Introduction

First Trust Global Wind Energy ETF (NYSEARCA:FAN) is an exchange-traded fund that invests in accordance with the fund’s benchmark index, the ISE Clean Edge Global Wind Energy Index, which is in turn designed to track public companies that are active in the wind energy industry. That makes FAN an interesting renewable energy investment opportunity.

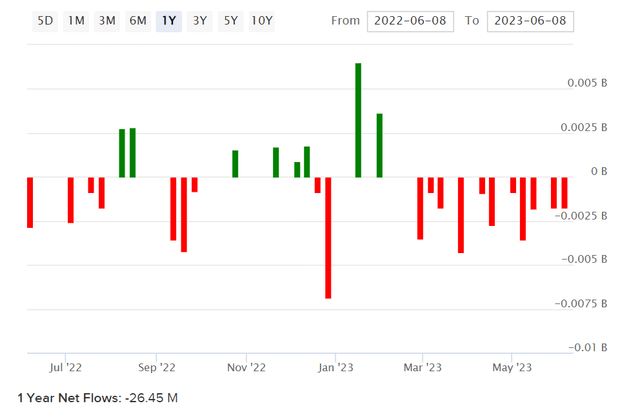

The net expense ratio of FAN is reported as being 0.60%, while the 30-day median bid/ask spread is currently 0.17%. Net assets under management were $268.6 million as of recent, which is fairly small in the investment world and follows net outflows of about -$26 million over the past year (see chart below).

ETFDB.com

Holdings and Exposures

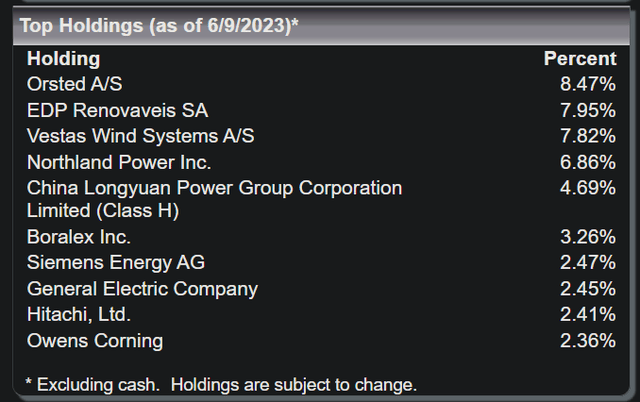

FAN is invested in wind energy companies. There were 55 holdings as of 9 June 2023, with the largest listed in the table below.

FTPortfolios.com

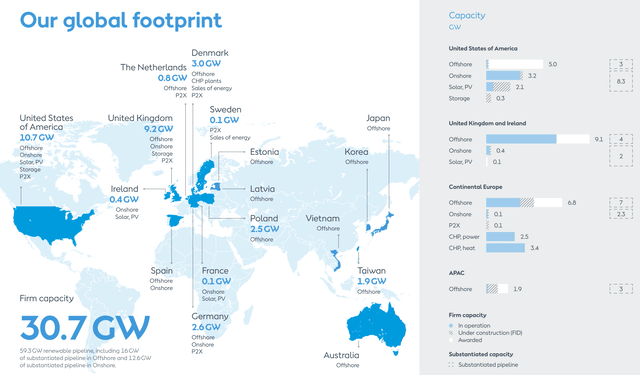

The largest holding, Ørsted A/S (OTCPK:DOGEF) is a Danish multinational energy company that has built more offshore wind farms than any other developer in the world; approximately 30% of the global offshore wind power installed capacity, excluding mainland China. The company produced 90% of its energy from renewable sources in 2022, aiming for 95% in 2023 and 100% by 2025. The company also has a “science-based” (“substantiated … through specific long-term reduction targets”) 2040 net-zero target. The company also invests in solar, but the company is largely driven by investments in wind.

Ørsted Annual Report FY 2022

Other top holdings include EDP Renováveis SA (OTCPK:EDRVF) which is a Madrid, Spain-based leader in renewables and the fourth-largest wind energy producer globally, and Vestas Wind Systems A/S (OTCPK:VWDRY), another Danish company which manufactures, sells, installs and services wind turbines globally. However, bear in mind that below the top holdings, FAN’s portfolio is rather mixed in terms of its business exposures. Many companies in this portfolio are not strictly wind energy focused, so one must accept that FAN is about the best portfolio one can construct for wind in a diversified manner without the inclusion of private equity opportunities.

