Predicting the direction of the US or global economy has always been a humbling profession, but doing it in the post-Covid economy where monetary and fiscal activity has gone into ‘Ludicrous’ mode only makes an impossible job even harder.

The latest releases of global flash PMI readings for November from S&P Global only add to the already long list of examples. As discussed with the overseas releases in The Morning Lineup earlier today, these indices make up about 85% of responses for the final PMI reading in a given month.

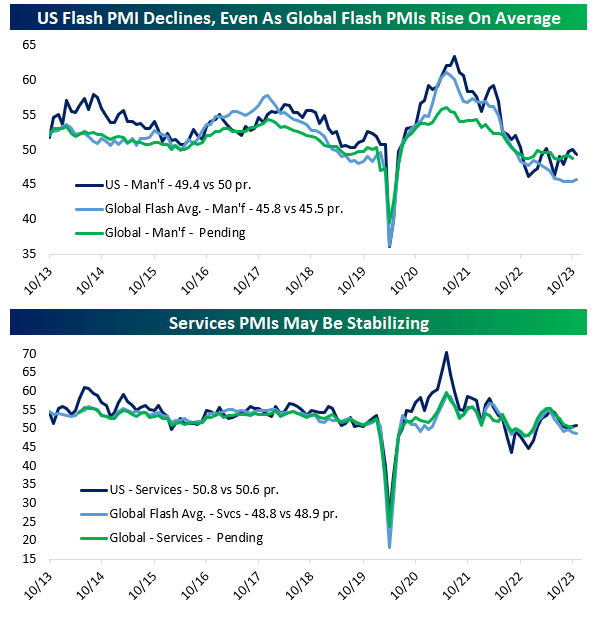

As for the US, manufacturing activity, as measured by the PMIs, slipped back into contraction during November. Manufacturing PMI has now been at or below 50 for 12 of the last 13 months and the last 7 straight, and S&P Global noted that “demand conditions stagnated” at US factories.

As for Services, activity beat and rose sequentially, marking the 10th straight month of expansion (a reading above 50).

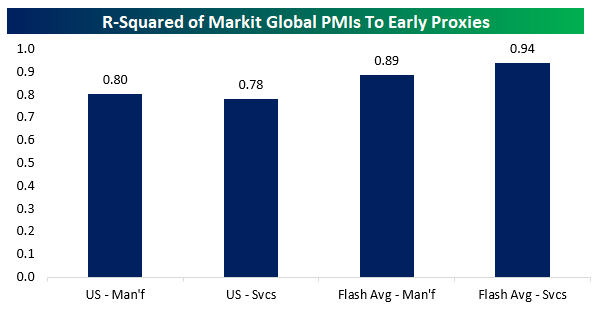

As shown in the charts below, historically, US PMIs have been a solid guide to global activity, explaining about 80% of the variation in global manufacturing and services activity.

When we do the same analysis for the average across flash economies, we do even better, as these readings explain 89% or more of the variation (0.89 for manufacturing and 0.94 for the services sector).

While the US readings and the average of the global flash readings have both done a good job as a guide to the global economy, their short-term moves in November were contradictory.

In the charts below, we show the US, global, and an average of all the readings for economies that report flash PMIs.

As shown, for both the manufacturing and services sectors, average flash data tends to be a pretty consistent guide to where global final data (green line) for a given month ends up and confirms the results from the chart above.

For this month, though, in both the manufacturing and the services sectors, the direction of the US reading was in the opposite direction as the average flash readings of its global peers.

This is hardly the first (or the last) time these readings will move in opposite directions on a month-to-month basis, but it doesn’t help what is an already confusing environment to navigate.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here