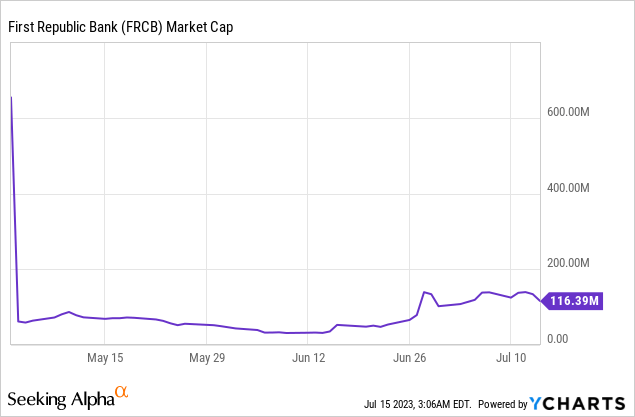

Is it completely irrational that First Republic Bank (OTCPK:FRCB) common stock equity is worth $117 million? The bank itself was seized by the FDIC, which then sold it to JPMorgan Chase (JPM) in early May. There are a number of complex issues involved, and this article will try to explain why the equity is not trading at $0.00. Since the FDIC receivership could last for many years, FRCB might continue to trade for years, which means those expecting the stock to go to $0.00 in the near future might be disappointed.

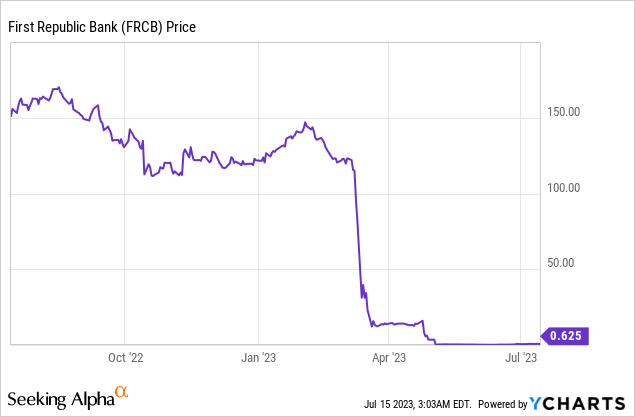

The stock now trades OTC with the ticker FRCB instead of FRC. The price has plunged from over $150 last year to $0.62 currently. The price increased somewhat since early May.

Common Equity Capitalization Since FDIC Seizure

First Republic Bank Is Not In Ch.11 Bankruptcy

First Republic Bank is not in Ch.11 bankruptcy because it is a bank and banks can’t file for Ch.11 bankruptcy. This is completely different than Silicon Valley Bank, whose parent company SVB Financial Group (OTCPK:SIVBQ) is in Ch.11 bankruptcy. Silicon Valley Bank is not itself included in the bankruptcy filing. (Note: there is a critical status conference regarding SVB’s litigation against the FDIC regarding their $2 billion cash deposit that was at Silicon Valley Bank set for August 15, and I plan to cover this in an article.)

The fact that FRCB is not governed by the Ch.11 bankruptcy process might actually be beneficial for FRCB shareholders. I am going to use Sears Holdings’ bankruptcy as an example. As a regular corporation, Sears Holdings Corp. was able to file for Ch.11 bankruptcy. Part of their bankruptcy process involved litigation against CEO Eddie Lampert and others. After years of litigation, Lampert and others agreed to pay about $175 million. That cash did NOT go to Sears shareholders. It went into the bankruptcy estate to be distributed under a confirmed bankruptcy plan. Since shareholders were the lowest class for any recovery under the plan, they got nothing, and SHLDQ shares were eventually cancelled. Shareholders were not even listed as beneficiaries of the liquidating trust. Some of the assets of the estate were used over the years to pay the large legal fees involved in this litigation.

There already are FRBC investor class action lawsuits filed against various individuals and entities. Assuming just for the sake of discussion that they are successful and win judgements, that cash, after fees, would go directly to investors and not into a bankruptcy estate that would be governed by the confirmed plan for distributions.

A number of lawsuits have been filed seeking class action status, such as Kusen v. Herbert, II, et al., No. 23-cv-02940 (N.D. Cal.). There currently is a hearing set for October 12 in Northern District Court of California to consolidate all the cases into just one class action. Kusen case would include those who bought First Republic securities from January 14, 2021 to April 27, 2023. Based on current filings, investors who bought after April 27 would not be included. At this point, it is not clear if the consolidated class action would include holders of the notes and preferred stock. Even if all the investor types are included, the final judgement/settlements usually do not follow the typical priority payment procedure that bankruptcy plans follow.

FDIC Receivership

Instead of some bankruptcy court having jurisdiction over First Republic Bank, the FDIC is the receiver and controls the process. The First Republic Bank fund is #10543, and eventually, quarterly reporters will be posted on this FDIC website. First Republic Bank was closed, and the FDIC was appointed the receiver. After a bidding process, the FDIC and JPMorgan Chase agreed on May 1 to a purchase and assumption of most of First Republic Bank’s assets and deposits. (This is a copy of the 102-page agreement that includes some redactions.). There are a few items in this agreement that I think are interesting.

