I recently shared with members of Outperforming the Market about my takeaways from Enovix (NASDAQ:ENVX) CEO Raj Talluri at JPM’s annual Technology, Media, and Communications Conference, which many members found to be useful.

Since the news flow on Enovix has been rather slow, I will share more reasons on why I think that the company is well positioned for the future given its strong value proposition and sustainable competitive advantage. In addition, the company’s near-term catalysts will be the final agreement with YBS and then in August when the Gen2 equipment will undergo Factory Acceptance Testing. Lastly, I think that the EV opportunity cannot be understated, which I will elaborate more on below.

Strong value proposition

This is arguably one of the simplest and most important parts of the Enovix investment case.

The company’s technology brings about a very strong value proposition that would unlock other areas of advancements.

With the increased energy density as one of its key value proposition, as highlighted in the earlier deep dive, this will be a key strategy for Enovix to charge a premium in the market where there are no close competitors.

Customers will be willing to pay a premium not only because there are no other alternatives but also because this improvement in energy density brings an improvement in battery life that will enable them to bring forth the advancements in technology in other areas like cameras, displays and processors to enhance the overall user experience and potentially bring in new use cases and applications.

In some cases, Raj highlighted that Enovix is even able to charge almost two times per Wh as Enovix has a strong case to charge customers higher selling prices.

In addition, because Enovix is materials agnostic, it does not need to change or upgrade its equipment as it can benefit from the improvements in cathodes, anodes and separators as time goes by. What this means is that the equipment that Enovix uses can then be amortized over a much longer period of time and thus, brings along upside to margins as well.

As a result, I am more confident about Enovix’s value proposition, and its ability to charge a premium after the conference as a result of their unique, high energy density battery. On top of that, it is able to drive margin upside from long-term use of its equipment as a result of its materials agnostic characteristic.

Sustained competitive advantage

Enovix is clear that it not only has a competitive advantage over competitors but also one that can be sustained over the long run.

While there may be some graphite producers looking to add about 5% to 8% silicon content into their batteries to increase their batteries, Enovix continues to cement its competitive advantage today.

First, Enovix is able to differentiate itself with its 100% active silicon content and continues to use its know-how and this 100% active silicon content to be ahead of competitors.

Second, Enovix is working with customers and looking to incorporate their understanding of customer needs to ensure that Enovix’s batteries meet their high requirements and standards. With the high-volume sampling that is being done in 2023, Enovix can thus gain competitive advantage over peers by being the first to meet a customer’s requirements and thus lock in a long-term agreement with a customer before competitors do so. What Enovix is able to do is to understand what a customer prioritizes, be it voltage or cycle life, and meet these requirements after customers have sampled Enovix’s batteries in larger quantities.

As a result, I think that Enovix continues to have a competitive advantage over competitors which it can sustain as high-volume sampling continues and as Enovix leverages on its know-how about its 100% active silicon batteries.

Operational progress on track

Management remains on track to producing 180k units from Fab-1 in 2023. They are not ramping up production levels in Fab-1 in the United States and instead, are controlling production levels because of the relatively higher costs of production to produce batteries in the United States compared to in its Malaysia factory.

While demand for its batteries is strong, Enovix is focused on optimizing margins in the near-term. What this means is that it will be using its near-term capacity for smaller sized batteries. This is because smaller sized batteries deliver higher margins to Enovix as a result of the inherent challenges involved to increase energy density in a small form factor.

Thus, it seems Enovix is focused on optimizing its product mix in the near-term. For subsequent lines, Enovix intends to have less flexibility on these lines to optimize it for each product segment, improve throughput and lower costs to produce batteries.

In terms of its choice of YBS as its contract manufacturer in Malaysia, management highlighted that YBS has the necessary know-how and an available facility for the needs of Enovix.

The final agreement with YBS will be finalized in the next month or two, and YBS intends to invest in one of the four lines expected.

