Investment Thesis

Gold and gold miners have gained significant traction since the outbreak of the COVID-19 pandemic in 2020. With heightened market volatility driven by global events such as the pandemic and geopolitical tensions, gold has emerged as a favored safe haven asset. This article delves into the factors driving gold’s success, including central bank buying activities, short positions in Treasuries, and the strength of the US dollar. The discussion also highlights the need for a forward-looking approach and considerations for investors regarding gold miners and potential market corrections.

About GOAU

The U.S. Global GO GOLD and Precious Metal Miners ETF (NYSEARCA:GOAU) is an exchange-traded fund that focuses on providing exposure to gold and precious metal mining companies. GOAU offers investors a convenient way to gain exposure to the gold and precious metal mining sector. By investing in a diversified portfolio of companies involved in the exploration, development, and production of gold and other precious metals, the fund aims to capture potential growth opportunities within the industry.

US Global ETFs

Investors can use GOAU as part of their portfolio to hedge against inflation or diversify their investment holdings. The fund can serve as a strategic allocation to the gold and precious metal mining sector, providing exposure to a tangible asset class that historically has been viewed as a store of value during times of economic uncertainty.

For further details, please make sure to check the fund’s prospectus.

Bear Flags Abound

Gold has emerged as one of the top-performing assets since the onset of the COVID-19 pandemic in early 2020. The heightened market volatility resulting from the pandemic, followed by the Russian war in Ukraine and subsequent inflationary pressures, have all contributed to this trend. Gold has long been recognized as a safe haven asset in times of rising uncertainty, and it has in my opinion performed as expected during this period.

Refinitiv Eikon

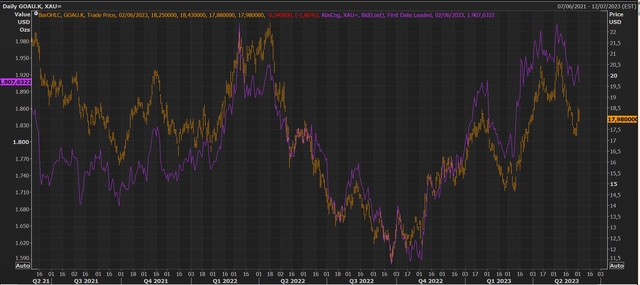

Gold miners have reaped the benefits of the increased value of their underlying commodity, garnering attention from market participants. However, it’s important to note that prices have exhibited extreme volatility. For example, if we consider the peak-to-trough performance for GOAU from Q1 2020 to the present, the value of the corresponding investment declined by over 50%. While there have been remarkable opportunities for profit, it underscores the wild swings experienced in recent months. Yet, as investors, we must focus on the future rather than dwell on the past and I have reason to believe that gold and by extension gold miners seem to be overstretched currently.

Refinitiv Eikon

Central bank buying activities have played a significant role in driving gold prices higher over the past few quarters, as they seek to diversify their holdings away from the dollar-based economic order. However, there are limits to how much gold central banks can acquire, given the prominence of Treasury bonds as the asset of choice at the heart of this dollar-based system. A rising dollar also puts pressure on other currencies, and we’ve seen a very strong dollar over the last 18 months.

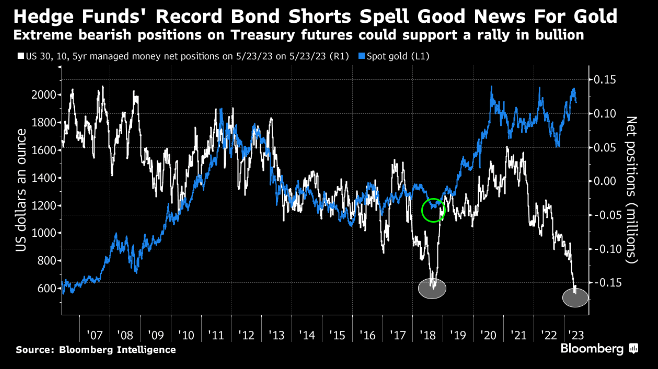

Additionally, short positions in Treasuries resulting from higher interest rates have acted as a positive catalyst for the gold market. Currently, Treasury shorts have reached extreme levels, suggesting the potential for a rally. This will be further accelerated by the debt ceiling resolution, where gold again was touted as a safe haven asset.

Bloomberg

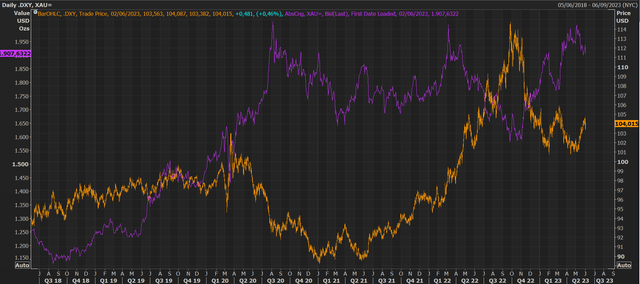

It’s worth noting that the dollar has displayed unexpected strength in recent weeks, which should be closely monitored. Economic data from Europe has been bearish compared to the one in the US, propelling the dollar higher while the price of gold trended lower. The dollar may remain range-bound until we witness a deterioration in US economic data that prompts a more accommodative monetary policy from the Federal Reserve. However, we have not reached that stage yet, and a resilient dollar poses challenges for gold bulls.

Refinitiv Eikon

Taking a cyclical perspective, I believe it’s prudent for investors to exercise caution and consider reducing exposure or implementing hedging strategies as gold still trades near its all-time highs. Although new highs are possible, the likelihood of a correction has increased in recent months in my view. In addition to the debt ceiling agreement and inflation coming down, another bear flag could be the resolution of the conflict in Ukraine early next year.

Refinitiv Eikon

Key Takeaways

To sum up, gold has been an excellent investment since 2020. It has delivered on its safe haven asset promise during times of heightened volatility. Gold miners have naturally benefited from higher prices and while the path has been volatile, GOAU is now trading on the higher end of the last 5-year range. Considering the current high levels of gold, the bullishness surrounding this asset, lower inflation, and a potential resolution to the Ukraine conflict, I would be cautious on the long side and probably look to sell or hedge out my position.

Read the full article here