Introduction

Ecolab Inc. (NYSE:ECL) specializes in creating and promoting goods and services for cleaning and disinfection. The company was established in 1923 and now operates in more than 170 nations, providing services to clients in a variety of markets, including hospitality, healthcare, food and beverage, and water treatment. With an emphasis on sustainability and innovation, it has developed into a multibillion-dollar corporation committed to assisting businesses in resource conservation, environmental protection, and financial growth.

Given its strong foundational principles, including environmental responsibility, innovation, social responsibility, and partnership with robotics, I believe there’s a bull case here. I rank the company as a buy because I have high confidence in its performance in the future.

Company Overview

Ecolab is a company that makes and sells sanitation and cleaning supplies. Hotels, restaurants, medical facilities, educational institutions, retail establishments, commercial and industrial laundromats, food processing plants, etc., and all back up the enterprise. The company is split into three main sections.

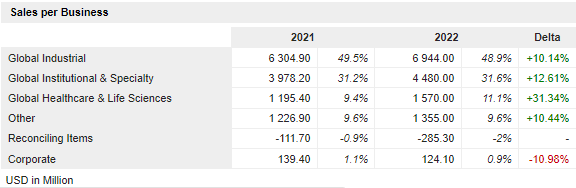

The segments include Global Industrial, Global Institutional & Specialty, and Global Healthcare & Life Sciences segments. Below is the company’s revenue distribution per segment.

Market Screener

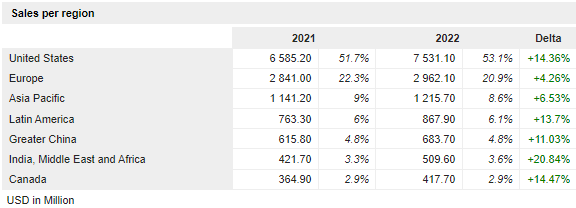

The organization is spread out throughout a number of different countries and offers a wide variety of services. Regarding net sales, the United States accounts for 53.1%, Europe for 20.9%, China for 4.8%, Asia/Pacific for 8.6%, Latin America for 6.1%, India/the Middle East for 3.6 %, and Canada for 2.9%.

Market Screener

Environmental Stewardship

Ecolab is committed to upholding the environment and has established challenging sustainability goals. By saving water, electricity, and other resources, the business aims to have a smaller negative impact on the environment. It also encourages its clients to do the same. The 2030 Impact Goals are a new set of sustainability objectives that they unveiled in 2019.

By 2030, ECL aims to:

- Deliver water savings of 300 billion gallons for its customers.

- Reduce greenhouse gas emissions in its operations and supply chain by 10%.

- Enable recycling or reuse of 100% of its packaging.

- Support the sustainable production of its top 10 raw materials, accounting for 75% of its procurement spend.

- Achieve a 20% reduction in accident rates compared to 2017 levels.

These objectives expand upon Ecolab’s earlier sustainability goals, established in 2015 and accomplished by 2020. The company seeks to be more sustainable to lessen its environmental impact while simultaneously generating value for its stakeholders and customers.

Innovation

ECL is dedicated to innovation and makes significant investments in R&D. The company’s research and development efforts are concentrated on creating innovative technologies and solutions that aid its clients in resource conservation, safety enhancement, and operational efficiency. It boasts a committed group of scientists and researchers constantly working to create new goods and services.

Ecolab’s 3D TRASAR Technology is an example of an innovative concept. It is used in business settings to improve water treatment systems. The technology uses advanced sensors and analytics to track the quality of the water and automatically change the chemicals and processes used in water treatment to get the best results. Ecolab’s commercial customers can save water, use less energy, and make their workplaces safer by using 3D TRASAR Technology.

The Apex Warewashing System, used in industrial kitchens to improve cleaning and sanitation, is another example of Ecolab’s creativity. The method uses a mix of advanced detergents, rinse aids, and cleaning tools to get better results while using less water and energy. Apex has been shown to cut water use by up to 50% and energy use by up to 25% while also cleaning dishes and cooking equipment.

Corporate Social Responsibility

Several programs are in place to help ECL fulfill its goal of becoming a good corporate citizen. All workers and partners are expected to follow the company’s Code of Conduct, which lays out the company’s ethical and legal expectations. Ecolab’s expectations of its suppliers and partners are spelled out in the company’s Supplier Code of Conduct.

