Ferrexpo (OTCPK:FEEXF)(OTCPK:FEEXY) is a Swiss headquartered iron ore company that operates mines in Ukraine. Prior to the Russian invasion of Ukraine, Ferrexpo was the third largest exporter of iron ore in the world.

Ferrexpo operates mines in Poltava, Yeristovo and Belanovo, located in central Ukraine. Despite the war, Ferrexpo has shown resilience and doubled their iron ore pellet production to 0.90 million tonnes in Q1 2023 (4Q 2022: 0.42 million tonnes).

For context, Ferrexpo produced 11.2 million tonnes in 2021 before the war and is therefore operating below historical capacity.

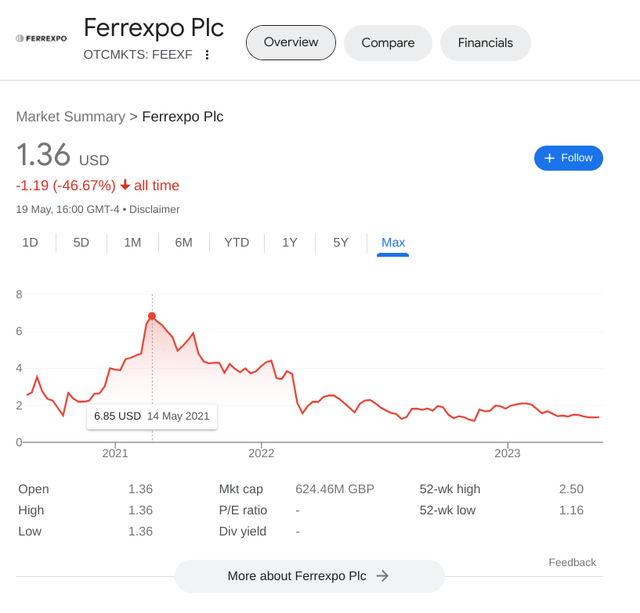

From a peak of $6.85, the share price of Ferrexpo has cratered to $1.36 today. The fall in the share price represents a high risk, high reward opportunity for investors.

Google

The opportunity reminds me of the story of Nathan Rothschild in 1815 who bought loads of UK government bonds after learning that the British won the war against Napoleon in the Battle of Waterloo ahead of anyone else.

Rothschild had set up a private courier system with shipping agents in Dover, Calais and Ostend with fast light vessels ready to sail at any time. Due to this, he received the news of the victory 24 hours before the government’s official messenger arrived.

UK government bonds soared on the news and Rothschild made £1 million, which was significant given that the average wage was £50 per year at that time.

Valuation

Ferrexpo has a market cap of $800m (£650m). If we calculate the P/E ratio for Ferrexpo using the 5-year average earnings, we can observe the under-valuation.

|

Ferrexpo |

2022 |

2021 |

2020 |

2019 |

2018 |

|

Revenue ($m) |

1,248 |

2,518 |

1,700 |

1,506 |

1,274 |

|

Earnings ($m) |

219 |

870 |

635 |

403 |

335 |

Ferrexpo has a 5-year average earnings of $492m, which is equal to a P/E ratio of 1.6.

According to Simply Wall St, the industry P/E ratio is 12.2, which implies that Ferrexpo is under-valued on a P/E multiple basis.

However, the low P/E ratio is explained by the potential write-off of the business due to the Russian invasion of Ukraine.

Shares in Ferrexpo could essentially be worthless if Russia takes control of Ukraine and appropriates the country’s assets illegally.

At the same time, Ferrexpo could be a winner if Russia agrees to a peace agreement where the company’s mining operations are not annexed and the trading route to Asia via the Black sea is resumed.

In such a scenario, we could expect Ferrexpo to return to a higher P/E ratio.

Why should you invest in Ferrexpo?

1. Resilience

Despite the war, Ferrexpo has managed to stay profitable in 2022, producing a profit of $219 million. Additionally, the company has doubled its production of iron ore from 0.42 million tonnes in 4Q 2022 to 0.90 million in Q1 2023.

I am quite impressed by the numbers given the exceptional circumstances.

There has also been an improvement in the supply of electricity to the mining operations in Ukraine. In April 2023, Ukraine also announced that it had resumed electricity exports to Europe, which is a positive sign.

2. Reconstruction of Ukraine

Iron ore is the raw material used for producing steel. The demand for iron ore and steel will be strong post-war to enable the reconstruction of Ukraine.

It is estimated that the current cost of reconstruction in Ukraine amounts to $349 billion, which is expected to grow in the coming months as the war continues.

The demand for iron ore and steel will also continue in the coming years due to strong fiscal stimulus by the U.S and the European Union to enable the on-shoring of critical manufacturing operations from China.

Risks

The Russia-Ukraine war is a wildcard situation. It is unclear what will happen and how it will get resolved.

If we look at the shortest and longest war in history, we can get an idea of how unpredictable war is.

The Anglo-Zanzibar war was a military conflict between the United Kingdom and the Zanzibar Sultanate and it lasted for 45 minutes.

On the other hand, war between the Netherlands and the Isles of Scilly lasted for 350 years.

Conclusion

Depending on your view of how the conflict in Ukraine will end, Ferrexpo could be an interesting high risk, high reward play.

I would not bet the house on Ferrexpo but a small investment on the resilience of Ferrexpo to weather the Russia-Ukraine war could be extremely lucrative.

If you do invest, be prepared for a full write-off of your investment in the event that Russia manages to invade Ukraine completely.

You could also wait for more clarity on the outcome of the Russia-Ukraine war and trade Ferrexpo like Nathan Rothschild did with UK government bonds in 1815.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here