Editor’s note: Seeking Alpha is proud to welcome The Gaming Dividend as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

I believe the Federal Agricultural Mortgage Corporation (NYSE:AGM) currently sits at an attractive buying opportunity to capture some long-term growth and reliable dividend income with a yield over 3%. Based on current price targets, there is an attractive 20%+ upside potential in stock price which can be easily supported with the 62% net income increase they have shown since pre-pandemic.

Company Overview

The Federal Agricultural Mortgage Corporation is in the business of lending. Farmer Mac is federally chartered. According to the Farm Credit Association:

Farmer Mac was established to function as a secondary market for agricultural loans – this includes mortgages for agricultural real estate such as farms, as well as housing in rural America.

They purchase loans directly from lenders, providing them with liquidity and allowing them to offload loans from their balance sheets. This allows lenders and farmland investors to access capital for their operations. These activities help facilitate the flow of funds in the agricultural finance market and support the growth and stability of the industry.

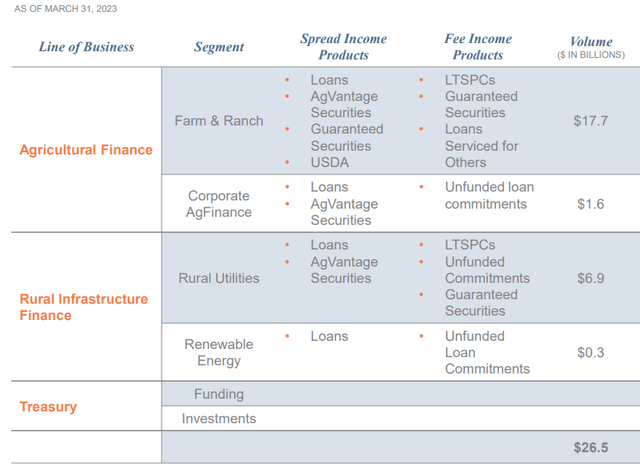

We can see that the majority of their business is within agricultural finance, followed by rural infrastructure finance.

Farmer Mac Q1 2023 Presentation

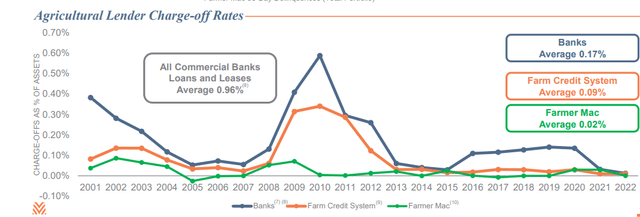

Risk

Often times the term “secondary market” is associated with a higher level of risk. Although elevated risk is possible, historical data shows us that this isn’t necessarily probable. Something that really stands out to me is the incredibly low amount of losses Farmer Mac has taken on loans, especially compared to other banks. I’m not sure if I am able to find another company in the business of lending, with this great of a track record.

Farmer Mac Q1 2023 Presentation

Agricultural Finance Mortgage Loans have maintained an impressive track record with historical cumulative losses of only 0.11%. Over the course of its historical business volume, totaling $36 billion, Farmer Mac has experienced cumulative losses of $38 million specifically in Agricultural Finance Mortgage Loans. While losses never make us happy, we need to recognize that this is exceptionally low and indicates that AGM has a strong set of criteria for their lending practices. I believe the risk here is limited, as this historical data shows.

According to the USDA’s Economic Research Service, net cash incomes in 2022 reached an estimated $189.9 billion, marking a substantial increase compared to incomes in both 2021 and 2020.

However, the forecast for 2023 anticipates a decline of 21% in net cash income, primarily attributed to elevated input costs and moderating commodity prices. Despite this projected decrease, the expected levels for 2023 still exceed the 10-year average for farm profitability.

I do think a projected decline of 21% shouldn’t be completely ignored – but don’t take that at face value and instead dive deeper into why I think they will still thrive.

