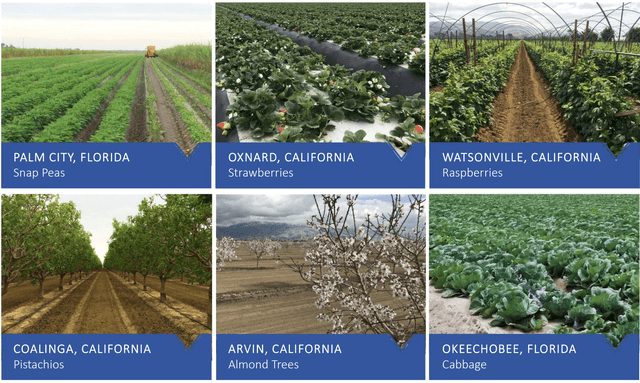

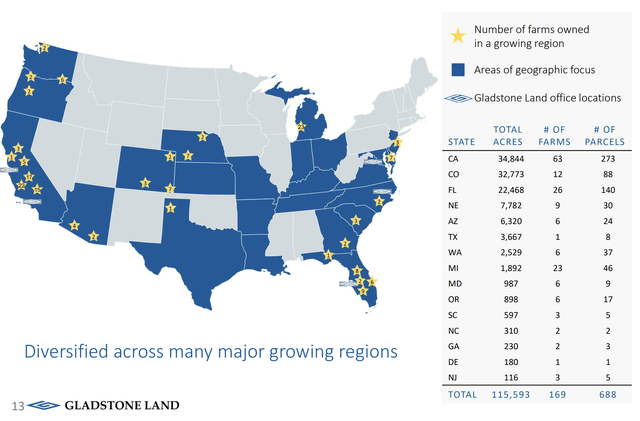

Gladstone Land (NASDAQ:LAND) has dipped 22% year-to-date and is down around 8% from when I last covered the ticker. The farmland REIT is now trading for 21x its price to annualized FFO for its recent fiscal 2023 third quarter. Whilst this multiple is higher than most equity REITs, Alexandria Real Estate (ARE) is currently trading at an 11.5x price to annualized FFO, it compares favorably to peer REIT Farmland Partners (FPI). FPI has recorded negative FFO for its last two quarters but is trading hands for roughly 74x times its forecasted forward FFO. LAND owns US farmland leased on a triple-net basis to farmers growing fruits, vegetables, and nuts. The REIT owns 116,000 acres on 169 farms and about 45,000 acre feet of banked water. Critically, the most striking part of LAND’s bullish thesis is its numbers for the underlying value of its assets.

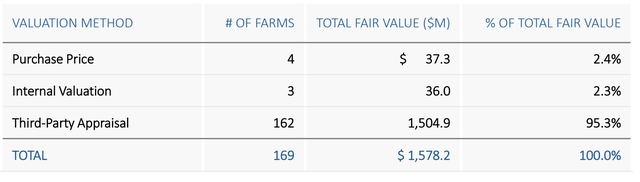

And together, they are valued at approximately $1.6 billion for both the land and the water.

LAND August Presentation

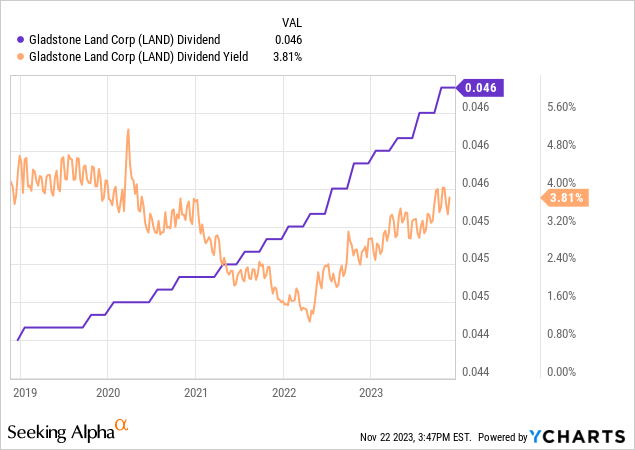

This estimate was provided by LAND’s CEO during the third quarter earnings call. The REIT is currently trading at a $520 million market cap, roughly a third of this estimate. LAND is diversified with its farmland leased to around 90 different tenant farmers growing 60 different types of crops. The REIT pays out its dividend every month, last paying $0.0464 per share, unchanged sequentially and for a 3.8% annualized dividend yield.

