When thinking about companies that are most likely to benefit from the rising trend in adoption of Artificial Intelligence or AI, not too many manufacturing companies rise to the top of the list. That is, unless you are familiar with the concept of the Fourth Industrial Revolution, which I have previously written about when discussing Powell Industries (POWL). The rise of AI and ML (machine learning) to reduce material loss, optimize manufacturing processes, streamline operations, increase efficiency, and improve customer satisfaction are some benefits that are now being realized as trends that are indicative of the Industry 4.0 movement.

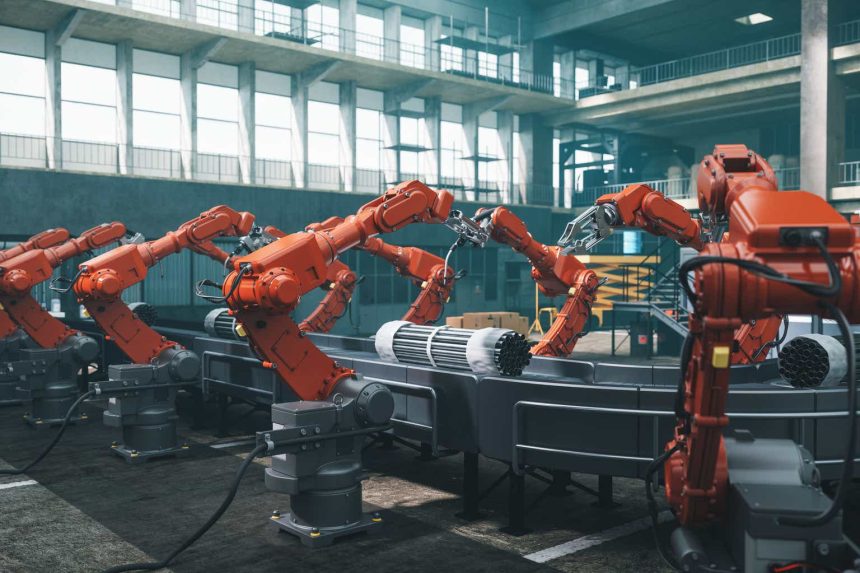

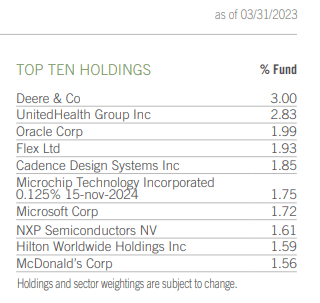

AIO top 10 holdings (Virtus)

While thinking about a company that I wanted to write about for the Best AI Idea competition, I decided to review the top holdings in a fund that I own shares of that invests in AI related businesses. That fund, Virtus Artificial Intelligence & Technology Opportunities Fund (AIO) has several non-technology holdings in its top 10 including Flex (NASDAQ:FLEX).

In this article, I wish to discuss the merits of AI as a concept being embraced wholeheartedly by Flex, formerly known as Flextronics International. In fact, in an article published by Hooi Tan, President of Global Operations and Supply Chain for Flex, he writes that it is time to join the Fourth Industrial Revolution and explains how Flex is doing just that.

The effects of the global pandemic, labor shortages and uncertain political situations around the world in recent years have underscored the need for manufacturers to be agile, resilient and able to adjust to changing circumstances. Fortunately, the technologies and the means for making the transition are available.

With Industry 4.0, new technologies-ranging from artificial intelligence and virtual reality (VR) to advanced robotics and the Internet of Things (IoT)-can now integrate digital elements into manufacturing processes, increasing automation, communication and overall output.

In the article, he writes that there are 4 areas in manufacturing that are ripe for digital transformation – automation, connectivity, intelligence, and continuous improvement in processes/teamwork. He concludes the article with this suggestion:

While legacy systems may have worked well for decades, they now threaten to leave manufacturers in the dark ages. In today’s digital world, agility and resiliency are essential to an organization’s success. A digital transformation is the key to improving efficiency, enabling innovation and staying competitive. The time to transform is now.

