Summary

This post is to provide an earnings update on easyJet (OTCQX:EJTTF) and its stock. EJTTF is one of Europe’s largest low-cost carriers. I believe the company is set to benefit from near-term travel demand strength, and revenue per seat growth will continue to drive top-line growth. EJTTF’s valuation should also be in line with peers given similar expected growth rates and its lower leverage ratio.

Investment thesis

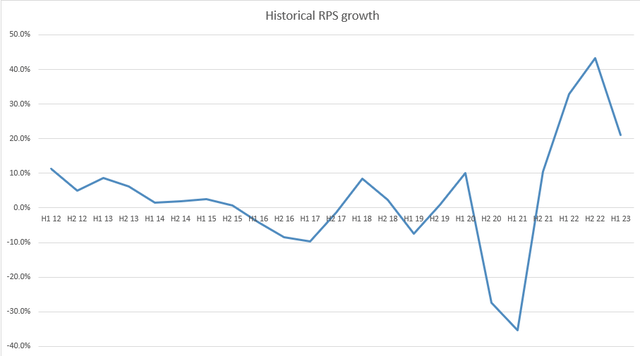

I believe the focus for EJTTF’s 3Q23 trading update was its revenue per seat [RPS]. I believe 3Q23 RPS fared pretty well, albeit 4Q23 guidance was weaker than I had imagined. 4Q23 RPS is now expected to grow 10%, which suggests continued recovery momentum from the COVID period. While the 10% seems like a slowdown, I note that it is against a tough comp in FY22. From a long-term perspective, the new guide on Q4 RPS continues to stay above the high end of the historical growth range.

Author’s own calculation

Management’s commentary on 1Q24 bookings has been quite positive, therefore I anticipate growth to remain above the 10% range for the foreseeable future. In particular, management expects yields to rise relative to 1Q23, which is good news in light of persistent worries about the slowdown in demand after summer. Now that we have this new comments, I think the consensus will begin reflecting this ongoing strength in their projections, which should boost optimism about the company.

In addition to this, I think it’s important to pay attention to the ex-fuel unit cost projection, which has been restated at broadly flat yoy for 2H23, suggesting that margin expansion is possible as top-line growth continues to outpace historical rates. Average passenger fares were up 22% from 2019 levels, another encouraging statistic that caught my eye. This runs counter to the macro scenario, as consumers are reducing their discretionary expenditure. This, in my opinion, is a sign of the travel industry’s underlying strength and should help businesses weather the current macroeconomic storm.

Balance sheet strength improving

A key aspect of EZJ that I am favorable to is its balance sheet strength. EZJ has effectively no debt, which gives it a lot of financial flexibility to invest aggressively (acquire more planes, ramp up hiring, marketing, etc.) to take advantage of this travel demand recovery. I see this as a competitive advantage relative to other European LCC players like Wizz Air Holdings and Norwegian Air Shuttle.

Valuation

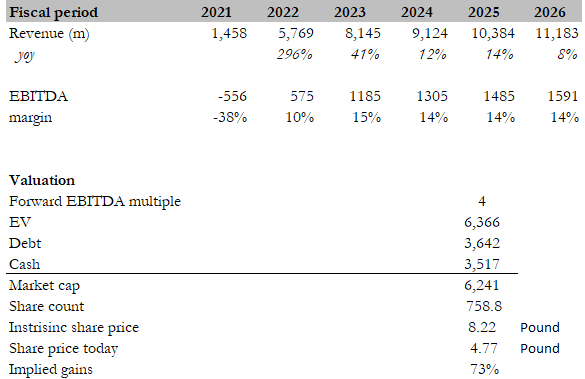

I believe the fair value for EJTTF based on my model is 822 pence. My model assumptions are that: growth will continue to stay above 10% for the near term as the travel recovery continues to stay strong. As the US economy recovers, EJTTF should see another year of strong growth (in FY25) before decelerating back down to the historical RPS growth rate. For margin, I remained conservative by assuming a flat margin for the coming years, as I believe some portion of cost inflation (particularly labor) will stay structural.

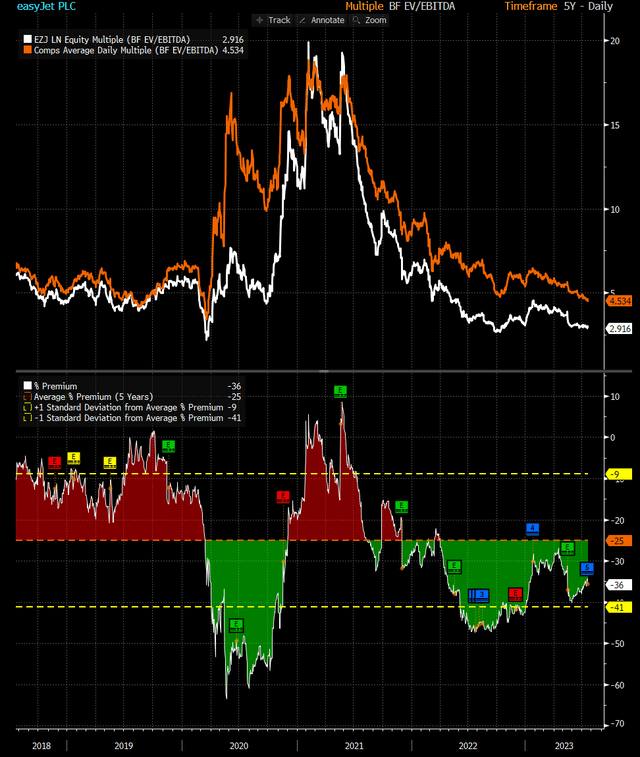

I also think that EJTTF should trade in line with other industry peers, who trade at an average of 4x forward EBITDA. The reason being that EJTTF is expected to experience a similar level of growth, but it has a lower than average leverage ratio. The lower exposure to debt deserves a premium, especially in the current high interest rate environment.

Author’s relative valuation model

Bloomberg

Risk

EJTTF operates in a very cyclical industry that is extremely sensitive to the economic cycle. While results and performance have been strong so far, the business is not going to escape harmlessly if the US economy dips into a steep recession. I would expect to be decimated in that scenario.

Conclusion

I recommend a buy rating for easyJet based on its strong RPS growth and favorable long-term prospects. The company is well-positioned to benefit from the current travel demand recovery, with management’s positive commentary on future bookings and yield growth adding to the optimism. However, it’s essential to acknowledge the inherent cyclicality of the airline industry, which could pose risks during economic downturns.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here