Introduction

It is well-known that the Energy Industry has seen many fluctuations and instability. This is because many factors affect the supply and demand in this market like macroeconomic variables, geopolitical events, policies, and regulations on everything like emissions, zoning rights, and so on, which can affect companies in this market to a great extent. Thus, it is of great importance for value investors to have a good perspective of the financial stability of the companies in this market and hence, analyze their ability to absorb these risks. Energy Transfer (NYSE:ET) is one of the largest energy infrastructures in the United States that transfers energy fuels and liquids throughout the US and internationally. As I covered in my previous analysis of ET in detail, one of the main strengths that set ET apart from its peers is its diversified asset portfolio that has spread across different geographic regions, which has enabled the company to generate strong cash flow.

In this article, I investigate some main Energy market factors and the effect of recent geopolitical and technological events on the energy supply and demand while analyzing the company’s financial health compared to its peers, ultimately providing an estimation of ET’s unit fair price.

Market Outlook

The energy market has encountered many fluctuations and has been one of the most volatile industries. Various factors affect the supply and demand in this market including geopolitical events, policies, and regulations on emissions, zoning rights, and so on. Macroeconomic variables like interest rates and inflation, which push up materials costs, and new technologies are other significant variables that can play crucial roles in both demand and supply sides and investments within the Oil and Gas industry. However, will oil and gas be eliminated from the economies any time soon?!

This idea never made sense to me at least for the near future. For example, throughout the COP28 conference held in April 2024, participating countries agreed on reaching 11,000 GW of renewable capacity by 2030. In other words, it means an average of 800 GW of new capacity is required to be added each year from 2022 to 2030. What are the existing capacity levels? In 2022, the global wind capacity was 832 GW, while the global solar capacity was 892 GW. As a result, the annual addition capacity needed is almost as large as the entire wind and solar capacity around the world in 2022. Undoubtedly, the renewable energy share in the world’s energy is growing fast. However, reaching this target by 2030 may bring significant challenges.

Additionally, the role AI will be playing in energy consumption is significant. In minutiae, on average, a ChatGPT query requires 10-fold electricity compared to a Google search. With fast-developing AI in economies, the electricity consumed by data centers will rise to 3-4% of overall power by the end of this decade. Over the last decade, US power demand growth has been approximately zero, and the main reason for that might be related to the technology efficiencies that result in lower power use. However, it is predicted that the power demand rise by approximately 2.4% between 2022 to 2030, while data centers will use 8% of US power by 2030, in comparison with 3% in 2022.

The mentioned future high energy demand rise seems to receive support on the supply side. The United States is producing more than 13 million barrels per day of crude: its all-time highest production. Due to geopolitical tensions like Iran’s conflicts with Israel, which added uncertainty to the current heightened tensions in the Middle East, oil prices increased in April. However, the oil price volatility has been kept in check to a great extent because of higher crude oil production capacity likely from the US and other countries. In a nutshell, in case of more short-term supply disruption, global supply can be available to the oil market. All these developments and geopolitical events around the world indicate our dependency on oil and show that it will not end soon. As a result, the higher the demand for energy, the more opportunities for energy infrastructure companies like ET to cover the increase in the storage demand.

ET’s Financial Outlook

2024 has already been a bright year for ET in terms of many financial terms. For instance, the company generated $3.9 billion of adjusted EBITDA in the first quarter of this year compared to $3.4 billion at the same time last year. Moreover, the company increased its cash distribution by 3.3% to $1.27 on an annualized basis as a result of higher distributable cash flow (DCF) of $2.4 billion in 1Q 2024 versus $2 billion in 1Q 2023. During the last few months, the management redeemed a huge number of their outstanding units, which is a sign of lower future cash outflow for the company as they do not need to pay dividends to these number of units. Energy Transfer’s main focus in terms of capital spending has been on Midstream, NGL, and Refined Product Segments, which will lead to higher volumes. It is worth mentioning that the highest increase in the adjusted EBITDA refers to their crude oil segment, which was $848 million at the end of the recent quarter versus $526 million in the first quarter of 2023. As the management commented: “This was primarily due to significantly stronger pipeline volumes, increased terminal throughput, as well as favorable timing on gains associated with hedged inventory.” Energy Transfer increased its crude oil transportation volumes from 4.2 million barrels per day at the end of 1Q 2023 to 6.1 million barrels per day at the end of the recent quarter, which shows a 44% surge. The management has ongoing plans to expand potential capacities in different segments, like moving to the next phase of capacity expansion to transfer natural gas from Northern Louisiana to the Gulf Coast. Another worthy point is related to ET’s contract methodology. Approximately 90% of the company’s contracts are fee-based to protect the company from commodity price fluctuations. Thereby bringing confidence that regardless of the high-risk nature of this industry, Energy Transfer is providing stability and improving its operational efficiency by increasing its volumes.

In early May 2024, the company completed its acquisition of NuStar Energy LP. This acquisition will bring extra potential capacity increase because NuStar has about 9,500 miles of pipeline. It also has 63 terminal and storage facilities to store and distribute crude oil, refined products, renewable fuels, and ammonia. Considering the positive impact of this requisition on ET’s financials, the management revised their 2024 adjusted EBITDA guidance from $14.5 to $14.8 billion to $15 to $15.3 billion.