In the article, the company facility in Sorocaba, Brazil was cited as an example of one where a digital transformation using Industry 4.0 initiatives led to reduced material loss, improved operational efficiency, increased productivity, and higher customer satisfaction.

Who is Flex?

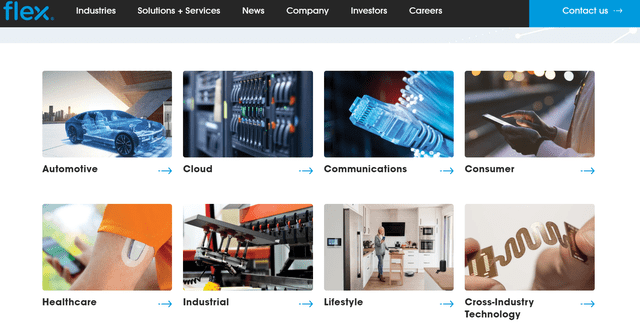

For over 50 years, Flex has been building a global manufacturing base across 30 countries to make great products that create value and improve people’s lives. In addition to manufacturing, the company offers design and engineering, supply chain and value-added fulfillment services to a variety of industries and end markets.

Flex

The company started out as Flextronics in 1969 in Silicon Valley making printed circuit boards. In 1981 they set up a manufacturing facility in Singapore, and then in 2007 bought their long-time competitor Solectron for $3.6 billion. That move shifted them from a contract manufacturing company to a full lifecycle partner and gave them the scale to help customers with all aspects of product development. In 2015 they rebranded to Flex and in 2019 the company celebrated 50 years of history by bringing in a new CEO, Revathi Advaithi, who has been responsible for architecting the company’s transformation and strategic direction.

Solar Energy Developments

On February 1, 2023, the company announced the IPO of its subsidiary company, Nextracker (NXT). Nextracker is a provider of solar panel tracking technology and the IPO, which took place on February 9, was highly successful opening at a price of $30.31 after upsizing the offering to $638M. Flex retains a controlling interest in NXT following the offering. NXT shares closed at $37.79 on July 14, 2023.

In other solar energy developments, Flex is partnering with Enphase (ENPH) to manufacture microinverters at their new Columbia, SC facility. On July 5, 2023, the companies jointly announced that shipments had begun.

“Enphase shares our commitment to accelerating the world’s transition to clean energy through advanced technology and strategic regional manufacturing,” said Revathi Advaithi, CEO of Flex. “We thank Enphase for their 15-year partnership to deliver their IQ Microinverters to market faster and at scale globally with reliable, sustainable business practices.”

Automotive Innovations

In the automotive business group, Flex is making advances in innovations related to electric vehicles, ADAS (advanced driver-assisted systems) and the path to autonomous driving, including their recent partnership with Nvidia (NVDA) in leveraging the DRIVE Orin platform.

From a story published in the World Economic Forum, Mike Theony, President of Flex Automotive Group wrote:

One example of how the next-generation ecosystem accelerates innovation is Flex’s collaboration with NVIDIA to develop an automotive computing platform that makes ADAS and the path to autonomous driving more accessible. During the project design process, we engaged a diverse subset of automakers that jointly invested in the development effort. While these automakers were aware they were part of a cohort, the identities of their peers were not disclosed, enabling true open collaboration. The pooled investment from these automakers helped fund development, while their feedback accelerated the validation of the solution. Such an innovative, collaborative setup showcases how to lower investment hurdles and enable automakers to accelerate time-to-market and reduce costs without sacrificing safety or quality.

