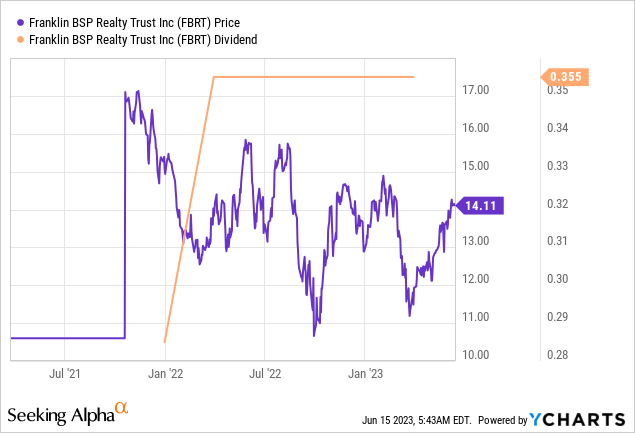

Franklin BSP Realty Trust (NYSE:FBRT) last declared a quarterly cash dividend of $0.355 per share, in line with its prior payout and for a 10% annualized forward yield. The stock price of the externally managed mortgage REIT has been resilient through 2023, a year that’s seen the Fed funds rate hiked to its highest level since 2008 and the March regional banking panic. Whilst the US economy has proven to be a lot more resilient than early expectations, the situation remains fluid against a gloomy global picture, where several developed nations have recently met the conditions of a technical recession. The prize here is a double-digit yield and a stock price that’s swapping hands at a discount to its book value per share of $15.78 as of the end of the mREIT’s fiscal 2023 first quarter.

Whilst the quarterly was raised from a maiden dividend of $0.285 per share, there have been no raises since then. Bears, who form the 2.38% short interest, would be right to state this conveys overall weakness with the mREIT’s commercial real estate debt portfolio. However, Franklin BSP should be commended for maintaining dividend stability against what’s been pertinent warnings about the health of US commercial real estate and wholesale dividend cuts across the mREIT industry. Are the common shares a buy? It depends. The expected June FOMC rate pause came with a caveat that there will be further interest rate rises later in 2023. Hence, any expected closing of the discount to book value will be limited in scope as macroeconomic conditions remain abnormal.

CRE Loan Originations Drives Dual Beats

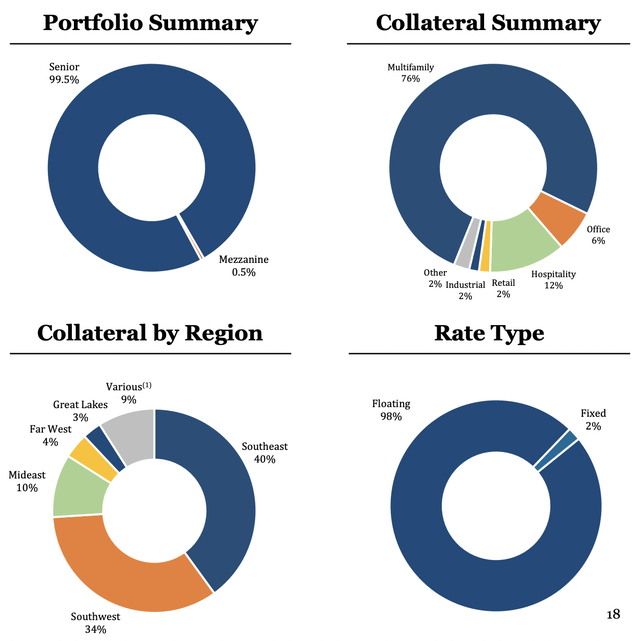

Franklin BSP owns a diversified portfolio of senior secured floating-rate loans. As of the end of the mREIT’s fiscal 2023 first quarter, this portfolio was worth $5.1 billion and spread across 150 senior loans at an average size of $34 million. There were also seven mezzanine loans at an average size of $3 million. The mREIT is heavy on CRE loans to multifamily properties at 76% of the portfolio, hospitality forms the second-largest sector exposure at 12% with office and retail at 6% and 2% respectively.

Franklin BSP Realty June Investor Presentation

The mREIT has also been more insulated against rising rates, with 98% of the portfolio being floating-rate loans. This drove first-quarter revenue of $62.77 million, a 13.9% increase over the year-ago comp and a beat by $8.76 million on consensus estimates. Franklin BSP closed $200 million on new investments at a weighted average spread of 580 basis points during the quarter. This was a large $120 million initial loan, with another $80 million in future funding, to a cross portfolio of 12 limited-service hotels at an all-in coupon of 10.60%.

GAAP net income was $43.8 million for the first quarter, up sequentially from $27.2 million in the prior fourth quarter. Distributable earnings were $44.8 million, around $0.44 per share, up sequentially from $38.8 million and $0.37 per share in the fourth quarter. It also beat consensus estimates by $0.07 and grew from $0.39 in the year-ago period. Critically, the mREIT’s payout ratio against the current quarterly dividend stands at 80.7%. This comes with the commons currently trading at a 10.6% discount against their book value. The mREIT exited the first quarter with three loans on its watch list, down from five in the prior quarter, with the Brooklyn hotel loan coming to a resolution in April. This saw the sale of the Williamsburg Hotel for $96 million in gross proceeds, with Franklin BSP recovering 100% of its principal on the loan and another $20 million in additional proceeds.

Exploring The Series E Preferreds

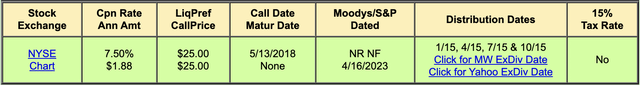

QuantumOnline

Franklin BSP 7.50% Series E Cumulative Preferred Stock (NYSE:FBRT.PE) offers a fixed $1.88 annual coupon for a 9.5% yield on cost. The preferreds are currently swapping hands for $19.75 per share, a roughly $5.25 difference and a 21% discount to their $25 par value. With the yield around 50 basis points lower than the common shares but with a larger discount to intrinsic value, the preferreds could present more overall value here. The preferreds also offer several distinct advantages. They’re cumulative to radically slim the likelihood of a coupon suspension, as any unpaid coupon will accrue as a liability on Franklin BSP’s balance sheet for repayment at a later date. Further, they’re perpetual, which means no maturity date. They’re currently trading five years past their May 13th, 2018 call date.

Seeking Alpha

Total returns year-to-date for the commons versus the preferreds place both securities at roughly the same level, albeit with the commons outperforming if you zoom out over the last 12 months. Whilst I don’t have a position in either security, I lean towards the commons with their fully covered double-digit dividend yield and well-positioned and conservative portfolio of floating rate loans set to maintain stability against the current abnormal macroeconomic environment. These are both holds.

Read the full article here