Introduction

Gladstone Commercial Corporation (NASDAQ:GOOD) is a Maryland-based REIT that owns industrial and office properties. GOOD has historically entered into, and intends in the future to enter into, purchase agreements for real estate having net leases with terms of approximately 7-15 years with built-in rental rate increases. The REIT invests in single-tenant and anchored multi-tenant net leased assets, with an industrial product emphasis. They are net lease, which is my favourite type of lease, as the tenant is required to pay most or all operating, maintenance, repair, and insurance costs and real estate taxes.

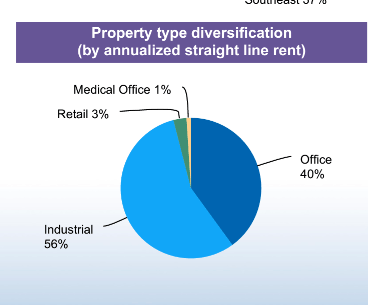

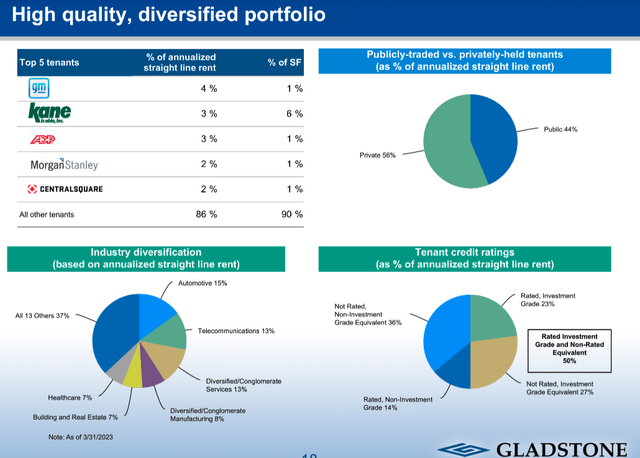

As of February 2023, GOOD owned 137 properties totalling 17.2 million square feet of rentable space, located in 27 states with an occupancy of ~96%, and a weighted average lease term of ~7 years. 59% of rent comes from industrial space, 39% from office, 3% in retail, and 1% in medical offices. The largest tenants include General Motors (GM), Kane Is Able Inc., ADP (ADP), and Morgan Stanley (MS). In fact, 50% of their rent is from investment grade (or equivalent if private) companies.

Q1 2023 Investor Presentation (Gladstone Commercial)

Q1 2023 Investor Presentation (Gladstone Commercial)

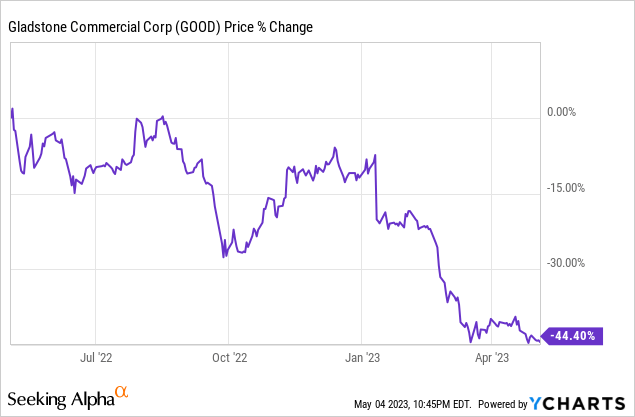

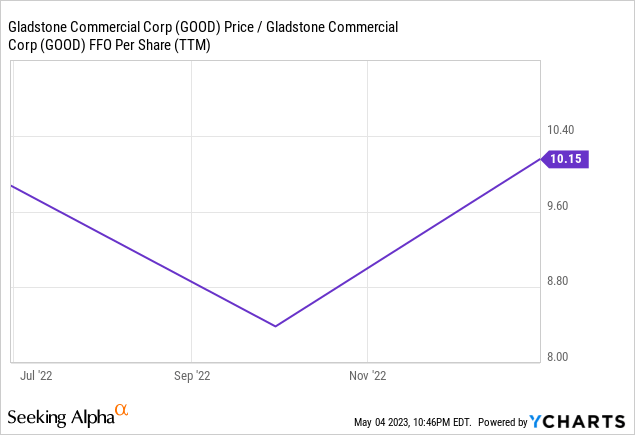

The common stock has fallen 44% over the past 10 months and now trades at ~10 FFO, which may seem like a steal for a REIT that is predominantly in the desirable industrial space, but as we will see this low valuation may in fact be warranted.