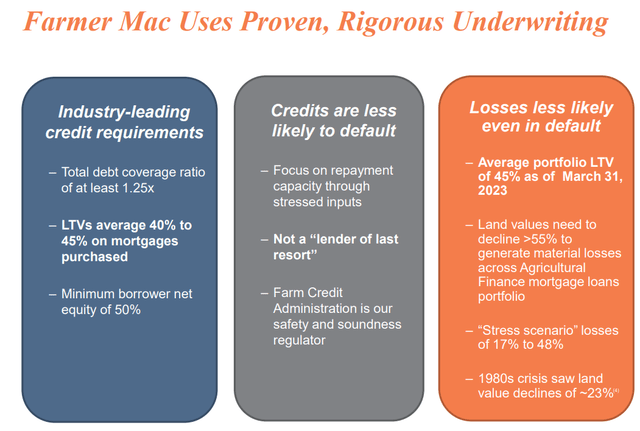

How The Risk Is Managed

Farmer Mac Q1 2023 Presentation

Ultimately, I strongly believe losses are unlikely to occur with these tight metrics:

- Total Debt coverage ratio of 1.25x – meaning that borrowers need at least 25% excess of positive cash flow to be eligible for lending.

- An average LTV (Loan-to-Value) ratio of 45% is very conservative. I’d like to point out that the average LTV ratio for most within banking, is approximately 80%.

- A key item here is that AGM is not a lender of last resort. Lenders of last resort is usually a classification given to lenders that are providing funds to borrowers that are near collapse. AGM is lending to the much safer end of the spectrum.

To me, these metrics prove that even though Farmer-Mac is operating within the secondary market, they are doing so with a strategic approach and making very calculated moves with who they choose to lend to. Even in usually times, such as the previous pandemic, I do believe AGM’s policies are well put together and leave themselves well protected in future economic headwinds.

This is further supported by the fact that AGM currently holds $864 million in cash. Just for reference, Farmer Mac’s total market cap is $1.5 billion. This is a beautiful position to be in as this cash in crucial in paying down operating expenses and being put to uses that can ultimately benefit their growing business and shareholders. When I see a company holding this much in cash, I ultimately feel more secure in my investment because I know there’s a strong likelihood of them being prepared for any market downturn.

Chartered Status – Only Major Risk?

A potential risk that would possibly sway my stance on AGM would be their federally chartered status. If for some reason this were to change, it would have a huge impact on the business. I believe it would add a layer of risk to AGM’s model considering a sizable portion of farming income comes from government assistance.

Since the majority of AGM’s portfolio consist of lending to farmers, Farmer Mac is set to benefit from this as their borrowers have government-based income. A report from 2020 shows that 39% of farm income was from government payments. If these payments were to stop, this could have a drastic effect on the cash flow levels of AGM and would warrant another outlook. It is safe to assume that the total loan losses incurred would slowly grow. A change like this would also impact the beneficial stance on margins that AGM can obtain during their lending process.

Valuation

I previously talked about the risk, but now we shall focus on the potential reward.

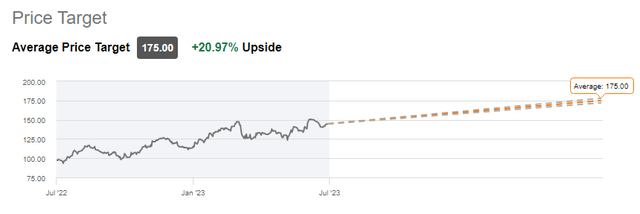

The average price target for AGM currently sits at $175/share.

This represents a potential 21% upside from its currently price level.

Seeking Alpha

EPS (Diluted) has steadily increased since pre-pandemic. With a 31% increase from $8.70 in 2019 to $11.42 as of 2022. This is important to note because it proves that through the pandemic, AGM was able to increase profitability during a time where most other businesses were experiencing a declining EPS.