Gen2 equipment in Fab-2 will be key

Firstly, the agility line in Fab-1 will give investors an early look into the Gen2 equipment and provide Enovix with the ability to do customer battery cell qualification. What this means is that Enovix will be able to provide customized battery solutions for different needs of each individual customer.

Also, the next milestone for Gen2 equipment will be in August. The company has already chosen the vendors that are able to make complex semiconductor back-end equipment.

Based on commentaries from management, Gen2 equipment stacking is “much faster” and the lasers are also “much more powerful” than Gen1.

In August, the equipment will undergo Factory Acceptance Testing at the site of the vendor and this will be followed by Site Acceptance Testing in its own facilities.

The key for Enovix is to ensure that yields and uptime are kept up to their own standards.

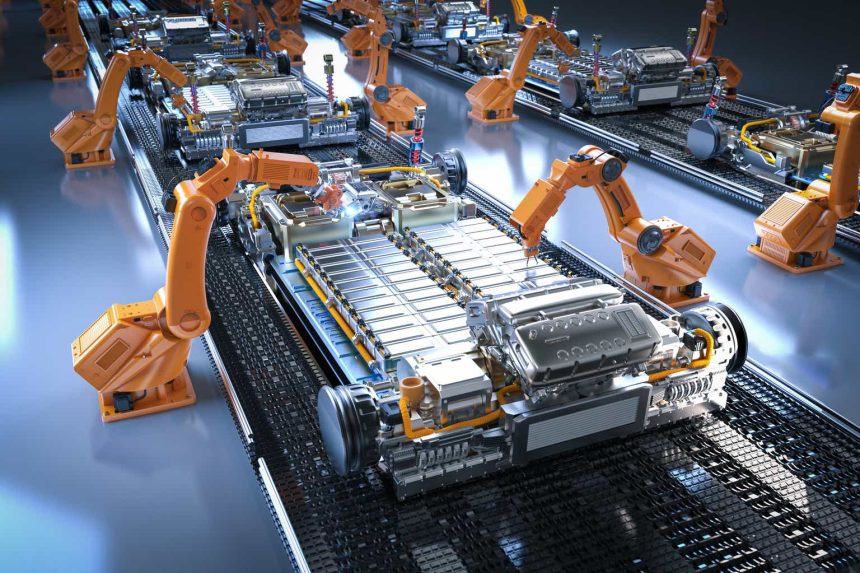

EV strategy

Enovix continues to work on its EV strategy to deploy Enovix’s proprietary architecture into EVs. As mentioned in the earlier deep dive into Enovix, the benefits of incorporating Enovix’s proprietary architecture into EVs is due to Enovix’s advantage in heat dissipation and energy density.

EV OEMs have two main problems they face, which include energy density and heat generation. As a result of its inherent advantage of dissipating heat, Enovix batteries allow much faster charging.

There are also some nuances and differences between the use of Enovix architecture for EVs compared to consumer electronics as it requires different materials to be used.

The Enovix mobility team is currently in the process of pulling together a proof of concept. Management believes that they will employ a joint development strategy with an OEM. In fact, Raj commented that this joint development agreement could potentially be announced by the end of 2023 or 2024.

This will certainly be a huge catalyst to Enovix as it proves that there is interest by EV OEMs for Enovix’s proprietary architecture and this then opens a huge total addressable market for Enovix as other EV OEMs take notice of Enovix.

To be clear, I think that many automotive OEMs are increasingly interested in looking at silicon anode batteries to improve energy density. For example, automotive players like Mercedes (OTCPK:MBGAF), Porsche (OTCPK:POAHY) and General Motors (GM) are looking to use silicon anode batteries in some of their models.

Conclusion

I think that with Enovix, we are looking at a silicon anode battery player with a sustained competitive advantage over competitors, strong value proposition that attracts large customers and command higher margins. At the same time, demonstration of its mass production capabilities will be key and that’s where Raj and team is focusing on the bulk of their time, to ensure that high volume production is successful when it begins. Lastly, the opportunity in automotive for silicon anode battery players like Enovix cannot be understated and this is certainly a potential catalyst for 2023 or 2024.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here