DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note’s date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Rock Steady

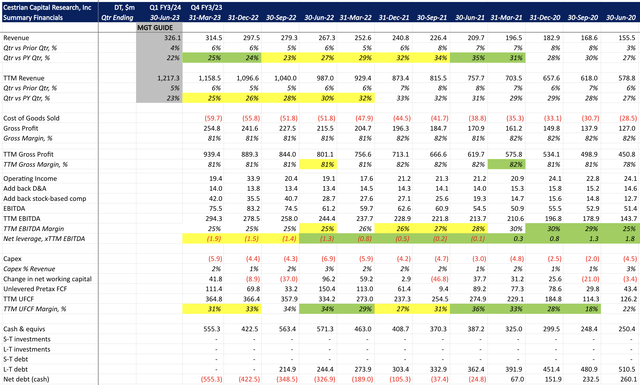

If you’re thinking of starting or buying an enterprise software business, take a few days to study Dynatrace, Inc (NYSE:DT). The company’s financials are a thing of beauty — 25% growth, 31% cash flow margins, >$500m net cash on the balance sheet, RPO 1.7x TTM revenue and RPO growing at the same rate as TTM revenue.

Or in English:

Solid growth, great cash flow margins, high levels of revenue visibility, underlying revenue growth supports continued growth at the current levels or better, balance sheet safe as houses. Unlevered houses, that is.

The company printed a great quarter yesterday before the open. Growth accelerated, margins held up, RPO accelerated, all good. Stock reaction was, meh. On a bright green day. Make of that what you will.

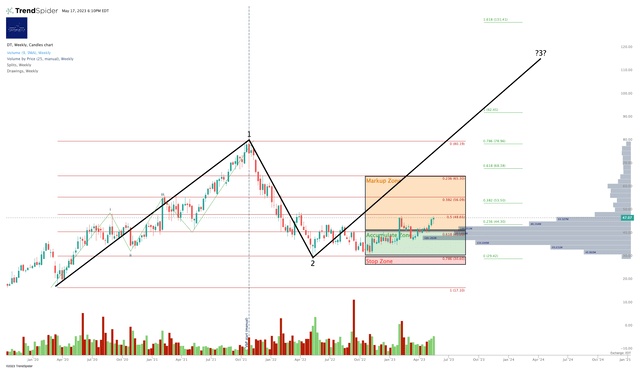

We now rate at Hold as the stock moves up through our Markup Zone. We had previously rated this as an Accumulation opportunity in our Growth Investor Pro service.

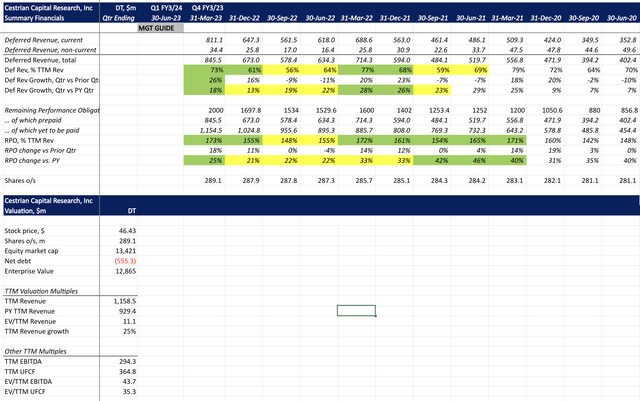

Fundamentals & Valuation

DT Fundamentals I (Company SEC filings, Ycharts.com, Cestrian Analysis)

DT Fundamentals II (Company SEC filings, Ycharts.com, Cestrian Analysis)

Stock Chart

You can open a full page version of this chart, here.

DT Chart (TrendSpider, Cestrian Analysis)

Cestrian Capital Research, Inc – 18 May 2023.

Read the full article here