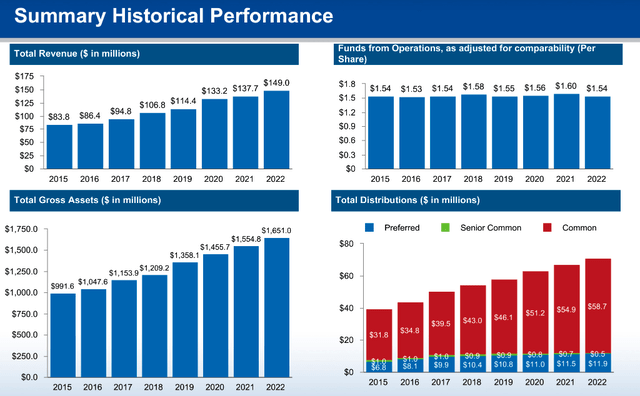

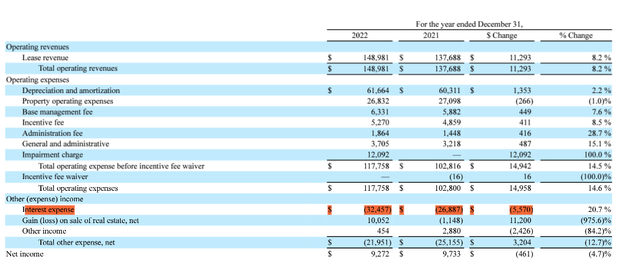

First of all, the REIT has managed to grow the revenues and assets YoY over the last eight years, but FFO remains flat. This is in part because of management and incentive fees paid under their advisory agreement which rise in line with increases in their asset base for finding, evaluating contracts, and assisting in the negotiating to purchase real estate on GOOD’s behalf. The management fee is 1.5% of equity and the incentive fee is based on core FFO exceeding 2.0% quarterly, or 8.0% annualized, which is the hurdle rate. The Adviser will receive 15.0% of the amount of GOOD’s pre-incentive fee Core FFO that exceeds the new hurdle rates. The incentive fee has been eliminated for the first two quarters of 2023, however.

Q1 2023 Investor Presentation (Gladstone Commercial)

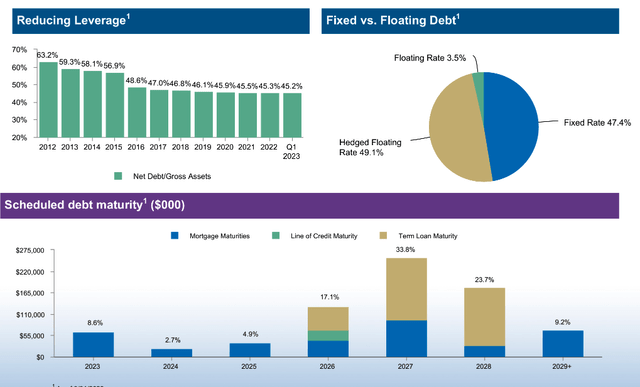

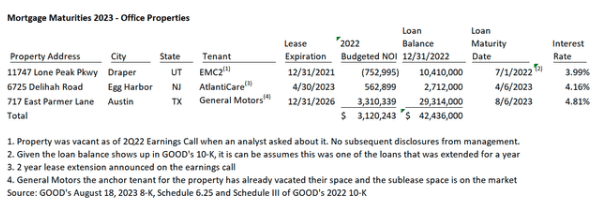

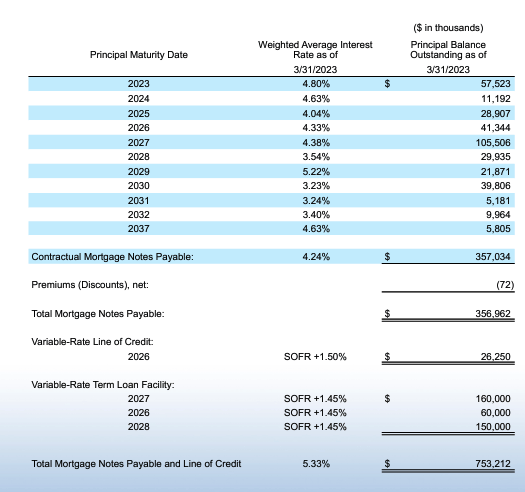

Second, interest expense has risen steadily since 2020 as a result of rising interest rates 19% YoY as a result of rate increases. As far as leverage goes, the REIT isn’t in the worst possible position, with 45% debt-gross book value and only 7% of debt coming due in 2023. In addition, the rates are predominantly fixed or at least hedged, with a weighted average rate of 5.33%. The majority of GOOD’s 2023 mortgage maturities are secured by office properties with tenants on short-term leases of three years or less, which is an asset class banks have been shying away from unless long-term leases are in place. This is because office space has become the most dreaded asset class as the work-from-home era has kicked into gear.

