For a long time, Enphase Energy (NASDAQ:ENPH) seemed like it would be able to avoid the valuation reset seen across the entire growth stock universe. Perhaps some investors had prematurely begun finding concrete reasons behind the relative strength, be it the long term solar opportunity or the solid GAAP profitability. Yet after the latest earnings report, ENPH has shown an important reality: every stock, at some point, must come face to face with valuation. While ENPH continued to show typically strong results, commentary on the conference call indicated that the company may not be as immune to the rising interest rate environment as the stock price may have otherwise implied. With the valuation reset, this is as good a moment as any to revisit the name.

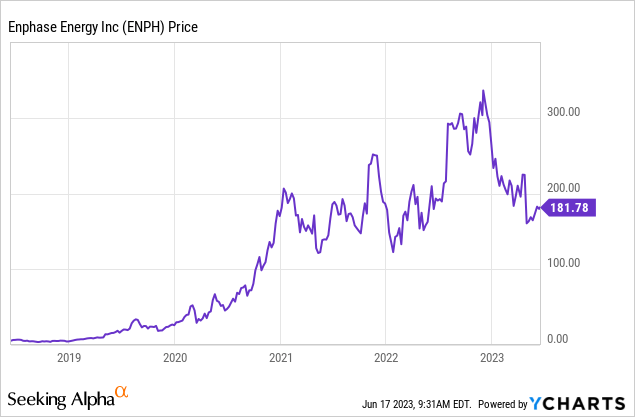

ENPH Stock Price

After a dramatic tumble from all time highs, ENPH stock now trades at the same levels it did in early 2021.

I last covered ENPH in September where I highlighted the valuation risks and called it potentially “the next bubble to pop.” The stock has since fallen 36%, representing a tangible valuation reset in what is otherwise a high quality stock.

ENPH Stock Key Metrics

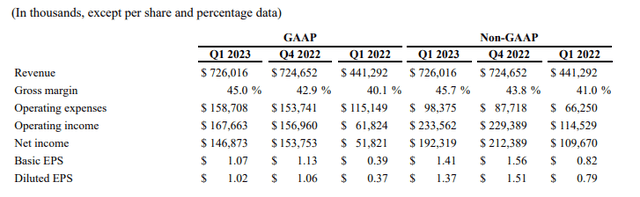

In its most recent quarter, ENPH delivered strong top and bottom-line growth, perhaps making some investors puzzled as to why the stock crashed so hard.

2023 Q1 Press Release

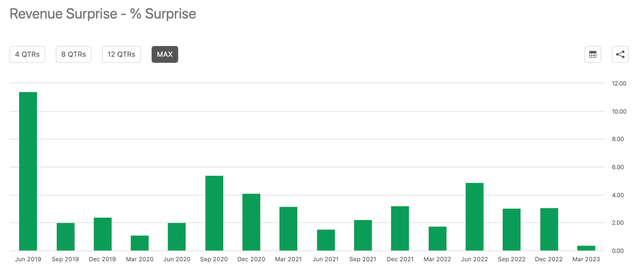

It all comes down to valuation. With high valuations (and ENPH stock traded at arguably nosebleed valuations prior to the crash) comes high expectations. ENPH’s revenue beat was miniscule compared to what investors have come to expect as in the past.

Seeking Alpha

Moreover, management guided for the next quarter’s revenues to grow by only 32% to 41.5%. While management stated on the conference call that this guidance should be considered conservative, the steep deceleration from the 64% growth posted this past quarter was not taken well by Wall Street, especially considering that consensus estimates called for 43.3% growth. Management also guided for tax rates to be at a more typical 22% after previously being around 10% to 11% in the last several years.

Management noted that the US saw some weakness with revenue declining 9% sequentially “due to seasonality and macroeconomic conditions” but was offset by strength in Europe, where revenue grew 25% sequentially.

ENPH ended the quarter with $1.78 billion in cash and investments versus $1.3 billion in debt, representing a strong balance sheet considering that ENPH generates solid GAAP profits.

In my view, the real reason why ENPH stock collapsed has to do with specific commentary on the conference call regarding challenges faced in the marketplace. Management noted that the rising interest rate environment has changed the typical transaction “from selling low APR with high dealer fees, to selling market rate loans with low dealer fees.” Wall Street may have interpreted this to imply that ENPH has been a prime beneficiary of the zero interest-rate policy (‘ZIRP’) with risks that the company’s strong fundamentals might not persist in this new interest rate environment. Management even stated that “the demand will unleash only when the interest rates are back to normal.”

On the other hand, management expressed confidence that installers will be able to adjust to the new environment, commenting that the second quarter should see some sequential strength. ENPH is not a cheap product, a point which may lead some readers to conclude that it may face deteriorating demand under tough economic conditions. However, management notes that the higher price of the inverter is more than offset by the cost savings of a higher quality inverter. But perhaps investors may be spooked: might ENPH be facing not just headwinds from decreasing solar demand (from higher interest rates) but also headwinds within solar due to price sensitivity? Such fears are beginning to take hold on the stock price.

Is ENPH Stock A Buy, Sell, or Hold?