When I invest, I like to know that my investments can maintain a steady dividend distribution as a steady income is a big factor on my decision. So naturally, one of the most important metrics I take a look at is their cash flow and growing revenue. If Farmer-Mac was able to increase revenue during such unusual times, I fully expect them to dominate when markets resume typical activity.

Compound Annual Growth Rate Of 10%

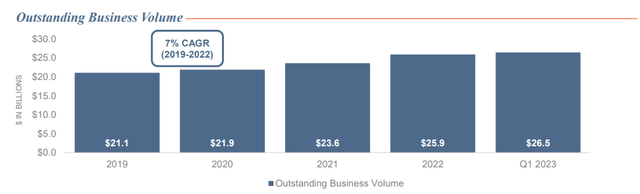

In addition to its strong revenue composition, the company has achieved an impressive compound annual growth rate (CAGR) of 10% in outstanding business volume from 2000 to 2022.

In my opinion, two decades of consistent growth is a strong metric to convince me of their business model and lending criteria. If they were able to have 10% CAGR over the last two decades, including all prior recessions, this is a strong indicator that maintaining a conservative 7% CAGR should be likely if market conditions remain the same. I strongly believe that this will resume in the future because a big part of this growth starts with AGM’s strict lending requirements. They make sure to eliminate any risks at the door so that they are as protected as possible during any market down turns.

While AGM is not totally indestructible, as they were below the 10% average since 2019, they have maintained a 7% CAGR over the course of the pandemic and are currently trending upward as the economy gets back on track. I see no reason why this will not continue into the future.

This growth rate was also reinforced during the latest earnings call.

Farmer Mac

In my view, the consistent growth in outstanding business volume showcases the company’s market competitiveness and its capacity to adapt to changing market dynamics. By consistently expanding its business and increasing its market share, the company has positioned itself for continued success in the industry with will inevitably result in shareholders being rewarded. My perspective is that , assuming a 10% CAGR in business volume can be maintained, the price target of $175/share can be easily crossed and exceeded.

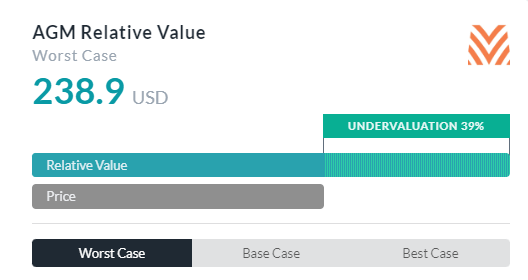

According to my relative analysis, the fair value of AGM would be near the $200/share ballpark. We can see that AlphaSpread has its fair value at $238/ share. This would represent the stock being 39% undervalued.

AlphaSpread

I prefer to take a conservative approach when formulating these type of estimates as it keeps expectations in check and also shows how strong the potential is here even when using a conservative outlook.

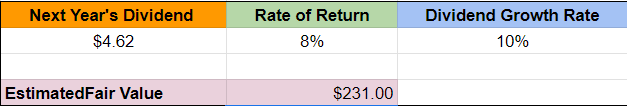

In this second approach, we will take a more conservative estimate now to calculate the fair value based on previous dividend growth.

The dividend increase from 2022 to 2023 was approx. 15% but for this estimate, I will be conservative and estimate that the net increase will only be 5%. This would mean next year’s hypothetical dividend would be $4.62/share.

Now, I will also be conservative with the avg growth rate over the next 5 years. As it stands, the current 5 year avg dividend growth rate is 16%, but for the sake of this estimate, let drop that down to 10%. A conservative expected rate of return of 8% will be used.

We can see based on these quick calculations, I estimate a fair value of approx. $231/share. This can be calculated with the following:

Estimated Fair Value = Dividend Amount / (Rate of Return – DGR)

My Calculations Based On Historical Data

Q1 Results

Taking a quick look at the Q1 results for this year, Farmer Mac delivered a strong 31.8% Y/Y revenue growth. Net interest also grew 21% Y/Y to $79 million. 90-day delinquencies only represented 0.27% out of their entire $26.5 billion portfolio.

