Author’s note: This article was released to CEF/ETF Income Laboratory members on May 22nd.

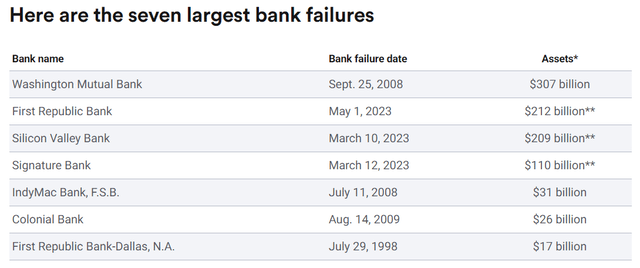

2023 has been one of the worst years for financials in history. Several banks have gone bankrupt, others are in distress, and most are harboring significant unrealized losses due to rising interest rates. Three of the five largest bank failures have occurred this year, and it’s only June.

Bankrate

With industry conditions in flux, thought to have a quick look at some of the most impactful recent industry events or trends. Four stand out.

Banks have massive unrealized losses, due to higher interest rates / declining bond prices.

Net interest margins have increased, product of higher loan rates, but stagnant deposit rates. Margins could soften if consumers pivot from deposits to T-bills and similars, however.

Earnings growth is expected to be weak, but positive, due to worsening economic fundamentals.

Valuations are a bit cheaper than average, but not by a lot.

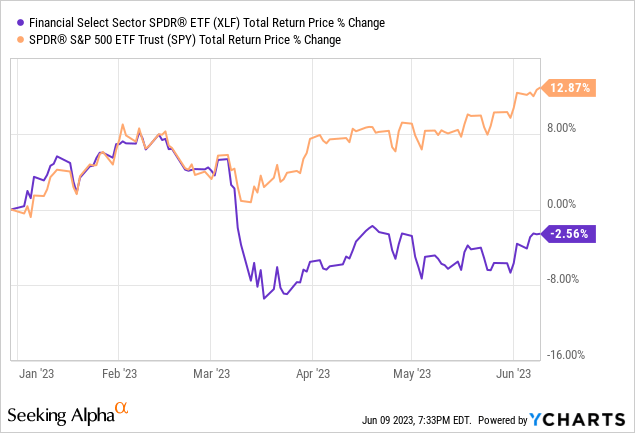

In my opinion, current conditions / trends are a net negative for financials. Unrealized losses will take years to recover, higher margins notwithstanding, and markets seem very impatient. The Financial Select Sector SPDR ETF (NYSEARCA:XLF) is the largest financials fund in the market, and is impacted by these same trends as well.

Massive Unrealized Losses

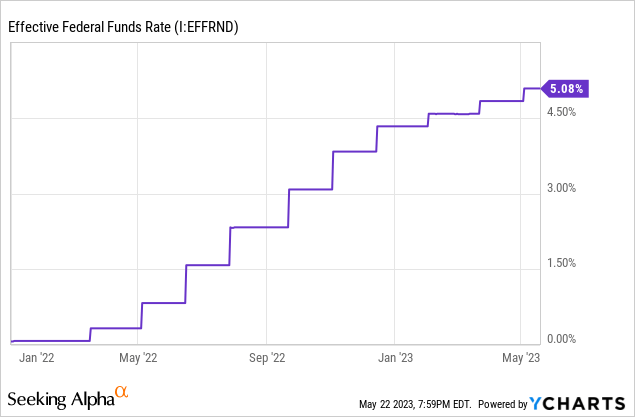

The Federal Reserve has engaged in one of the most aggressive hiking regimes in recent history, hiking benchmark rates from around 0.0% in early 2022, to 5.00% – 5.25% as of mid-2023.

Data by YCharts

As rates rise, demand for older, lower-yielding bonds declines, leading to lower prices for the same. As an example, demand for 10Y treasuries issued in 2020 is quite low, as these older treasuries yield 0.50% – 1.00%, but newer issues yield +3.50%. The same is true for most other bond and fixed-income sub-asset classes, including investment-grade bonds, high-yield bonds, mortgages, and even simple commercial or personal loans.

