Introduction

Esperion Therapeutics (NASDAQ:ESPR), a specialized pharmaceutical company, dedicates its efforts towards the development of non-statin, oral, daily medications for the management of high LDL-C cholesterol. This focus has propelled the company to notable advancements within the cardiometabolic biotech sector. In 2020, Esperion achieved international recognition with the approval of its two premier products, bempedoic acid (Nexletol) and its ezetimibe combination tablet (Nexlizet), offering a new therapeutic option for patients with atherosclerotic cardiovascular disease and heterozygous familial hypercholesterolemia.

Recent events: Esperion recently presented the results of their phase 3 trial at two major cardiology conferences, showing that their drugs Nexletol and Nexlizet significantly reduced the risk of major adverse cardiovascular events and heart attacks compared to a placebo. Based on this data, Esperion plans to file for expanded CV risk reduction labels by June 2023 and expects to receive them in the first half of 2024.

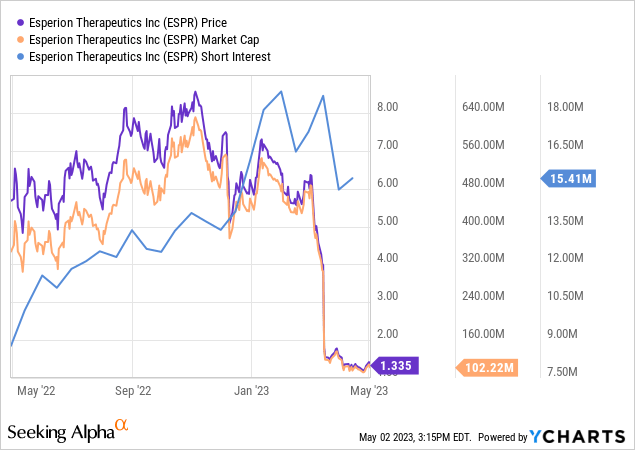

However, the company has been embroiled in a dispute with Daiichi Sankyo Europe over milestone payments, which has led to a recent drop in their stock value. Despite this, Esperion went ahead with a registered direct offering, selling 33.1 million shares and short-term warrants, which closed in March, raising $56.7 million for general corporate purposes.

Esperion took legal action against Daiichi Sankyo soon after, claiming that they owe them $300 million in milestone payments. The dispute revolves around the language used in the agreement. Daiichi Sankyo argues that bempedoic acid did not satisfy the condition of reducing “cardiovascular risk” by a minimum of 15%, as the drug only brought down MACE-4 (a combination of four cardiovascular events) by 13%. On the other hand, Esperion highlights the 27% decline in heart attacks – one of the endpoints – and the vagueness of the term “cardiovascular risk reduction”.

Financials

Let’s first review the financials. Esperion released its Q4 and full year financial results for 2022, reporting a 22% increase in total revenue for Q4 2022 and a 4% decrease for the full year compared to the previous year. The increase in revenue was due to increases in net US product revenue and royalty revenue, while the decrease in revenue for the full year was due to a one-time milestone payment in Q2 2021. US product revenue and royalty revenue saw significant increases for both Q4 and the full year. Research and development expenses increased due to costs associated with accelerating CVOT expenses. Selling, general, and administrative expenses decreased due to savings from a transformative plan implemented in Q4 2021. Esperion had net losses of $55.5 million for Q4 2022 and $233.7 million for the full year. As of December 31, 2022, cash, cash equivalents, restricted cash, and investment securities available-for-sale totaled $166.9 million.

Although Esperion did not give any indication of their cash runway, based on their expenses in 2022, it seems that they have a maximum of five quarters of cash runway.

With the company’s next earnings report set for May 9th, investors will be closely monitoring Esperion’s management of expenses and the performance of bempedoic acid revenue.