We delivered another strong quarter, with new all-time records achieved for revenue, earnings, and net effective spread,” said President and CEO, Brad Nordholm.

The results for the quarter showcases the effectiveness of their disciplined asset liability management approach and the benefits of their strict lending criteria. Furthermore, they reflect the successful endeavors Farmer-Mac has take in growing their revenue through diversifying their income streams.

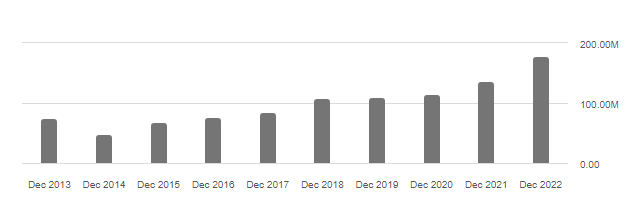

Stellar Dividend Growth

Their strong cash flow on “safe” loans has resulted in a 5 year dividend growth rate over 16% with also providing investors with dividend raises for over 10 years. We can see in the chart below how steadily their net income as increased over the last decade – an approximate net income growth of 62% from pre-pandemic levels.

Net Income:

2019: $109M

2022: $178.1M

Seeking Alpha

Although AGM’s current yield of 3% may not be eye watering , it is crucial to recognize that it is a highly secure dividend.

The payout ratio remains below 35%, and its conservative business practices contribute to its safety and likelihood for further expansion of its loan book. I expect this to lead to stronger earnings in the future and opens up the potential for future dividend increases as there is currently plenty of cushion in their cash flows to support this.

Again, remember that AGM is holding $864 million in cash. There is plenty of opportunity and cushion for the dividend to continue increasing into the future.

Competitive Advantage

As previously mentioned, Federal Agricultural Mortgage Corp is federally charted.

Federal charters come with a list of benefits. These benefits may include access to government support and/or funding

Overall, Farmer Mac’s charter results in a distinct competitive edge by allowing the company to strategically combat interest rate risks and maintain low loan default losses. This positions Farmer Mac as a reliable and secure, providing a strong foundation for continued success in the agricultural market.

Farm subsidy programs have played a crucial role in supporting farmers by providing financial assistance. In more recent years, subsidies have also been extended to farmers when their crop revenue falls below average annual levels. If this trend continues, I think that AGM is still in a defensive position and would be able to maneuver this.

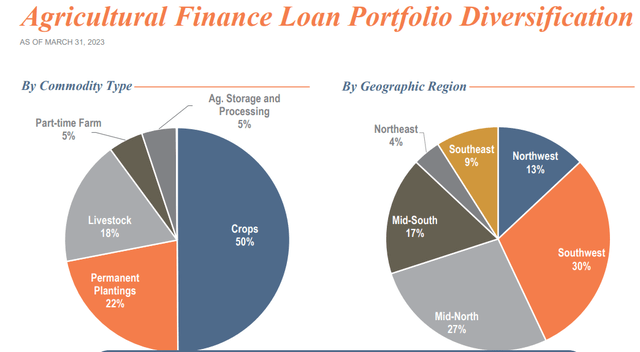

Diversity

Another competitive advantage would be the diversity of the loans. I love seeing a business that tries to create multiple streams of income. To me, this means they are actively using the cash on-hand to grow different parts of the business as well as increase the reward for me, as the investor.

Within its loan portfolio, the company strategically divides its agricultural finance across various sectors. Crops account for 50% of the portfolio, followed by permanent plantings at 22%, livestock at 18%, part-time farm operations at 5%, and agricultural storage and processing at 5%.

This allocation demonstrates the firm’s deliberate approach to diversification and risk management. Furthermore, the company maintains a well-balanced presence across different regions within the United States.