2022 FYE Results (Gladstone Commercial)

Q1 2023 Investor Presentation (Gladstone Commercial)

Q1 2023 Results (Gladstone Commercial)

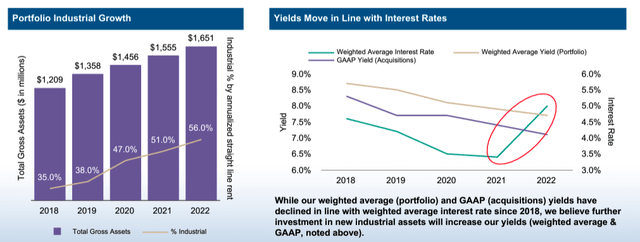

While interest rates have been rising on their fixed rate debt refinancing, the cap rates on their acquisitions have not kept up as per below, which is not a recipe for FFO growth. According to management:

The demand for industrial space has continued due to the continuing growth of e-commerce and recent trend of manufacturing onshoring, which appears to have partially rebounded from the adverse effects of COVID-19 on the commercial real estate industry in 2020, 2021, and early 2022. However, the increased cost of construction materials and product delivery delays caused by supply chain disruption and related inventory management issues, and the apparent labor shortage we are facing nationally, have resulted in inflation and higher costs for both industrial and office construction projects. Further, a tightening of available financing due primarily to higher interest rates has caused a slowdown in new construction starts throughout the fourth quarter of 2022, as compared to the record breaking third quarter of 2022, which should lead to lowered deliveries into 2024.

Source: 2022 Annual Report

Q1 2023 Investor Presentation (Gladstone Commercial)

Q1 2023 Investor Presentation (Gladstone Commercial)

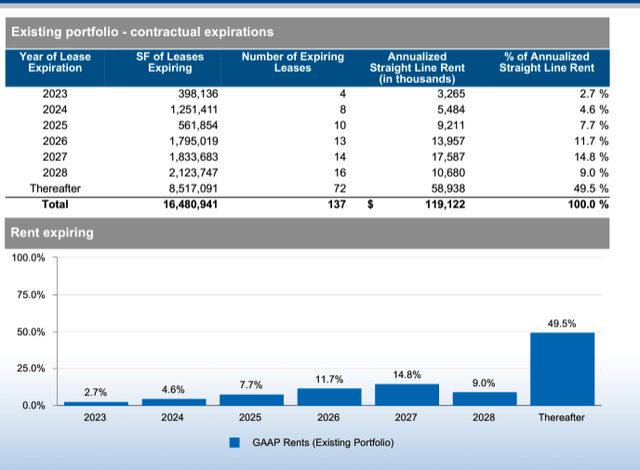

Now sure, they will be able to realize strong leasing spreads on their expiring leases, but unfortunately only four leases expire in 2023 and eight in 2024, which combined accounts for only 7% of rental income. Unfortunately, two of the leases expiring in 2023 are office properties which are now held for sale.

Q1 2023 Investor Presentation (Gladstone Commercial)

All of this has culminated into a multi-year FFO payout ratio of over 100% as management kept raising the dividend on a YoY basis despite little growth in FFO/share. At the end of 2022 management finally decided to cut the monthly payment dropped from $0.1254 per share to $0.10, a painful 20% haircut. This is a major red flag on management capabilities, considering they collected 100% of contractual rent throughout the year. Even that may not be enough with the payout ratio at 81% based on run-rate FFO.

The Preferred Shares

Now let me change the tone of this article from the negative to the positive. Just because the common shares show signs of being speculative does not mean the preferred offerings have to.

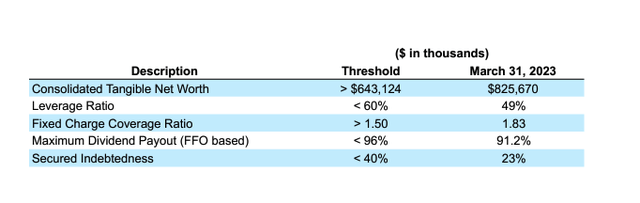

Gladstone is after all well onside with its credit covenants. It is unlikely they would have to suspend preferred dividend payments to be granted forbearance from their operating banks.