ET Valuation

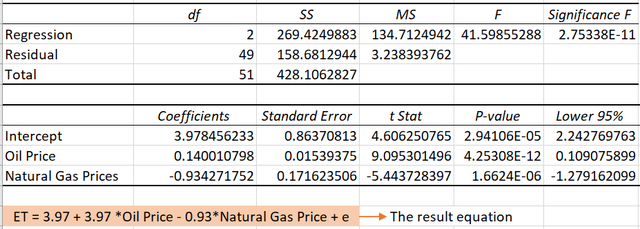

Making the most of data is my forte. Considering my modeling for the ET unit price, my analysis statistically highlights the importance of oil and gas prices in determining the stock price. These results indicate how fluctuations in these energy prices may affect the resulting price, thus highlighting the high-risk nature of this industry (See Table 1).

Table 1- Regression model to predict the effects of oil and gas prices on ET’s stock price

Author’s calculations

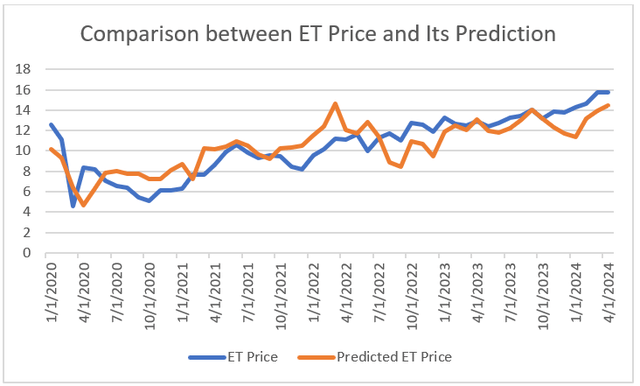

I have plotted my prediction for the period from 2020 to the first quarter of 2024. As Figure 1 shows, my predictions were close to the actual stock price to a great extent. As a result, based on the anticipations for higher oil prices in the near future and their strong effect on the company’s stock price, which was shown earlier, I believe ET still has a bright future.

Figure 1 –

Author’s calculations

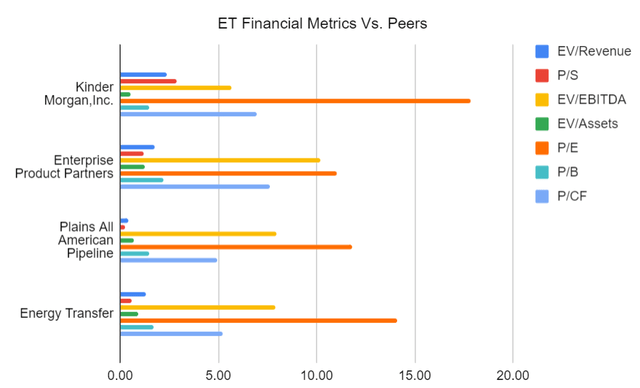

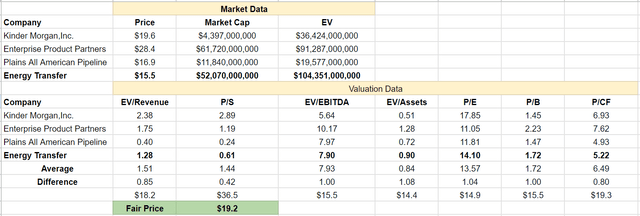

Besides the effects of the market variables on the company’s stock, its financial statements show a healthy and strong outlook for ET in comparison with its peers. In this regard, I used the Comparable Companies Analysis (CCA) method to analyze ET’s financial health versus its peers and evaluated its unit price. As it has been shown in Table 2, ET’s P/S ratio of 0.61x is one of the lowest among its peers, after Plains All American (PAA) with P/S of 0.24x. Overall, as a sign of potentially undervalued, ET’s P/S ratio is far lower than the group’s average. ET has an EV/EBITDA of almost the same as the peers’ average of 7.93x, while Enterprise Products Partners (EPD) has the highest ratio. Also, after PAA, Energy Transfer has the lowest P/CF, which, for value investors, indicates, compared to peers, it has a higher ability to generate cash flow relative to its market price, which reflects a sign of operational efficiency. Figure 2 indicates a comprehensive comparison of ET financial metrics vs. its peers.

Figure 2 –

Author’s Calculations based on Seeking Alpha data

When all is all, ET has shown relative undervaluation in comparison to its peers, and its financial metrics indicate the company’s financial and operational health. As Table 2 illustrates, the fair price for ET is approximately $19 per unit based on the CCA approach, which is quite close to the stock’s pre-pandemic hits, and I believe ET’s unit price has the potential to reach its pre-pandemic records.

Table 2 – ET unit valuation based on the CCA method

Author’s calculations based on Seeking Alpha data

Risks Related to Energy Transfer Investment

One of the main risks related to ET operations except for fluctuations in commodity prices is related to regulations through this industry. Energy Transfer is one of the largest energy infrastructure companies in the United States and is operating in a highly regulated industry. States and federal regulations in different aspects like environmental concerns may affect the company’s financials negatively. Although I am bullish on ET, we should consider several risks that the company is facing like a recent increase in investments in renewable energy technologies, which may bring technological challenges for the company and decrease the demand for fuels it transports and ultimately, negatively affect their cash flow generations. Moreover, economic conditions like recessions, inflations, and interest rates may directly affect lower household spending on gasoline, diesel, and travel. Last but not least, weather plays a crucial role in energy utilization rates, which can affect the demand for ET’s infrastructures on a seasonality basis.

Conclusion

In this article, I investigated how new technologies like AI may push up the power demand. On the supply side, although geopolitical events, especially in the Middle East, may disrupt the supply, higher supply from the United States and other countries can solve this shortage. In terms of Energy Transfer’s financial health, I am bullish on the company based on its metrics compared to its peers. When all is said and done, I evaluate ET’s fair price around $19 per unit.

I appreciate your time for reading this content, and as always, I welcome your thoughts and opinions.

Read the full article here