Operations, Tenant Issues, And Dividend Coverage

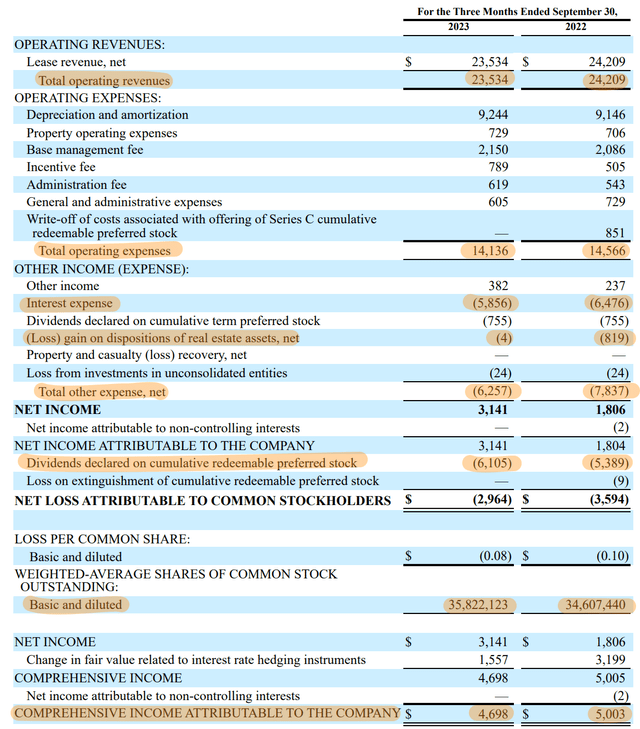

LAND has raised its dividend by a 3-year compound annual growth rate of around 1%. The REIT recorded third-quarter revenue of $23.53 million, down 2.8% over its year-ago comp and a beat by $2.11 million on consensus estimates. Total operating expenses at $14.14 million were down by around $430,000, or 3%, over the year-ago period. The dip in operating revenue came with 12 farms currently being operated by a third-party management company and another three farms being vacant.

LAND Fiscal 2023 Third Quarter Form 10-Q

The REIT recorded a third-quarter adjusted FFO of $5.6 million, around $0.15 per share, down roughly 6 cents from the year-ago period. Hence, the REIT currently covers the 3-month aggregate of its dividend by 109%, a 92% payout ratio. The most striking figure from LAND’s operations is that interest expense at $5.86 million fell from $6.48 million in the year-ago period despite the Fed fund’s rate being hiked to a 22-year high at 5.25% to 5.50% through the period. Further, the REIT’s weighted average shares of common stock outstanding rose over its year-ago comp by 3.5% to 35,822,123. Whilst LAND has to optimize its capital stack by issuing new equity, doing so whilst trading at a discount to stated intrinsic value is dilutive. 3.5% isn’t terrible though but not ideal.

American Farmland On The Cheap

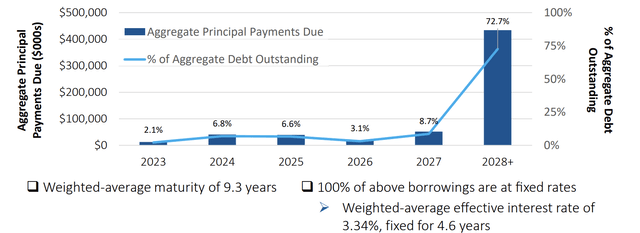

LAND August Presentation (Debt Maturities)

The REIT held a total debt balance of $644 million at the end of the third quarter, with 100% of this being at a fixed rate. This was with a weighted average effective interest rate of 3.34%, remarkably fixed for 4.6 years. Further, it’s incredibly well laddered with 72.7% of the balance only coming due past 2028. Hence, LAND has been relatively resistant to the impact of rising rates on its operations. FPI has a significantly more floating rate portfolio which has caused its recent FFO numbers to be negative and for the REIT to be forced to sell some of its farm properties to bridge its liquidity gap and meet dividend payments.

LAND August Presentation

Is LAND a buy? It depends. Investors buying for diversification have received a ticker that’s tracked the broader REIT market lower over the last year despite a heavily fixed balance sheet. However, 2024 stands to provide some positive upside catalysts toward REIT sentiment with the CME’s 30-Day Fed Funds futures pricing data placing the odds of any further interest rate hikes at close to zero. Whilst any future cuts would not have a material impact on LAND’s existing operations due to its long-dated maturity and low fixed-rate debt, it would improve underlying investor sentiment and could drive some positive upward share price moves. This would also help its Series B (NASDAQ:LANDO), Series C (NASDAQ:LANDP), and Series D (NASDAQ:LANDM) preferreds to back to their $25 par value.

LAND August Presentation

Management’s $1.6 billion ballpark figure for the underlying value of their assets forms the core reason for a long position in the REIT. This would be a case for acquiring US farmland and water assets for around 33 cents on the dollar. The REIT is down around 65% from its all-time high in early 2022 before rates started rising markedly. LAND currently does not fill a niche with its dividend yield less than what you could get on a certificate of deposit which is currently offering rates of up to 5.75%. Hence, LAND will continue to trade somewhat flat like other REITs until the Fed starts cutting rates and the dividend yield looks more attractive. The ticker is a hold.

Read the full article here