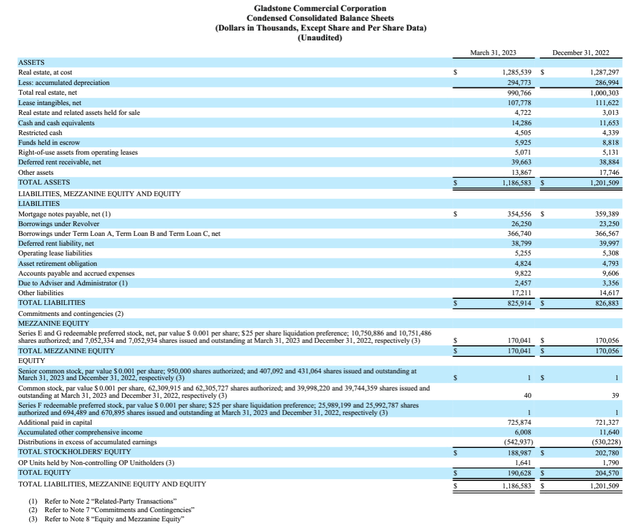

Q1 2023 Results (Gladstone Commercial)

Q1 2023 FFO was $14,847,000 or $0.37/share which annualized is $59,388,000 or $1.48/share (without the incentive fee however). This is FFO available to common shares relative to $3,002,000 in payments to preferred shareholders. That is coverage of almost 20x. The preferred shares may be 89% of book equity, but real estate is likely as little as $280 Million undervalued using a conservative 6% cap rate and a run-rate of $94 Million in NOI. Class B industrial space gets cap rates of 4-5% while class B office gets 6-7% in most US markets at this time.

Q1 2023 Results (Gladstone Commercial)

There are three preferred share issuances available, with the Class F being recently issued. 22,256 Class F shares were issued for net proceeds of $0.5 Million. Only the 6.625% Series E (NASDAQ:GOODN) and the 6.00% Series G (NASDAQ:GOODO) are publicly traded and are summarized below. Both issues have been beaten down over 30% since September 2022. Both issues are cumulative, meaning the common share dividend must be cut before the preferred share dividend can be and all preferred share payments must be paid in full before common dividends can be resumed. Both issues have similar current yields at 9.81-9.90% and upside to call which is over 24%. GOODO has the longer dated call date, so the high yield can be locked in for longer.

Gladstone Preferred Shares (Google Finance)

| Issue | Ticker | Monthly Dividend | Market Price | Yield | YTC | Call Date |

| Gladstone Commercial 6% Series G | (GOODO) | $0.125 | $15.18 | 9.90% | 24.22% | 06/21/2021 |

| Gladstone Commercial 6.625% Series E | (GOODN) | $0.138 | $16.63 | 9.81% | 25.28% | 10/04/2024 |

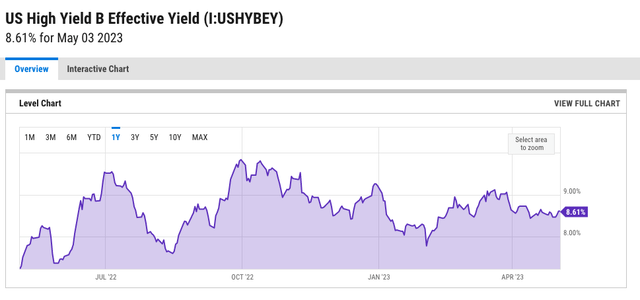

The debt does not seem to be rated by any of the major ratings agencies (Fitch, S&P, Moody’s). The REIT is still well onside with debt covenants but has a negative outlook, anything less than upper speculative grade (BB) seems unfair. I would argue Necessity Retail REIT (RTL) debt which I wrote on last week is hardly any less risky and is rated upper speculative. The US High Yield B Effective Yield is currently 8.61% meaning these preferred shares are trading at a 121-129 bps premium, indicating a huge mispricing.

US High Yield B Effective Yield (Interactive Brokers)

If you are in agreement with my fair yield methodology, these preferred shares should trade closer to $17.42 and $19.23/share, respectively.

Verdict

Q1 2023 results discussed some positives that have transpired between January and the end of April. Most notably the acquisition of a 76,089 square foot industrial property for $5.3 million at a cap rate of 9.70%, which is leased to one tenant on a 20-year lease. This should add half a million to NOI on an annual basis and was badly needed to keep pace with rate increases. They also collected 100% of the first quarter’s cash rents and 100% of April cash rents. They have listed their vacant office properties for sale at $17.5 Million and 158,501 square feet. Whether they can fully pay down the encumbrances is another matter.

The outlook does not look promising for the common stock and given the repositioning required to deleverage, I would not be surprised to see another dividend cut. The coverage on the preferred shares is still more than adequate, and the risk of these dividend payments getting cut is fairly low.

These preferred shares offer a low risk play to pocket double-digit returns in the preferred space.

Read the full article here