In addition to its codes of conduct, it also has a number of charitable initiatives aimed at bettering society and the environment. The Ecolab Foundation awards funding to non-profits advancing environmental protection, educational opportunities, and social justice. They also offer paid time off for employees to volunteer with community groups through Volunteer Match.

Miso Robotics-Ecolab Partnership

Miso Robotics, which uses robotics and intelligent automation to revolutionize the restaurant sector, recently announced a partnership with Ecolab and a multimillion-dollar investment from the company.

Miso Robotics has developed Flippy, the first fully autonomous robotic kitchen assistant for quick-service restaurants. In addition to boosting food safety and quality requirements, Flippy can perform all the activities at the fry station with speed and precision. Miso’s products are powered by cutting-edge computer vision technology specifically designed to streamline back-of-house operations in the restaurant business.

Ecolab’s investment will help Miso Robotics expand and innovate, and the two businesses will be able to work together to find new ways to use automation and digital technologies to improve food safety, hygiene, and efficiency in the food industry.

Dividend

Currently, Ecolab Inc. pays an annual dividend yield of around 1.22% and a dividend payout ratio of 45.71%. The company has a dividend growth history of 29 years with a 5-year CAGR of 5.92%. Besides its sustainable dividend, I think this makes the company a reliable and reputable dividend payer.

There are a number of reasons why I regarded its dividend as favorable and why it may be a good investment for investors seeking a steady income stream.

First off, it is a stable and dependable company with a solid financial position that generates consistent cash flows, enabling it to pay dividends. Companies that pay dividends are typically viewed as stable, dependable, low-risk investments, attracting long-term investors.

Second, Ecolab Inc. has consistently increased its dividend payment to shareholders. The company’s faith in its ability to increase profits in the future is reflected in a dividend increase. This can potentially boost the share price, which is good news for stockholders.

Finally, it’s a part of a highly guarded market. Hygiene and sanitation products remain in demand even during economic downturns, which might give some stability during market turbulence. ECL is a good investment due to its growing dividend and defensive sector. For these reasons, it’s an excellent choice for those prioritizing the safety of income and growth potential over the long term.

Valuation

ECL looks to be overvalued based on relative valuation criteria. The price-to-earnings ratio of 43.38X is considerably higher than the 13.55X median of similar businesses in the same market. I think the market is placing a high value on it because of its solid fundamentals and appealing financials. I believe the company’s profits, cash flow, and revenues are sufficient to warrant a premium trading price.

Considering the company’s good underlying fundamentals, I think its forward PE of 36.10X is a reasonable expression of optimism in the company’s capacity to deliver higher future earnings. This bodes well for future dividend increases due to the company’s expected greater earnings.

Why I Am Bullish

Although the stock seems to be selling at a premium, I think the company’s strong fundamentals, especially its constant innovations, social responsibility, and sustainability, will keep its shares rising, at least in the long run. Given that I think its forward PE is a measure of industry optimism about the company’s future earnings potential, I think it lends credence to my bullish view. In addition, the company’s track record of dividend payments encourages me to look forward to the future.

Risks

Even though this company is a good investment because it has strong fundamentals, there are risks to investing in ECL, just like there are risks with any other investment. Some of the risks of buying here are described below.

Stiff Competition: Ecolab faces stiff competition in a wide variety of markets worldwide. Providing high-quality and high-value-added products, technology, and service is essential to the company’s competitiveness. Nonetheless, there is no guarantee that the company will achieve its technology development goals or that competitors’ technical breakthroughs will not eventually render any of its goods, technologies, or services less competitive.

Data Security Threat: Ecolab’s ability to run as a company heavily depends on the state of its IT networks and systems. Due to its scale and complexity, the company’s IT infrastructure is at risk of breakdown, malicious intrusion, and random attacks.

Conclusion

Sustainability, innovation, and CSR are three of ECL’s top priorities. It aspires to make the world a better, safer, and more efficient place through its sustainability initiatives, innovative projects, and charitable initiatives. Ecolab is ideally situated to pioneer the delivery of value and impact for its customers and stakeholders as the sustainability agenda remains a top priority for businesses and consumers alike. I base my bullish thesis on its strong fundamentals, including its stable, rising, and sustainable dividend, and recommend buying it.

Read the full article here