Thesis

This article delves into FB Financial Corporation (NYSE:FBK) performance and analyzes key results following their recent Q2 earnings report, which revealed earnings per share (EPS) beating expectations by $0.12 but revenue missing by $1.40M. While the company maintains a solid liquidity position, defensive strategies, and a favorable valuation, it faces headwinds such as declining profits, shrinking net interest margins, rising expenses, and a dip in deposits. Consequently, I currently rate the bank as a “Hold” with a cautious outlook.

Company Overview

FB Financial Corporation, an institution deeply rooted in the annals of Nashville’s financial landscape since 1906, embodies a vibrant banking force encompassing a wide array of offerings tailored to address the multifarious needs of its diverse clientele. As the progenitor of FirstBank, FB Financial Corporation offers all-encompassing banking solutions for a myriad of stakeholders, ranging from enterprises and seasoned professionals to everyday individuals.

To further augment its extensive repertoire, FB Financial Corporation extends its services to include an assortment of commercial real estate loans, catering to both owner-occupied and non-owner-occupied properties. This comprehensive suite encompasses 1-4 family mortgages, multi-family residential properties, commercial and industrial spaces, as well as land acquisition loans-affirming their commitment to cater to a broad spectrum of real estate financing requirements.

FB Financial Corporation’s Q2 2023 Earnings Highlights

FB Financial Corporation reported a marginal increase in its adjusted banking segment’s pretax pre-provision from the previous quarter, but it’s still down by 17% compared to 2022’s analogous period. This downward trajectory can be primarily traced back to a 12% upswing in core non-interest expenses in the banking sector.

Despite being squeezed by funding pressures, the bank’s net interest income has merely dipped under 1% from Q2 2022, pointing to a relative stability. Loan growth and asset yield improvements have stepped up to the plate to soften the sting of the past year’s funding stresses.

FB Financial stands on solid ground in terms of liquidity, boasting $1.4 billion in liquid assets, alongside an additional $6.4 billion unsecured borrowing capacity. A further safety net comes in the form of $2.2 billion in real estate loans held in reserve, ready to be funneled back into the bank to enhance borrowing capacity if the tides turn.

Peering into its securities portfolio, the bank sits comfortably within its preferred range, with securities making up 11% of total assets and a timeline of approximately 5.4 years. Keeping adaptability in its corner, FB Financial is contemplating offloading some underperforming securities and leveraging excess capital for strategic trading maneuvers.

On the deposit front, the bank reported a $311 million slide from the last quarter, largely due to a dwindling in public funds. According to management, this contraction is likely to extend into Q3, pushing public funds further down. With escalating deposit costs under the spotlight, shifts in the deposit composition and a fiercely competitive marketplace are the key players stirring the pot.

The bank’s net interest margin experienced a slight hiccup, dropping to 3.4% for the quarter, 11 basis points shy of the first quarter. Further compression seems to be on the horizon owing to persistent funding pressures, but a rebound to 3.41% in June injects a glimmer of hope that the rate of contraction could be kept at bay in the forthcoming quarters.

Non-interest income hit the mark, coming in at $11 million, and is projected to hold the line at similar levels in 2023. The escalating non-interest expense poses a concern as the bank braces for ongoing margin pressure. In response, FB Financial has enacted cost containment measures like halting hiring outside of revenue-generating roles and reining in discretionary expenses.

Tuning into the cautionary notes (which I’ll highlight some more in “Risks & Headwinds” below), FB Financial bumped up its allowance for credit losses in light of a modest economic forecast downturn. Yet, the overall provision expense witnessed a relief due to a decrease in unfunded commitments. According to management, the bank is keeping a vigilant eye on its portfolio, ready to ramp up protective measures as necessary.

Expectations

FB Financial is covered by seven Wall Street analysts with an average “Hold” rating on the company accompanied by a meager price target outlook of +1.71%.

Seeking Alpha

Performance

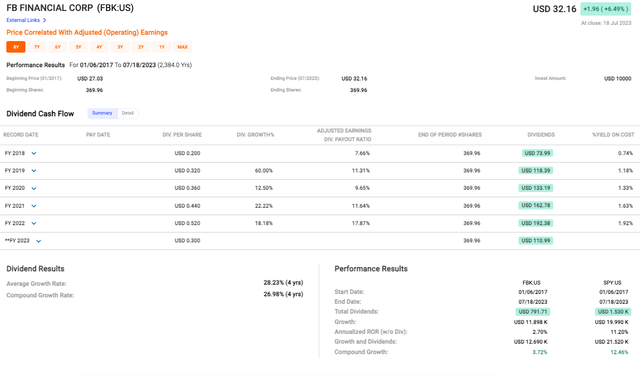

In the realm of medium-term prospects (as depicted in the accompanying chart), FB Financial has exhibited a steady, albeit unremarkable, trajectory of expansion, capturing my attention with a few notable particulars.

