Introduction

Since November 2022, I’ve written only 3 articles about Alphabet Inc. (NASDAQ:GOOG) (NASDAQ:GOOGL), the last of which warned investors that the stock could face the “sell the news” phenomenon after the release of financials for the first quarter of fiscal 2023. I rated GOOG as a “Hold” at that time.

Fortunately for investors, I was wrong – Google has grown even more since then, increasing its market capitalization by about $200 billion [+15%]. This coincided with the ongoing AI craze in the market, which remains prevalent to this day. Take, for instance, the case of NVIDIA (NVDA) stock. Despite not having the largest operations, it has emerged as the leading semiconductor manufacturer stock, surpassing all other peers in the market.

If you’re reading this article, you’re probably wondering what’s next for GOOG – will the company continue to grow and pick up the AI tailwind, or is all the growth already priced in and the stock has little room for expansion? Let’s try to figure it out together with the help of critical thinking, financial analysis, and recently published calculations from major investment banks.

Google And Its AI Revolution

During Google I/O on May 10, 2023, Google announced significant updates and new AI-driven features across its products and services. Key highlights include the launch of PaLM 2, Google Bard’s expansion, the introduction of Gemini, improved AI-powered search tools, generative AI features in Workspace, the release of Google Cloud’s Vertex AI platform, and a focus on safety with new tools. These developments solidify Google’s position as a leader in AI-driven businesses, Goldman Sachs analysts commented in their note right after the conference [proprietary source, 05/11/2023].

J.P. Morgan’s analysts also commented [proprietary source, 05/10/2023]. They find that Google demonstrated real progress in re-imagining Search and other products with Generative AI, reclaiming the narrative from Microsoft (MSFT). Google’s accelerated pace of innovation is evident in getting GAI-driven products to users and businesses. The company’s wide user base, with over 15 products having more than 500 million users and 6 products with over 2 billion users, indicates widespread adoption beyond the core Search segment.

On May 23, Google held its annual Google Marketing Live conference, where it unveiled its leading AI-driven ad products suite as Google continues to focus on connection, creativity, and trust (performance), according to Morgan Stanley’s analysts [proprietary source, 05/23/2023]. The tools aim to reduce friction for advertisers, improve creativity, increase conversion, and deliver sustained, multi-year ad growth. AI is transforming Google’s products, from Search to YouTube to the backend platforms that marketers engage with. Google also continues to ramp up the pace of many of its newly announced products that are expected to launch soon (or at least by the end of this year).

Analysts from Credit Suisse decided to summarize their investment case based on the 2 events [proprietary source, 05/30/2023]. They think that GOOGL’s Generative AI will enhance search traffic and ad inventory value, while AI-powered content in SERPs will aid decision-making. Google’s long-term AI integration and free services limit competitors’ ability to charge for similar offerings. Generative AI also democratizes advertising and expands the market. Overall, the investment case remains positive for ongoing monetization improvements, non-Search businesses, and new monetization initiatives.

Scrolling through these reports and delving into the essence of the described impact on the company’s business, I understand that AI has become a truly revolutionary thing for Google’s development in the foreseeable future. However, it’s a straightforward task to argue in such intangible categories. How about quantifying AI in Google’s future financials?

AI’s Financial Impact On Google

It is unlikely that a single AI/ML innovation will result in a “winner take all/most” scenario, considering the presence of multiple platforms with significant resources and established business models capable of adapting to changes in computing habits. But we must understand that Google has already made significant investments in AI development, estimated to be over $100 billion in the past five years, and could leverage its scale to reap the benefits before everybody else plans to launch their spending plans.

From the recent Marketing Live event, we know that Google has observed an increase in impressions (76% increase) and clicks (32% increase) for product offers that include more than one image. Additionally, it’s expected that the company will announce new tools that should lead to higher market productivity and performance, which is particularly valuable for small and medium-sized businesses (which account for 90% of total businesses).

So I’m sure Google is going to experience a significant increase in revenue. According to analysts from Morgan Stanley, the upside potential for the company’s revenue in FY2025 is around 14%, which falls within the middle range of their projections [based on Click Through Rate increase of 6%].

Morgan Stanley’s analysts [proprietary source, 05/23/2023]![Morgan Stanley's analysts [proprietary source, 05/23/2023]](https://wealthbeatnews.com/wp-content/uploads/2023/06/49513514-16855985405440748.png)

And that leads to the Search’s EPS upside of 5% even amid rising costs:

Morgan Stanley’s report [proprietary source, 05/23/2023]![Morgan Stanley's report [proprietary source, 05/23/2023]](https://wealthbeatnews.com/wp-content/uploads/2023/06/49513514-1685598963314049.png)

Let’s assume that the calculations of Morgan Stanley’s analysts aren’t far from the truth. How will the company’s profit margins change then?