Another use of AI and Industry 4.0 technologies is the use of digital twins and simulation in automotive manufacturing processes as explained by Mike Theony in this article from Digital Engineering 247:

In an increasingly chaotic world, digital twins and other Industry 4.0 technologies allow manufacturers to quickly understand the true risk and impact of disruptions,” he says. “We can simulate line flow to understand the potential effect of shortages and other challenges to deliver as planned, providing alternatives and optimizations to limit the impact. This helps accelerate the change process and validates changes before implementation, saving cost and time.”

Medical Device Innovations

As most of you are well aware the demands on the healthcare system in the US and across the globe are greater than ever, especially since the Covid-19 pandemic. Healthcare providers need to constantly find new ways to treat a large and diverse patient population more cost effectively while also empowering patients to manage their own care. The rise of “connected health” and HMI (human machine interfaces) is one way to address that growing need. Flex has over 30 years of experience integrating HMIs.

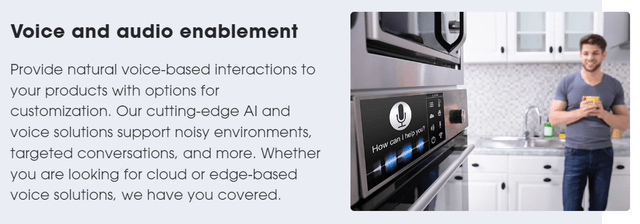

For example, voice and audio enablement using AI and voice solutions for targeted conversations in noisy environments can be customized to fit customer needs. Touch and haptic sensors or touchless technologies using holographic sensors offer alternatives to traditional HMIs.

Flex

With the rise of simulation, AI, machine learning, audio processing, optical sensors, and innovative materials, Flex is leading the way in finding creative solutions to HMI requirements for medical and other devices.

Cross-Industry Technologies

In addition to medical HMI devices, other products that use Smart Audio and voice technology are produced by Flex.

Streaming audio, voice assistants, gesture control, adaptive beamforming, enhanced noise and echo cancelation, and customizable microphone arrays – it’s quickly becoming the norm to see technologies like these in any industry.

Flex

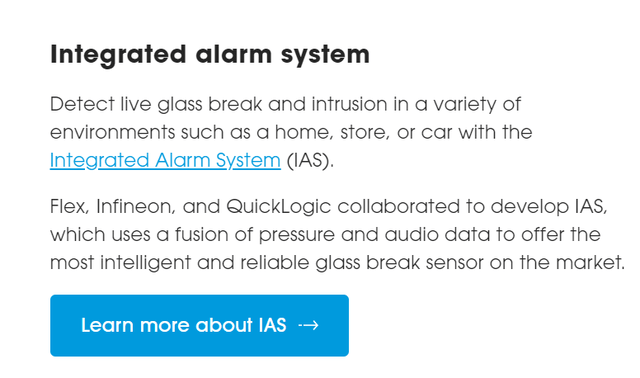

Flex offers a complete sensor ecosystem with the ability combine data streams from multiple sensors into a machine learning model to provide accurate detection of physical events. For example, they offer an Integrated Alarm System made in collaboration with Infineon (OTCQX:IFNNY) and QuickLogic (QUIK).

Flex

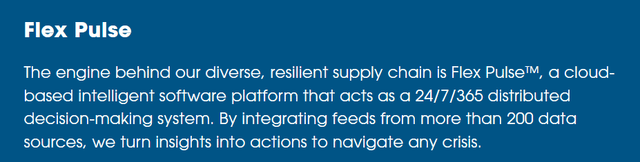

Smarter decision making through supply chain digitization is another service offered by Flex. Flex Pulse provides a data visualization dashboard to enable real-time supply chain management.

Flex

The company also offers other Analytics building blocks based on AI/ML technology as described on the company’s website:

Over the years, we have developed and deployed several real-time data and analytics applications in the It-Right platform powered by AI/ML to give our customers more confidence in their supply chains. Some of these solutions include:

A pricing application deployed in 2016, which leverages internal and external data to ensure that quotes for components are competitive and accurate.

