Company Overview

Dynavax Technologies (NASDAQ:DVAX) is a commercial-stage biopharmaceutical firm specializing in innovative vaccines. The company’s flagship product, HEPLISAV-B, is a unique two-dose Hepatitis B vaccine approved in the U.S. and European Union. They manufacture CpG 1018 adjuvant, pivotal in HEPLISAV-B and numerous COVID-19 vaccines. Besides these, Dynavax has several clinical programs underway, including a tetanus, diphtheria, and pertussis booster vaccine, a shingles vaccine, and a Department of Defense-funded plague vaccine, all incorporating the CpG 1018 adjuvant. Additionally, collaborations for advancing vaccine candidates for influenza and other diseases are ongoing.

The following article discusses Dynavax’s financial performance, stock assessment, growth strategies, and an analysis recommending a ‘Hold’ position on the company’s stock.

Financial Performance

Starting with financials: Dynavax reported a Q1 2023 revenue of $46.9 million, down from 2022’s $114 million. The HEPLISAV-B vaccine brought in $43.5 million, a 109% YoY increase, while DoD-funded plague vaccine revenue reached $3.5 million. With partnership agreements ended, CpG 1018 adjuvant didn’t contribute to revenue, reducing total sales costs to $14.7 million. Increased costs for HEPLISAV-B, product development, and higher personnel and marketing costs elevated expenses. Unrecoverable receivables resulted in a $12.3 million bad debt expense. A GAAP net loss of $24.3 million was recorded. Dynavax’s 2023 forecast anticipates HEPLISAV-B revenue of $165 – $185 million and higher R&D and SG&A costs.

Stock Assessment

According to Seeking Alpha data, Dynavax stock presents an intriguing investment consideration with mixed financial metrics. The forward-looking earnings per share [EPS] estimates show the company gradually decreasing its losses, aiming for near-breakeven by 2025. The YoY EPS growth is projected to increase significantly, suggesting a potential recovery from current loss-making status.

However, FY1 earnings revisions suggest a level of uncertainty with more downward revisions than upward. The valuation metrics are mixed, with no P/E ratio due to current negative earnings but a reasonable enterprise value (EV) to sales ratio of 2.18, indicating the stock might not be overvalued.

Growth metrics are positive with substantial YoY revenue growth and a striking three-year revenue compound annual growth rate [CAGR] of 153.25%. However, the levered free cash flow has dropped significantly YoY.

The company demonstrates strong profitability metrics with high gross profit, EBIT, and net income margins. Its impressive return on equity at 55.44% is indicative of effective management of shareholder funds.

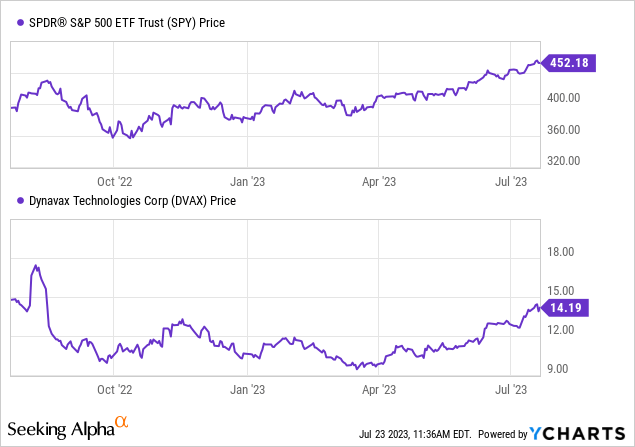

Despite a slight year-over-year decline in stock performance, Dynavax’s short-term momentum outpaces the S&P500, making it a potential candidate for momentum investors.

With a market cap of $1.82 billion, the company’s capital structure includes a healthy cash position of $651.96 million and manageable debt levels of $257.82 million.

Growth Strategies

During the recent earnings call, Dynavax management reported continued progress in their strategic priorities, with a focus on growing their commercial product, HEPLISAV-B, a Hepatitis B vaccine. Their Q1 net product revenue for HEPLISAV-B set a record, outperforming expectations, and they anticipate 30-50% annual revenue growth for 2023. They attribute this success to the ACIP’s recommendation for adult Hepatitis B vaccination, market growth, and capturing a majority of the expanding market share.

Simultaneously, Dynavax continues to progress three clinical stage adjuvant vaccine candidates for Tdap, shingles, and plague and to explore new opportunities to utilize their CpG 1018 adjuvant technology in preclinical efforts. They shared encouraging data on their Tdap and shingles programs and announced completed enrollment in the second part of the Phase 2 program for their plague vaccine.

Further, management announced their intention to identify and review strategic opportunities to accelerate growth. Their primary focus is on commercial or late-stage assets in the vaccine space and high synergy commercial assets within the infectious disease space that broaden their focus to therapeutic modalities beyond vaccines. They emphasized a disciplined capital allocation strategy aimed at generating significant value and accelerating growth.

My Analysis & Recommendation

After thoroughly examining Dynavax Technologies, I see a company with both potential and challenges. On the positive side, it has a strong product in the form of HEPLISAV-B, a unique two-dose Hepatitis B vaccine, administered one month apart (as opposed to the typical three doses over six months). HEPLISAV-B’s sales volume has been growing, driven by an expanding market and increased market share. Based on treatment recommendations and market uptake, I anticipate the strong launch to continue. Outside of HEPLISAV-B, there are promising signs in the R&D pipeline, with three clinical stage adjuvant vaccine candidates for Tdap, shingles, and plague. Plus, their cash position is healthy, suggesting they can support their operations and R&D efforts.

However, Dynavax has its set of challenges. Despite revenue growth from HEPLISAV-B, the total revenue in Q1 2023 decreased significantly due to the absence of CpG 1018 adjuvant product revenue, which was a major source of income in 2022. Also, the company reported a GAAP net loss and a significant bad debt expense, which are concerning.

For investors looking to the Q2 earnings report on August 3, it would be wise to look out for any changes in HEPLISAV-B’s sales volume and market share. Keep an eye on the status of their R&D pipeline, especially the clinical stage adjuvant vaccine candidates. Any potential new collaborations or strategic opportunities identified by management could also be a game-changer for Dynavax. If HEPLISAV-B continues its current growth trajectory, it could generate substantial annual revenue.

Dynavax’s market cap of around $1.8 billion seems to fit its current situation and future prospects. However, the significant YoY revenue drop and ongoing net losses are causes for caution.

Based on these factors, I would currently recommend a ‘Hold’ position on Dynavax. I do believe continued stock value appreciation is more likely from here, but would like to see a clear path towards profitability from the wings of HEPLISAV-B before rerating.

Read the full article here