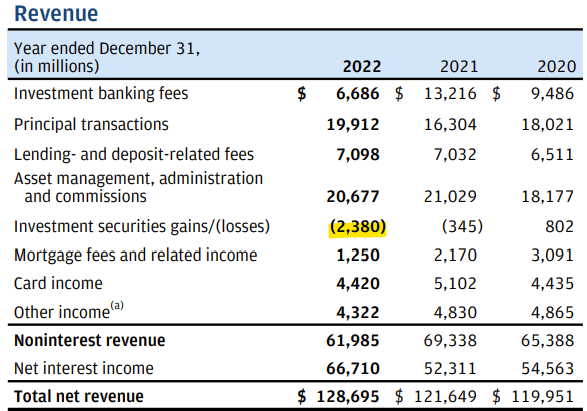

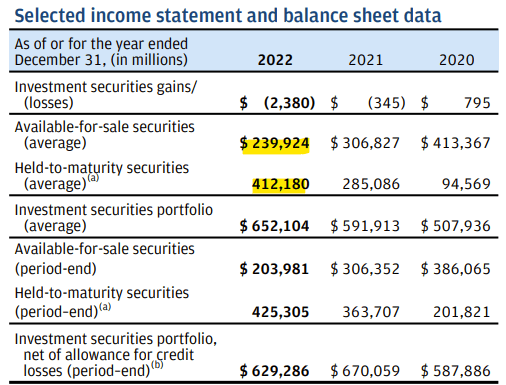

Banks invest quite heavily in treasuries, mortgages, and other assorted fixed-income securities, and so have seen significant losses from higher interest rates. As an example, JPMorgan (JPM) saw realized losses of $2.4B in 2023:

JPMorgan

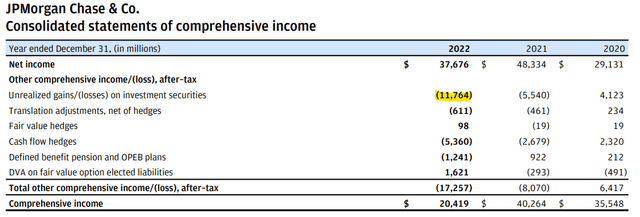

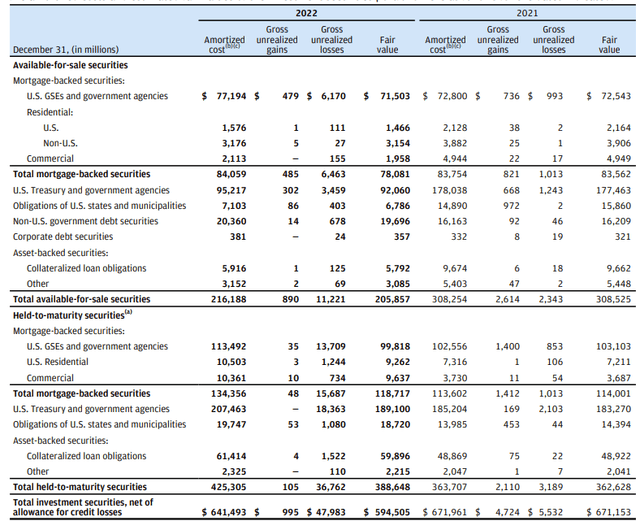

Unrealized losses were quite a bit higher, at $11.8B.

JPMorgan

Importantly, due to accounting conventions, banks are not required to mark-to-market their held-to-maturity securities. Meaning, if a bank says they will hold a 10Y treasury until maturity, they can ignore any short-term price movements, and do not need to record these in their accounting statements. Banks generally hold a sizable percentage of their assets as held-to-maturity securities, with these encompassing around 63% of JPMorgan’s portfolio.

JPMorgan

These have seen around $36.6B in unrealized losses, albeit not accounting losses.

JPMorgan

Add it all up and it seems JPMorgan saw $50B in losses in 2022, a staggering amount, even for a $400B market-cap behemoth.

As per the FDIC, total industry unrealized losses amounted to $620B, as of late 2022. From what I’ve seen, losses are significant for most banks, but not life-threatening. Some regional banks experienced above-average losses and were forced into receivership, including Silicon Valley Bank (OTCPK:SIVBQ) and First Republic (OTCPK:FRCB). These losses have, in turn, led to reduced share prices for most banks and financial institutions. XLF itself is down 2.6% YTD, underperforming the S&P 500.

In my opinion, and considering the magnitude of unrealized losses, bank leverage, and recent stock market performance, financials could very easily see further losses. Losses are, however, far from guaranteed, as economic conditions could always improve, and as markets are not always necessarily rational.

Higher Net Interest Margin

Some context first.

Banks own assets, from which they receive interest. Assets include treasuries, mortgages, and the like.

Assets are financed through deposits, long-term financing, equity, and other means. The bank generally has to pay interest for these sources of financing.

Banks earn money from the net interest margin between their assets and liabilities (financing).