Bempedoic Acid Shows Significant Cardiovascular Benefits in Statin-Intolerant Patients

In a double-blind, randomized, placebo-controlled trial with 13,970 patients who couldn’t take statins due to adverse effects, bempedoic acid showed significant cardiovascular benefits. After a median follow-up of 40.6 months, bempedoic acid reduced the incidence of a primary endpoint event (11.7% vs. 13.3%, hazard ratio 0.87, 95% CI 0.79 to 0.96, P=0.004), a composite of death from cardiovascular causes, nonfatal stroke, or nonfatal myocardial infarction (8.2% vs. 9.5%, hazard ratio 0.85, 95% CI 0.76 to 0.96, P=0.006), fatal or nonfatal myocardial infarction (3.7% vs. 4.8%, hazard ratio 0.77, 95% CI 0.66 to 0.91, P=0.002), and coronary revascularization (6.2% vs. 7.6%, hazard ratio 0.81, 95% CI 0.72 to 0.92, P=0.001). However, bempedoic acid had no significant effects on fatal or nonfatal stroke, death from cardiovascular causes, and death from any cause. Higher incidences of gout and cholelithiasis were noted with bempedoic acid.

These findings imply that bempedoic acid may be a beneficial treatment alternative for individuals who are unable to tolerate statins, despite the need for close monitoring of side effects and the fact that it does not impact certain outcomes. Current UpToDate guidelines recommend the use of bempedoic acid in statin-intolerant patients requiring modest lipid reduction while monitoring for any side effects.

“Statin-intolerant” refers to patients who can’t tolerate statins, drugs often used to lower cholesterol. These patients, estimated to be 10-15% of all those prescribed statins, experience side effects such as muscle pain, increased blood sugar levels, and occasionally, memory issues or liver damage. This intolerance creates a significant medical need for alternative cholesterol-lowering treatments, leading to a growing market. Current alternatives include cholesterol absorption inhibitors, bile acid sequestrants, fibrates, nicotinic acid, omega-3 fatty acid supplements, PCSK9 inhibitors, and new non-statin oral medications like bempedoic acid.

Understanding the Multifaceted Evaluation Process for Cardiovascular Risk Reduction Indications

While there are positive signals from this study that bempedoic acid could reduce CV risk, it’s uncertain whether the data will be sufficient to persuade regulatory bodies to add a CV risk reduction indication to the label. They will carefully weigh the significant reduction in certain CV events against the lack of impact on others (like stroke and death from any cause) and the potential safety concerns. The large sample size and the rigorous design of the study (double-blind, randomized, placebo-controlled) are strengths, but the final decision will be multifaceted and also consider other evidence not provided here.

When comparing bempedoic acid to other drugs that have a CV risk reduction label, such as statins and PCSK9 inhibitors, the cardiovascular benefits of bempedoic acid seem modest but potentially meaningful.

-

Statins: Statins, including drugs like atorvastatin and rosuvastatin, have been widely used for CV risk reduction. The JUPITER trial for rosuvastatin, for example, showed a relative risk reduction of about 44% for the composite endpoint of myocardial infarction, stroke, arterial revascularization, hospitalization for unstable angina, or death from cardiovascular causes. This is more substantial than what is seen for bempedoic acid. However, statins can have side effects such as muscle pain, which is why the study population for bempedoic acid specifically included patients who couldn’t take statins due to adverse effects.

-

PCSK9 inhibitors: Drugs like evolocumab and alirocumab have also been approved for CV risk reduction. The FOURIER trial for evolocumab demonstrated a 15% relative risk reduction in the composite endpoint of cardiovascular death, myocardial infarction, stroke, hospitalization for unstable angina, or coronary revascularization. The ODYSSEY Outcomes trial for alirocumab demonstrated a 15% relative risk reduction in the composite primary endpoint of death from coronary heart disease, nonfatal myocardial infarction, fatal or nonfatal ischemic stroke, or unstable angina requiring hospitalization. These reductions are similar to the ones seen for bempedoic acid. PCSK9 inhibitors are generally well-tolerated but can cause side effects such as injection site reactions, since they are injectable medications.

Simply put, the decision to expand the indication for bempedoic acid will ultimately depend on regulatory authorities’ evaluation of the drug’s benefits and risks. While the phase 3 trial data is compelling, it remains to be seen how it will fit into the broader context of current cardiovascular therapeutics.

