The Golden Rule: He who has the gold makes the rules. – Anonymous

As the ultimate diversifier, gold has historically been a reliable asset to turn to during periods of stock market turmoil, economic uncertainty, and increasing risks. With its strong performance year-to-date, there’s been a lot of talk about the potential that it finally breaks out from longer-term resistance and pushes to new highs.

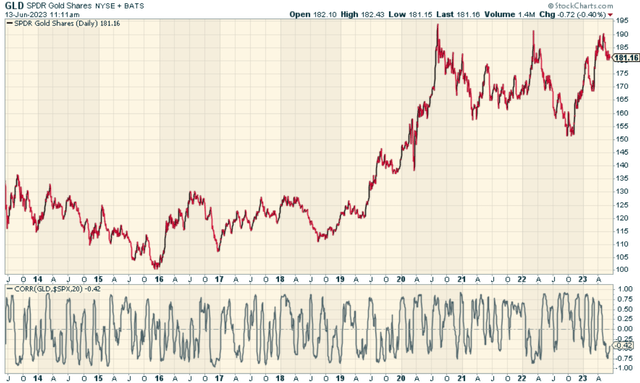

In order for this to happen, I think we need to see a risk-off stock market moment. Using the SPDR® Gold Shares ETF (NYSEARCA:GLD) as a proxy, we can see that we are on the cusp of either a breakout, or another leg lower and failed move.

TradingView

Gold Versus Stocks

In comparison to the S&P 500 (SP500), we know that Gold has been a terrible performer (which, by the way, is exactly what makes it such a good diversifier, because of its non-correlation). It’s worth noting that the ratio of GLD to SPY still looks like it’s in an uptrend, just as everyone is screaming about a new bull market for stocks.

TradingView

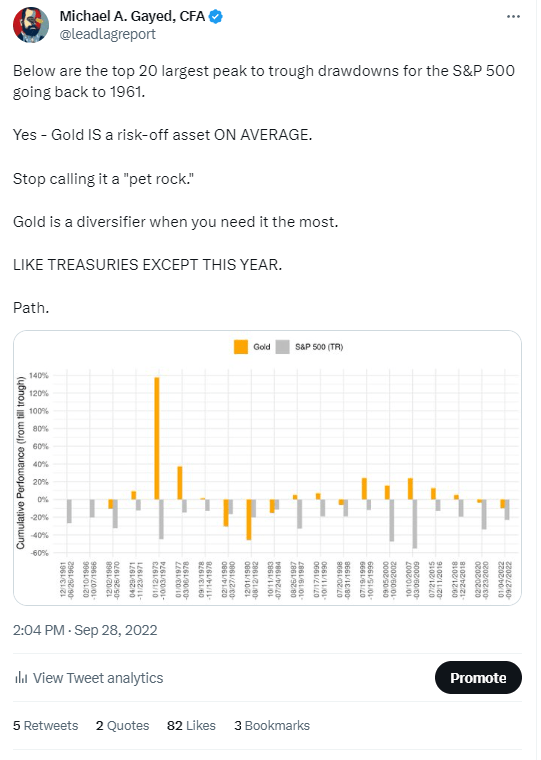

Gold as a Diversifier

As a diversifier, gold has several unique attributes that can help reduce the overall risk of an investment portfolio. These characteristics include its low correlation with other assets, such as stocks and bonds, and its ability to act as a hedge against inflation and currency devaluation.

Low Correlation with Other Assets

One of the primary reasons investors consider gold a diversifier is its low correlation with other assets. This means that gold’s price movements tend to be independent of the performance of stocks, bonds, and other traditional investments. This low correlation can be particularly beneficial during periods of market turbulence, as it can help to reduce the overall risk of an investment portfolio and potentially offset losses in other asset classes.

There is ample evidence that suggests GLD’s low to negative correlation actually is additive to a portfolio over time, even though in the small sample it can detract from the overall performance.

StockCharts.com

Hedge Against Inflation and Currency Devaluation

Gold is also widely regarded as a hedge against inflation and currency devaluation. As the value of paper currencies declines due to inflation or other economic factors, gold’s value has historically tended to rise, providing investors with a means of preserving their wealth.

I suspect that a Fed pause could cause the Dollar to enter a long-term secular bear market, which would be supportive of the yellow metal.

TradingView

Benefits of Investing in GLD

I’m not interested in debating whether one should hold physical Gold or paper Gold. With that said, investing in the GLD ETF has several advantages over owning physical gold, including:

- Liquidity: GLD shares can be easily bought and sold on the stock market, providing investors with a high degree of liquidity and flexibility in managing their investments.

- Lower Costs: Unlike physical gold, which may require storage and insurance fees, GLD shares have no such costs, making them a more cost-effective investment option.

- Diversification: As a gold-based investment, GLD shares can provide investors with the diversification benefits of gold without the hassle of owning the physical metal.

Gold’s Momentum and a Stock Market Correction

Gold’s momentum is likely to persist only when a stock market breakdown and risk-off period takes place. As stock market volatility continues, investors may increasingly turn to gold as a means of preserving their wealth and mitigating the risks associated with stock market corrections. This flight-to-safety sequence could further reinforce gold’s role as a diversifier and strengthen its appeal as an investment option. If that happens to occur with Gold already hovering around its multi-year highs, that may be just enough of a reason for a sustained breakout.

Twitter

Conclusion

Gold has demonstrated its value as a diversifier and potential hedge against stock market corrections and economic risks. While momentum may have stalled, any kind of sudden volatility surge in equities may be exactly what’s needed for momentum to re-assert as allocators position defensively and remain wary of Treasuries as a diversifier. This is a particularly fascinating juncture for markets and one which I think we will look back on as having fooled bulls and bears.

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Are you tired of being a passive investor and ready to take control of your financial future? Introducing The Lead-Lag Report, an award-winning research tool designed to give you a competitive edge.

The Lead-Lag Report is your daily source for identifying risk triggers, uncovering high yield ideas, and gaining valuable macro observations. Stay ahead of the game with crucial insights into leaders, laggards, and everything in between.

Go from risk-on to risk-off with ease and confidence. Subscribe to The Lead-Lag Report today.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

Read the full article here