Valuation

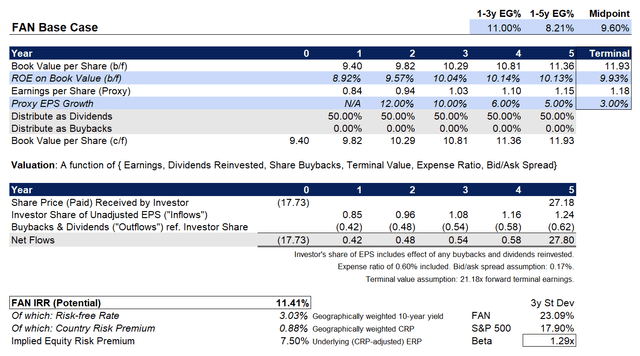

Gauging the valuation of FAN can begin with collecting some basic financial data. Due to the limitations of a consistent data source for both trailing and forward price/earnings, we will use Morningstar’s forward estimate of 21.18x as a basis, together with their price/book ratio of 1.89x and three- to five-year average earnings growth estimate of 16.30%. These forward figures give us an idea of the forward return on equity (implicitly 8.92%, which is relatively low, although this stands to grow over time). Also, given the relatively high dividend yield of 2.8% indicated by Morningstar, I will assume a distribution rate of 50% going forward.

All considered, with my own midpoint (albeit on a one- to five-year time frame, rather than a zero- to five-year time frame, as I do not have trailing earnings data for the latter), I generate a base IRR of 11.41% for FAN. This is a five-year IRR potential with a constant forward price/earnings ratio, and an implicitly increasing return on equity over time but only modestly to circa 10%.

Author’s Calculations

I was also tempted to reduce the forward earnings multiple to circa 18x, as if to value the fund on the assumption of zero “real” earnings growth (maturity of earnings to CPI inflation levels) and an equity risk premium of 5.5% at maturity. However, it is unlikely that wind energy will fully mature before the year 2028 (in five years’ time). So, I expect forward earnings will maintain at a higher level over time, although it may turn down a little as the portfolio matures. Nevertheless, there should be a long runway for FAN’s portfolio, and I expect with more research, development and adoption of wind energy more economic efficiencies will come with scale. This could also lead to higher returns on equity and earnings growth. My earnings growth stream is fairly modest versus expectations over the same time frame.

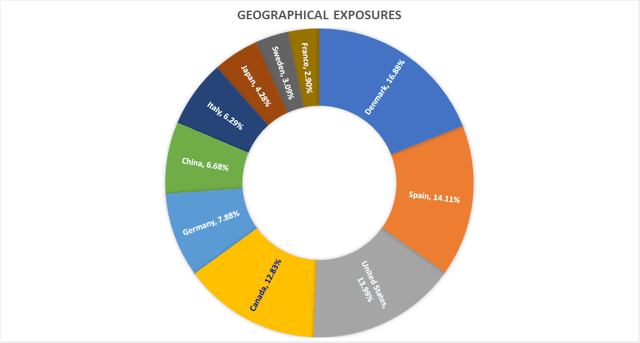

On balance then, the underlying equity risk premium for FAN looks to be in the region of about 7.5% after adjusting for the country risk premium (balanced by the fund’s geographical exposures, see my chart below, and Professor Damodaran’s country risk premium assumptions). Top exposures include Denmark (16.88%), Spain (14.11%), the United States (13.99%), and Canada (12.83%).

Data from FTPortfolios.com

I also calculated the beta of FAN as being 1.29x on a five-year, monthly basis relative to the S&P 500 U.S. equity index. On a beta-adjusted basis, the total equity risk premium (including the country risk premium element) would be 6.5% instead. Therefore, the ERP is going to fall in the range of 6.5-7.5% per my calculations, which suggests under-valuation. A fair equity risk premium would be in the region of 5.5% or less on a risk-adjusted basis. Therefore, FAN offers an interesting long-term opportunity and a strong headline IRR of over 11% coupled with fundamental mis-valuation as a tailwind, if you will pardon the pun. I would take a bullish stance on FAN.

Read the full article here