A design application launched in 2017, including the company’s largest engineering parts database with over 5 million components, was developed to identify alternative parts. This supports multi-sourcing, as well as design and engineering activities.

An application to provide insight and visibility into the electronics components market that was implemented in 2020. The tool shows key metrics including pricing, lead times, and stock availability. Flex tracks over 340,000 unique parts week-over-week, which has resulted in faster and better decision-making to act on market trends to create value for Flex and our customers.

Financial Results

The fiscal year for Flex ends March 31 and the company reported Q423 and FY23 year end results on May 10. Results were very good with non-GAAP EPS of $0.57 beating consensus estimates by $0.06. Revenue of $7.3B increased 9.2% YOY. The Q124 revenue estimate is now $7.42B and Q124 EPS is estimated at $0.54. The FY24 EPS estimate now stands at $2.42.

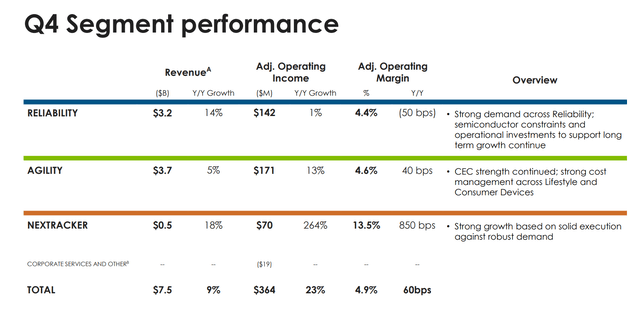

The company reports across 3 business segments – Reliability Solutions, Agility Solutions, and Nextracker, as shown in this slide from the Q423 investor presentation.

Flex Q423 investor presentation

All 3 segments reported YOY growth in revenues and adjusted operating income with Nextracker reporting the strongest growth based on solid execution against robust demand as shown in this slide from the investor presentation.

Flex Q423 presentation

Adjusted gross profits increased by 7.7% to $2,330M in FY23 from $1,957M in FY22. Adjusted operating income increased by 4.8% YOY to $1,442M. Adjusted EPS rose to $2.36 in FY23 from $1.96 in FY22.

On the earnings call, CEO Advaithi had the following comments regarding FY23 results:

Overall, it was another solid quarter. Our revenue grew 9% year-over-year with growth in our reliability, agility and NEXTracker segments. Adjusted operating margin came in at 4.9%, and we delivered $0.57 of adjusted EPS, which was a new record for fiscal Q4. Looking at the full year results, fiscal ’23 was very strong despite the continuing challenges in the macroeconomic landscape. We grew revenue 17% year-over-year with adjusted operating margins for the full year at 4.8%. And we delivered adjusted EPS of $2.36, up — up 20%. That’s the third year in a row EPS has grown at least 20%.

Breaking it down further by business unit, consumer devices was the only unit that did not experience YOY growth in the quarter, declining by -19% from FY22. In the Reliability segment, Automotive increased by 22%, Health Solutions by 9% and Industrial increased YOY by 24%. In the Agility segment, CEC increased by 30% YOY and Lifestyle by 2%. The Nextracker unit provides only about 6% of overall revenues but increased by 31% YOY.

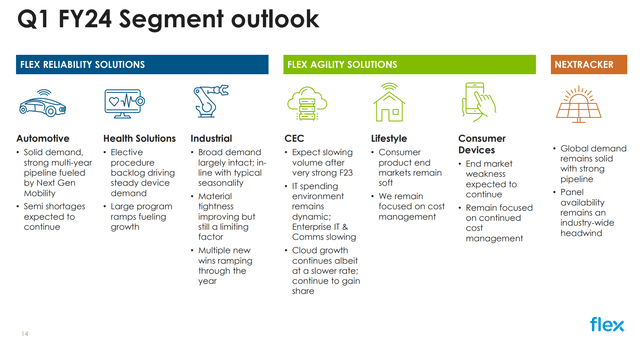

The outlook for Q124 is mostly optimistic and the details are explained in the following slide from the Q423 presentation.

