Thesis

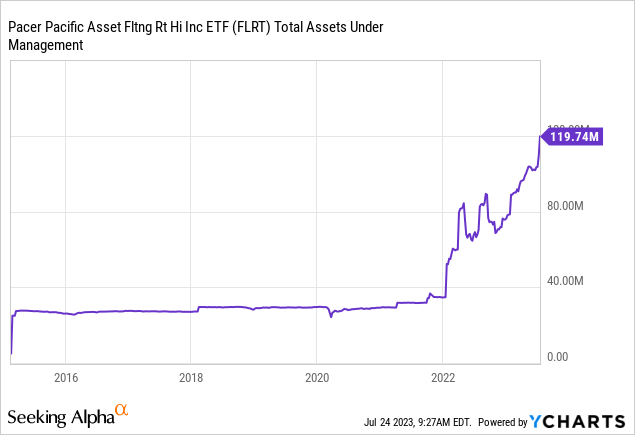

Pacer Pacific Asset Floating Rate High Income ETF (NYSEARCA:FLRT) is an exchange traded fund. The vehicle is on the smaller side with only $120 million in assets, but has seen its AUM balloon since the start of the rate hiking cycle:

The fund is a rare find, its portfolio blending floating rate leveraged loans with ABS/CLO securities. This composition has helped the name navigate very well the rising rate environment, given its overall duration of only 0.3 years. Floating rate assets have done incredibly well in the past year, both investment grade and high yield. Also, given risk free rates levels hovering around 5%, the all-in yields offered by this fund have moved to very appealing levels – the ETF currently has a 30-day SEC yield of 9%, distributed monthly.

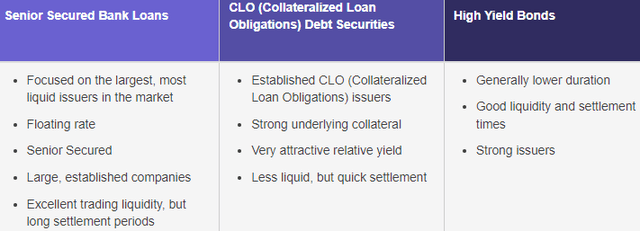

The vehicle seeks to provide a high level of current income, and it mainly invests in the below asset classes:

Fund Holdings (Fund Website)

Currently the portfolio contains roughly 50% senior secured bank loans, roughly 40% CLOs and 10% high yield bonds. The fund has had a total return in the past year exceeding its pure floating rate loan peers, but also takes slightly more risk via its composition. The CLO tranches purchased by the fund are usually mezz or subordinated tranches, which do offer higher yields but also higher risk via their embedded leverage.

What is a nice about this fund is the fact that it manages to achieve its yield with a very low standard deviation of 4.7, which was very close to the drawdown seen for the fund last year (-6.8% drawdown). We like funds which have yields exceeding their maximum drawdowns since you can safely ‘wait out the storm’ in those funds.

This Pacer fund is a great little gem with really robust risk/reward analytics. We are a Buy here for FLRT.

Analytics

- AUM: $0.12 billion

- Sharpe Ratio: 0.64 (3Y)

- Std. Deviation: 4.7 (3Y)

- Yield: 9%

- Premium/Discount to NAV: N/A

- Z-Stat: N/A

- Leverage Ratio: 0%

- Composition: Fixed Income – Leveraged Loans / ABS

- Duration: 0.3 yrs

- Expense Ratio: 0.61%

Holdings

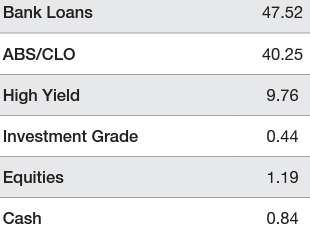

The fund contains a mix of leveraged loans and ABS/CLO securities:

Collateral (Fund Fact Sheet)

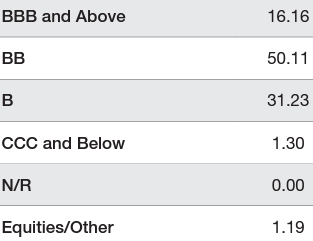

This build is interesting, because it contains embedded leverage. The fund is an exchange traded fund, thus has no leverage on top of the capital structure. However, the ABS/CLO tranches it contains are mezzanine and subordinated tranches mostly, thus containing anywhere from 25% to 35% embedded leverage. We can see the composition reflected in the fund’s rating matrix as well:

Ratings (Fund Fact Sheet)

Pure leveraged loan funds do not contain any investment grade securities because all leveraged loans are high yielding securities (as a rule of thumb). The fund’s ‘BBB and Above’ category contains some of ABS/CLO tranches discussed above.