This location diversification allows the company to mitigate region-specific risks and capitalize on opportunities arising from varied agricultural landscapes and market dynamics.

Farmer Mac’s Q1 2023 Presentation

Competitors

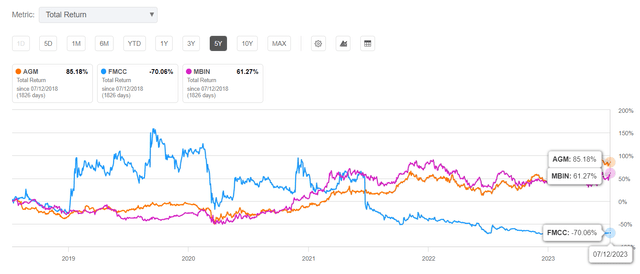

Being that AGM is in the business of lending, the price movements tend to follow those within banking. Using the below comparison, we can see that Farmer-Mac crushes the closest competition in terms of Total Return. Competitors such as Federal Home Loan Mortgage Corp (OTCQB:FMCC) and Merchants Bancorp (MBIN) are severely underperforming in comparison

Seeking Alpha AGM Peers

While AGM has higher valuation multiples compared to its peers, I believe it manages to outperform because of how their business is structured. Farmer Mac’s remarkable performance over a 5-year period resulted in a total return of 85%, accompanied by impressive increases in revenue and earnings. One of the main differentiators between AGM and their competitors is that AGM has a conservative 45% LTV ratio whereas their competition does not.

In my opinion, this shows that AGM’s lending criteria / model is well-crafted and positions them to perform well, even through rough market environments like the one we previously experienced.

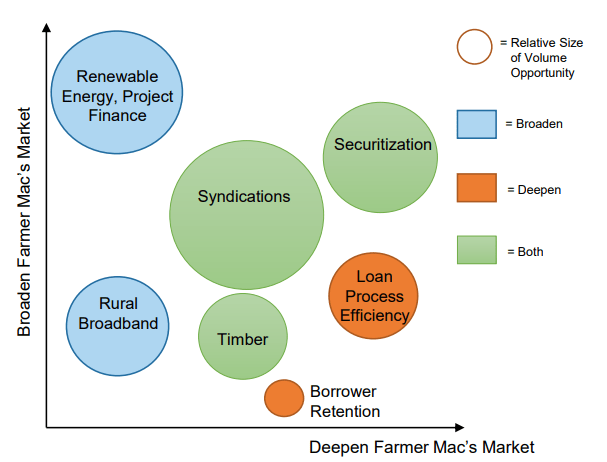

Growth Opportunity

Farmer Mac can explore new avenues and potential opportunities in the agricultural market that they have not yet tapped into.

With a focus on expanding its presence in rural infrastructure, Farmer Mac is actively pursuing opportunities in renewable energy as seen in the below. Simultaneously, the company deepen integration by leveraging increased securitization, forging partnerships with syndication firms, and expanding its footprint in the timber industry.

By tapping into the growing demand for renewable energy and improving rural connectivity, Farmer Mac sets themselves up to support sustainable development and capitalize on emerging opportunities – to me, this translates to a buying opportunity.

Farmer Mac

Conclusion

Farmer Mac’s charter has demonstrated stability and even expansion over time, supported by conservative lending practices. Although it is important to acknowledge potential risks, such as changes to Farmer Mac’s federal charter status.

With a CAGR of 10% for the last two decades and a diverse revenue stream, I think this is a great buying opportunity that has the potential to reward shareholders handsomely in time through growth and a ultra stable dividend that is well covered and has room to grow. Using different metrics, we can determine that the fair value of AGM sits near or above $200/share.

AGM has a well-thought-out set of criteria for their business, and its well-crafted process returns results in increasing revenue, interest income, and slim delinquency count on its portfolio.

Read the full article here