Introduction

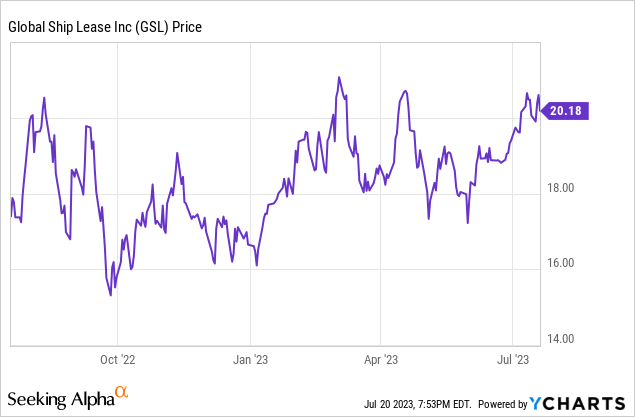

It has been two years since I last discussed the preferred shares issued by Global Ship Lease (NYSE:GSL) and that usually means good news: the only task of a preferred share is to continue to make the preferred dividends on a quarterly basis and Global Ship Lease has definitely done so. In the previous article I argued an investment in the preferred shares was a bet on the company not calling the preferreds for redemption as the preferred shares can be called at any given day. This obviously hasn’t happened yet and investors generated an absolute return of almost 20% on these preferred shares.

Long-term charters provide a nice cushion for the next 2-3 years

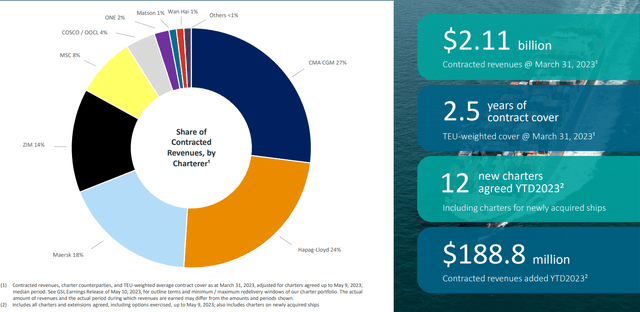

As this article is meant as an update to my previous articles on GSL and its preferred shares, I will mainly focus on the company’s financial performance from the perspective of a preferred shareholder rather than providing a deep dive into the business model. That business model is pretty simple: Global Ship Lease owns container vessels which it leases out to the operators. Its top-4 of lessees will look familiar with the world leaders like CMA CGM, Hapag-Lloyd, Maersk and ZIM (ZIM) as main lessees accounting for 83% of the contracted revenue.

GSL Investor Relations

The company currently owns 68 vessels after completing a recent sale and leaseback agreement on four old container vessels.

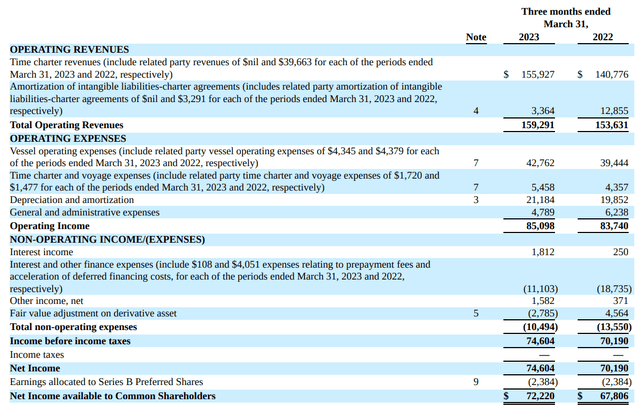

During the first quarter of this year, the total revenue came in at $159.3M, which includes about $3.4M in amortization of intangibles. The total operating costs were just $75M resulting in an operating income of $85.1M. This included about $21.2M in depreciation and amortization expenses on the vessels.

GSL Investor Relations

And as Global Ship Lease has a good handle on its leverage and debt situation, the net finance expenses actually decreased during the first quarter (and Global has hedged its interest rate risk) and this resulted in a net income of $74.6M and after taking the preferred dividend payments into consideration the net income attributable to the shareholders of Global Ship Lease was $72.2M or $2.02 per share. A good result for a company trading at just around $20 per share.

The income statement also already provides a very important piece of information for the shareholders of the preferred shares: as you can see above, the company needed just 3% of its net income to cover the preferred dividends. And even if the charter rates would fall by about 40% across the board upon rechartering (this is just a theoretical explanation to prove a point), the preferred dividends would still be fully covered. So from a preferred dividend safety perspective, the preferred dividends are well-covered.