The fund bought mezz/sub ABS/CLO tranches to enhance the yield in the vehicle. But nothing is for free in life – the additional yield comes with additional risk, namely credit risk. If a severe and prolonged recession hits, the price variability for some of the lower grade ABS bonds will be higher. Historically, even deeply subordinated ABS/CLO tranches have very low default rates, so the concern is more geared around volatility.

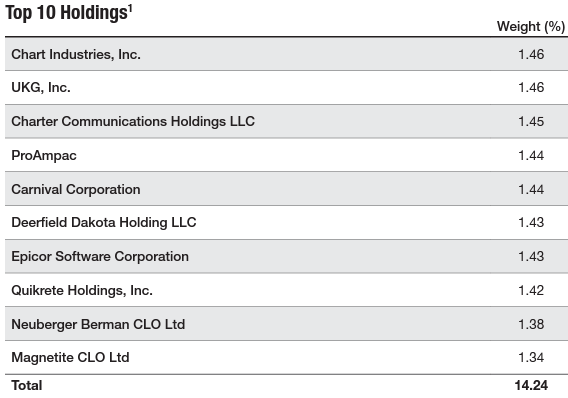

The fund is very granular, with no single name accounting for over 2% of the collateral:

Top 10 Holdings (Fund Fact Sheet)

Keep in mind that CLO tranches are themselves extremely diversified, with each CLO containing hundreds of individual leveraged loans.

Performance

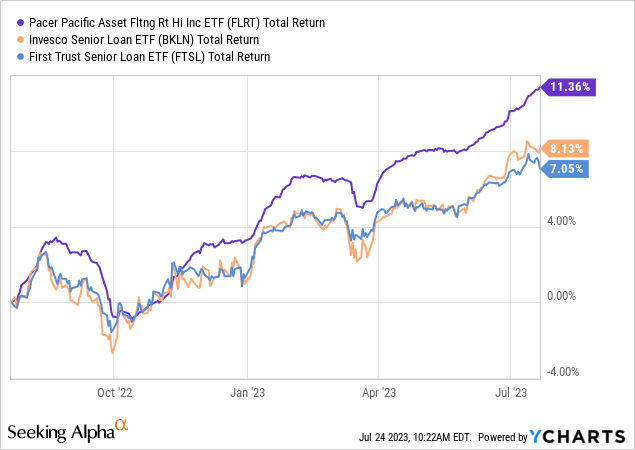

The fund has outperformed its pure leveraged loan peers in the past year:

We can see FLRT outperforming by almost 400 bps in the past twelve months. We are looking at a total return chart here, and the reason for that is represented by the high yields in the market currently, which we want to factor in.

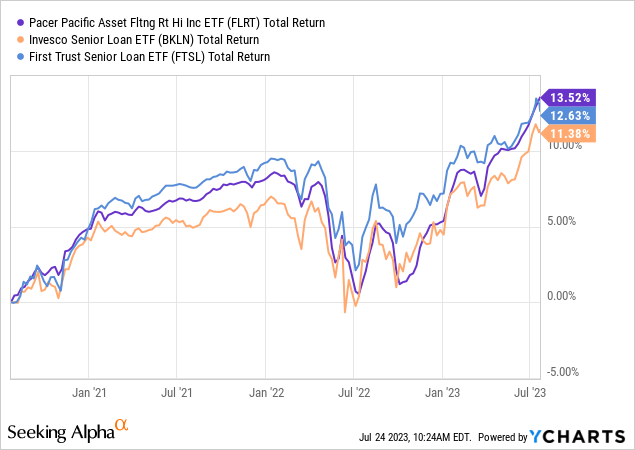

Longer term though, the vehicle is in the middle of the cohort from a performance standpoint:

The advent of higher rates had an initial impact on all the funds, but as yields rose in the underlying instruments, the fund’s carry started making up for the lost ground. Also to note, the collateral can change substantially here. It is unclear where the fund was in terms of its CLO allocation during 2021.

Conclusion

FLRT is an exchange traded fund. The vehicle has a mixed composition, blending leveraged loans, CLOs and high yield bonds. The fund has a current 30-day SEC yield of 9%, obtained with a low standard deviation of 4.7. The collateral pool is granular and diverse here, with the fund containing some embedded leverage via its mezz CLO tranche holdings. The fund has seen its AUM increase substantially on the back of higher rates, and has printed an 11% total return in the past year. This fund is a nice little find with attractive risk/reward analytics, and we are a Buy for the name.

Read the full article here