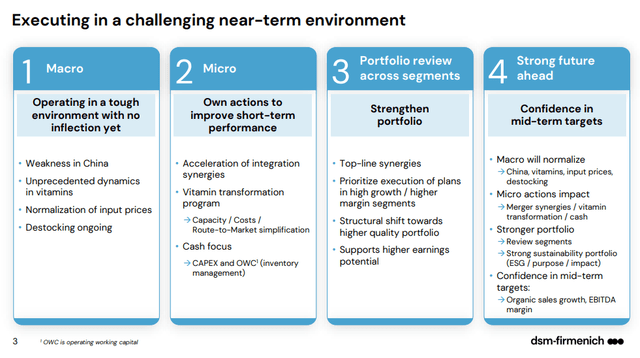

DSM-Firmenich believes current challenging conditions are temporary, and that things will either normalize or the company will take corrective actions. Two big headwinds are the current conditions in the vitamins industry, with weak demand and low prices, as well as general weakness in the Chinese market. The company has also been affected by inflation in its input prices, and de-stocking at some of its customers as strong expected demand failed to materialize.

We give the company credit for taking actions to counter these headwinds, such as reducing costs in the vitamin segment. It is also reasonable to expect that some of the macro headwinds will eventually dissipate. We are not as confident that all the expected synergies from the merger will materialize, but for the time being we are giving the company the benefit of the doubt.

DSM-Firmenich Investor Presentation

Future Outlook

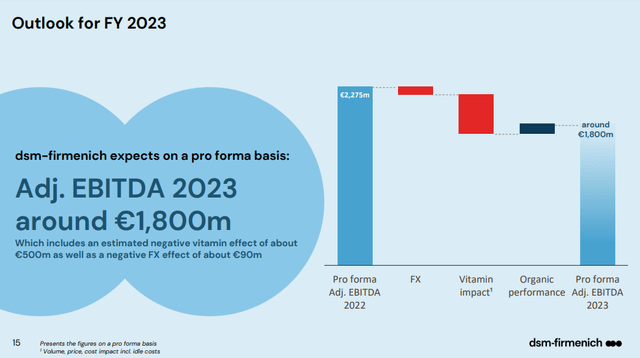

When the company reported Q3 2023 results it updated its guidance on the expected adjusted EBITDA for 2023. Given the negative impacts this is not surprising. For comparison, the company has a market cap of ~€24 billion and an enterprise value of ~€27 billion, putting an EV/adj. EBITDA ratio at ~15x. If things normalize and the company is able to restore its previous earnings generation capabilities, the EV/adj. EBITDA ratio would go down to ~11x, which we would argue is not unreasonable for a high-quality company with such a strong competitive moat.

DSM-Firmenich Investor Presentation

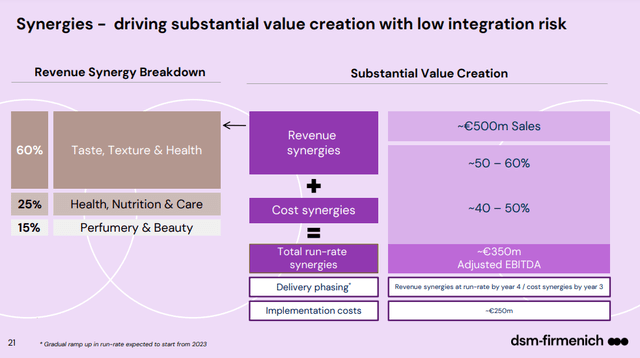

Where we are a bit skeptical is on the revenue synergies the company expects from the combination. In our experience we have seen companies more easily deliver on cost synergies (basically eliminating duplicate roles/operations), but revenue synergies are harder to obtain. In their presentation they show some products resulting from their combined IP/knowledge, so there might be some opportunity for new innovations thanks to their combined scientific capabilities and intellectual property. Still, it remains to be seen if these new innovations can really add hundreds of millions of euros to the top line.