Flex Q423 presentation

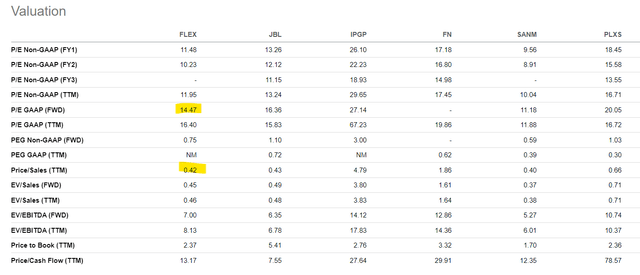

Valuation and Comparison to Peers

While Flex reported a strong quarter and the stock price has responded positively in the two months since the report, there is still some room for further price increases with a low Price/Sales ratio and reasonable forward Price/Earnings ratio, especially compared to peers. Only Samina (SANM) has better numbers in those 2 growth-oriented ratios.

Seeking Alpha

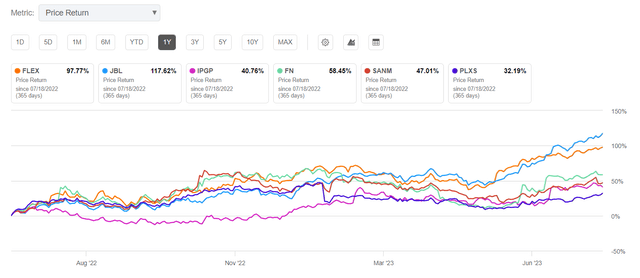

The performance of FLEX over the past year has been better than their peers except for Jabil (JBL), which has a similar growth trajectory and also a favorable valuation.

Seeking Alpha

Flex reports strong liquidity with an increase in net working capital from $3.6B in 2022 to $5.2B as of March 31, 2023, as described in the 10-K.

We believe net working capital is a key metric that measures our liquidity. Net working capital is calculated as current assets less current liabilities. Net working capital increased by $1.6 billion to $5.2 billion as of March 31, 2023, from $3.6 billion as of March 31, 2022. This increase was primarily driven by a $0.9 billion increase in inventories due to strong demand, coupled with increased buffer stock to address continued component shortages and logistics constraints, clear-to build constraints and logistics challenges and increases in inventory pricing, an $0.8 billion decrease in bank borrowings and current portion of long-term debt due to debt repayments, a $0.4 billion increase in accounts receivable, net and a $0.3 billion decrease in accounts payable, partially offset by a $1.1 billion increase in deferred revenue and customer working capital advances due to advances from customers to offset required investments in inventory.

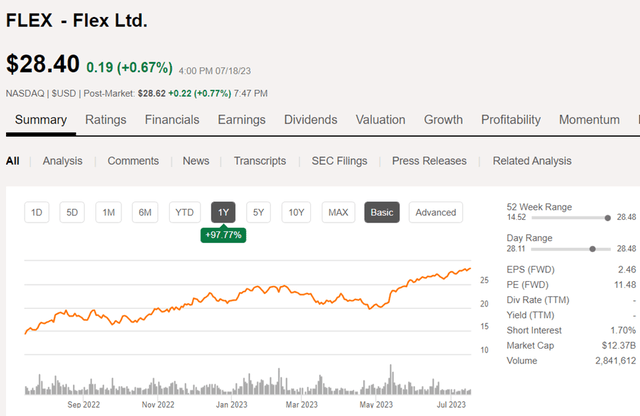

From a historical perspective, FLEX is trending higher over the past year in terms of GAAP P/E and Price/book ratios, so there is a risk that the price could pull back if there is any sign of slowing growth in the next quarterly earnings report, which is due to be released after market close on July 26. The momentum is currently working in favor of FLEX investors as the stock recovers from a very low valuation compared to a year ago.