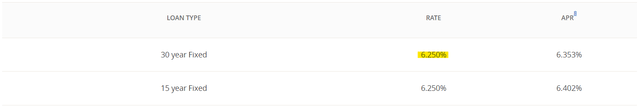

JPMorgan issues mortgages at 6.25%:

JPMorgan

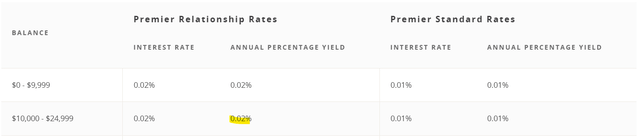

These are financed through deposits, with a rate of 0.02%:

JPMorgan

For a cool 6.23% net interest margin, almost entirely profits for the bank.

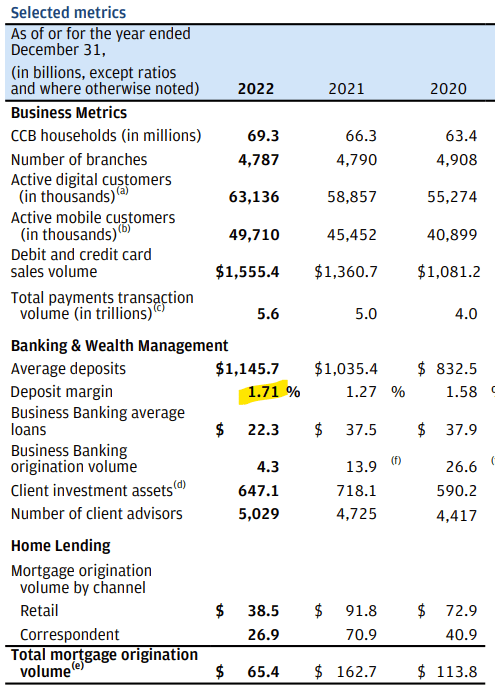

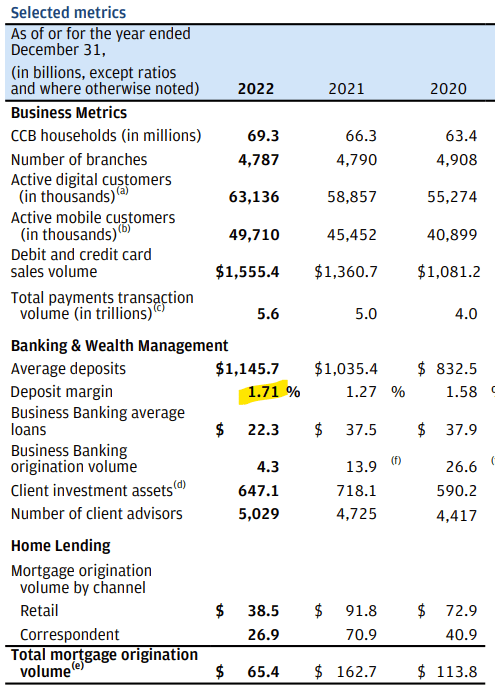

Some deposits have higher rates, and some mortgages, especially older mortgages, have lower rates, so margins are much lower. JPMorgan reports a deposit margin of 1.71%, a more reasonable, standard figure.

JPMorgan

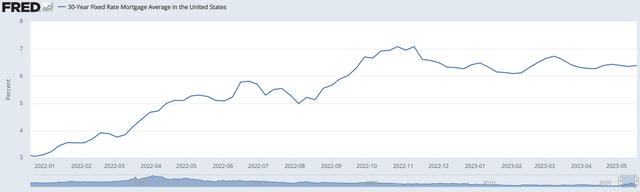

Higher Federal Funds rate has led to higher interest rates across the board, but the magnitude of these has not been the same. In most cases, bank assets have seen significant increases in rates. As an example, 30Y mortgages increased from 3.1% in early 2022, to 6.4% as of today.

Federal Reserve Bank of St. Louis

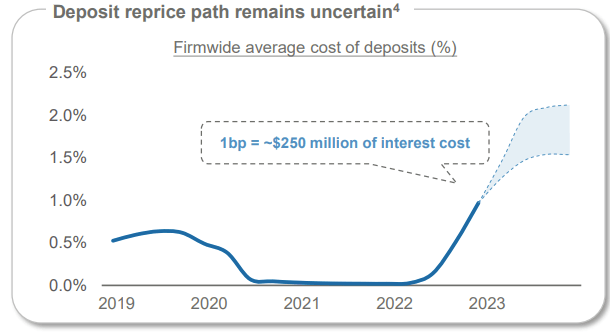

Bank deposit rates, however, have seen much more tepid increases. JPMorgan, for instance, reported a 1.0% increase in average deposit rates during 2022.