I did not like ENPH stock when it was much higher, but after this valuation reset we mustn’t forget the compelling long term thesis. ENPH plays a critical role in a solar-powered future – it can be considered a “next-generation” power enabler, with its positioning in solar being similar as Apple (AAPL) in smartphones or Netflix (NFLX) in video content.

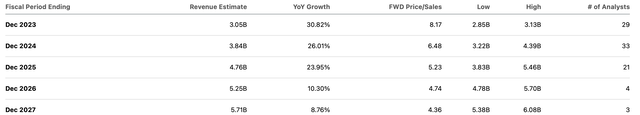

The solar industry itself looks quite promising – if anything, the ongoing shift to electric vehicles is likely to accelerate demand for electric rooftops. Shares were trading hands at around 33x forward earnings.

Seeking Alpha

That valuation looks more reasonable considering that ENPH is expected to grow revenues at around 26% moving forward. I note that consensus estimates may end up proving too optimistic if it turns out that fears related to higher interest rates end up proving prescient. That said, this is a name which I can see growing for a very long time due to the long growth runway of the broader solar energy sector.

Seeking Alpha

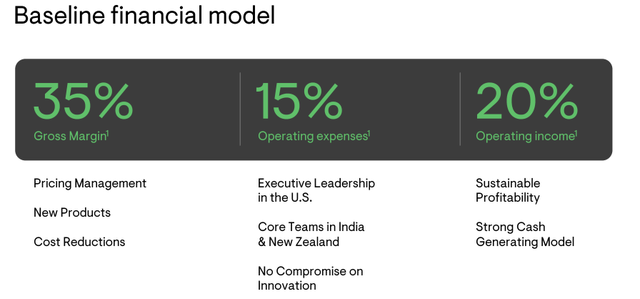

Management has guided for operating margins to come down to around 20% long term. While I suspect that this is meant to provide a conservative framework, ENPH is already generating margins in excess of this and this could be acknowledgement by the part of management that their excess margins cannot last forever.

2023 Q1 Presentation

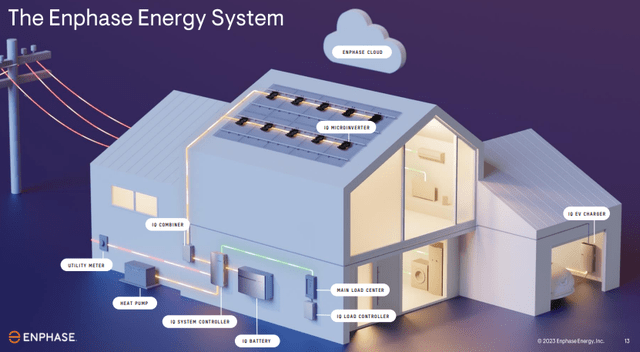

Investors may be wondering if they have “missed the train” on ENPH stock, given that it is still up around 100x over the last 5-6 years. The stock is still not cheaply valued, but the incredible returns may be a reflection of strong execution as well as a previously unloved stock. ENPH has done an incredible job in expanding its products to cover more and more of every house.

2023 Q1 Presentation

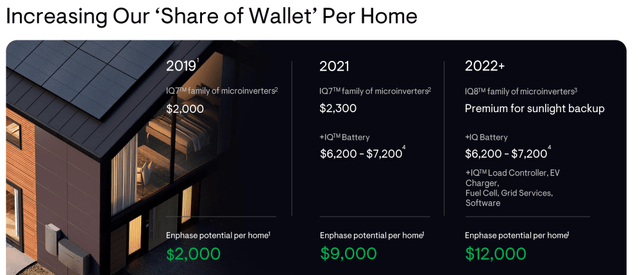

ENPH has steadily increased its “share of wallet” per home by 6x since 2019.

2023 Q1 Presentation

Between price compression and great potential for decelerating growth rates, the current 33x earnings multiple does not look so compelling. I must also note that the price does not look stretched either. The large volatility experienced in the stock price in the past several months has created potentially lucrative opportunities in the options market – those interested in getting exposure to upside of the stock but at lower stock prices might find some long-dated put options compelling to sell, a strategy shared by yours truly. For example, the put options expiring in June 2024 with a strike price of $125 sell for around $12.50, giving investors the ability to earn around a 10% premium in exchange for the promise to purchase the stock at $125 per share if it ever falls that low. That would be an implied valuation of around 22x forward earnings, which would be a compelling valuation to directly buy the stock.

What are key risks? ENPH has been a big winner over the past several years but it is unclear how the business – or stock – might perform in this higher interest rate environment. Moreover, it is possible that competition emerges, such as from SolarEdge (SEDG), which accelerates the expected price compression. If margin compression were to occur, perhaps due to competition or worsening demand, then the stock might lose its valuation premium relative to growth peers (on the basis of P/S). While ENPH stock is down considerably from all time highs, it is not yet dirt cheap and I hesitate to assign a buy rating due to the high degree of uncertainty amidst this tough macro environment. Those looking to take advantage of the sell-off in the stock but also wanting to avoid the rich valuation might wish to employ the options strategy discussed in this article. I am upgrading my valuation from “avoid” to “hold” as the valuation is no longer immediately egregious.

Read the full article here