DSM-Firmenich Investor Presentation

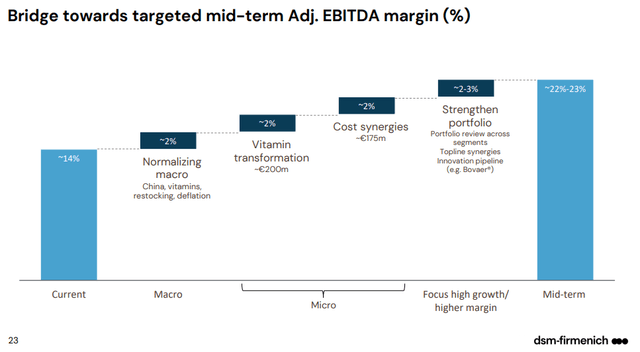

Fortunately, there is a lot of room for profitability improvement, even without the topline synergies. In their bridge towards their mid-term target adj. EBITDA margin, synergies are part of the “Strengthen portfolio” bucket, which is expected to contribute only around 2-3% improvement. We think the rest of the factors are more realistic, which could still take the adjusted EBITDA margin to ~20%.

DSM-Firmenich Investor Presentation

The Vitamin Problem

The most visible issue right now with the company is its “vitamin problem”, which the company is addressing with cost cutting measures. These measures are estimated to result in savings of around €200 million per year once fully implemented. This is going to take some time, with the full benefit taking around two years to be seen. The measures taken include the closing of some plants, labor force reduction, simplifying and separating the business unit, and operating with a more agile approach.

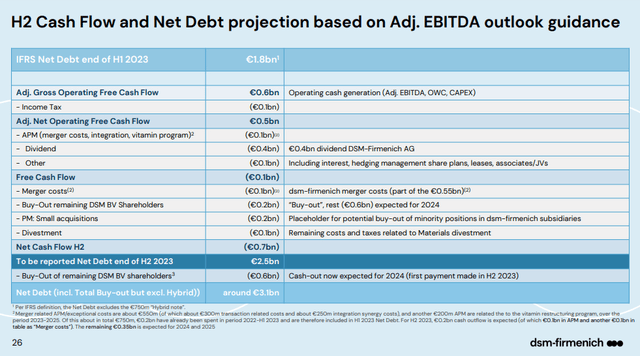

Balance Sheet

The company has a very strong balance sheet, which gives it ample room to either boost M&A activity, or to invest in organic growth opportunities. DSM-Firmenich expects to end the fiscal year with ~€3.1 billion in net debt, excluding the €750m Hybrid note. Still, even including the Hybrid, the Net Debt/ Adj. EBITDA 2023 multiple would be only ~2.2x.

DSM-Firmenich Investor Presentation

Valuation

Shares are currently trading at ~€91.88 in Europe, with almost no volume/liquidity seen in the US. Analysts are expecting the company will deliver ~€3.25 earnings per share for FY2024. This puts the forward p/e multiple at ~28x, which might appear high, but it is not unreasonable for a company with such a strong competitive moat in most of its businesses. If we believe the company can achieve its mid-term growth targets, earnings per share could grow at high single digits, or possibly even low double digits. We estimate the net present value of its future earnings at ~€95, using a 7.5% discount rate. While we find the valuation to be reasonable, we don’t believe the shares are particularly attractive at the moment, leading us to a ‘Hold’ rating.

| EPS (€) | Discounted @ 7.5% | |

| FY 24E | 3.25 | 3.02 |

| FY 25E | 3.54 | 3.07 |

| FY 26E | 3.86 | 3.11 |

| FY 27E | 4.21 | 3.15 |

| FY 28E | 4.59 | 3.20 |

| FY 29E | 5.00 | 3.24 |

| FY 30E | 5.45 | 3.29 |

| FY 31E | 5.94 | 3.33 |

| FY 32E | 6.48 | 3.38 |

| FY 33E | 7.06 | 3.42 |

| FY 34E | 7.69 | 3.47 |

| Terminal Value @ 5% terminal growth | 141.17 | 59.27 |

| NPV | €94.95 |

Risks

In general we believe DSM-Firmenich is a below average risk company, as it benefits from customers’ high switching costs, significant intellectual property and trade secrets that protect its ingredients and their manufacturing processes, as well as significant scale making it an ideal supplier for many global corporations. Still, it has not been immune to the negative effects of high inflation, and some of its businesses are experiencing difficulties, such as the vitamin segment. The risks are also mitigated by its strong balance sheet, business and customer diversification, and a strong innovation track record.

Conclusion

While recent results have been relatively weak and the company is facing several headwinds, we believe things will eventually normalize. The current valuation appears fair, but nothing to get too excited about either. Still, this is a leading company in a very attractive industry, and we believe investors should pay more attention to it. We are starting coverage with a ‘Hold’ rating, mostly as a result of the valuation not being particularly attractive at the moment.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here