JPMorgan

JPMorgan mortgages are more expensive, while its savings account continues to pay a pittance. This should lead to higher net interest margins for the company, as seems to be the case (check the growth between 2021 and 2022).

JPMorgan

As per the FDIC, margins have also improved across the industry as a whole.

If higher margins persist, these should lead to higher revenues and earnings moving forward. Long-term, these should more than cover recent losses. Higher margins might not persist, however, as some banks seem pressured into increasing their deposit rates to attract and retain customers. There is not a ton of demand for 0.0% savings accounts when T-bills yield +5.0%.

XLF, as a financials index ETF, benefits from higher industry margins. The benefit would be tremendous if these were to persist into the future. Which brings me to my next point.

Average Growth Prospects

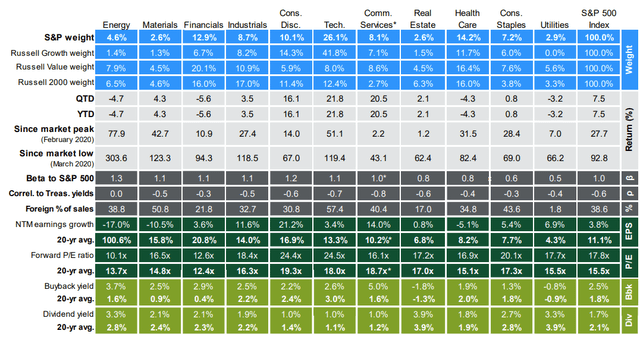

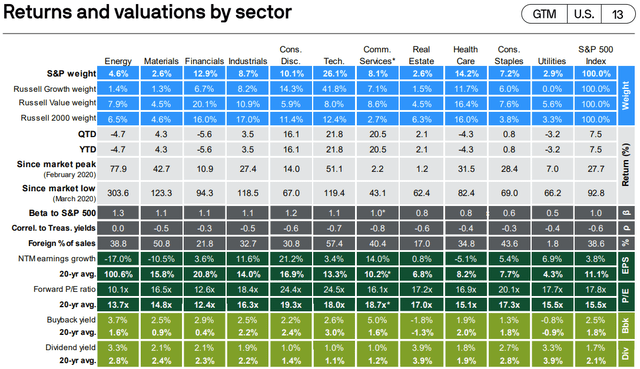

Market analysts expect 3.6% in earnings growth for the financial industry in the next twelve months. It is a relatively low rate on an absolute basis, and much lower than the industry’s 20.8% average. It is, however, quite close to the 3.8% expected earnings growth for the S&P 500.

JPMorgan Guide to the Markets

Considering the above, it seems that the market does not expect significant earnings growth from higher margins. I have no reason to disagree, although bear in mind, markets are sometimes wrong, and earnings have come in higher than expected.

Slightly Cheaper Valuation

Financials have seen declining share prices for the past few months. Although these have led to a softening in industry valuations, the impact does not seem terribly significant. Financials currently trade with a 12.6x forward P/E ratio, slightly more expensive than their 12.4x historical average. On the other hand, financials are a bit cheaper than average, with the S&P 500 sporting a 17.8x forward P/E ratio. The S&P 500 generally trades with a P/E ratio of 15.5x.

JPMorgan Guide to the Markets

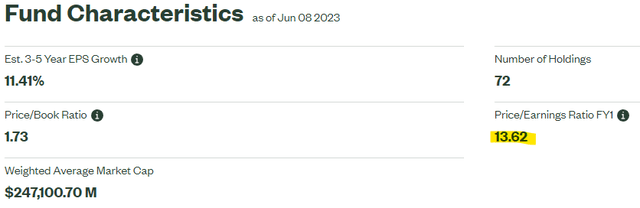

XLF itself seems to trade with a slightly more expensive valuation than above. The fund reports current P/E ratios, not forward, which explains some of the difference.

XLF

In my opinion, it would be fair to say that XLF trades with a slightly cheap valuation. Or, at the very least, it is less overvalued on a historical basis than the S&P 500. This seems like a small benefit for the fund, but a benefit nonetheless.

Conclusion

Rising interest rates have caused significant losses across banks, but also led to higher margins. In my opinion, the net impact is negative, and not yet reflected in XLF’s share price.

Read the full article here