First off, regrettably, the overall performance of FBK has fallen short of the norm when compared to the wider market, as indicated by the modest annualized ROR (Return On Investment) of a mere 2.7% for the stock, contrasting with a healthy 11.2% enjoyed by the S&P 500 Index (SP500).

Fast Graphs

Turning to the matter of dividends, FBK has showcased a noteworthy average dividend growth rate of 28.23% over the past four years, reflecting an impressive compound growth rate of 26.98%. Nevertheless, even with dividends reinvested, FBK has only achieved a compound growth of 3.72%, which pales in comparison to the S&P’s 12.46%. While I aim not to portray an excessively pessimistic outlook, the data indicates that FB Financial has struggled to keep pace with the broader market.

Valuation

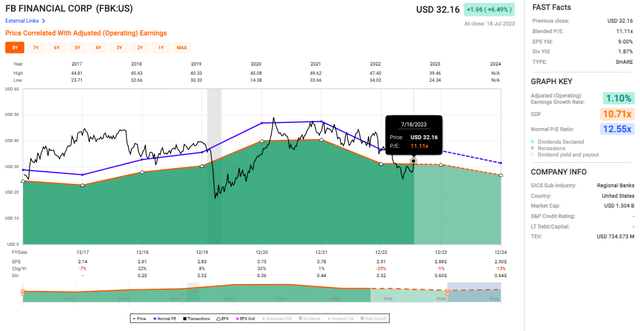

In the realm of financial metrics (see chart below), the company’s blended Price to Earnings (P/E) ratio, presently residing at a modest 11.11x, finds itself trailing behind the historical norm P/E of 12.55x. Such a juxtaposition implies the possibility of the stock being undervalued, an attractive prospect for discerning investors.

Fast Graphs

Furthermore, the EPS Yield, currently standing at an impressive 9.00% is a notable figure that could serve as an additional clue pointing towards the stock’s undervaluation. However, a word of caution is warranted, for the company’s earnings growth rate clocks in at a mere 1.10%. Such a sluggish growth rate could have the potential to dampen future earnings, thereby affecting the yield as well.

Risks & Headwinds

Starting with the net interest margin, this critical barometer of a bank’s lending profitability has shrunk by 11 basis points quarter-on-quarter, standing at 3.4% for the second quarter. Essentially, intensifying competition has put margins under duress, and we’re also seeing the fallout from the termination of the First Horizon merger. The shrinkage in the net interest margin is no small issue-it forms the bedrock of a bank’s revenue and, consequently, its capacity to generate profits and shareholder value.

The bank is also battling a two-pronged challenge-deposit mix and pricing pressures-both escalating the cost of deposits. Notably, non-interest-bearing accounts, traditionally a reliable source of low-cost funding, have dwindled by $89 million, reflecting an alarming 14% annualized decline. If this trend persists, the bank could find itself in a tightening vice of squeezed margins and higher funding costs.

Another concern spot is the uptick in non-interest expenses, which have surged by 12% YoY within the banking segment. Despite earnest efforts to curb the expense load, the bank seems to be on an uphill battle. This inflation in expenses could potentially chew into the bottom line, and if unchecked, could dampen overall profitability.

Finally, we can’t ignore the glaring $311 million quarter-on-quarter dip in total deposits. This may signal possible customer attrition or diminished faith in the bank’s capabilities. Either scenario would be troubling. The contraction in deposits could impact the bank’s liquidity and lending capabilities, not to mention the potential damage to the bank’s reputation.

Final Takeaway

Based on my research, I would rate the FB Financial Corporation as a “Hold.” The bank’s financial health, as demonstrated by its solid liquidity and defensive strategies to manage potential funding stresses, is promising. However, concerning factors such as an annual decline in pretax pre-provision profits, shrinking net interest margins, increasing non-interest expenses, and a contraction in deposits, signal potential challenges. Also, FB Financial Corporation’s modest earnings growth rate and unimpressive performance in comparison to the broader market make it less compelling as a “Buy” at this time.

Read the full article here