Stocks of business development companies have sold off in response to increased market concerns about regional banks, and I believe that passive income investors who value dividend stability should overweight those business development companies with good dividend coverage and invest in the safest forms of debt with a low default probability.

Despite the fact that Goldman Sachs BDC (NYSE:GSBD) saw a drop in new investment originations in the first quarter due to the sharp rise in short-term interest rates, I believe GSBD has become very appealing as a high-yielding dividend investment.

I’m not concerned about the drop in originations because the Fed may pause rate hikes later this year.

Given that Goldman Sachs BDC has continued to outperform its dividend with net investment income, and that the stock is currently trading at a discount to NAV (and at a 52-week low), I recommend GSBD to passive income investors.

Portfolio Growth, New Originations And Credit Quality

During crises, such as the one currently unfolding in the U.S. banking system, it is far more important for business development firms to maintain a high-quality investment portfolio and good credit quality rather than pushing for new originations and portfolio growth.

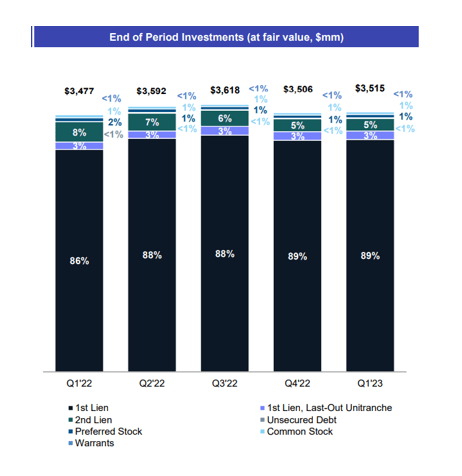

The investment portfolio of Goldman Sachs BDC consisted of 92% highly rated first liens, 5% second liens, and only 2% equity. While equity exposure can result in higher valuations in a rising economy, a large allocation of funds to the Equity Category can be problematic in a falling economy, when defaults tend to rise. As a result, I am very comfortable owning GSBD because I believe the portfolio is well-positioned defensively.

End Of Period Investments (Goldman Sachs BDC)

Looking at Goldman Sachs BDC’s new gross originations in the first quarter, we can see that the company continued to favor First Liens/Senior Secured Loans, which accounted for 100% of the company’s new investment commitments.

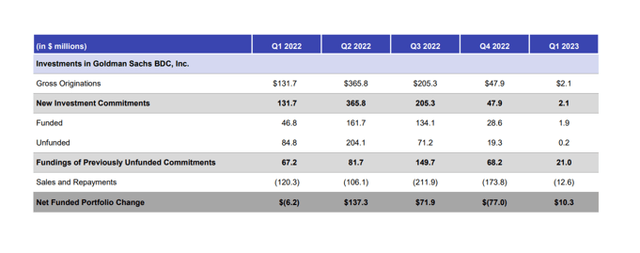

The sharp drop in gross originations at Goldman Sachs BDC is due to higher interest rates, which weigh on demand for new investment capital. The BDC originated only $2.1 million in new loans in the first quarter of this year, compared to $131.7 million in the same period last year.

I don’t think GSBD will see a short-term rebound in origination activity unless the central bank acknowledges the pain felt by many financial institutions and begins to cut interest rates. Investors should not expect a lot of portfolio growth in 2023, as originations have almost completely stopped.

New Investment Commitments (Goldman Sachs BDC)

Goldman Sachs BDC Has Solid Good Portfolio Quality And Dividend Coverage

Goldman Sachs BDC maintained good dividend coverage in the first quarter, despite increased uncertainty caused by the U.S. banking system. As a provider of debt capital, it is critical that business development companies like Goldman Sachs BDC provide solid dividend coverage and a well-performing loan portfolio to passive income investors.

Overall portfolio quality remained strong in 1Q-23, as the BDC added one debt investment while exiting another. The non-accrual ratio was 0.6% on March 31, 2023, compared to 0.3% on December 31, 2023. In my opinion, a non-accrual ratio of less than 1% is not cause for concern.

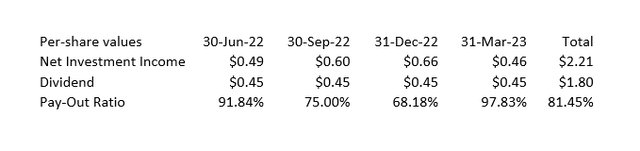

Goldman Sachs BDC earned $0.46 per share in net investment income in the first quarter, compared to $0.49 per share in the same period last year. The dividend payout has remained constant at $0.45 per share.

Goldman Sachs BDC’s payout ratio in the first quarter was 98%, while the payout ratio over the previous 12 months was 81%. Thus, unless GSBD experiences a fundamental change in its underlying credit quality, the dividend should be sustainable, in my opinion.

Pay-Out Ratio And Dividend (Author Created Table Using BDC Information)

Goldman Sachs BDC’s Valuation Implies A Moderate Margin Of Safety

Goldman Sachs BDC had a net asset value of $14.44 per share as of March 31, 2023, a 3% decrease QoQ.

With the BDC’s stock currently trading at $13.01 per share, the valuation reflects a solid 10% discount to net asset value. Most BDCs have recently seen valuation cuts, which are not due to poor performance but rather to the stock market’s general risk-aversion. The 10% NAV discount makes GSBD an especially appealing passive income investment in my opinion.

Upside/Downside Risks For Goldman Sachs BDC

Goldman Sachs BDC is a well-managed, First Lien-focused business development company with significant potential to grow its portfolio in a lower-rate environment as demand for capital and origination opportunities rises.

If the U.S. bank crisis triggers the economy to enter a recession, which increases the likelihood of loan defaults, Goldman Sachs BDC may see an increase in non-accruals. However, as long as GSBD covers its dividend with NII, I am unconcerned.

My Conclusion

Goldman Sachs BDC’s stock price did not deserve to fall to a 52-week low last Friday, given that the business development company overall provided a very good earnings report for the first quarter.

Even though the BDC’s origination declined in 1Q-23 due to higher interest rates, the dividend of $0.45 per share was still covered by net investment income, and the stock is currently trading at a discount to net asset value.

I believe investors should take advantage of the selloff and buy GSBD. Though the 13.8% yield appears to be excessive, it is covered by the BDC’s NII.

Read the full article here