Morgan Stanley’s report [author’s calculations]![Morgan Stanley's report [author's calculations]](https://wealthbeatnews.com/wp-content/uploads/2023/06/49513514-16855998126883078.png)

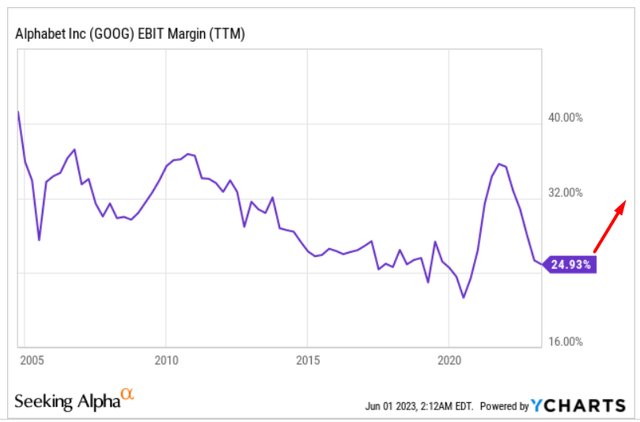

As you can see, the bank’s analysts are expecting a massive expansion of the EBIT margin in their forecasts. In my opinion, this is quite realistic – after all, Google has already had the opportunity to settle for even higher figures in the recent past:

YCharts, author’s notes

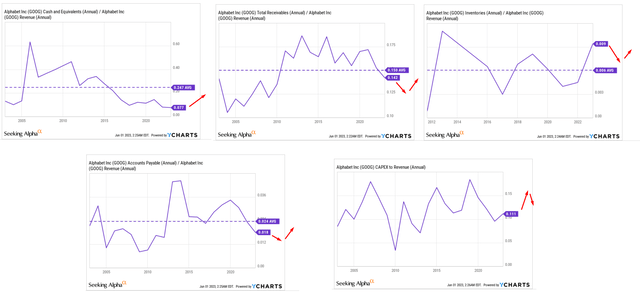

With consensus data on the company’s revenue for several years into the future – thanks to Seeking Alpha Premium – we can adjust it a bit to account for all the efficiencies the company is set to get. Now to the question of how I see the changes in working capital. I focus here primarily on the mean reversion effect, but at the same time, I take into account the trends of the last years.

YCharts data, author’s work

All this is translated into the following operating indicators:

stratosphere.io [author’s work]![stratosphere.io [author's work]](https://wealthbeatnews.com/wp-content/uploads/2023/06/49513514-16856013810383518.png)

Now let’s talk about the WACC. Alphabet has bonds that mature in 2027 and have a coupon of 0.8% per annum. Not surprisingly, they’re now trading well below par, yielding investors ~4.12% – that’s the company’s cost of debt:

Boerse-frankfurt.de [author’s notes]![Boerse-frankfurt.de [author's notes]](https://wealthbeatnews.com/wp-content/uploads/2023/06/49513514-1685601739309259.png)

I use TTM’s effective tax rate of 17.01% (Seeking Alpha data). The risk-free rate is currently 3.64% (10-year treasuries, YCharts). I assume a Market Risk Premium of 5%. So the implied WACC stands at 9.05% which is quite good for a base-case scenario, in my view.

This is what the build-up free cash flows would look like based on the above assumptions:

stratosphere.io [author’s work]![stratosphere.io [author's work]](https://wealthbeatnews.com/wp-content/uploads/2023/06/49513514-16856021236834483.png)

I estimate that Google will grow at a rate of 4-5% in perpetuity – slightly more than the generally accepted rate of 3% for maturing companies. In that case, the company’s fair value today should be somewhere in the middle of the $113.91-136.74 per share range:

stratosphere.io [author’s work]![stratosphere.io [author's work]](https://wealthbeatnews.com/wp-content/uploads/2023/06/49513514-1685602454172889.png)

In the bull scenario, I don’t change any of the data except revenue growth – let’s assume that Google has 5% higher revenue growth in the first four forecast years than I previously assumed. Then the fair value rises to just $144.05 per share:

stratosphere.io [author’s work]![stratosphere.io [author's work]](https://wealthbeatnews.com/wp-content/uploads/2023/06/49513514-16856027426555424.png)

In a bear scenario, I assume that AI-related tailwind will evaporate in YoY terms as early as 2025 dropping to 8% by FY2027. Accordingly, Google will grow at 3% per year in perpetuity under these conditions. Then the fair value should fall to $105.45 per share:

stratosphere.io [author’s work]![stratosphere.io [author's work]](https://wealthbeatnews.com/wp-content/uploads/2023/06/49513514-16856033600311031.png)

My 3 scenarios above look too low compared to what Morgan Stanley expects based on EV/EBITDA multiples:

Morgan Stanley’s report [author’s calculations]![Morgan Stanley's report [author's calculations]](https://wealthbeatnews.com/wp-content/uploads/2023/06/49513514-16856037818150966.png)

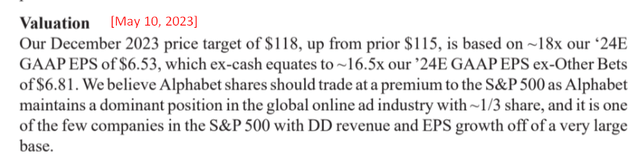

It’s worth noting, however, that of all the reports I mentioned at the beginning of the article, Morgan Stanley is the most bullish bank on Google. Credit Suisse agrees with Goldman Sachs that Google’s fair value is around $135, which implies an upside target of only 9-10% by the end of 2023, assuming no recession and easing pressure on consumer and corporate spending shortly. J.P. Morgan, on the other hand, is more conservative in its valuation of the company:

J.P. Morgan on GOOG stock

The Bottom Line

Regardless of which bank is right, I believe Google’s recent rally has already managed to absorb most of the expected tailwinds of the AI revolution everyone is talking about.

You saw it yourself – I deliberately set the growth rates for the next few years higher than the consensus, but even so, my fair value target for Google is close to the current share price [the upside of +1.6% looks meaningless]. Only in the bull case scenario should the stock of GOOG be worth 15% above the closing price of the last trading day. In conjunction with the conclusions from my calculations, I confirm my previously given “Hold” rating and suggest waiting for a correction to open new positions below the fair value.

Thanks for reading!

Read the full article here