My Analysis & Recommendation

At this point, investing in Esperion is indeed a risky speculation, largely based on the potentially overly pessimistic sentiment that seems to be dominating the market. The company’s growth strategy depends on several major elements that are currently unstable.

First, Esperion must successfully address a contentious issue with Daiichi Sankyo that has unfortunately negatively impacted its stock price. Based on the limited facts available, I personally believe that Esperion may struggle to outright win the lawsuit, as MACE-4 is more indicative of “cardiovascular risk reduction” than heart attacks alone. The lawsuit is likely to be complex, especially given the differing label requirements in the EU and US. Yet, it seems the market has entirely dismissed Esperion’s chances. Second, Esperion is responsible for continuously improving and validating the efficacy of its drugs through stringent clinical trials. Finally, the company needs to establish strategic partnerships and alliances to enhance its market penetration and financial strength.

Investors are recommended to closely monitor the ongoing dispute between Esperion and Daiichi Sankyo, as a resolution in Esperion’s favor could provide a significant boost to its financial status and accelerate its drug development efforts. In the highly competitive pharmaceutical industry, Esperion’s main challenge is to secure a unique market position. To compete effectively, it needs to improve its marketing efforts and highlight the unique advantages of its products, especially for the statin-intolerant market it aims to serve.

Although bempedoic acid fell short of many high expectations, it seems to be vastly undervalued, as the market currently deems it virtually worthless. While I remain wary of Esperion’s future prospects in light of recent developments, I believe its current market valuation is conspicuously low, indicating a hasty dismissal by investors. I do anticipate that Esperion will obtain an additional indication for cardiovascular risk reduction, which would significantly expand the market potential for bempedoic acid and potentially enable them to access some of the milestone payments. Therefore, Esperion presents a potentially lucrative, albeit speculative, buying opportunity. However, investors should exercise caution and avoid dedicating a substantial portion of their portfolio to Esperion.

Risks to Thesis

When the facts change, I change my mind.

There are several risks that could impact my “Buy” recommendation.

-

Regulatory Risks: While Esperion’s drugs have shown promise in clinical trials, there is always uncertainty around whether regulatory bodies will approve the drugs for expanded indications. The drugs’ side effects and lack of significant impact on certain cardiovascular outcomes could potentially limit their approval.

-

Legal Dispute with Daiichi Sankyo: The ongoing legal dispute with Daiichi Sankyo presents a risk. A negative resolution could significantly impact Esperion’s financial health and potentially limit its ability to continue developing its drugs.

-

Commercial Success: Even if Esperion’s drugs are approved for additional indications, there is no guarantee of commercial success. The company will need to effectively market the drugs and convince doctors to prescribe them. Additionally, it needs to compete with other treatments for high cholesterol, some of which may be more effective or better tolerated.

-

Financial Stability: The company reported net losses for Q4 2022 and the full year. If these losses continue, it could impact the company’s ability to invest in research and development and bring its drugs to market. Although they raised funds through share selling and warrants, their ongoing expenses could outpace their revenue, leading to financial instability.

-

Pricing and Reimbursement: Pricing pressures from insurance companies and government healthcare programs could affect the profitability of Esperion’s products. If the company is unable to secure adequate reimbursement rates, it could negatively impact sales and revenues.

-

Adverse Clinical Trial Results: The company’s future success relies heavily on the results of ongoing and future clinical trials. Any adverse or unexpected results from these trials could lead to delays, increased costs, or even the discontinuation of development for a drug candidate, significantly impacting the company’s prospects.

-

Reliance on the Statin-Intolerant Market: Esperion’s primary target market is statin-intolerant patients. If the size of this market decreases, or if new treatments for statin intolerance are developed, it could significantly impact Esperion’s sales. Furthermore, there is much debate surrounding the relevance of “statin-intolerance”. Many believe it is overestimated.

-

Dependence on Single Class of Drugs: Esperion’s pipeline is focused on non-statin, oral, daily medications for managing high LDL-C cholesterol. If a significant problem is discovered with this class of drugs or if more effective treatments are developed, it could severely impact the company’s prospects.

Read the full article here