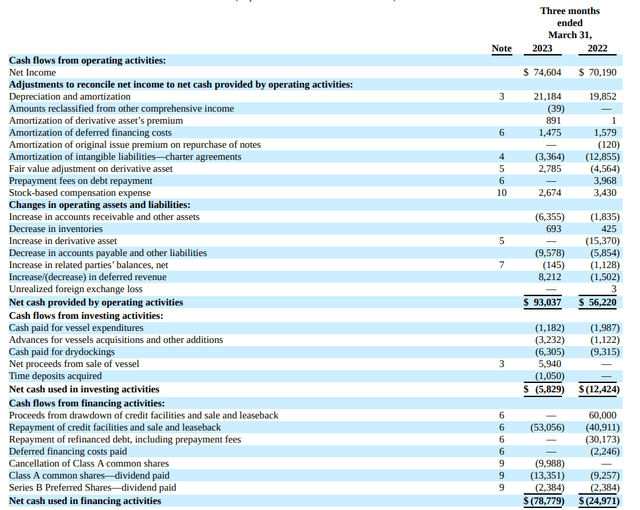

Looking at the cash flow result, Global Ship Lease released an operating cash flow of $93M. This includes a net investment in the working capital of $7.2M which means the underlying operating cash flow exceeded $100M in the first quarter of the year.

GSL Investor Relations

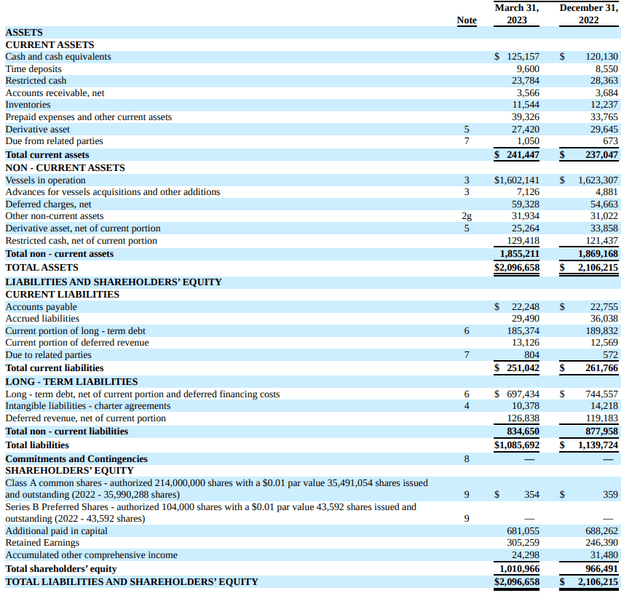

This means Global Ship lease generated plenty of cash to cover the dividends on the preferred shares and the common shares (just under $16M combined). The strong cash flow obviously helped GSL to complete the $123M purchase of the sale-and-leaseback vessels subsequent to the end of the first quarter. The company’s cash position increased to $125M as of the end of Q1 while the total gross debt level was approximately $880M resulting in a net debt of just over $750M. This is backed by a book value of the vessels of in excess of $1.6B. And as you can see below, this means that there was about $900M in common equity which ranks junior to the preferred shares.

GSL Investor Relations

As of the end of Q1, there were 4.36M preferred shares outstanding for a total principal value of $109M.

The preferred shares

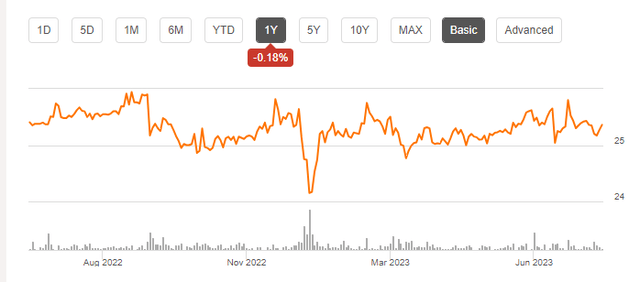

The preferred shares (NYSE:GSL.PB) have an 8.75% distribution rate which works out to $2.1875/share per year, payable in four equal quarterly tranches. As a reminder, these preferred shares can be called by Global Ship Lease at any time, that is the main risk here.

Seeking Alpha

And as mentioned earlier in this article, the dividend coverage and asset coverage level of the preferred shares is strong. It will however be interesting to see the charter rates once Global Ship Lease will have to extend and renew leases.

Investment thesis

Two years ago I focused on buying and expanding my position in GSLD, the publicly traded baby bonds of Global Ship Lease. That meant I wasn’t too focused on the preferred shares, but I think they are still pretty attractive. Sure, the preferred shares are still trading at a premium to the principal value (which obviously also is the call price) but the share price will rarely exceed $25 + 1 quarter of preferred dividends so even if one would buy it right away and see the prefs get called right away, the downside would be limited to just a few cents per share.

It will be very interesting to see the new charter rates for some of the older vessels once they are up for renewal, but thanks to the robust balance sheet and the relatively low amount of preferred shares outstanding, I don’t think the preferred dividends would be in jeopardy. As mentioned before, even if the charter rates would drop by 50% across the board, the preferred dividends would still be fully covered.

Read the full article here