Seeking Alpha

Risks to the Business

In the highly dynamic environment that we have been experiencing in 2022 and 2023 there are multiple risks to the Flex business including geopolitical uncertainty, ongoing inflation, rising interest rates impacting borrowing costs, continuing concerns of a recession in the US that could negatively impact demand, as well as competition from other manufacturers in certain niche industries such as automotive.

Regionalization is one area where Flex has addressed some of those risks by offering manufacturing at scale in more than 100 sites across 30 countries. They also offer advanced supply chain solutions as discussed above and can offer regional fulfillment networks. As the company navigates the various risks and uncertainties, they appear to be well positioned to excel using agile and adaptable solutions to global supply chain issues leveraging their years of experience and by making good use of AI/ML and other Industry 4.0 technologies.

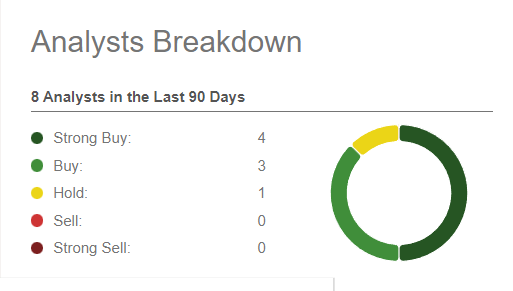

Ratings and Recommendations

Wall Street analysts like the FLEX stock and give it 4 Strong Buy, 3 Buy and 1 Hold ratings in the past 90 days, with 2 recent upgrades – one from Bank of America who kept a Buy rating and raised the price target from $28 to $31, and an analyst with JP Morgan started coverage with an Overweight rating and $30 price target.

Seeking Alpha

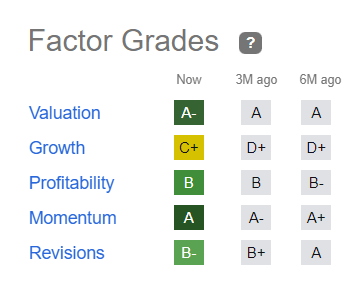

The SA Quant ratings give it high scores and currently place it #2 out of 19 stocks in the Electronic Manufacturing Services Industry.

Seeking Alpha

Although the stock has risen by nearly 100% in the past year and is near its 52-week high, I believe that the stock still deserves a Strong Buy rating given the forward P/E of 11.4 and with 6 upward revisions to future earnings.

Seeking Alpha

Overall, Flex is doing everything right to leverage AI technology for both its own manufacturing processes and for their customers and partners. They are improving margins, growing revenues at a healthy clip, and have a strong balance sheet. The company has a solid plan in place to leverage Industry 4.0 technologies to become a world leader in manufacturing for a variety of industries and end markets and are firing on all cylinders in executing on their transition plan.

In summarizing Q423 performance and the outlook for FY24, CEO Advaithi explained why their performance has improved so dramatically:

We are very well positioned to help companies reduce risk, decrease time to market and become more resilient. A good example is in our lifestyle business, which significantly outperformed weak consumer end markets in fiscal ’23 from targeted wins and share gains. Many of these wins came from our ability to regionalize our customers’ manufacturing and deliver in multiple geographies. Overall, we’ve done very well managing through this cycle, and that is reflected in our fiscal year performance.

We have built strong relationships with our customers and our suppliers, increased our opportunities for growth and implemented new capabilities across our operations that make us even stronger and more resilient going forward.

In summary, I am extremely impressed with the company, and I like the prospects for FLEX stock going forward and plan to buy shares for my personal growth portfolio at my next opportunity. I recommend that growth-oriented investors who are looking for strong AI-influenced ideas consider FLEX for your own portfolio.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Best AI Ideas investment competition, which runs through August 15. With cash prizes, this competition — open to all contributors — is one you don’t want to miss. If you are interested in becoming a contributor and taking part in the competition, click here to find out more and submit your article today!

Read the full article here