First, JPM purchased securities at their fair/market value on the purchase date – not their book value. It seems that subsequent to the purchase, JPM sold many of these securities at a loss of $900 million, according to their July 14 2Q release. The loss was based on the purchase price, which was the market value in early May, and since interest rates trended upward during the last part of 2Q, JPM lost a significant amount of money because most of these were very long-term securities.

Second, there is a shared loss between the FDIC and JPM on various types of loans. JPM is protected for 80% against losses on residential mortgages for up to 7 years and 80% against losses on commercial loans for up to 5 years. Since FRCB had very high-quality loans, it seems unlikely they will need much protection against defaults. For example, the medium FICO score for their residential mortgage borrowers was 780. The interesting part is actually the 7 years. This seems to indicate that the receivership will be kept open for at least 7 years, which could mean that FRCB shares may trade for at least 7 more years.

The FDIC estimated a $13 billion loss to the FDIC insurance fund. Before FRCB investors get anything from the receivership fund, this $13 billion estimate will have to be paid first. I have serious questions, however, about this $13 billion figure. Since JPM is paying FDIC $10.6 billion, the FDIC estimate implies some $23.6 billion in liabilities. There are some loss protections, such as those mentioned above for loans, but I just can’t determine after reading the agreement how they got that estimate. I wonder if it is a very conservative number that assumes the worst.

The payment order is governed by section 1821(d)(11)(a):

amounts realized from the liquidation or other resolution of any insured depository institution by any receiver appointed for such institution shall be distributed to pay claims (other than secured claims to the extent of any such security) in the following order of priority: (i) Administrative expenses of the receiver. (ii) Any deposit liability of the institution. (iii) Any other general or senior liability of the institution (which is not a liability described in clause (iv) or (v)). (iv) Any obligation subordinated to depositors or general creditors (which is not an obligation described in clause (v)). (v) Any obligation to shareholders or members arising as a result of their status as shareholders…

FRCB shareholders are last for recovery. Approximately $1.28 billion in notes, an unknown amount of creditors who filed claims, and $3.6 billion in preferred stock, in theory, would have to be paid in full before FRCB shareholders receive anything. The bar date to file a claim is September 5, 2023. The FDIC is required to notify the claim filer within 90 days if the claim is rejected/accepted, which does not mean they will actually be paid after that time period. It could take years.

Why Did First Republic Bank Fail?

First Republic Bank got into serious financial trouble because interest rates soared from early 2022 to mid-2023. Their problem was they held almost exclusively long-dated assets, including mortgages and securities with maturities over 10 years that are more sensitive to changes in interest rates. As I posted in a March 12 article on bank unrealized securities losses, FRCB had a $5.242 billion total unrealized loss in their securities accounts, which was approximately $28.15 per FRBC share. I included this “yellow flag” statement in the article:

(Special note: $27,403 million of the HTM securities mature after 10 years. Longer the maturity, the more sensitive is the bond price to changes in interest rates. In addition, $16,808 million of that number are tax-exempt municipal bonds that mature after 10 years. Munis are also often much less liquid than UST securities.)

In addition to their unrealized losses in both their available-for-sale – AFS and hold-to-maturity – HTM portfolios, their loans, which are approximately 73% single-family and multi-family residential mortgages, had “fair values” significantly below carrying values on their books. The fair value for their real estate mortgages was $117,520 million for year-end 2022 compared to a carrying value of $136,793 million. That is a difference of $19,273 million, or about $103.50 per share. The difference for their other loans is approximately $2,886 million, or $15.50 per share. This implies a total of $119 per share, and if you add that to the securities’ unrealized loss per share of $28.15, you get a staggering $147.15 “paper loss” per share. Some depositors may have been shaken by these numbers and withdrew their deposits, which resulted in the bank being seized by the government.

The increases in interest rates were not hedged. First Republic Bank stated in their 10-K, “nor do we originate or trade in derivatives for our own account” and further stated we do “not have any derivatives designated as hedging instruments”.

Conclusion

First Republic Bank provides a learning lesson. They had top-quality assets unlike some other failed banks in the past that had junk assets, but they were completely destroyed by dramatically increasing interest. As the interest rates rose, the market value of almost all their assets dropped sharply. Plus, their assets were not diversified enough.

Buying FRCB stock at current price levels is extremely risky. The problem is that there is not much specific information on liabilities that could still be incurred by the FDIC that would then impact payments, if any, to investors. The $13 billion estimate seems questionable. FRCB shareholders also have to remember that there still could be billions of dollars that have to be paid by the FDIC 10543 fund to cover various liabilities associated with the agreement with JPM, such as covering losses associated with loans, before shareholders get anything. Trading in FRCB could go on for a very long time and after the first quarterly report is filed by the FDIC investors might get better information on the current status. For these reasons, I consider FRCB stock a neutral/hold.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here